dusanpetkovic/iStock via Getty Images

We all know those drivers who can’t seem to take it easy when they drive. They speed up to red lights, slam on the brakes, and then hit the accelerator hard when it’s time to go. They generate a high level of uncertainty and mistrust among passengers because of how they drive.

The Federal Reserve is beginning to remind me of this kind of driver with its “all-in” and “all-out” policies and the excessive drama they create.

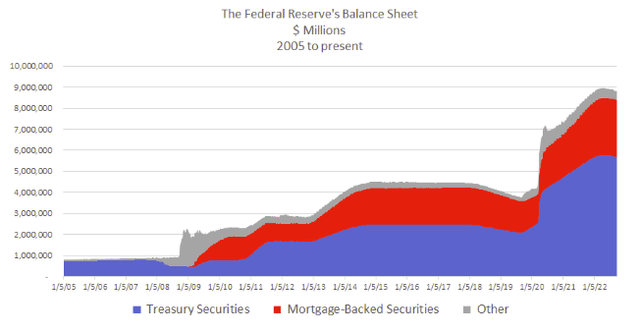

In March, 2020 the Federal Reserve dropped rates suddenly as a response to the Pandemic and doubled their balance sheet from $4.5 trillion to $9 trillion, the highest ever.

Then it sat comfortably pat for two years on ultra-low rates while these rates created an asset bubble in housing, bonds, and tech stocks. In come-lately fashion – the Federal Reserve has now lurched into a spectacular rise in interest rates, creating, as one economist put it:

…an accelerated loss of trust in policy making. Markets, which for years appreciated the US Federal Reserve and the UK government as volatility suppressors, have shifted into viewing them as significant sources of unsettling instability.” (Mohammed E-Erian, Washington Post, September 26, 2022)

Individual investors might be tempted to view economics as an arcane mixture of mathematics and probability statistics, brooded-over by careful government alchemists and brainiacs.

But Fed Policy is becoming a behavior of responding late in the game to lagging indicators, and then lurching-out dramatically when change is needed.

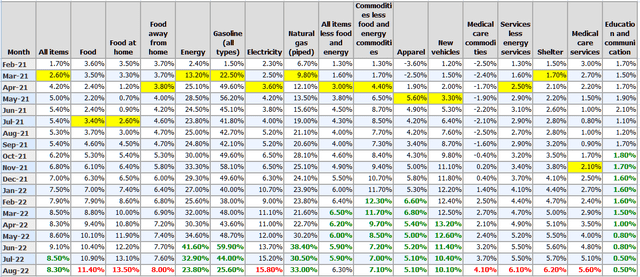

In the table below, taken from the Bureau of Labor and Statistics, the yellow squares are the dates when serious inflation first accelerated in the U.S. in March and April of 2021, almost a full year before the Federal Reserve actually raised rates in March, 2022.

- The green font identifies categories where inflation has begun to recede.

- The red font is categories where there has been NO abatement of inflation, and where it remains persistently at the highest level in the cycle.

- The four categories which are still rising are Food, Electricity, Shelter, and Medical Care, categories which most effect lower income families and individuals. Because their net earnings are smaller, inflation absorbs a greater percentage of their total monthly costs.

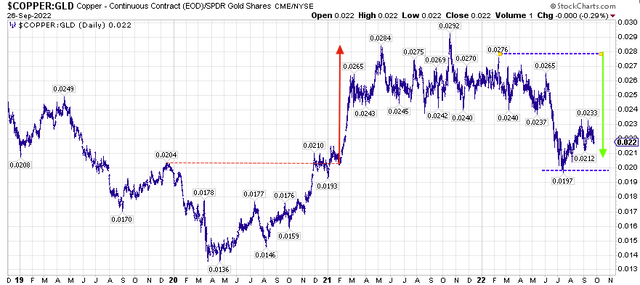

The copper-gold ratio, and especially the price of copper, is considered the leading indicator for industrial output. Copper is integral to so many products that a significant rise in the ratio indicates a burst of activity in the economy.

In February, 2021, this ratio accelerated into a cyclic top, and stayed there for over a year until the Federal Reserve finally raised rates in Spring, 2022. When interest rates began to increase by 75bps in consecutive sessions, the ratio dropped predictably and precipitously.

