AntonioSolano

Perpetua Resources (NASDAQ:PPTA) expects to run the largest independent gold project in the country. Well-known investors have already taken positions in the stock. I made my own valuation assessment with production of more than 297 koz per year and price of gold of $1850/oz. My results indicate that the stock is significantly undervalued. PPTA also believes that the company should be worth much more in the market. In my view, as new information about the publication of the SDEIS report is delivered in 2022, the stock price may trend higher.

Perpetua Resources: Recent News And More Awareness Could Drive The Stock Price Up

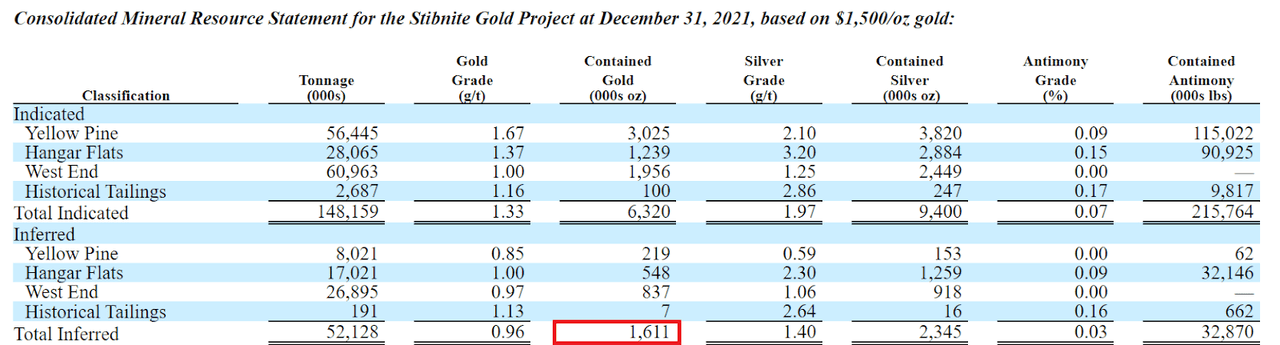

The Corporation’s principal mineral project is the Stibnite Gold Project, which contains several gold, silver, and antimony mineral deposits.

