Falcor/E+ via Getty Images

The Q1 Earnings Season for the Gold Miners Index (GDX) is just around the corner, and one of the first companies to report its preliminary results is Nomad Royalty (NYSE:NSR). While some companies like Victoria (OTCPK:VITFF) came out of the gate with a limp, Nomad has come out galloping, reporting record quarterly deliveries. While the increase in sales is great, this is a mere blip compared to the triple-digit growth rate Nomad will enjoy if its partners can execute successfully. Given Nomad’s attractive dividend yield and industry-leading growth profile, I continue to see significant upside long term, even after the recent rally.

Platreef Project – Nomad Royalty Gold Stream (Ivanhoe Mines Presentation)

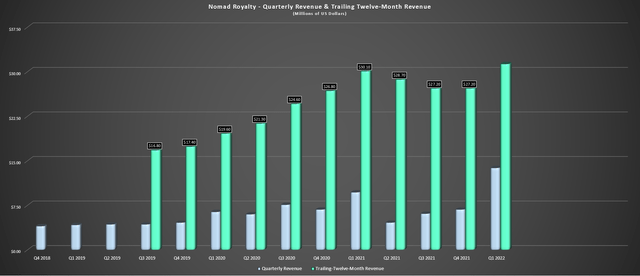

Nomad Royalty released its preliminary Q1 results this week, reporting quarterly deliveries of ~6,600 gold-equivalent ounces [GEOs], a ~17% increase from the year-ago period. This has placed the company well on its way to meeting its guidance mid-point of ~25,000 GEOs. Notably, with higher metals prices and a sharp increase in quarterly deliveries, revenue soared, increasing more than 41% to ~$13.8 million. Let’s take a closer look below:

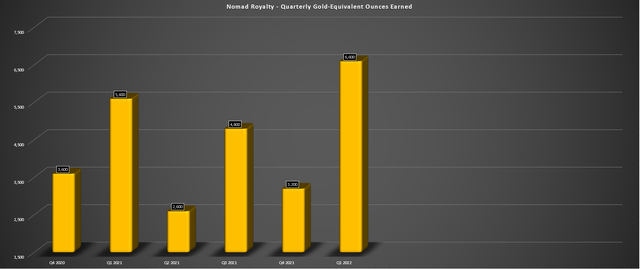

Nomad – Quarterly Gold Equivalent Ounces Earned (Company Filings, Author’s Chart)

As shown in the chart above, Nomad saw a meaningful improvement in its quarterly GEO deliveries in Q1 2022, with deliveries of ~2,700 ounces of gold, ~215,600 ounces of silver, and an equivalent ~1,200 GEOs from copper, related to its royalty on the long-life Caserones Mine in Chile. The growth was driven by a significant improvement at the Blyvoor Gold Mine, where mining rates came in above 500 tonnes per day in March, an asset where Nomad holds a massive 10% gold stream. Notably, the Blyvoor Gold Mine has already produced ~1,000 ounces in the first ten days of April, with continued ramp-up expected for the remainder of the year.

Outside of Blyvoor, the new contribution from Caserones copper net smelter return [NSR] royalty helped boost quarterly deliveries, with this acquired in May of last year and topped up in August to a ~0.63% NSR royalty on the asset. Meanwhile, when it comes to developments across the portfolio, the construction of Greenstone (a key growth pillar for Nomad) is well underway, with first gold pour in H1 2024. Additionally, Ivanhoe (OTCQX:IVPAF) has announced accelerated development at Platreef, with Shaft #2 expected to be equipped for hoisting in 2027, 18 months ahead of schedule, with the first production from Platreef expected in Q3 2024.

Platreef and Greenstone are two key assets for Nomad’s growth, and the progress at these two projects certainly bodes well for Nomad to meet its goal of high triple-digit attributable production growth by FY2025. Elsewhere, though, it’s nice to see Blackwater progressing well, even if the royalty on this asset is quite small (~0.21%), with Artemis (OTCPK:ARGTF) hoping to pour its first gold in H1 2024. While Artemis may be unfamiliar to some, it is led by Steven Dean, who had an incredible track record at Atlantic Gold (OTCPK:SPVEF) before it was acquired for just shy of $1.0 billion by Australian producer St. Barbara Limited (OTCPK:STBMF).

