Marat Musabirov/iStock via Getty Images

Main Thesis/Background

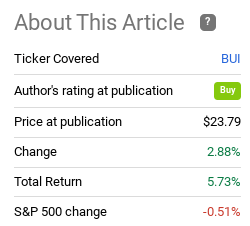

The purpose of this article is to evaluate the BlackRock Utility & Infrastructure Trust (NYSE:BUI) as an investment option at its current market price. The fund is managed by BlackRock, and its objective is to “provide total return through a combination of current income, current gains and long-term capital appreciation”. BUI seeks to achieve this objective by investing in equity securities issued by companies in the Utilities, Infrastructure, and Power business segments and by utilizing an option writing strategy.

This is a fund I have owned for a long time and represents roughly half my direct Utilities exposure. When I covered it earlier this year in March, I suggested readers consider buying it. In hindsight, that would have worked out fairly well, despite all the ups and downs we have had this year:

Fund Performance (Seeking Alpha)

As we head into the final stages of 2022, I wanted to take another look at BUI to see if I should keep on recommending it. After review, I actually believe it makes sense to get patient at this juncture. I see an environment that will make further gains tough to come down and suggest that a “hold” rating is probably the most appropriate at this time.

BUI Has Done All Right, But VPU Has Done Better

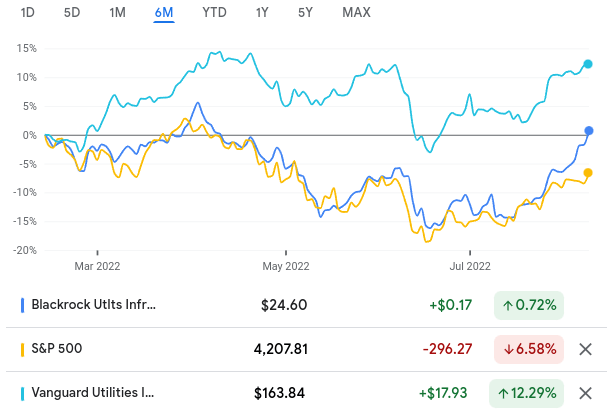

To start, I want to dive into relative performance over the past six months. As the initial graphic showed, BUI seemed like a reasonable buy given its outperformance of the S&P 500. That is a fair enough point to make. But this is not surprisingly the result of strong performance in the underlying Utilities sector. BUI has gone up along with the broader sector, but its overall performance actually comes up short when we look at a passive basked of U.S.-focused Utility stocks, as measured by the Vanguard Utilities ETF (VPU):

6-Month Performance (Google Finance)

As you can see, VPU has been vastly outperforming both BUI and the S&P 500 since mid-February. In fairness, the spread between BUI and VPU is a bit narrower than it looks on the surface, given BUI’s yield is roughly twice VPU’s. But this still leaves about a 10% alpha from buying VPU directly.

So let us examine why that might be. One, in a rising market, BUI can underperform because it writes covered call options. The objective here is that when the underlying holdings are gaining modestly, or declining in value, the options will expire before being exercised and BUI will get to keep the premium paid for that option. This strategy is what allows the fund to offer an above-average yield – the premiums add to the income in the fund. However, when the underlying holdings are rising aggressively, as they have the last six months, then those options do get called and BUI has to deliver the shares to the options holder, limiting the upside.

Therefore, when the underlying stocks are rising consistently, a fund like VPU will allow investors to capture the entirety of that gain, while investors in BUI will see a smaller return because their gain is capped on the covered calls up to the strike price (above which the option will theoretically be exercised). Therein lies the downside risk to having a covered call strategy. When the market (or sector) is doing very well, we won’t see all the upside.

