Scharfsinn86

Nikola’s stock (NASDAQ:NKLA) has gained close to 30% this quarter thanks to marked operational improvement that has started to restore its credibility after the post-IPO fraud debacle, overshadowing its dark past. Yet, the stock has remained largely range-bound at the $6- to $7-level since reporting a sales and earnings beat for the second quarter. Even the recent passage of the Inflation Reduction Act (“IRA”), which Nikola seeks to benefit from, has done little to lift the stock further.

The stock’s rangebound performance continues to reflect investors’ angst over Nikola’s progress in ramping up production and delivery volumes of its Tre BEV and Tre FCEV battery electric and fuel cell trucks to adequately capitalize on what looks to be a robust demand environment ahead. While Nikola has shown notable operational improvement in 1H22, there is still much left to do before achieving its goal of becoming a provider of “market-leading products in the long-haul segments of class 8 trucks”. For now, Nikola is uniquely positioned within a robust demand environment where commercial electric vehicle (“EV”) adoption is in early stages of acceleration, but whether it is ready to benefit from this trend remains a big question mark.

Core Demand Driver: Favourable Policy Support

The transportation sector is one of the primary sources of global greenhouse gas emissions, accounting for almost a third of the world’s carbon footprint. And the increasing urgency to rein in climate change, and resulting stringent emissions reduction targets set across global governments – including Nikola’s target markets in the U.S. and Europe – have been a core driver of favourable policy support for the adoption of EVs across both the passenger and commercial sectors in recent years.

Under its “Fit for 55” pledge, the European Union has committed to reducing emissions by 55% by the end of the decade. And electrification of the transportation sector is a key priority on its agenda for achieving the goal. The European Commission has already tightened the region’s vehicle emissions standards across the passenger and commercial segments to not only reduce the transportation sector’s GHG emissions by at least 15% by 2025 and 30% by 2030, but also foster the ultimate phase-out of ICE vehicles. Specifically, the bloc has recently unanimously agreed on the elimination of ICE vehicle sales by 2035, which makes strong tailwinds for Nikola given its planned entry to the region by 3Q23 under its joint venture with truck-maker IVECO (OTCPK:IVCGF).

Meanwhile, the U.S. has also pledged to reduce GHG emissions by at least 50%-52% from 2005 levels by the end of the decade. This has accordingly fostered the enactment of a slew of favourable policy support aimed at shoring up EV adoption across America, including a push for emissions-free vehicles to make up half of new car registrations by 2030. In order to achieve this target, the Biden Administration has allocated $7.5 billion in funding towards the build-out of public charging stations over five years as part of the Bipartisan infrastructure bill. The government has also pledged to build a network of 500,000 charging stations across the U.S. by the end of the decade, addressing what is known to be a key barrier to EV adoption – range anxiety.

The U.S. has also been active in providing direct financial incentives to both consumers and fleet operators to encourage the switch from ICE vehicles to emissions-free alternatives. Specifically, Nikola has been a beneficiary of state purchase subsidy programs like the California HVIP, which provides an incentive of up to $150,000 per truck, and the New York NYTVIP, which provides an incentive of up to $185,000 per truck. This accordingly makes an attractive offer to fleet operators looking to convert their legacy inventory running on ICEs to EVs, considering Nikola’s Tre BEVs currently start at a price in the $300,000-range.

The federal government has also stepped up its support in encouraging commercial fleet transitions to electric – a key piece to the country’s decarbonization efforts given the sector currently accounts for “more than 20% of fuel consumed in the U.S.”. As part of the IRA that President Biden has recently signed into law, heavy-duty commercial EVs will be eligible for an additional tax credit of up to $40,000 if their batteries “contain minerals extracted from or processed in a country the U.S. has a free trade agreement with, and a portion of components [are] manufactured or assembled in North America”. And Nikola’s Tre BEV fits the bill – the Tre BEVs are currently manufactured at Nikola’s Coolidge, Arizona facility, with U.S.-based Romeo Power (RMO) being a primary supplier of its battery cells.

