Dimensions/E+ via Getty Images

Research Thesis

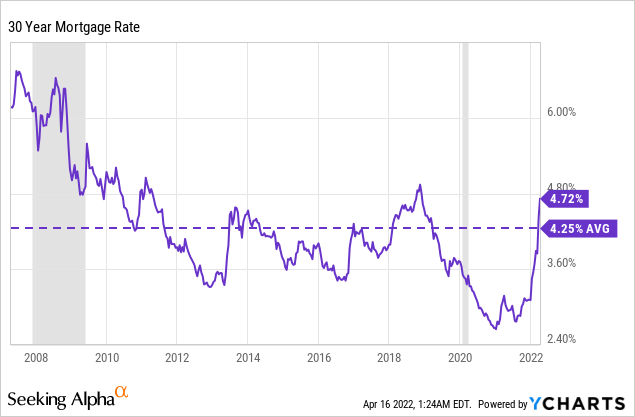

Unfortunately, housing affordability concerns are through the roof following the interest rate hike that pushed 30-Year fixed-rate mortgage rates above the 5% mark. As a result, negative sentiment is suppressing the whole housing sector, reminding us of the darkest days in 2008. Similarly, the SPDR S&P Homebuilders ETF (XHB) has underperformed the S&P 500 over the past year, but I remain very bullish on the housing sector, despite the challenges ahead.

In Part 1 of this developing sequel, I aim to explore the housing and mortgage insurance market outlook, which supports my very strong buy rating for the market-leading homebuilder D.R. Horton, Inc. (NYSE:DHI), which is part of my model portfolio and the small but fast-growing mortgage insurer NMI Holdings, Inc. (NASDAQ:NMIH), part of my highly concentrated portfolio. In later parts, I will move vertically on the supply chain covering the upstream side with homebuilding material suppliers as well as the downstream side with retailers.

The Market Outlook

Concerns over a housing market crash are farfetched and remote. In the past year, we have seen a red hot market with record-high homeownership demand and a prolonged housing undersupply that caused home prices to soar. Undoubtedly, the rising mortgage rates will lead to a cooling-off period, but the pullback in home prices is vital for the long-term growth and sustainability of the housing sector.

The Housing Market is far from Crashing

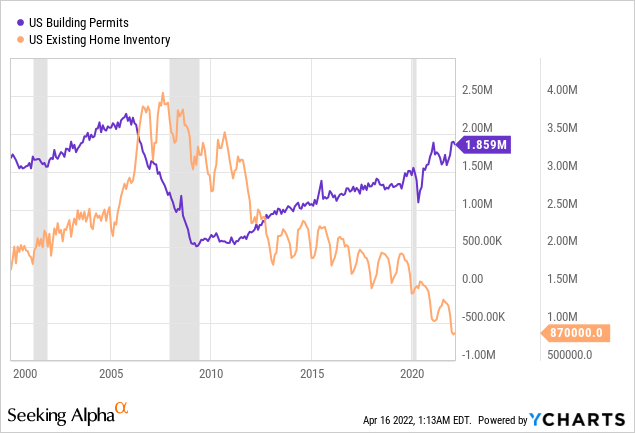

One of the strongest arguments against a housing downturn is the huge underbuilding gap in the market of at least 5.5 million housing units. As a result, this has led to a prolonged disequilibrium in the housing market for more than a decade. In addition, despite the elevated US building permits, currently at 1.86 million, the existing home inventory is declining, limiting the housing supply and pushing home prices further up. On the contrary, single-family homes are inelastic, meaning that an increase in prices results in a slight change in the quantity demanded.

Due to the industry’s nature and dynamics, any sudden rise in home sales will reduce the total available housing units in the market, and this gap cannot be restored fast due to the time needed for construction companies to build homes. The housing market is undergoing an unprecedented short supply, with existing home inventory reaching all-time low levels of just 870.000 properties available in February. As a result, 2022 will be a sellers’ year due to the robust demand and a tight supply, and as the spring season approaches, it would be reasonable to expect elevated activity. Favorably, even though building permits slightly decreased from January highs, there are still strong and act as a leading indicator for future homebuilding activity.

