Andy Feng

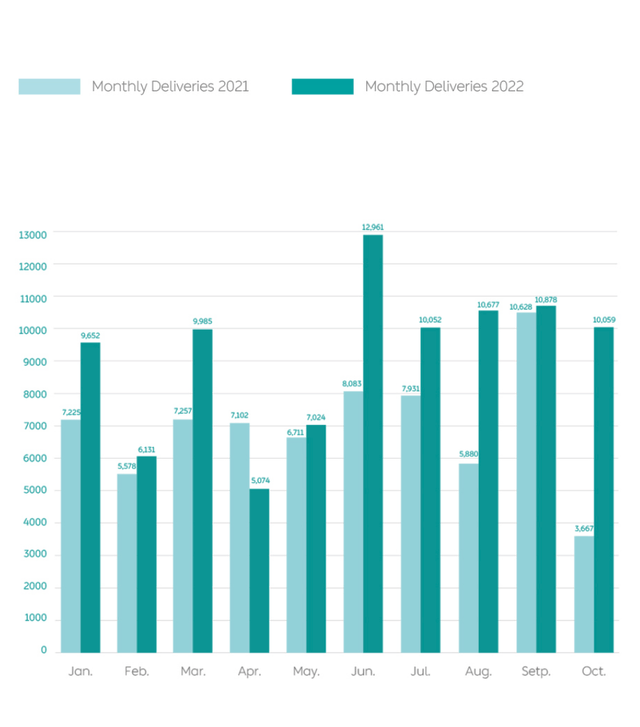

Although NIO Inc. (NYSE:NIO) bucked the trend in October with a strong month of deliveries, recording 10,059 monthly deliveries for 174% y/y growth, the manufacturer has seen the end of the month and the start of November hit with production suspensions at its main factories. Even with the solid start to the quarter — with a slight sequential decline m/m in deliveries — the scope of the production suspensions have led to a downward revision on projected deliveries for Q4. The risk that Nio disappoints with delivery data in November and December heightens as shares remain depressed on elevated geopolitical tensions and supply chain concerns.

October Deliveries Quite Strong

Deliveries moderated slightly from September’s three-month high, dropping 7.5% m/m. Nio managed to post a whopping 174% y/y growth comp as October 2021 deliveries were “significantly impacted by reduction in production volume” from restructuring and upgrading manufacturing lines and preparing new vehicles to bring to market.

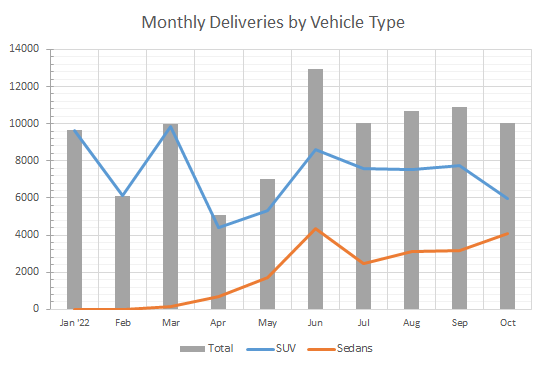

As visible in the graph above, deliveries are moderating. While Nio is pointing to “operation challenges in our plants as well as supply chain volatilities due to the COVID-19 situations in certain regions in China” as headwinds to growth, the challenges may lie deeper.

A Glaring Weakness In SUV Deliveries

Taking a look into Nio’s deliveries by vehicle segment — SUV versus sedan — the month’s strength stems from strong ES7 and ET5 deliveries. ES7 deliveries of 2,814 grew 48.5% m/m in its third month of deliveries; ET5 deliveries increased 366% to 1,030 in its first full month of deliveries.

Data from Nio

Sedan deliveries continued solid growth, notching another month of growth after a weak July. Sedans grew 29.6% m/m, boosted by the ET5, as ET7 delivery growth m/m was a minimal 4.2%. SUV growth declined sharply, falling 22.6% on the month as the delivery report highlighted major weakness in its long-standing ES8, ES6 and EC6 models.