Nomad – Quarterly Revenue & Trailing-Twelve Month Revenue (Company Filings, Author’s Chart)

Recent Portfolio Upgrades

One reason that some investors might have been less interested in Nomad previously as an investment is because its producing assets were somewhat concentrated and it didn’t have many heavy-weight operators. However, in the past 18 months, Nomad has added Barrick Gold (GOLD), JX Nippon Mining & Metals, Ivanhoe Mines, and Artemis Gold as partners, as well as Equinox at one of Canada’s soon-to-be largest gold mines. This gives it some of the strongest partners both operationally and financially sector-wide, which has considerably de-risked the Nomad thesis.

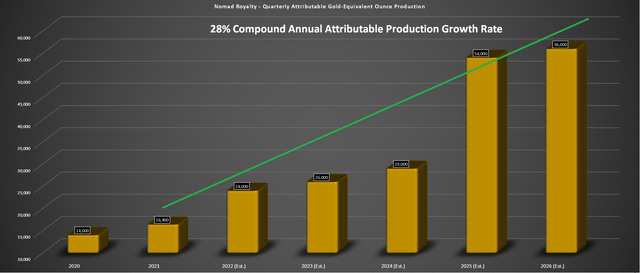

Nomad – Growth Profile & Forward Estimates (Company Filings. Author’s Chart & Estimates)

In addition to a stronger roster of partners, Nomad is set to see a significant improvement in its asset concentration, with Mercedes, Blyvoor, and Caserones being diluted by new assets that are set to come online. This will move Nomad from eight producing assets with moderate concentration to a royalty company with 14 assets and triple its FY2021 production profile by 2026 (28% compound annual production growth rate). Notably, some of these assets will be world-class mines, including the Greenstone Project, the Platreef Project, the Blackwater Project, and the Robertson Project. Just as importantly, a bulk of these assets will be in top-rated jurisdictions (Ontario, British Columbia, Nevada).

Based on this significant improvement in the royalty/streaming portfolio over the next four years, this is not just growth for the sake of growth, but it’s very high-quality growth (better operators, mostly Tier-1 jurisdictions, costs in bottom quartile of the cost curve). Meanwhile, although Nomad has had a laser focus on construction/producing assets with an emphasis on cash-flow generation, which is a refreshing business model relative to some of its junior peers, it recently completed a deal to upgrade its early-stage portfolio as well. This has given the company 22 total assets, with royalties held by O3 Mining (OTCQX:OIIIF) and a couple of other small operators in Tier-1 jurisdictions (Ontario, Quebec).

Valuation

Based on ~62 million shares and a current share price of US$8.08, Nomad has a market cap of ~$500 million. At first glance, this may appear steep for a company with revenue of just ~$27.2 million. However, I don’t think there’s any value in using a trailing revenue multiple for a company with a ~28% compound annual production growth rate. In fact, if Nomad meets its estimates, this compound growth rate will be north of 35%, with the potential (FY2021-FY2025) for deliveries of ~60,000 GEOs by FY2025, or ~260% growth.

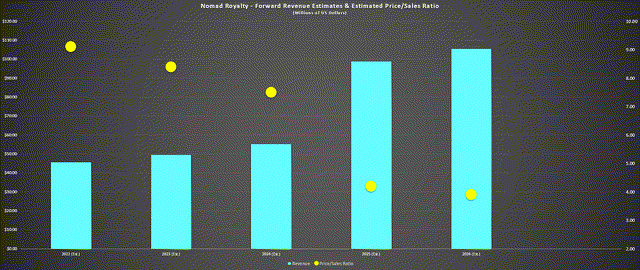

Nomad Royalty – Forward Revenue & Estimated Price/Sales Ratio (Author’s Chart & Estimates)