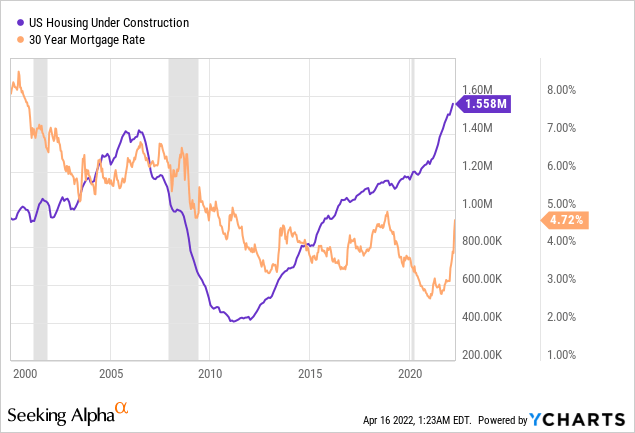

In addition, since the housing bubble and financial crisis in 2018, construction activity has plunged to unprecedented low levels. The historically low mortgage rates have encouraged homeownership, and it took more than a decade for the construction activity to reach its previous levels. It is also notable that from 2015 until the end of 2018, there was a positive correlation between rising mortgage rates and housing construction, signaling that the overreaction to the recent rate spikes might be transitory.

Undoubtedly, the market is in much better shape now than in 2008, with tighter lending standards and excess demand. Remarkably, the US economy reported the longest period of economic growth, but with the current red hot market, we should expect a cooling-off period, which is normal. Therefore, considering the above, the housing shortage will persist for the foreseeable future, but the rising mortgage rates will ease the strong demand, leading to home price normalization in the near term.

The PMI Market

The Private Mortgage Insurance (PMI) sector is tied to the housing market, and they move in tandem. Undoubtedly, the increasing home prices provide companies in the PMI sector with a wide margin of safety in terms of equity buffer offering protection against default claims. Fannie Mae estimates that median new home prices will increase throughout 2022, reaching $450 thousand by the end of the year, while Freddie Mac predicts much slower growth of just a 1.5% increase in home price for 2022, much slower than 2021.

On the negative side, the current mortgage rates have just exceeded their 15-year average of 4.25%, and even though most experts predicted that rates would rise in 2022, no one expected a volatile rise from 3% up to 5% in such a short timeframe. Nevertheless, recent forecasts predict the rate to stabilize by mid-year around the 3.8% mark throughout 2022.

Affordability concerns are greater than ever

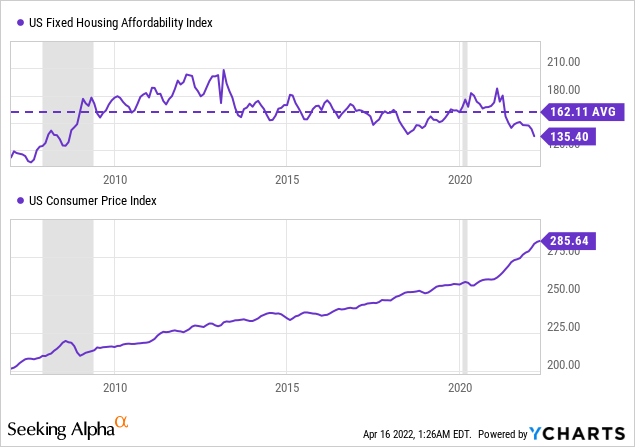

Indeed, a reinforcing loop is noted between rental and home prices. Year to date, the monthly principal and interest (P&I) payment has increased by 24% for an average-priced home and accounts for about 29.1% of the median household income. Indeed, historically this is a very high proportion, and the current monthly P&I payment stands at $1.692, estimated based on a 4.42% mortgage rate.