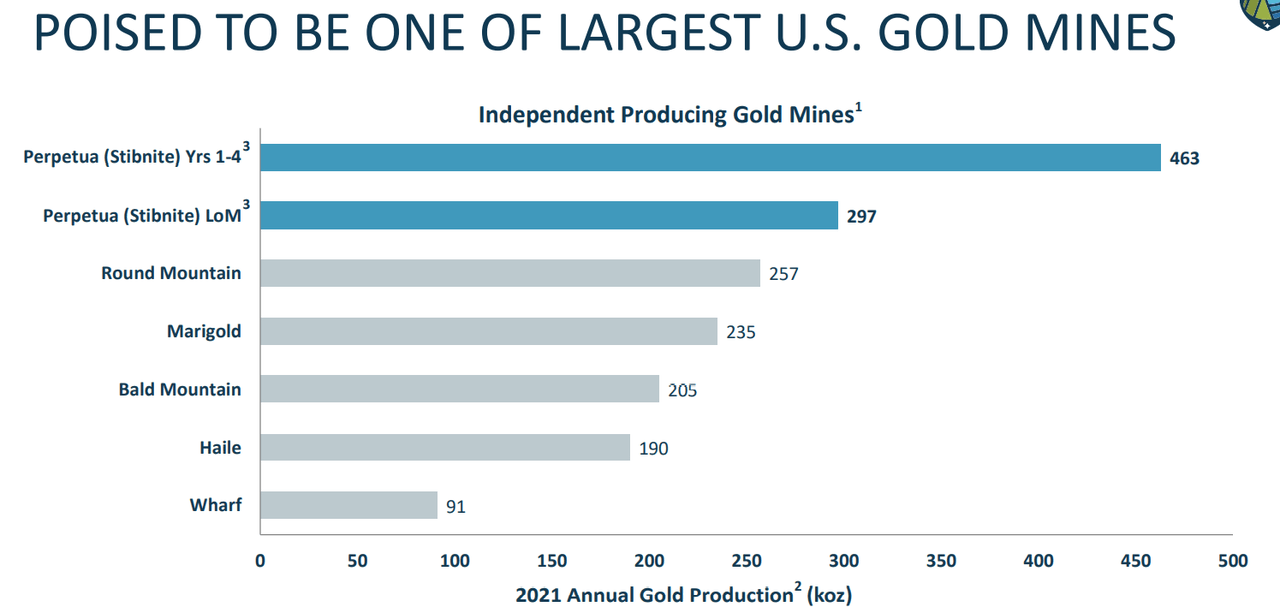

Management noted that its mine is poised to be one of the largest gold mines in the United States.

Company’s Presentation

Perpetua intends to explore other deposits known as the Hangar Flats deposit, West End deposit, and Yellow Pine deposit. It means that the company is worth much more than simply the production estimates from the Stibnite mine.

With that, the amount of proven reserves in these deposits is not known, so I will try to remain very conservative in my estimates. I am assessing the valuation of only the Stibnite mine.

The Corporation’s current focus is to explore, evaluate and potentially redevelop three of the deposits known as the Hangar Flats Deposit, West End Deposit and Yellow Pine Deposit, all of which are located within the Stibnite Gold Project as well as reprocess certain historical tailings located on the Project. These development activities would be undertaken in conjunction with a major restoration program designed to address impacts related to historical activities in the Project area. Source: 10-K