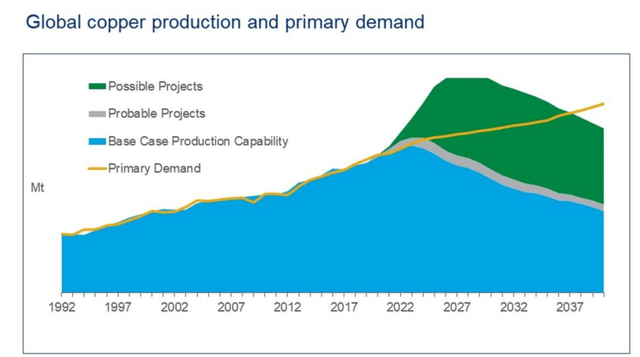

Under this assumption, Nomad would generate $110 million in revenue in FY2025, a figure that is quadruple last year’s sales. So, as the chart above shows, while Nomad might look fairly valued at just over 10x FY2022 revenue, it’s trading at less than 4.5x FY2025 revenue (~$500 million market cap / $110 million) if it meets its FY2025 goal, and this assumes no help from gold, silver, or copper prices. With Nomad having exposure to copper and copper having a very bullish supply/demand picture due to soaring demand with the trend towards electrification, I would argue that there could be some additional upside for copper prices looking out to 2025.

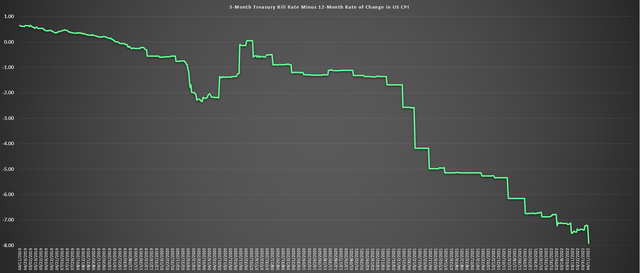

Copper – Supply/Demand Outlook (Wood Mackenzie) Real Rates (YCharts, Author’s Chart)

This copper exposure is a key differentiator for Nomad vs. purely precious metals peers and a nice addition to round out its portfolio. Meanwhile, when it comes to the company’s precious metals portfolio, I wouldn’t rule out further upside for gold or silver either over the next few years, given that real rates are deep in negative territory. Historically, negative real rates at these levels have been quite bullish for precious metals, suggesting a positive backdrop for its primary exposure (gold/silver).

It’s also important to point out that the current revenue assumptions and revenue multiple assume that the company does not complete a single deal between now and FY2025. I would argue that this is highly unlikely, with Nomad quite busy in FY2021 and likely to complete another few deals on producing/near-producing assets in the next 2-3 years. However, even assuming the company adds only 5,000 GEOs from new transactions over the next three years, this would push FY2025 revenue north of $115 million, pushing Nomad’s FY2025 revenue multiple to just 4.3. To be ultra-conservative, I have assumed zero transactions are completed.

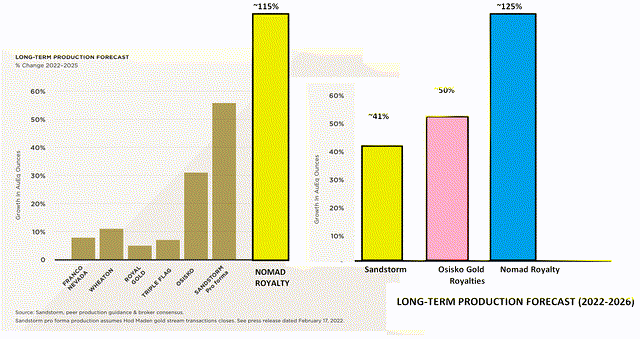

Peer Group – Attributable Production Growth Comparisons (Sandstorm Gold Presentation, Author’s Chart & Drawings)

If Nomad was a no-growth company with industry-lagging margins, a revenue multiple below five and a discount to P/NAV might make sense. However, with Nomad having industry-leading growth (as shown above), the discount to P/NAV and low single-digit FY2025 revenue multiple makes little sense. So, while the stock has closed a small portion of its valuation gap relative to peers during its recent rally, I still see more than 35% upside to fair value for Nomad to my 18-month target price.