Surprisingly, owning remains 6.6% cheaper than the $1.812 median rental spending, and as consumers fear the rising household costs, they would prefer locking in fixed mortgage payments instead of rentals. Even if rates stabilize at 5%, this would translate into $1.809 in P&I payments, nearly matching rental cost. Similarly, a recent Realtor.com study has shown that buying a home is more affordable and cost-efficient than renting. Therefore, even though affordability concerns have reached historically low levels since 2008, the rising rental cost still counterbalance the mortgage rate hike.

Moreover, rising inflation rates show no signs of slowing down. Thus, the CPI index is at all-time high levels, and the persisted increases across all goods and services shrink consumers’ purchasing power and marginal propensity to consume. To that effect, building material products are no exception, and rising raw material cost (i.e., lumber) pushes home prices further up, harming consumer confidence which could ease prices in the short term. Therefore, real estate still remains a great investment and an inflation hedge in a rising interest rate environment.

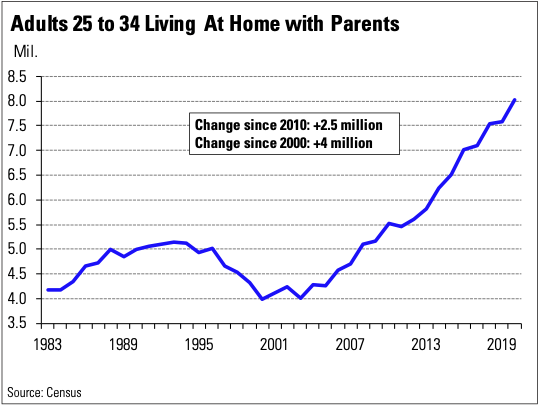

Millennials, the largest generation in history, have already entered the first-time homebuying average age, and they have delayed purchasing a home for years. As a result, more than eight million millennials live with their parents, which supports the strong homeownership demand for the following five years.

Justifiably, skeptics will argue that rising prices will cut out Millennials from the market. However, a recent study by Freddie Mac regarding the public sentiment in the market found that people remain confident in the housing market, and 25% of the respondents responded that they are likely to buy a house in the next six months. Indeed, affordability is a real issue, as 47% of respondents reported housing payment concerns. However, such concern is more intense for renters (58%) and less intense for homeowners (41%).

Rosen Consulting Group (National Association of REALTORS®)

Foreclosure & Forbearance levels keep normalizing

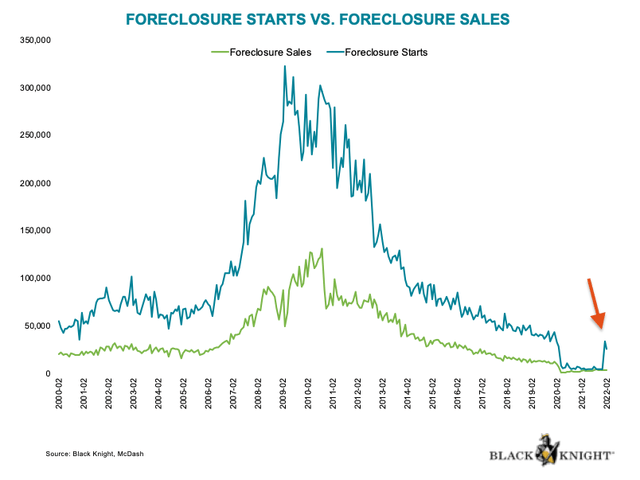

Favorably, ‘foreclosures starts’ pulled back after a massive spike in January with a seven-fold increase. The rising foreclosure rates created a mini shock in the market as it might indicate that a housing market crash and a downturn might be around the corner. However, such a rise in 2022 was expected, considering that Biden’s moratorium protections have kept foreclosures to artificially low levels.

Further, foreclosure completed sales have decreased by nearly 20% in February, so even if foreclosures remain relatively high, the strong demand could rapidly absorb them. Nevertheless, there are encouraging signs with declining active forbearance plans falling to 743,000 during March and reporting consistent monthly improvements.

Black Knight Feb Report (Black Knight, Inc.)