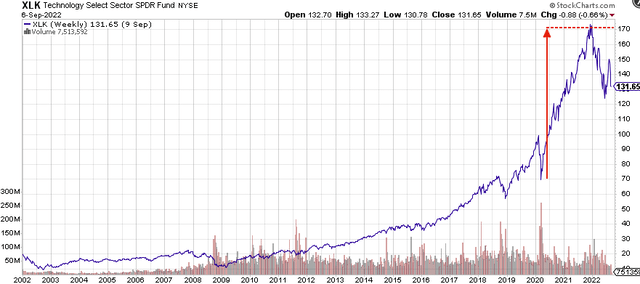

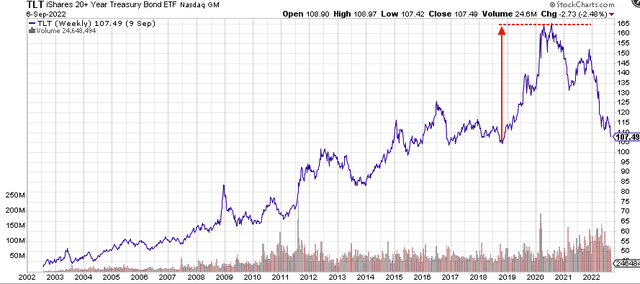

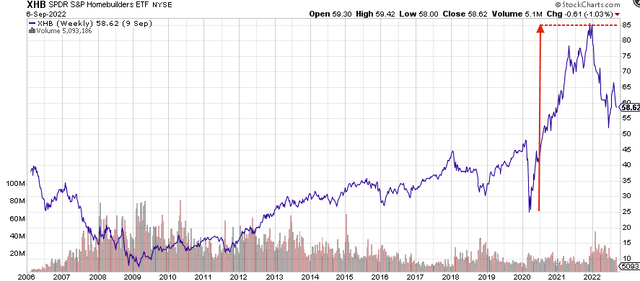

In two years of the Federal Reserve’s post-pandemic easy-money policy (lower for longer), it created an asset bubble of epic proportions in tech stocks, bonds, and home prices that is now being painfully unwound.

Stockcharts.com Stockcharts.com Stockcharts.com

Shelter and the CPI

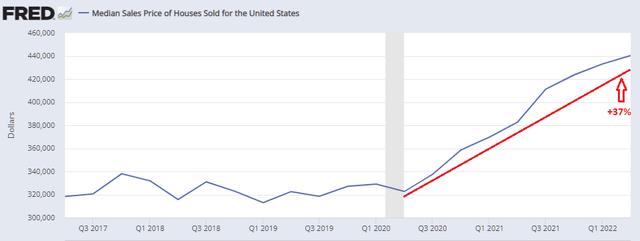

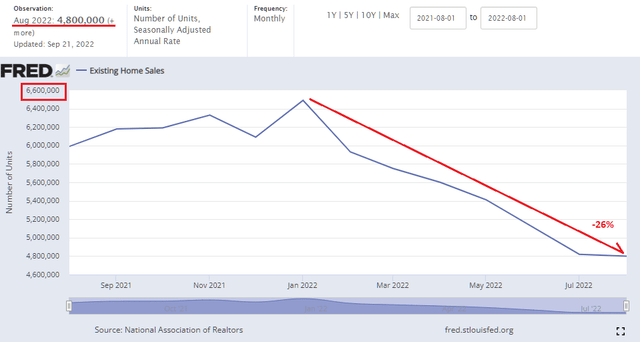

Shelter (housing) is 33% of the CPI. The Federal Reserve’s goal is to hammer-away at the egregious rise in shelter cost, and thus cut its overall effect on increasing CPI inflation. To wit, home prices cooled in July at the fastest rate in the history of S&P Case-Shiller Index.

In just 2 years, the median price for a home in the U.S. has risen by 37%, from $322,600 to $440,300, making it extremely-difficult for young families to enter the market.

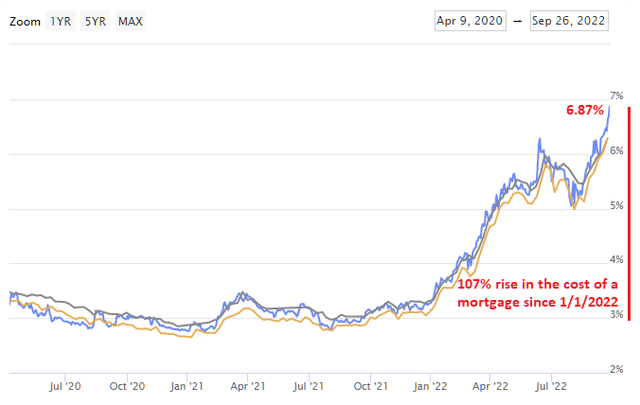

And with the recent rise in mortgage rates, the cost of buying these already expensive homes has risen even further, beyond the reach of many families. It’s a double-whammy of asset inflation, caused first by the Fed’s easy-money stance, and now by its highly-restrictive interest rate policy. Prospective home buyers are backing out of contracts at record-high rates.

