jetcityimage/iStock Editorial via Getty Images

After having analysed Renault, and initiated a buy rating on Volkswagen AG and Mercedes-Benz, today we are focusing on Nissan Motor Co. (OTCPK:NSANF) (OTCPK:NSANY). Many Wall Street analysts are looking at the Japanese carmaker based on past results and as a restructuring story. Indeed, looking at the past is clearly important to understand and foresee a company’s future, but it is not always the most suitable method. Cross-checking the IBES consensus estimate, we see that on Price to Book value Nissan is currently trading at one standard deviation figure below its historical average and might offer an attractive entry point.

We do have a mixed feeling about Nissan, here below are our positive & negative key takeaways:

- (+) At the end of January 2022, Nissan, Renault and Mitsubishi Motors announced Alliance 2030: Best of 3 Worlds for a New Future. The conference aimed to release a joint roadmap towards 2030 aiming at EVs and connected mobility. Going to the details: the Alliance will invest €23bn in the next five years and is proposing to launch 35 new models of EVs by 2030. They claim to enhance the usage of common platforms to reach 80% in 2026 (thanks to five common EV platforms) versus common platforms that today represent 60%. Concerning autonomous mobility “by 2026 Alliance members expect to have more than 10 million vehicles on the road across 45 Alliance models equipped with autonomous driving systems”. It also aims to install an integrated cloud system in over 5 million vehicles and be the first global mass-market car producer to offer the Google ecosystem in its cars.

- (+) The Alliance also announced a common battery strategy. Nissan and Renault will have the same battery supplier and this will benefit economies of scale – quoting the news: this will enable: “to reduce battery costs by 50% in 2026 and 65% by 2028″.

- (+) Related to point 2) Nissan is increasing its investments and will lead an all-solid-state battery technology development for the Alliance 2030;

- (-) Nissan production and sales continue to deteriorate;

- (-) Nissan’s exposure to Russia is quite irrelevant but they have suspended exports and closed their St. Petersburg facility. In Nissan’s latest report, Russia has been named 11 times – the relevant fact is that they produced 35,278 out of 2 million vehicles in Russia, representing a very low percentage.

Q3 Results

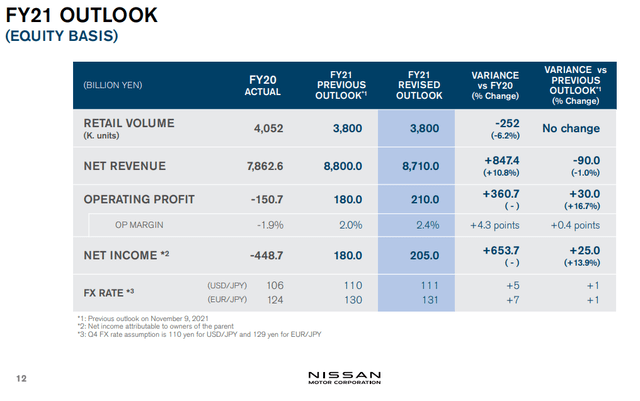

While the semiconductor shortage continues to have an impact, favourable market conditions in the United States, coupled with sales quality improvement led to a significant increase in net unit revenue. Profit has improved significantly year-over-year thanks to financial discipline and tight control of fixed costs. Although the forecast of sales volumes for the fiscal year 2021 remains unchanged at 3.8 million units, the shortage of semiconductors and the increase in infections from Covid-19, due to the spread of the Omicron variant, are affecting Group operations.

Despite these challenges, Nissan revised its forecasts for the full year upwards, thanks to further improvement in performance due to higher sales quality and cost optimisation as well as to a favourable Yen depreciation.

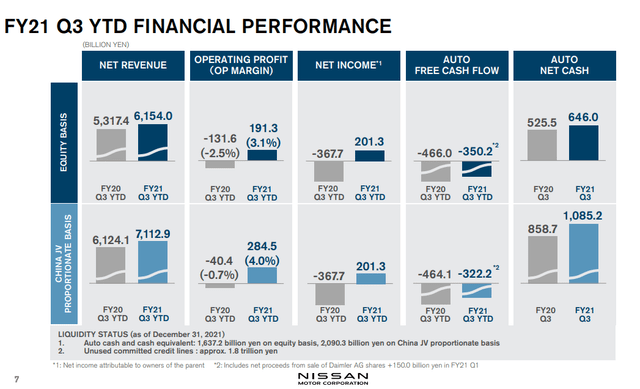

The first nine months of the year were good for the Japanese carmaker. Consolidated net revenues were 6.15 trillion yen and operating profit stood at 191.3 billion yen, with an operating margin of 3.1%. Net profit amounted to 201.3 billion yen. Operating results on a pro-forma basis, which include Nissan’s joint venture in China, reported an operating profit of yen 284.5 billion, equivalent to an operating margin of 4.0%.

Q3 Nissan Fin Performance

Source: Nissan Q3 results

Valuation and downside risks

The next key catalyst is the dividend payment restart and reset. Currently, there is clear visibility of positive FCF in the year and Nissan needs to show some meat to the investor community. Our valuation is based on a target ROE of 7% for the 2023 forecast, arriving at a target price of 600 yen versus 500 yen at the time of writing. Downside risks are equally important, we note execution risks in new models, higher input costs, macroeconomics deterioration, stronger yen, chip shortage and COVID-19 impact.

Nissan Outlook

Source: Nissan Q3 results

If you are interested in our latest automotive sector coverage, please have a look at:

- Mercedes-Benz: More Aerodynamic After Truck Trim

- Renault: The Most Exposed Automotive Company In Russia

- Volkswagen: All About The Long-Term Trends

- Ferrari To RACE Again

Be the first to comment