1. DHI – A Market Leader

It’s been almost a year since I initiated coverage for DHI that later on reached $110.45 per share, nearly hitting my target price of $112.48 within six months, and generating a decent 22% return. However, the recent market conditions have caused uncertainty penalizing the homebuilding market and crashing the stock by 34% from the all-time high levels. Nevertheless, DHI is the largest homebuilder in the US and now offers an attractive entry point for investors that can stomach the intense volatility, break through the noise, and have an investment horizon of three to five years.

Undoubtedly, the housing market tailwinds with high homeownership demand and historically low supply have created the ideal market conditions for increasing homebuilding revenue activity and profitability. Still, as analyzed in an earlier section, the underbuilt gap in the market will take years to fill, and it is reasonable to expect a positive outlook for the next three years.

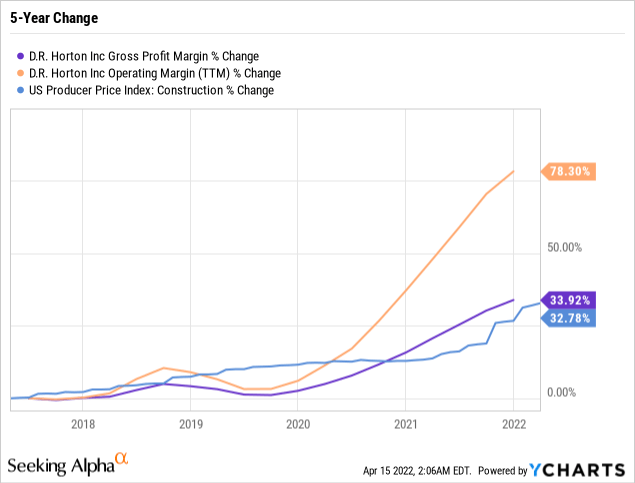

Critics of the homebuilders argue that the rising inflation will hurt profit margins and deteriorate homebuilders’ performance. On the contrary, DHI’s financials prove its resiliency and massive operational scale, with an impressive 5-year increase of 78.3% in operating margins, more than double the US producer price index.

I have previously emphasized on Return on Inventory (RoI) metric, which I consider the most representative performance metric when assessing homebuilders. Economic conditions have profoundly increased DHI’s profitability leading to elevated RoI figures for the last two years, reaching 38.5% in 2021. However, as a result of the demographics and market dynamics, it is reasonable to expect a prolonged housing cycle.

Capital Allocation & Industry Consolidation

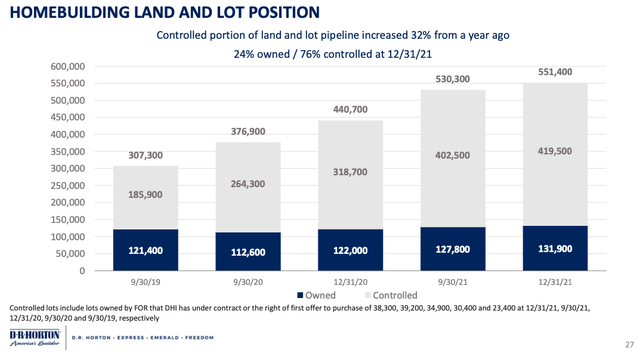

Favorably, DHI adopted a light-land strategy for years and currently controls 551,400 land lots, with 76% of them being optioned. In addition, the company has strategically increased by 25% YoY the total controlled lots while decreasing the owned portion from 28% in 2020 down to 24% in 2021.

A lighter asset strategy will enhance profitability metrics but will also provide ample financial flexibility for expanding production and acquiring potential targets since the company does not tie up capital for purchasing land lots. In addition, this strategy will also provide a hedge to the company if any tail-risk event throws the economy back into a tailspin, minimizing impairment losses.

DHI Land Mix (investor.drhorton.com/~/media/Files/D/D-R-Horton-IR/reports-and-presentations/presentations/q1-fy-2022-investor-presentation.pdf)

The company has recently announced an all-cash transaction with Vidler Water Resources, Inc. (VWTR) for a total consideration of $291 million. Even though the acquiree is a water supply company and not a home builder, its premium water-related assets and rights in the Southwestern US will allow DHI to gain a competitive advantage over a water-constraint area.

