Compassionate Eye Foundation/David Oxberry/OJO Images Ltd

Last month, I detailed how Chinese electric vehicle maker NIO (NYSE:NIO) announced another disappointment with its September delivery figures. Despite expectations for a massive delivery surge in the back half of this year, the company has consistently had production issues that have put large holes in the growth story. On Tuesday, we got the October delivery report from the company, and the result was even worse than last month’s bad news.

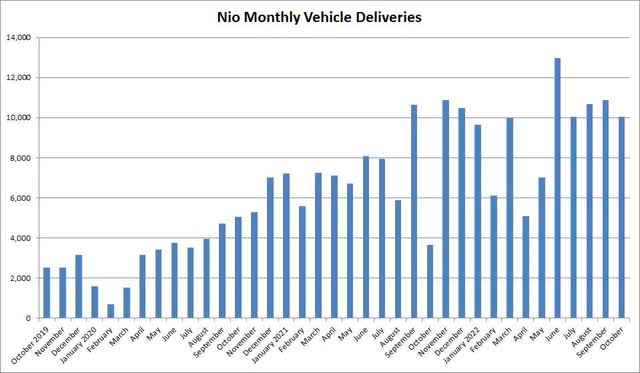

For the 10th month of the year, NIO delivered 10,059 vehicles. That does represent more than 174% growth over last year’s period, but the company has two more vehicles available for sale this year. Last year’s October also saw a dramatically low figure due to production upgrades and restructuring efforts that had the factory down for more than two weeks from September 28th to October 15th. The chart below shows how deliveries have trended each month over the past three years.

NIO Monthly Deliveries (Company Releases)

Additionally, the October figure is an increase of just 7 units above July, the first month of Q3, despite two factories that are supposed to be ramping quite considerably at the moment. NIO has also launched a new model since then, the ET5, that sold over 1,000 units in October. Management provided the following statement for why results were not as high as hoped:

The vehicle production and delivery were constrained by operation challenges in our plants as well as supply chain volatilities due to the COVID-19 situations in certain regions in China.

As I’ve been detailing for the past couple of years, there seems to be an issue for NIO basically every quarter. Either COVID issues, supply chain problems, or production upgrades seem to close facilities down at least once every few months. A separate report out Tuesday morning discussed how both factories have been facing shutdowns, and if they continue, November deliveries are going to face a meaningful challenge as well.

It’s now been more than a year and a half since the company and its partner announced an agreement to double annual production capacity to 240,000 units. In addition, NIO has started production at its own factory with a target of 10,000 units per month in rather short order, and the company is still nowhere near 15,000 deliveries a month even. Plans to get to at least 30,000 deliveries a month early in 2023 will likely have to be pushed back a bit.

Earlier this year, the goal for NIO was to deliver 100,000 vehicles in the second half of this year. Through the first four months of this period, the company has not even gotten to 42,000 vehicles. While this is a process that’s supposed to ramp over time and thus November and December should be the two best delivery months, it seems obvious that the 100k goal will not be achieved. Plans for substantial growth in 2023 also face headwinds from the expected ending of the Chinese EV subsidy, as well as Tesla’s (TSLA) recent price cuts to stimulate demand for its own Shanghai made vehicles.

Interestingly enough, NIO will report Q3 results next Thursday, November 10th. That’s a bit surprising, given some recent quarters have seen their reports come in the final month or even final week of the following quarter. At this point, guidance is not going to be close to the nearly 70,000 units needed to hit the second half goal, but can NIO even get to 50,000 at this point? That might itself be rather optimistic, so perhaps investors should prepare for guidance in the low to mid 40k range.

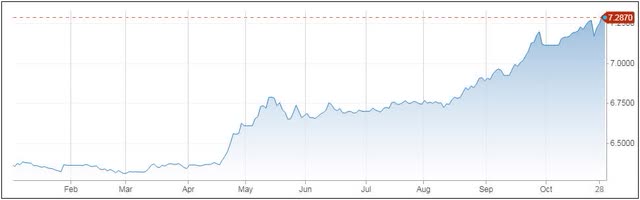

As of Tuesday, analysts were expecting $1.80 billion in revenues for Q3, but that figure was supposed to soar to $3.05 billion for the final three months of the year. Perhaps we’ll see some estimate cuts in the next week, but I don’t see how NIO can get over $3 billion unless there is a dramatic improvement in production rather soon. The situation is even more complicated because NIO translates its results into dollars using the Yuan (or Renminbi) rate based on the last day of the quarter. As the chart below shows, the US Dollar has soared against the Yuan this year, which will lower the translated revenue number a bit from quarter to quarter.

As for NIO shares, they closed Tuesday at $9.71. They are very close to their 52-week low of $8.38, which is down tremendously from the stock’s early 2021 peak of nearly $67 per share. It doesn’t help that the 50-day moving average is at $16 but declining, which could provide resistance should the stock start to rally. The average street price target is currently $28.53, but that figure itself has been more than halved over the past 12-months. Analysts are extremely optimistic, but this week’s news may change that sentiment a bit.

In the end, October was another very disappointing month for NIO. The Chinese EV company saw more production issues, limiting vehicle deliveries to just over 10,000. With COVID and supply chain problems continuing, it’s now clear that hopes for 100,000 deliveries in the back half of the year or 30,000 units a month in early 2023 need to be significantly curtailed. Without some decent guidance next week or some concrete statements that these ongoing production issues can be fixed quickly, this stock could easily hit a new 52-week low in the coming weeks.

Be the first to comment