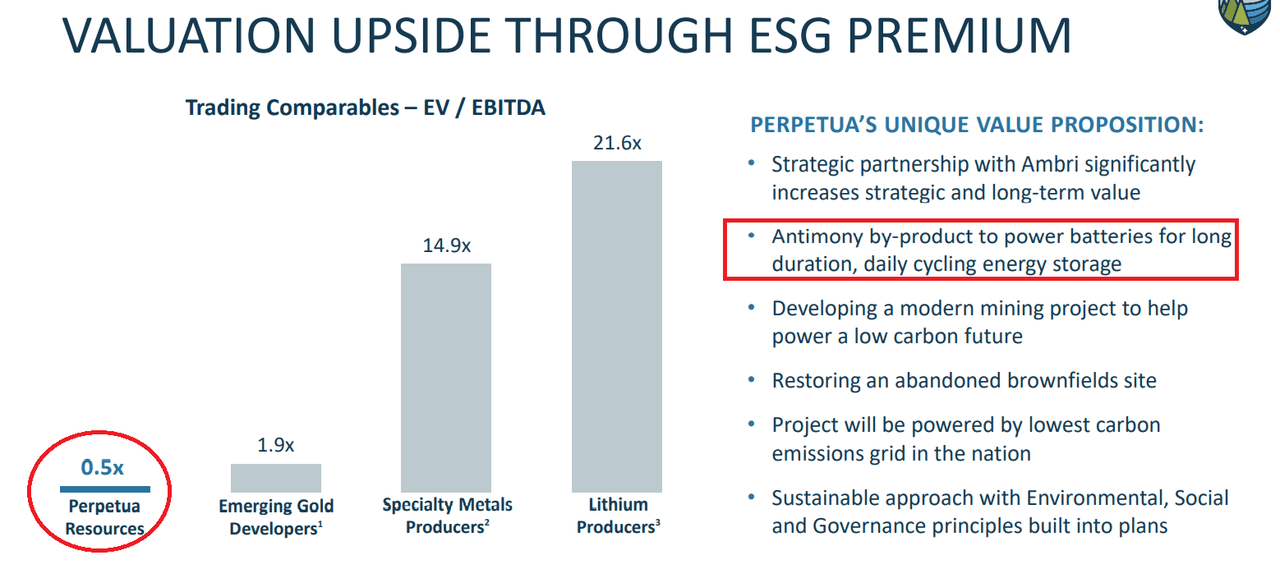

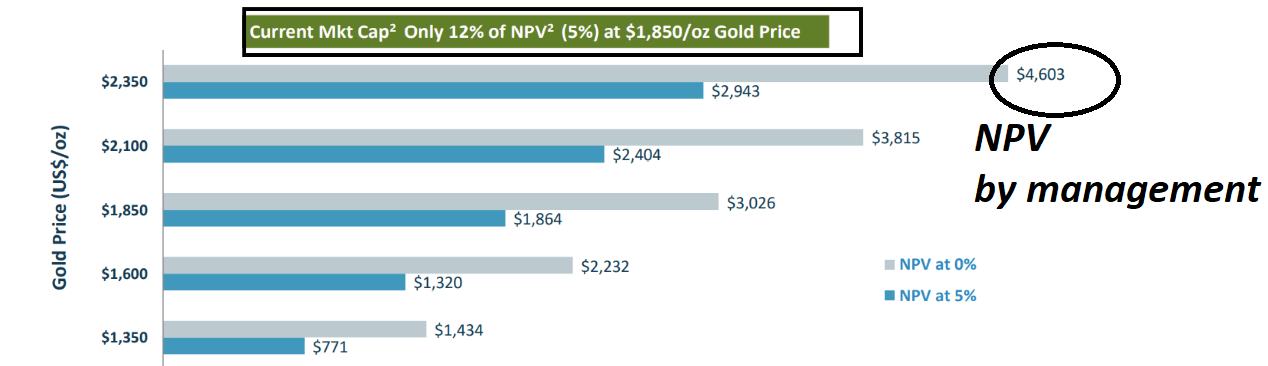

Perpetua has already claimed many times that its stock is quite undervalued as compared to other mining companies. The percentage of antimony in the company’s mines could represent valuable assets as a by-product to power batteries for energy storage. Management believes that these value drivers have not been incorporated in the current market price.

Company’s Presentation

I believe that the company’s stock price will reach more logical levels once more news hits the market. In this regard, I think that the number of news recently has accelerated. In June, management noted that it had received the Clean Air Act Permit to Construct for the Stibnite gold project.

Besides, the company delivered an interview By Dr. Allen Alper, PhD Economic Geology and Petrology from Columbia University, in which several large investors were mentioned. In my view, more news will likely lead to more awareness, which could increase market liquidity, and drive the stock price up.

Perpetua Resources announced today it has received the Clean Air Act Permit to Construct for the Stibnite gold project from the Idaho Department of Environmental Quality on June 17, 2022. Source: KITCO: Perpetua reaches first permitting milestone at its Stibnite gold project in Idaho

As I mentioned, Paulson & Co. owns about 39.3% of our stock. Sun Valley Gold owns about 8.2%, followed by B. Riley at 4.3%. And we recently announced that value-oriented investor, Kopernik became a new shareholder. Overall, we have issued outstanding shares of about 63 million shares. Source: Metals News – McKinsey Lyon

I Expect Regulatory Response In Q3 2022 To Move The Share Price

In the last annual report, management noted that the publication of the SDEIS for public review is expected by the third quarter of 2022. In my view, as this information is received by investors, the amount of liquidity in the market will likely increase. As a result, I think that the stock price will likely go to reasonable marks.

On February 22, 2022, Perpetua Resources announced that it expects a preliminary SDEIS to be circulated for cooperating agency review in the second quarter of 2022. The publication of the SDEIS for public review and comment is expected in early third quarter 2022. The USFS is expected to provide a formal schedule later this year regarding the remaining steps in the NEPA review process. Source: 10-K

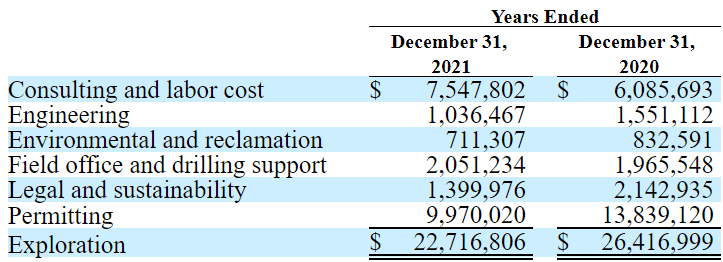

Management continues to invest a large amount of dollars in exploration, permitting, and drilling support. Hence, I believe that we will likely obtain more information about the proven mineral reserves in the Stibnite mine and the other areas in the near future. More information will likely increase the demand for the stock.

