da-kuk/E+ via Getty Images

Alkermes (NASDAQ:ALKS) is a fully integrated biopharmaceutical company engaged in the research and development, and commercialization of pharmaceutical therapeutics. The company has a portfolio of off-the-shelf products focused on addiction, schizophrenia, and bipolar disorder and a pipeline of product candidates in the development for neurodegenerative diseases and cancer. The company boasts a wide range of products that have each contributed to the company’s revenue. The company’s product platform includes injectable sustained release microsphere technology, LinkeRx technology, NanoCrystal technology, and oral controlled release (OCR) technology.

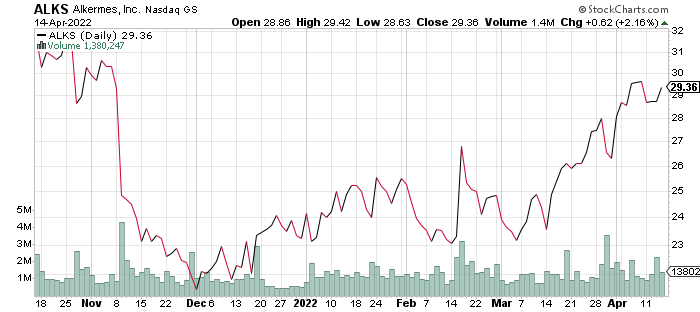

stockcharts.com

Comparing the losses, Alkermes reported in recent times will show how the company is on its way to becoming an excellent investment despite some initially discouraging figures. We will look at why this year will prove not only to be a decisive year for the company but one that bullish investors will look back at fondly.

Market Overview

The biopharmaceuticals market was worth approximately $325.17 billion in 2020 and could reach up to $496.71 billion in 2026 at a compound annual growth rate (CAGR) of 7.32% from the past year to the end of the forecast period. The Covid-19 pandemic has caused growth to decline in many industries, but naturally, the global biopharmaceutical market stands to benefit from the accelerated progress and attention it is getting. An increase in population and the overall demand for better healthcare quality are among the many factors driving the market growth. With the demand for pharmaceuticals on the rise in the West and urgent solutions needed elsewhere in the world, companies such as Alkermes will find themselves front and center in providing aid to those in need. An increase in revenue will occur as a natural consequence of the aforementioned factors. Still, funding and investment will also continue to see a rise, though at a more moderate pace when compared to pandemic times.

Alkermes has a market capitalization of $4.62 billion and continues to climb up the ranks as an important player in the biopharmaceutical industry. The company is able to bring in revenue through several different segments, including the addiction and psychiatry segment, oncology, and neuroscience. We will look at how each of these has contributed differently to the company’s growth in the past year and what to expect in 2022.

Financial Growth

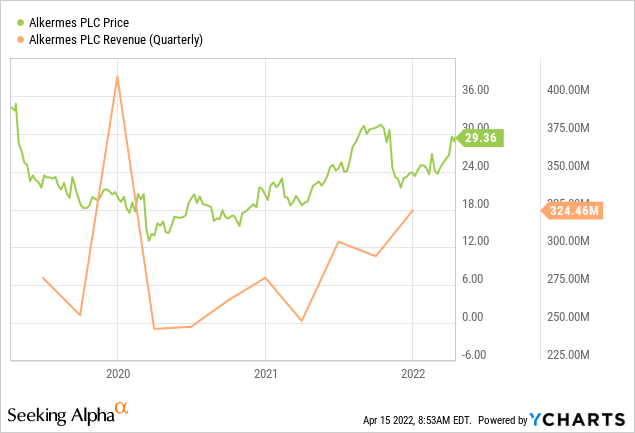

ycharts.com

Alkermes reported quarterly revenues of $324.5 million at the end of 2021. This surpasses both the same quarter the year before, at a reported $280 million, and the $294.1 million reported in the previous quarter. The company suffered a dip in earnings in the last two years but seemed to have finally surpassed 2018’s revenue for a total of $1.17 billion for the entire year. Compared to the mere $1.04 billion reported the year before, this marks a resurgence for the company and highlights just how important it is to stabilize the business in a post-pandemic world.