DHI adopts an acquisition strategy, and the current market environment favors strategic acquisitions of smaller home builders. For example, M/I Homes, Inc. (MHO) remains one of the most underappreciated smaller homebuilders, grows at the fastest rates in the industry, trades below its liquidation value, and has only $1.21 billion in market cap. Of course, making any predictions would be pure speculation, but DHI’s management has all the resources in place in combination with the cheap valuation environment, which makes the ideal conditions for targeting smaller peers, as the company has done in the past. As a result, through acquisitions, DHI can rapidly gain access to new valuable resources, such as land plots, production lines, and new target markets.

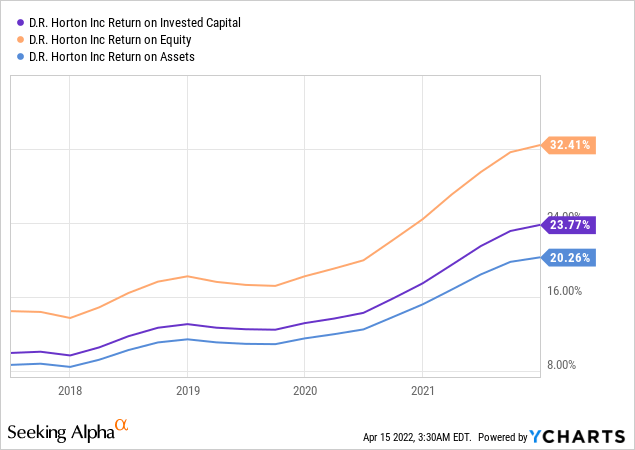

In addition to the impressive RoI, which is part of the capital allocation strategy, other metrics such as ROIC and RoE also support the management’s sound financial decision-making ability. For example, DHI remains underleveraged with a debt to equity ratio of just 31.6% and has consistently increased its RoE in the past three years compared to other peers that magnify RoE figures with excessive debt.

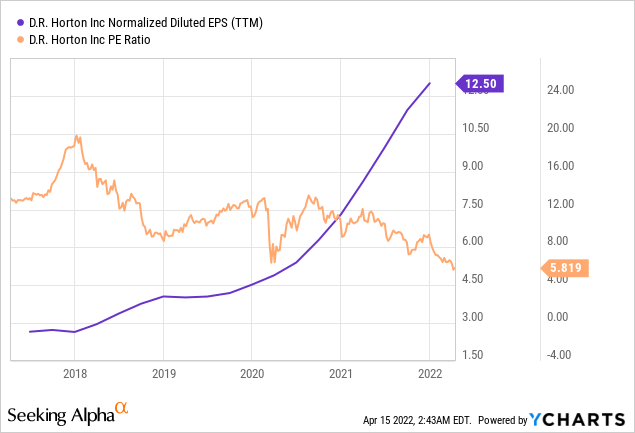

The Market penalizes DHI

Finally, it is clear that investors currently price in a housing market crash as a potential downturn in the economy will discourage home buying activity and might lead to home prices plunging from all-time high levels in the near term. Paradoxically, the company reports increasing DEPS since 2019, but the market assigns a lower P/E multiple, which provides a safe value investment case.

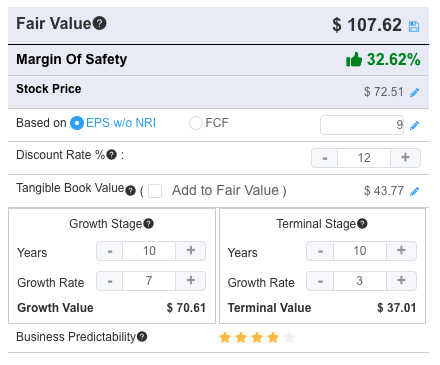

Undoubtedly, economic conditions have benefited homebuilders reporting strong EPS figures, and normalization is unavoidable in the following years. As a result, I have applied a basic DCF model based on normalized EPS at $9 to determine DHI’s fair value.