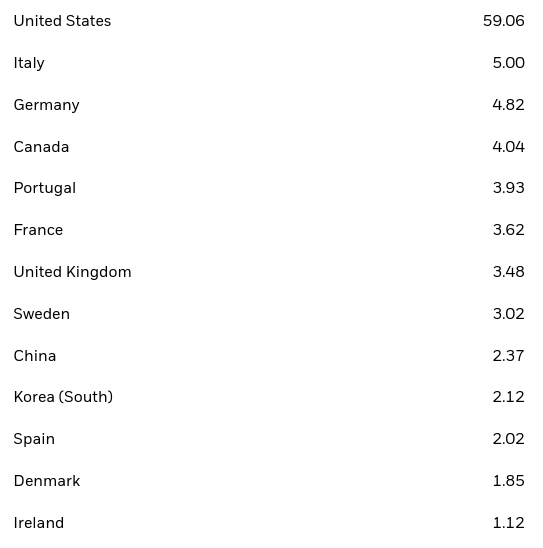

But that only partially explains the relative underperformance. The other part of note for BUI is the European exposure. While VPU is domestically focused, BUI has a lot of foreign holdings. Unfortunately for investors this year, those holdings are predominately based in Europe:

BUI’s Country Exposure (BlackRock)

It should be pretty clear why this has been a negative in 2022. With the Russian – Ukraine conflict continuing with no real end in sight for now, European exposure will pressure any fund – BUI or otherwise. This could be a buying opportunity, but I have been cautious on Europe as a whole since it became clear this was not going to have a quick resolution. At this moment, I continue to see limited catalysts that are going to keep that conflict from escalating, so a cautious approach to most continental Europe stocks makes sense for now.

Valuation No Longer Tempts Me

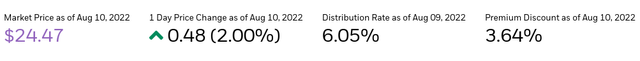

The next reason for downgrading my outlook has to do with valuation. Back in March, I thought stocks more broadly were oversold and BUI happened to be sitting at a slight discount to NAV. Today, the opposite is true. I see the market’s rebound as getting a bit too aggressive, too fast. I see this as a time to hold off on buys (broadly speaking), and maybe even use it as a chance to take some profit. With respect to BUI, this theme is consistent, as the fund now has a premium above 3.5%:

There isn’t much else to say except readers should take heed of a general tone of caution here. The market rally in equities, including Utilities, has been rewarding. But it has pushed up valuations, including in BUI. I would therefore be much more selective on purchases for the time being.

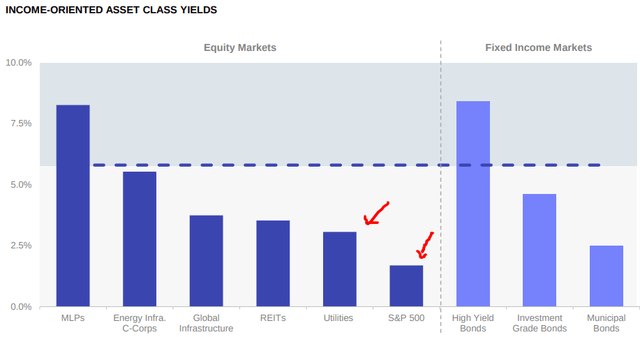

The Income Proposition Is Still Attractive, But Debt Securities Are Offering More

I will now shift to a more macro-take on this investment idea. Specifically, when one is considering the Utilities sector, whether through BUI or any other product, income is probably a key consideration. This is especially true with BUI, in fact since the fund’s strategy allows it to offer a higher income stream than a passive index fund. Yet, even for those in passive equity baskets or individual securities, a draw of the Utilities sector as a whole is that is has an above-average income stream. This gives it a more bond-like characteristic than much of the market, especially the more growth and Tech heavy equity indices like the S&P 500 and the NASDAQ.

With this in mind, there still is merit to owning Utilities at this juncture. I have a position in VPU and BUI, and I see no reason to start panic selling just because prices are soaring. Might I take some profit? Probably so, especially if the funds keep seeing strength in the short-term. But we should also recognize that from an income perspective, this sector still far outpaces what the S&P 500 offers. Therefore, there is merit to hanging on, especially as a defensive hedge:

Various Sector Yields (Goldman Sachs)

So the income story is still intact – right?