Prior to the commencement of ES7 deliveries in August, the three existing SUV models average 7,330 deliveries every month. April proved the weakest, with deliveries across the SUV line dropping to 4,381 units. October’s data highlighted major weakness in the three models, as the trio combined accounted for just 3,165 deliveries.

Putting this in perspective — the ES6 recorded 5,100 units alone in July, and has averaged 3,611 units since January 2021 — for 21 months, the ES6 has averaged higher deliveries than that of all three SUVs combined in October. ES6 deliveries likely have fallen 75% since July’s tally in just three months. This glaring decline in Nio’s existing SUV lines, which have been the cornerstone of deliveries for far over a year, could reflect either: a) a sharp decline in SUV market share, b) a sharp decline in SUV production due to supply chain challenges, etc., or c) a shift to focus on sedan production and production of the new ES7. Regardless of the exact cause, this major weakness in its three SUV models poses a major headwind, as Nio is now relying solely on its three new models to outweigh such weakness, penetrate the market and lead to delivery growth.

However, this view is already challenged — the ET5 witnessed 221 deliveries in its first day at the end of September, suggesting strong levels of demand; however, the supply picture is reflecting challenges in meeting this demand, with deliveries only reaching 1,000 in a full month. Reports recently surfaced that Nio is facing delivery delays due to covid-19 impacts, putting extreme pressure and doubt on Nio’s previously stated goal to reach 10,000 deliveries of the ET5 by December.

Production Suspension Leads To Revising Q4 Delivery Forecast ~17% Lower

36Kr reported that Nio has been facing production challenges since mid-October. The JAC-NIO F1 plant “originally planned to be closed for 3 to 5 days,” but “as the closure was extended, overall production and delivery was greatly affected.” Neo Park “was under closed control recently, and the vehicle production line of the JAC-NIO F2 plant has also been suspended.”

The production impacts at JAC-NIO F1 corroborate the decline in SUV production, as the manufacturing line primarily produces the ES8, ES6 and EC6 vehicles, which saw that aforementioned major decline. Impacts at the F2 plant likely are weighing down on ET5 production and deliveries, but the reported delivery delays show that these impacts and backlogs are likely to persist, limiting rapid delivery growth over the next two months. As such, Nio is likely to fall at least 40% short of that 10,000 unit goal for the ET5, potentially up to 60% to 70% short should these delays persist through the first part of November.

Given the production headwinds and the resulting stagnating growth, Nio’s previous projection for 42,000 vehicles in Q4, following a third consecutive month of delivery growth in September, has been revised nearly 17% lower.

CEO William Li said he believed the EV startup was “going to break record[s] every month” during Q4, as NIO has “been making active preparations to meet this target.” However, October fell far short of reaching record volumes — the month failed to show sequential growth and sat 22.4% below June’s 12,961 unit volume. Given the production headwinds, Nio is facing mounting challenges to post a record month in November, with trends in SUV deliveries and reported delays in ET5 deliveries dampening the outlook to 11,500 in an optimistic scenario. Rival XPeng (XPEV) recorded deliveries of 5,101 vehicles during October, down 40% m/m and 50% y/y, highlighting either supply chain and/or demand issues.

With challenges surfacing in late October and persisting into November, Nio’s Q4 delivery projection is now revised 17% lower to 35,000 vehicles. This target represents a major decline in q/q growth rates, down about 15.4 percentage points from Q3’s reported 26.1% q/q rate to about 10.7%. Nio has the manufacturing capacity to ramp vehicles to 15,000 or beyond by the end of the year, but the production impacts further pressure that forecast, leading to a projection of 13,500 units in December as these challenges are not quick to clear.

Outlook

October’s delivery report looked fairly strong with a headline 174% y/y growth figure, and especially compared to peers, but digging deeper into the delivery data highlighted major shortcomings in Nio’s SUV line. With minimal growth in the ET7 and a sharp drop in long-standing SUV models, Nio barely managed to eke out 10,000 deliveries as production challenges surfaced. Given the challenges to production, which are likely to persist through the beginning of November, a prior projection for Nio’s Q4 deliveries has been revised nearly 17% lower. These challenges are expected to weigh on deliveries, and increase the risk that delivery growth may disappoint moving through the end of the year.

Be the first to comment