Even though the company has a 10-year DEPS CAGR of 41.85%, I have used a very conservative annual growth of just 7% for the next ten years and a 12% discount rate to account for the implied housing market risk. Therefore, the model suggests an intrinsic value of $107.62, close enough to my previous valuation of $112.48, implying a 48.44% upside from current share price levels.

Finally, at current share price levels, DHI offers a favorable risk/reward profile, but most importantly, the increasing DEPS in conjunction with lower valuation provides a wide margin of safety for investors.

GuruFocus DCF Calculator (www.gurufocus.com/stock/DHI/dcf)

2. NMIH – A Rising Star

The recent pullback in the housing sector has also negatively affected all PMI peers, and the whole sector trades at a discount. The pullback provides a unique opportunity to own one of the best-in-class PMI names.

My initial investment thesis on NMIH remains intact with an intrinsic value estimate of $35, the company is a strong buy offering a deep margin of safety of 44.63% and trades around its book value. In addition, the company has outperformed operationally through COVID and has generated significant shareholder value.

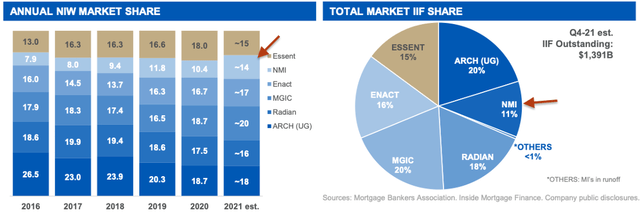

Inevitably, the total mortgage originations market is expected to shrink in the following years, but NMIH is well-positioned to grow by taking market share from its largest peers. For example, the company has done an impressive job expanding its dominance in the New Insurance Written (NIW) market with an estimated market share of 14% for 2021, a nearly 35% YoY increase.

Further, NMIH is the smallest player in the sector but records superior growth above all its peers and grows its revenues with a 5-year CAGR of 31.40%. Impressively, the growth also extends to earnings with a 5-year CAGR of 29.28%, signaling that NMIH enjoys operational leverage and high profitability.

ESNT Investor Presentation (s1.q4cdn.com/417295621/files/doc_financials/2021/q4/ESNT-Investor-Presentation-4Q21.pdf)

The rising mortgage rates have jumped to new highs breaking the 5% territory, leading to a drop in mortgage applications and refinancing activity last week. Undoubtedly, the rates hike creates mini shocks in the market, which might harm consumer confidence in homeownership. However, many experts believe that inflation may have peaked, creating expectations for easing interest rate hikes and mortgage rates in the second half of the year.

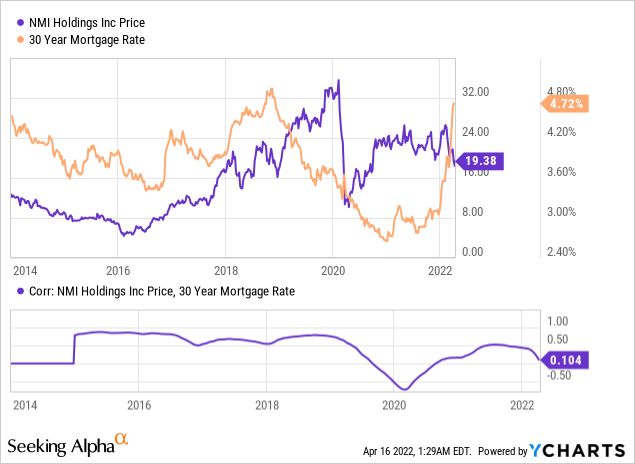

NMIH has shown some positive correlation with rising 30-year mortgage rates in the past, but lately, an inverse relationship has emerged. In addition, since the company’s IPO in 2013, it is notable that mortgage rates act as a leading indicator in specific periods. Therefore, despite the recent negative correlation, business-wise, it is more reasonable to assume that as soon as rates stabilize, NMIH will recover and resume its upward trajectory.

