Mikko Lemola/iStock via Getty Images

Recently a few readers have asked me to give more detail about what stocks I personally own. It’s a reasonable question to ask of someone who has the nerve to give other people investing advice. If their investments aren’t doing well for them, why should you pay them any attention?

That made me think it might be a good idea for me to review how my investing has gone over the past two years, which is, not so coincidentally, the period in which I have begun writing about investments again.

All of us tend to feel good about stock frogs we kissed that turned into beautiful princes. Most of us, however, just try to forget about the ones we kissed that turned into warty toads.

With that in mind, I thought it might be instructive and even humbling to take a good look at the trades I’ve made since I started building up a portfolio of well-valued income-paying stocks and ETFs to replace the income I could no longer get from CDs.

An Overview of My Current Holdings

Investment Strategy

My primary focus when I started building this portfolio in March of 2020 was to generate income to take the place of the income I was losing as rungs of my CD ladder came due. So most of the investments in this portfolio are income-oriented.

I like to think of myself as a value investor and I rely heavily on Fastgraphs and my own analysis spreadsheets to screen stocks. If you follow my writings you have seen me use those spreadsheets when valuing the most heavily weighted stocks held in ETFs. Once screened I do further research and use my common sense to evaluate whether a company really might be a good investment going forward, independent of the easily analyzed financial figures.

Though I want income from my investments, I also keep an eye on total return. I don’t strive to match the performance of S&P 500 at its most manic, but I want my stocks to grow their earnings and I like to see relatively consistent earnings growth which in time usually results in share price growth.

My Current Holdings

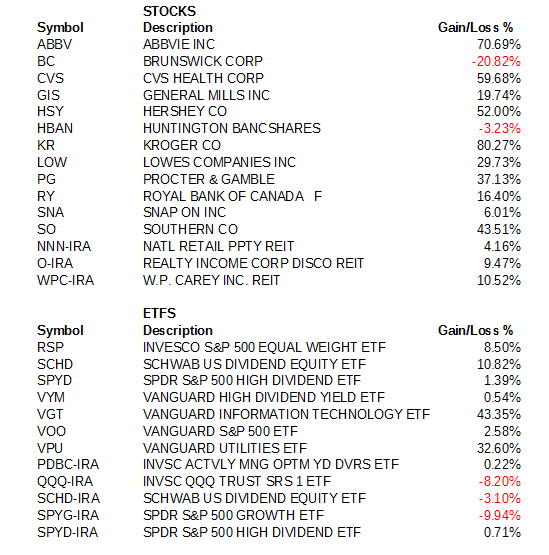

Below you can see the entire list of my current stock holdings and how they have performed. Note that my total stock investment is broken out to roughly 25% individual stocks and 75% ETFs. Outside of this portfolio have held a large amount of the Vanguard Total Stock Market ETF (VTI) since the early 2000s, but I don’t consider it part of this portfolio.

The Author’s Brokerage Account

My individual stocks were bought for income. I have increasingly been using the Schwab U.S. Dividend Equity ETF (SCHD) as a tax loss harvest partner when I have sold unsatisfactory dividend stocks. I tax loss harvested my latest SCHD buy in February and put the proceeds into the SPDR S&P 500 High Dividend ETF (SPYD) and the Vanguard High Dividend ETF (VYM).

Though you can see a heavy dividend emphasis in my holdings, not all the investments I have bought over the past two years were bought for income. As a believer in the wisdom of investing for the long term in broad market index funds, I have continued to make occasional investments in the Vanguard S&P 500 ETF (VOO) and the Invesco S&P 500 Equal Weight ETF (RSP).

I bought the Vanguard Technology ETF (VGT) in June of 2020 in a departure from my usual value approach the spirit of “if you can’t beat them join them.” The momentum of tech stocks was irresistible. Over the last six months as inflation has picked up I also have been investing, in my IRA, in the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC).