Assuming a 20% down-payment, the mortgage cost for that $440k median-priced home in the chart above has gone from $1,535/month on January 3, 2022 to $2,311/month today (September 26, 2022), a 50% increase in the monthly cost of home ownership in just 9 months!

The last time mortgage rates were this high (6.87%) was in May, 2002, twenty years ago. If this trend continues, it is possible we could see mortgage rates well over 7.5% and approaching 8% by the end of the year.

It is no wonder that home sales have fallen by 1,690,000 (-26%) since January, 2022.

Energy

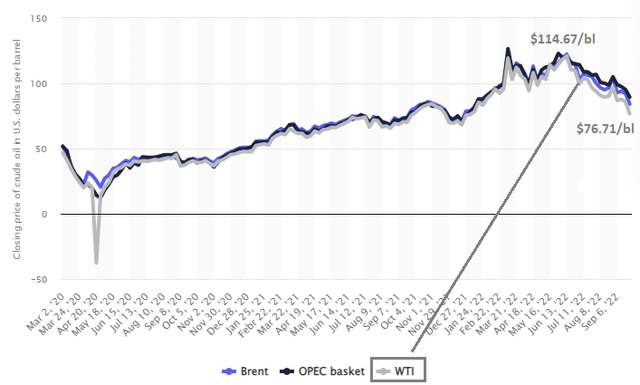

Energy goods and services, a category of which gasoline is a major component, accounts for roughly 7.5% of the overall CPI. The Federal Government is using the strategic oil reserve to cut the cost of crude, and with it, the cost of fuel for transportation, one of the biggest causes of the rise in food prices – the cost of transporting food to market.

From June 1, 2022, to September 26, 2022, the price of WTI crude (West Texas Intermediate) fell 33%, from 114.67/bl to 76.71/bl.

Summary

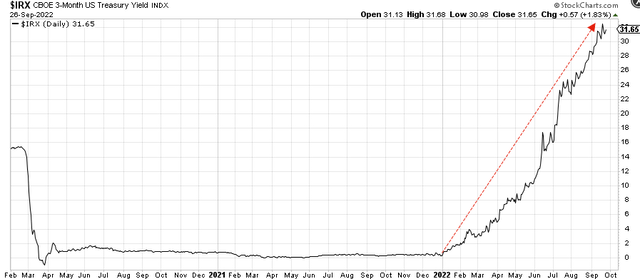

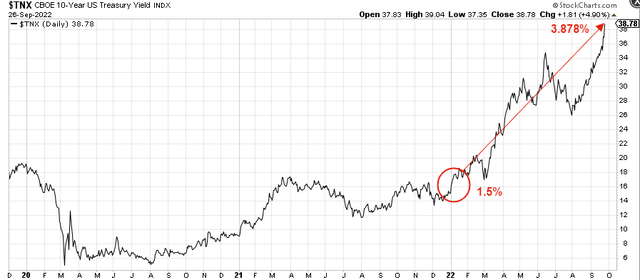

The Federal Reserve is late to the game. They did not make a pre-emptive move when inflation was clearly-visible and accelerating, and now are hitting the economy with restrictive policies in order to quickly recover 12 months of wasted inactivity. It is one of the strictest contractions on record.

The Fed’s game plan is to run these 2 rates (below) up at least another full percentage point through December, 2022.

Until inflation shows signs of peaking in all categories – especially in food, shelter, electricity and medical costs – it will be difficult for the markets to make headway.

The best that can be hoped for is the domestic economy slows rapidly (but not precipitously), the 4 peaking categories of CPI inflation mentioned above (shelter, food, electricity, medical costs) all fall to a level of equilibrium, and thus core inflation abates.

Jeffrey Grantham of GMO Investors has written two articles this year which outline the Fed’s culpability in both creating and encouraging asset bubbles, present and past. In each case the bubble that was created resulted in a severe contraction of 40% in equity prices

- Let the Wild Rumpus Begin, January 20, 2022

- Entering the Superbubble’s Final Act, August 31, 2022

When there is some sign of inflation abating, the lead foot of the Fed will likely come-off the brakes, and investors could accelerate (again) into a volatile upswing abetted by a pivot from the Fed.

Be the first to comment