Best-in-class Credit Quality

Even though the company is small relative to its peers, it has achieved a leading credit performance in the PMI market. NMIH does not rely on portfolio QC as most of its peers do, whereas the company individually underwrites and validates nearly 80% of the insured loans, and this demonstrates the high standards and strong internal practices the company implements. Through its comprehensive risk management framework and practices, the company has effectively managed credit risk supported by the following key metrics:

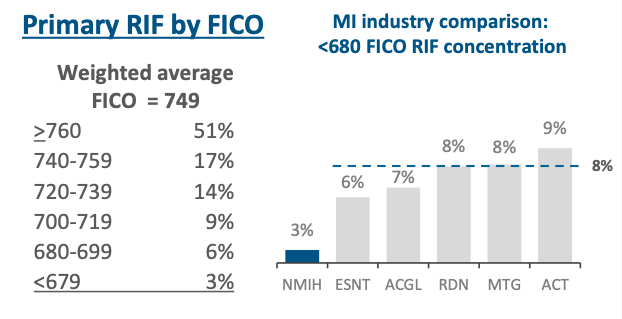

- Healthy FICO Scores: The company has a weighted average FICO composition of 749 above the industry’s average of 740, and more than half of the portfolio (51%) has scored more than 760. Remarkably, the company has only 3% of its in-force portfolio, falling under the <680 FICO category, well below all of its competitors.

ir.nationalmi.com/static-files/eea3fa46-9ff4-4603-aa88-1456578e8b5e

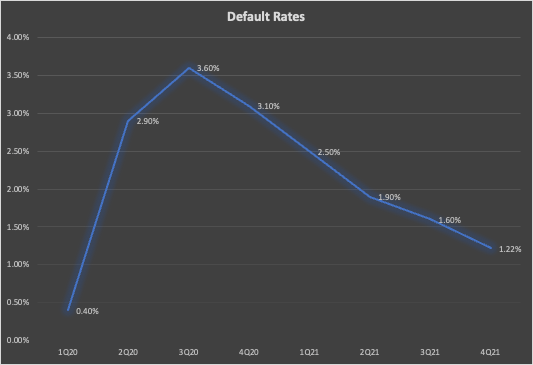

- Declining Default Rates: The default rates have normalized since the pandemic, reporting QoQ decreases approaching the 1% rate and continuing its favorable direction. As a result, the falling rates will unlock capital that could be deployed for generating more NIW. In Q4-2021’s earnings call, the CEO has noted that:

The performance of our early COVID default population, those borrowers who entered forbearance programs and defaulted in 2020 and are now reaching the end of their 18-month forbearance periods, has exceeded our expectations in a favorable way and prompted us to release a portion of the reserves we established for potential claims outcomes.

Chart created by author with data from the company’s SEC Filings

In addition, the company’s authorized $125 million 2-year share repurchase program is a tactful way for the company to utilize its excess capital for distribution to shareholders. Even though the CEO noted that 3-years is a reasonable buyback horizon, the current 52-week share price low provides a reasonable ground for the company to utilize a large part of the approved program to buy back shares that trade around its book value. The buyback program represents roughly 7.7% of the $1.61 billion market cap, and such actions will prove value-enhancing for shareholders in the near term.

Finally, NMIH remains one of the smallest but underappreciated PMIs with solid growth and a high-quality insured portfolio. However, the muscle memory keeps investors away from the PMI sector even though the whole industry has been restructured. Therefore, the current market conditions are a good test for the sector to prove its resilience and eventually attract more sensible valuations.

Concluding Thoughts

The housing market is expected to remain strong in the following 12-24 months, but home prices need to ease from high prices down to sustainable levels. I have been bullish on the housing sector for a while, and the recent pullback provides an attractive entry point for long-term investors to purchase quality companies at deep discounts.

Indeed, investors who cannot stomach high volatility and have a short-term horizon better invest in a homebuilder ETF, for example, HOMZ and XHB, or even better, avoid investing in the housing/PMI sector until the whole macroeconomic picture clears up.

Be the first to comment