Well, sort of. Against the S&P 500 that is certainly true. But that is not the other comparison to make. Given Utilities more unique positioning, there is merit to comparing it to other income ideas – such as REITs or fixed-income sectors. Importantly, the gains the Utilities sector has enjoyed for most of 2022 coincides with steep losses in the bond market. As a result, yields in junk bonds, IG bonds – including corporate debt and municipal debt, as well as foreign debt securities, have all risen markedly. As the graphic above also shows, some popular fixed-income sectors (notated in the lighter shade of blue) are offering higher income streams than Utilities.

I am not saying that Utilities should be avoided for this fact. Equities, whether they are Utilities or anything else, are not direct substitutes for bonds. So there is a lot more that has to go into consideration than just yield. But it does show that for those focused on income as a paramount consideration may want to look outside the equity market for the time being. I personally have been finding a lot of value in the muni space and have touched on that in a number of recent reviews. While the yield seems lower, when we factor in tax-savings it can often be higher than IG corporates. The broader takeaway is that there are a lot of spots we can find some value in right now, which supports my shift to a more neutral rating on BUI.

I Think The U.S. Utilities Market Has The Most Value

My final point on BUI has to do with the relative comparison against my other Utilities fund – VPU. At this juncture, I see some benefit in taking some profit from BUI and shifting those funds to VPU, for two key reasons.

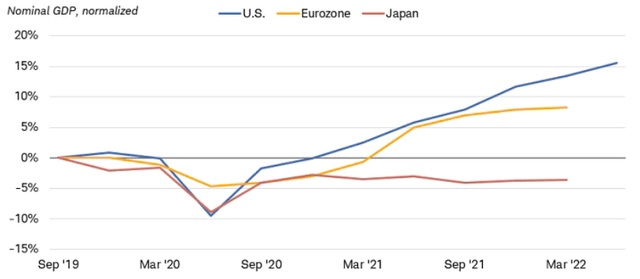

One, the European exposure limits my bullishness. This is not a knock-on BUI in isolation. As my followers now, I have been suggesting avoiding eastern and central Europe for a while now, and that storyline will continue until I see a resolution in the Russia-Ukraine conflict on the horizon. I don’t see a high likelihood of that happening any time soon, so that whole region is an avoid for me. The Euro-zone is feeling the pressure due to supply constraints, amplified inflation, and slower growth. Simply, the U.S. reigns near the top in the developed world in terms of GDP growth. Therefore, I view VPU’s exclusion of this European exposure as a positive attribute compared to BUI:

Developed World GDP Figures (Charles Schwab)

Beyond the European headwind, I think the recent progress on the “Inflation Reduction Act” could also benefit the Utilities sector as a whole. While this would be good for BUI, it would be better for VPU since VPU has more American-oriented exposure.

In particular, the bill has a couple provisions that could be tailwinds for utility providers. In an effort to make the U.S. energy grid “greener”, the bill has billions set aside to encourage the building of new renewable electricity plants. That should give a boost to utility operators with a major presence in renewable energy (think NextEra Energy (NEE), which is a top holding in both BUI and VPU). The bill also is expected to help push the transition to electric vehicles via tax credits. This will increase the demand for electricity, improving future revenue streams for utility companies.

While I don’t want to get into the politics of the bill, because there is plenty I disagree with, there are catalysts that could help the Utilities sector move higher. This suggests to me that “holding” is the right course of action and holding VPU at the expense of BUI is probably a viable move.

Bottom-line

BUI has been a good hedge in 2022 against the broader equity market. There is merit to holding on here because of this reality. Further, the income stream is attractive and the entire Utilities sector could get a boost from upcoming U.S. legislation. However, I also have concerns about the holdings in Europe, the premium valuation, and the relative outperformance of VPU compared to BUI. Due to these conflicting attributes, I believe a shift to a “hold” on this fund is appropriate. Therefore, I suggest readers approach any new positions very selectively at this time.

Be the first to comment