10-K

My Valuation Of Stibnite Gold Project And That Of Management

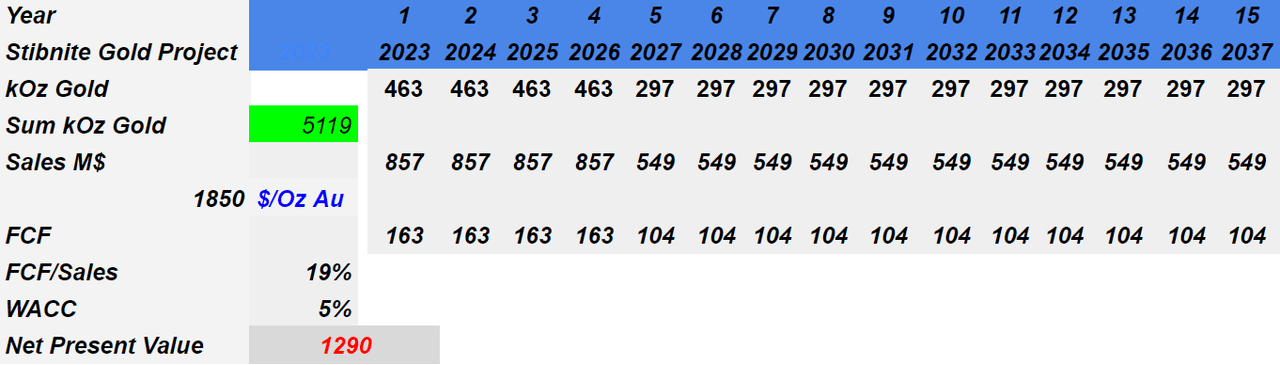

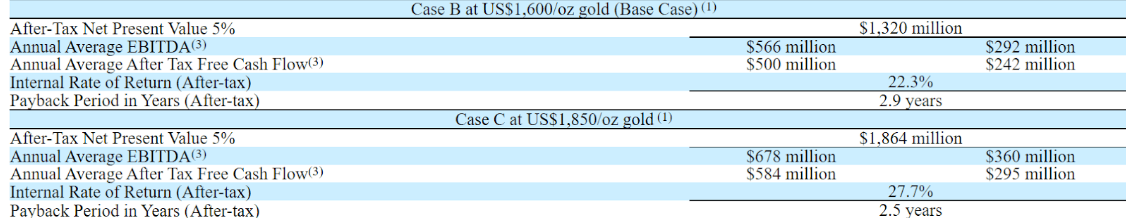

My valuation of the Stibnite Gold Project is a bit more conservative than that of management. However, my numbers are not that far from what management calculated. I included production of 463 koz per year from 2023 until 2026 and 297 koz from 2027 to 2037. If we use a price of $1850/oz of gold and a free cash flow margin around 19%, the free cash flow ranges from $163 million to 104 million. With a discount of 5%, the net present value of the mine stands at close to $1.29 billion.

My DCF Model

Notice that the sum of ounces produced in my valuation is equal to 5119 koz. In the last annual report, management included a total indicated amount of 6320 koz. Besides, note that I did not take into account the antimony grade, which would most likely make the mine even more valuable.

10-K

The company provided several case scenarios with a price of $1.6k/oz of gold and $1.85k/oz of gold, which implied a valuation between $1.3 billion and $1.8 billion. We would be talking about an IRR close to more than 22%.

10-K

With these figures, and also using several gold price estimates, the current market capitalization appears quite undervalued. Under my own figures, the market capitalization represents close to 10%-30% of the valuation of the mine.