A Look At My Holdings Performing Poorly

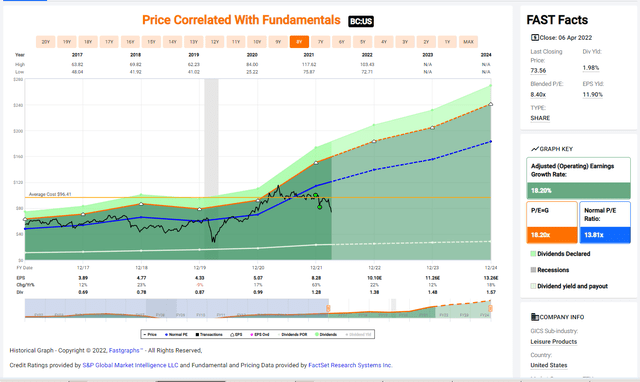

Brunswick Corporation (BC) has obviously been my biggest recent disappointment. I bought it because it appears to be very well valued, is a very strong player in its niche–recreational boat sales and maintenance products. I listened to its earning calls, was convinced that rising interest rates are not a threat to its future profitability, and felt like it might truly be an overlooked value.

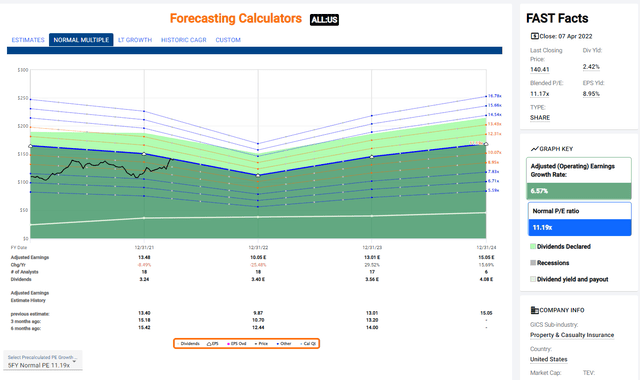

You can see what it looks like now on Fastgraphs below.

Brunswick Price, Earnings, and Dividend History and Forecasts

fastgraphs.com

Nothing has happened to change analysts’ expectations of its future earnings. Earnings forecasts have increased significantly over the past three months. However, Brunswick seems to be getting dragged down by its membership in the Leisure Products sub-sector of the Consumer Discretionary Sector. Investors who don’t look at individual stocks and think generically believe that rising interest rates threaten consumers’ ability to buy all leisure products. I think they may be wrong about Brunswick and I plan to hold it through another couple earnings calls. Other stocks I have bought that have had Fastgraphs that look like this have bounced back admirably when I have been patient, most notably AbbVie (ABBV) and CVS (CVS).

Huntington Bancshares (HBAN) is very volatile with a nice dividend. It recently acquired another Midwestern bank chain and is currently digesting it. I sold one lot of Huntington Bancshares shares at year end, which I had bought at way too high a price. But it pays a well-supported dividend and my remaining shares have been in the green as often as they have been in the red over the past quarter. Analysts still expect it to generate double digit earnings going forward, which along with its 4.39% yield will keep it in my portfolio for the foreseeable future.

The reason you see the Invesco QQQ Trust (QQQ), the SPDR S&P 500 Growth ETF (SPYG) sitting in my IRA with losses is that I invested in them at the beginning of 2022 when I decided to take profits on a nine-year old investment, the Prime Cap Odyssey Aggressive Growth Fund (POAGX) while it still had a significant profit to take. After years of fine performance it seemed to be losing its way the year and its high .68% expense ratio no longer made sense to me. I put half of the proceeds of that sale into the two growth ETFs currently in my IRA to maintain a big of my previous aggressive growth tilt and put the rest into SCHD. All three of these investments are down, but the total share price loss is not as much as I would have lost had I continued holding POAGX.

The Portfolio’s Overall Performance

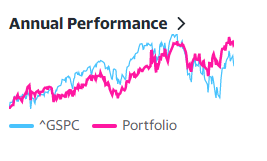

I track all the purchases I’ve made since March 2020 in a Yahoo portfolio. Yahoo tells me that over the past year that portfolio has outperformed the S&P 500. Given that the yield of that portfolio is considerably higher than that of the S&P 500, I feel my current holdings are doing their job.