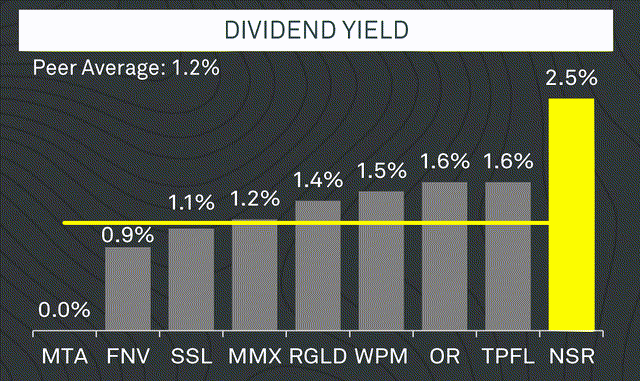

Dividend Yield vs. Peers (Nomad Royalty Presentation)

Finally, the last key differentiator for Nomad is its dividend yield, which dwarfs that of its peer group. As it stands, Nomad pays a dividend yield of ~2.0% or C$0.20 annualized [US$0.16], which is more than 50 basis points above its closest peer and more than 100 basis points above its peer average. This may not seem like much, but when we factor in that Nomad has a triple-digit production growth rate, it’s quite clear that the company’s cash flow profile will improve dramatically over the next 3-4 years.

Assuming Nomad’s partners, which are well experienced and well-funded (Barrick, Ivanhoe, Artemis, Equinox, Lundin Mining) can deliver on the planned growth, Nomad is in a position where it will be able to return significant capital to shareholders once cash flow increases. So, I would not be surprised to see the dividend increase to C$0.35 [US$0.28] or higher by the end of FY2025, giving investors entering below US$8.00 a yield on cost of ~3.50%. Given this outlook of industry-leading dividend growth and growth in cash flow, I have continued to add to my position over the past month.

The above chart which shows a dividend yield of 2.5% is dated; the actual current dividend yield is ~2.0%.

Technical Picture

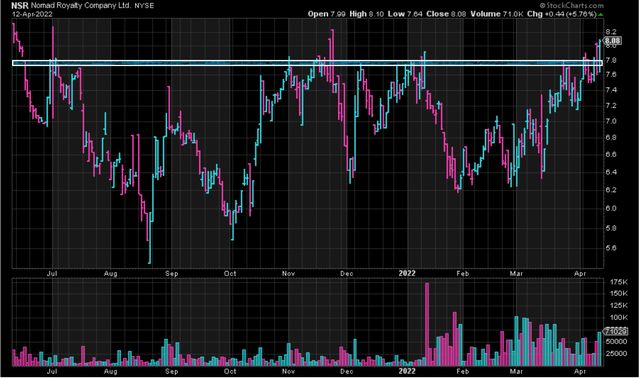

While the fundamental outlook is certainly rosy, it’s just as important to have a strong technical picture and an attractive setup to enter a stock with relatively low risk. When we look across the royalty/streaming sector, many large-cap and mid-cap names like Royal Gold (RGLD) and Sandstorm (SAND) are extended short term, making it difficult to pay up for them at current levels. However, as Nomad’s daily chart shows, the stock has a very attractive setup and appears to be under accumulation.

RGLD Daily Chart – Extended (StockCharts)

This is based on the stock currently working on a multi-month breakout and the fact that it’s seen a large increase in volume over the past 30 trading days. In fact, Nomad saw its highest-ever monthly volume on the US Market in March and closed dead on its highs, suggesting buyers are eager to pick up the stock. Given this much more attractive setup and valuation for Nomad as it works to break out of a large base, I believe this offers an opportunity to compound returns by moving some profits from extended and more expensive royalty plays like Sandstorm into a cheaper and higher-growth name like Nomad.

NSR Daily Chart Breakout (StockCharts)

Nomad had a solid Q1 with record quarterly deliveries, but given the company’s impressive growth profile, I would argue that the best is yet to come. It’s also imperative to point out that while some other royalty/streaming plays have growth, it is very lumpy towards one asset, which separates Nomad from some of its peers and makes its growth much more achievable. Given Nomad’s favorable fundamental and technical outlook, I remain bullish, and I would expect any pullbacks to provide buying opportunities.

Be the first to comment