Company’s Presentation

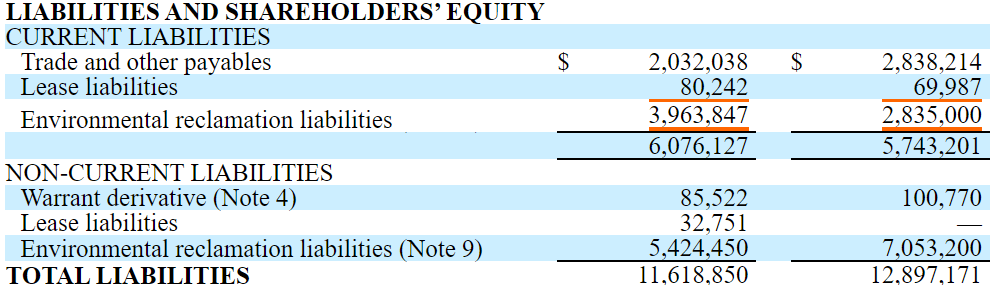

Balance Sheet

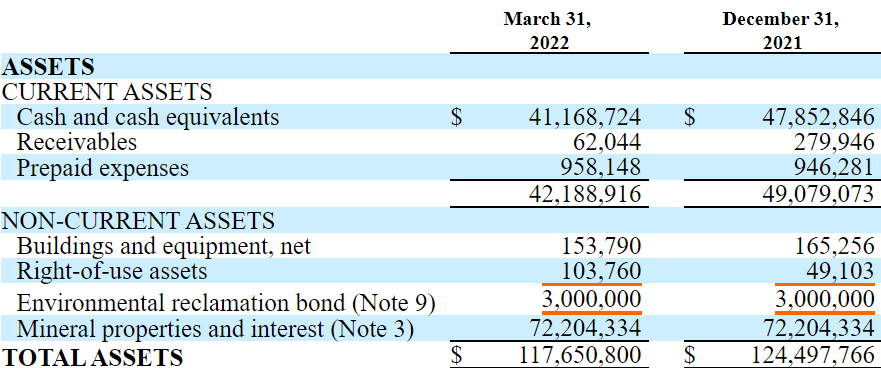

As of March 31, 2022, Perpetua Resources reports $41 million in cash and an asset/liability ratio of more than 10x. With these figures, management will likely not have any issue while trying to get either bank financing or sale of equity.

10-Q

It is also worth noting that Perpetua does not report a significant amount of debt. The total amount of liabilities is equal to $11 million.

10-Q

Risks From Regulators, Lack Of Production, Unprofitable Efforts, Or Lack Of Financing

Perpetua will require a significant number of permits in the future to operate its mines. It could happen that management cannot obtain regulatory approvals from authorities, which would likely lead to lack of production. With this in mind, I don’t believe that Perpetua is suitable for conservative investors. The risk is not small:

The future development of the Project will require obtaining permits and financing and the construction and operation of mines, processing plants and related infrastructure. As a result, we are subject to all of the risks associated with establishing new mining operations and business enterprises. Source: 10-K

Exploration could also not be successful, or the grade may be lower than expected. As a result, the company’s free cash flow/Sales would be lower than initially expected, or production could decrease over time. In the worst case scenario, journalists may discover Perpetua underperforming, which may lead to stock price deterioration.

Mineral resource exploration and, if warranted, development, is a speculative business, characterized by a number of significant risks, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits, which, though present, are insufficient in volume and/or grade to return a profit from production. Source: 10-K

Perpetua needs a substantial amount of dollars to run the Stibnite project. Well-known investors such as Paulson & Co support the company. However, we cannot really be sure that Perpetua will obtain the financing needed. Without financing, the stock price will likely decline over time.

Our failure to obtain sufficient financing could result in the delay or indefinite postponement of exploration, development, construction, or production at the Project. The cost and terms of such financing may significantly reduce the expected benefits from development of the Project and/or render such development uneconomic. There can be no assurance that additional capital or other types of financing will be available when needed or that, if available, the terms of such financing will be favorable. Source: 10-K

Conclusion

Perpetua Resources expects to operate the largest independent gold mine in the United States. If management is right, we would be talking about a gold project with a net present value of more than $1.2 billion. Considering the current market capitalization, the stock looks quite undervalued. With that, let’s note that the company’s operations are still quite immature. The fact that Paulson & Co. owns a massive investment in the stock is reassuring. However, there is a lot of exploratory work to be done, and management needs much more financing to reach meaningful production of gold.

Be the first to comment