Yahoo Finance Portfolio

Though it’s easy to track the performance of my current individual holdings and to compare the performance of those current holdings as a whole to that of the S&P 500 over the past year, it’s a hideously complex job to accurately track the true performance of my long-term investing. That’s because my stock portfolio has seen multiple buys and sells over several years as money has come in from maturing CDs. I also have followed a policy of tax loss harvesting. This means selling any stock that has generated a significant amount of dollar losses and replacing it at the same time with another stock or ETF that is similar but not identical.

Since this means I’m periodically getting rid of my losers, it’s hard to know how my portfolio really is doing. So with that in mind I set out to look at the stocks I have sold. I wanted to know whether selling them and replacing them with other investments was a good idea. How had my stock trading affected the potential performance of my portfolio?

How Wise Were My Stock Sales?

My policy in constructing this portfolio was that I would not sell profitable stocks held in my taxable portfolio. I was investing to replace five-year CDs and would be satisfied to receive a yield competitive with inflation. However, I would sell stocks that generated significant losses I could use to offset income while immediately replacing them with other investments of a similar nature to stay fully invested in stocks. This is what is known as “tax loss harvesting.”

My Stock Sales

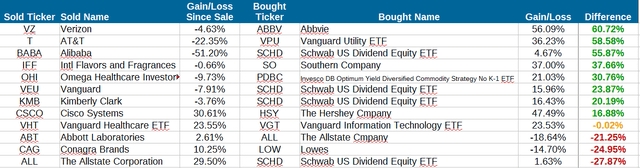

Below you can see the sales I have made in this portfolio from its beginning through the end of 2021.

My Stock Sales from March 2020 – Dec 31, 2021

The Author

The last two columns show what my gain or loss on my original investment would have been had I not sold these shares. The second column from the right shows the price change. The last column includes both price gain or loss and the dividends that I would have received had I held onto those shares.

All the stocks sold by year-end 2021 were sold for tax loss harvesting purposes except for the Omega Healthcare Investors (OHI) which I hold in my IRA, the Vanguard Total International Stock Market ETF (VXUS), and International Flavors and Fragrances (IFF).

I sold VXUS after deciding I didn’t want to own stocks domiciled in countries ruled by dictators like those who control China, Russia, and Saudi Arabia. I completed selling the rest of that position in early 2022.

I sold International Flavors and Fragrances for the price I bought it at. I had bought it by mistake, confusing its ticker with that of another stock I was thinking of buying.

How Did The Stocks I Sold Perform After I Sold Them?

I sold 15 stocks. As you can see, 11 of them went on to underperform. Three did very poorly – Alibaba (BABA), AT&T (T), and Omega Health Investors (OHI).

The table below shows you what gains or losses I would have experienced if I had bought these stocks on the day I sold them rather than selling them. The second from right column shows their price gains or losses from the time I sold them until now. The rightmost column shows their total gains or losses including both price appreciation and dividends paid since I sold them.

How The Stocks I Sold Have Performed Since Their Sale

The author

Verizon (VZ), Conagra Brands (CAG), Abbott Laboratories (ABT) and Qualcomm (QCOM) saw almost no price appreciation but would have generated a small total return due to their dividends.

Four sales in hindsight look like mistakes. Ironically, my worst apparent sales mistake was the Vanguard Healthcare ETF (VHT). I bought it, saw it drop, asked myself it really fit my investing style and sold it. It has gone on to be immensely profitable. That said, VHT really doesn’t fit my investment style, which is increasingly to avoid sector bets. The more I learn about how sectors are defined, the less I like them. They are arbitrarily defined and increasingly irrational. They do not serve investors well, as GICS, organization that defines what stock goes in what sector, has a nasty habit of taking successful stocks out of one sector and putting them into failing sectors to “maintain balance.”

Buying on the dips that got me selling Cisco Systems, Allstate, and Conagra Brands in retrospect superficially looks like it would have been the smart thing to do. But I’m still not crazy about the future prospects of these stocks.