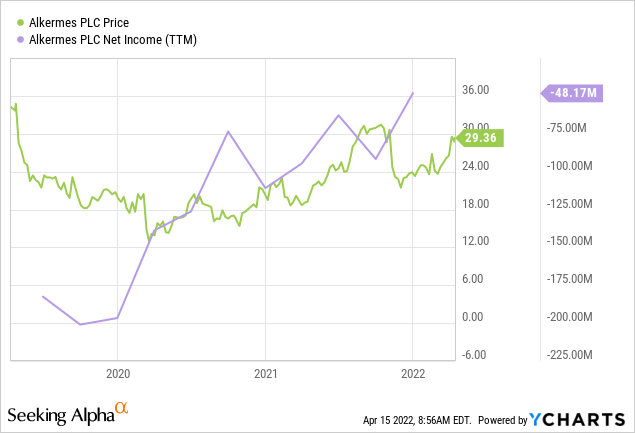

ycharts.com

Net income improved throughout the year as the company registered losses of only -$48.2 million. This is important as it marks an improvement for a company that reported losses of approximately $110.9 million the year before and -$196.6 million in 2019. Alkermes is on an upward trajectory that seems to involve a greater focus on reducing costs, instead of adding to revenue, in order to maximize profitability. The largest contributor to Alkermes’ growth was sales of proprietary products, which increased from $551.8 million in 2020 to a total of $627.4 million in the following year. Manufacturing and royalty followed with a total of $541.8 million in revenue for the year, while the company’s other offerings made up the rest.

Alkermes has consistently reported revenues of over $1 billion in the past few years, and you would expect the company to turn a profit by this point. Adding to this possibly perplexing figure is the fact that the company is operating within a booming industry. Upon closer inspection, however, you will find that the company has been experiencing a more subtle kind of growth. Revenue increased in the past year by over $135 million, while total operating expenses only increased by $50 million. Even as the cost of manufacturing went up by roughly $20 million, the company was able to improve its expenditure at a rate that indicates a positive outcome in 2022. The company also didn’t shy away from adding to its Research and Development (R&D) expenses, as these went up to approximately $406.5 million. Despite seeing losses, it is important that the company continues its work to develop better products, thus improving its long-term success. Ultimately, Alkermes concluded 2021 with losses of $0.30 per share and diluted profits per share of $0.43.

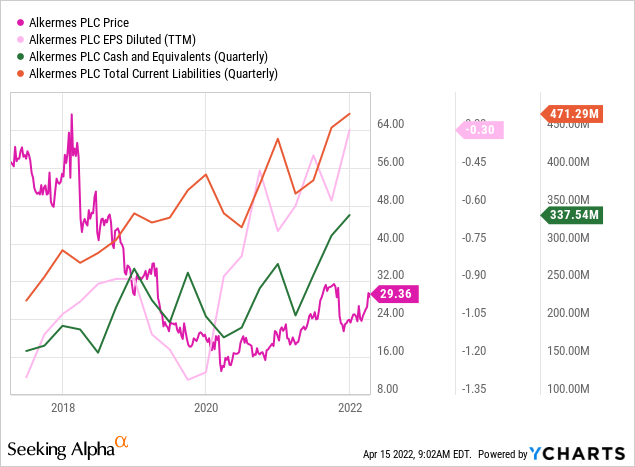

ycharts.com

Alkermes ended the year with total current liabilities of $471 million in 2021, which increased slightly from the year before, and the $338 million in cash and equivalents is a positive number, all things considered. Disruptions caused by the pandemic will mean that revenue will continue to see an increase and further improve the company’s profitability.

Risks

The number one risk Alkermes faces is yet another COVID-19 variant, or worse, another global pandemic that could unpredictably change the industry. Assuming no such issue arises, the company will still have a number of potential risks that could threaten to undermine its goals for 2022. After the threat of a prolonged pandemic, the company still has to contend with the many complications that arise from doing business abroad, such as the collection of royalties from their various product on sale. Licensing and other regulatory issues might come into play at some point. While the company has largely kept itself away from controversy in the past, increased growth in the development of new and improved products, as well further market reach, will add to the likelihood of such an event from occurring.

Alkermes also deals with third-party payers for reimbursement for its products. This dependency could give rise to a number of problems that might create unexpected expenses for the company. Finally, clinical trials could prove to be more complicated than previously thought, and other developments and products might be delayed. If the company does not meet its targets for the year, then the growth of the company may be affected, resulting in slower revenue growth or possible decline.

Conclusion

Alkermes released several updates on its progress in the final quarter of 2021. This includes progress with developing a number of different products that will help further increase revenue throughout the year. It also includes a series of decisions to cut costs and ties that might hold the company back and negatively affect profitability. While there are a few potential risks that could offset the company’s growth, the overwhelming evidence points to greater earnings starting from this year and should help create a sense of optimism about the company’s future.

There perhaps has never been a better time to switch from a neutral to a bullish position on Alkermes, as those who buy in early are likely to be rewarded in the near future. The sooner investors buy-in, the greater the returns, especially for those who invest in the long-term success of Alkermes.

Be the first to comment