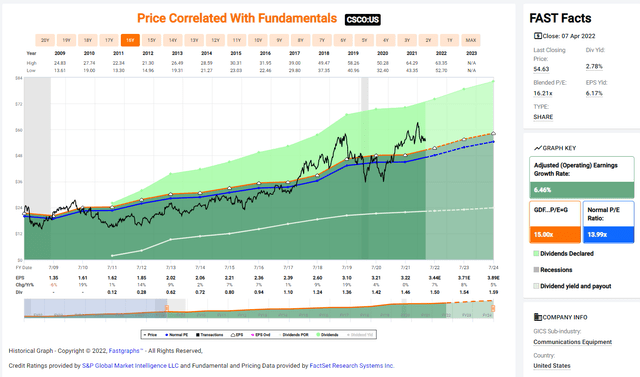

Cisco Systems’ (CSCO) surprising price recovery does seem to illustrate the value of patience. However, CSCO also doesn’t really fit my investment style. I don’t have the ability to understand what it is that the company sells its customers so I have no idea how different economic scenarios will affect it. I prefer to use well-diversified ETFs like QQQ and SPYG to cover my investment in technology stocks. It looks overvalued now, and its dividend is just a few basis points higher than that of the brokered three-year CD I bought this week that is yielding 2.75% and won’t lose value in a prolonged market decline.

CSCO Price, Earnings, and Dividend History

fastgraphs.com

Allstate (ALL): I sold because its primary business involves insuring cars at a time when aftermarket car parts have become very expensive. I sold it at the end of 2021, so there hasn’t really been enough time to see if that bear thesis plays out. Currently it seems to be benefiting by being classed in the Financial Sector since investors believe that higher interest rates benefit that sector. I’m not convinced that much higher repair expenses will benefit an insurance company.

Allstate’s earnings estimates have been falling every few months. I have learned through hard experience to take earnings forecasts with a huge grain of salt as the further out the forecast extends the more likely it is to be over-optimistic.

fastgraphs.com

Note: I have not included some tax loss harvesting sales I made in the first quarter of 2022 as it is too soon to judge how wise those sales might have been. The one sale I should let my readers know about, as I recommended this stock at year end and bought it myself then, is the mid-February 2022 sale of Fortune Brands Home & Security (FBHS). Some of you might remember that it looked like a good value at the beginning of the year. It has done nothing but tank ever since I bought it. It might turn around, as it still looks decently valued, but I only had room for one forlorn hope in my portfolio and that currently is Brunswick. I put the proceeds of the Fortune Brands sale into the Vanguard S&P 500 ETF (VOO) which has a similar dividend yield.

Conagra’s performance since I bought it has been mediocre, but I probably should have held onto it for the decent dividend, since I sold it at a time when there really was nothing better to buy in its place and lost on the trade.

How Did The Replacements I bought for My Tax Loss Harvests Do?

Next I compared the ongoing performance of the stocks I had sold with the performance of the stocks and ETFs I had bought to replace them. This was a tedious exercise but well worth doing. To keep the effort manageable, I only looked at how their prices performed and did not attempt to calculate how much dividend I had missed. In most cases the yield of the replacement investments were similar to those of what I sold.

Calculating the performance of The Commodity ETF, Invesco Optimum Yield Diversified Commodity Strategy No K-10 ETF (PDBC) which I hold in my IRA is not straightforward, as its performance this pasty ear has been entirely due to its huge, end of year 40% dividend. Once the dividend paid its share price drops by the same amount. So I figured the dividend into the investment’s performance for that one replacement investment.

Subsequent Performance of Sold Stocks vs. Their Replacements

The author

I was pleased to see that, overall, my replacement stocks had done far better than did those I had sold. Two of the exceptions, Abbott Labs and Allstate were the stocks that I bought at a time last year when I really couldn’t find any true values on the market and hence invested in stocks that I typically would have avoided.

Abbott was overvalued when I bought it. I must admit I had fallen in love with one of their products, the Freestyle Libre Continuous Glucose Monitor, and that swayed me to buy the stock. It was a mistake. It was even more of a mistake to replace it with Allstate. Allstate, like most Financials, is cyclical, and one of my oft-stated investment principles is to avoid companies that don’t have a consistent history of earnings growth.

My tax loss harvest of Conagra Brands failed because I invested the proceeds in Lowe’s (LOW), a company that had done very well for me until then. Unfortunately, I did not respect how overvalued it had become or face the fact that it had become momentum driven. I learned my lesson. I ended up tax loss harvesting the lot of Lowe’s I had bought in December 2021 in February, moving the money into Home Depot (HD) and then making a round trip back to Lowe’s a month later. That tax lot may, sadly, provide me with yet more tax loss harvest opportunities.

I did get the additional benefit of being able to use the losses I made in my taxable account to deduct $3,000 from my business, get out of a profitable investment in VXUS with a tax-free profit, and offset an unexpected capital gain I received at year end from a bond mutual fund.

What Are The Lessons To Take From These Results?

Only Tax Loss Harvest When Well-Valued Alternatives Are Available

The mistakes I made with my tax loss harvesting occurred when I sold losing stocks at a time when there really weren’t any stocks that met my usual value standards. Those require me to only buy companies when they are trading at a price that gives them a P/E ratio below their usual ones while also showing a steady history of growing earnings. I also want these stocks to be in businesses that give them reasonable expectations of being able to continue growing those earnings at a decent rate.

The stocks I bought in 2020 and the early part of 2021 matched those standards. Those I bought from October 2021 on did not given how toppy the entire market had become. The complete lack of high quality value stocks I saw in my screening should have made me more cautious.

Lesson learned: Stick to the investing principles you have decided to follow. Don’t stretch your definition of “value” when you can’t find anything to buy, no matter how much cash you have to invest.

Avoid Trending Stocks

Alibaba, AT&T, and Omega Health Investors were stocks that were heavily covered here on Seeking Alpha, almost always by authors who made a case that they were great deals for investors. BABA looked so ridiculously undervalued on Fastgraphs that I let myself buy a stock that paid no dividend that was domiciled in a country under a lot of international scrutiny. Omega Health Investors might have been a better investment if people had acted sensibly to avoid spurring another COVID surge last winter. Since they didn’t, it’s understandable that people who love aging relatives will do what they can to keep them out of nursing homes and that sensible workers will avoid working in these hotspots. I won’t be investing in nursing homes again, that’s for sure!

I have come to think that one major reason that stocks trend online is because they are doing poorly. Bag holding investors want to read articles that convince them they haven’t made a mistake buying in. Web publishers gauge the success of their authors by how many eyeballs they attract. The more bag holders, the more eyeballs, and the more articles.

Lesson Learned: Be more cautious the more coverage a stock has and the more you hear what a great buying opportunity it presents. You may be hearing investors whistling past a graveyard.

Don’t Count on a Dividend to Bail You Out

We also see that even with high dividends, companies that are on a losing trajectory for very good reasons stay losers. AT&T (T)’s 7% and 8% dividend still didn’t offset its share price losses. The “juicy dividend” wasn’t much help to owners of Verizon (VZ), Omega Healthcare Investors, or Kimberly Clark (KMB), either.

Kimberly Clark’s P/E ratio is currently over 20 which makes no sense for a company that grows its earnings at an average rate of 2.73% a year. Verizon is one of those stocks that always looks like a great deal with a stock price ready to take off. But just like AT&T, it never seems to be able to live up to investor hopes. Maybe it is because everyone already has more phones than they have ears?

Lesson Learned: When the price of every other stock on the market is surging after more than a year of a rampant bull market, almost anything that looks like a bargain is not.

Don’t Make Stupid Mistakes!

I must confess that the reason I owned AT&T was because I had done something dumb. I had actually gotten out of an earlier AT&T investment with a very small loss. Unfortunately, I had set a Good Till Cancelled order at what seemed like a very low price–and completely forgotten about it. Unlike other brokerages, Vanguard does not remind you about your open orders. My open order triggered when AT&T commenced its long slow swoon. I no longer have an account at Vanguard.

Lesson Learned: Do not set standing orders for individual stocks.

Be the first to comment