Nikola’s upcoming launch of its Tre FCEV fuel-cell truck, alongside complementary services such as the mobile charging and fuelling trailers and maintenance packages also make it uniquely positioned for a first-mover advantage in the provision of hydrogen solutions. As part of Nikola’s hydrogen fuelling business model, the company will not only partner with notable industry names such as TC Energy (TRP) and Wabash Valley Resources in running production hubs, but also supply and distribute hydrogen to fleet operators through its mobile fuelling trailers (“MFTs”) and dispensing stations. In order to optimize returns on this business model, the Tre FCEV fuel-cell trucks, which begin volume productions and customer deliveries in 2H23, will be sold via a “bundled lease” offering that includes accompanying hydrogen fuel and servicing solutions as well.

And Nikola’s provision of hydrogen solutions also comes at an opportune time. In addition to monetizing on the rise in demand for hydrogen fuel-cells in automotive applications – a market that is expected to expand at a CAGR of 53.5% through 2028 into a $35 billion opportunity – Nikola is also well-positioned to be a key supplier within the $200+ billion hydrogen fuel market in the U.S. alone through its dispensing operations. With the accelerating transition to zero-emission energy sources, the upstream market for hydrogen generation is slated for accelerated growth in order to keep up with global market demands:

As one of the most abundant resources in the world, hydrogen will extend from its traditional uses in the industrial sector for oil refining, fertilizer manufacturing and chemical production to new uses as a primary green energy source through synthetic fuel and fuel cell application.

Source: “Where Will Plug Power Be In 5 Years? Global And Profitable“

This accordingly makes a favourable backdrop for Nikola’s foray into hydrogen supply, which bodes favourably with both its commercial BEV and FCEV manufacturing business ahead of robust secular trends.

Nikola Needs to Step It Up

Based on the foregoing analysis, it is obvious that Nikola has found itself in the middle of quite a favourable demand environment at an opportune time. Its past association with fraudulent allegations are also starting to fade, as favourable operational progress demonstrated in 1H22 is redirecting investors’ focus back onto the truckmaker’s fundamental outlook.

Yet, there is still a long way to go for Nikola to optimize its benefit from the robust demand environment for electric commercial transportation fleet solutions. Specifically, its ability to ramp up production and delivery volumes remain a key focus area for investors.

For now, Nikola has reaffirmed its guidance on delivering 300 to 500 vehicles by the end of the year. As of its most recent reporting date, the company has only produced and delivered 50 Tre BEVs, which leans to the lower range of its previously set guidance for 2Q22 deliveries due to two weeks of lost productions in the quarter as a result of delayed battery pack supplies from Romeo Power. And with the expectation for continued industry-wide supply chain uncertainties in the near-term, Nikola has guided deliveries of 65 to 75 Tre BEVs in the current quarter. This spells a requirement for at least 175 Tre BEV deliveries in 4Q22 alone in order to achieve the lower range of Nikola’s full-year target, which is a meaningful jump from anticipated volumes through the September quarter.

However, with battery supplies being cited as a key bottleneck to its production ramp in 1H22, Nikola’s recent decision to acquire Romeo Power is expected to bring some respite over the longer-term once integration efforts complete. Valued at $144 million, Nikola will acquire Romeo Power via an “all-stock transaction” – shareholders of Romeo Power will receive 0.1186 Nikola shares at the time of completion. Nikola will also provide Romeo Power with “interim funding to ensure continued operations” of the supplier and subsidiary:

The funding comes in two parts, one, up to $20 million in a temporary price increase for each pack delivered through the transaction close plus, two, $15 million in a senior secured note.

While the arrangement is currently forecast to “weigh down [Nikola’s] Q3 and Q4 gross margin” by approximately -100%, the ultimate integration of Romeo Power into Nikola’s operations is expected to generate greater long-term visibility into battery pack supplies and enable a smoother production ramp trajectory going forward. This will be key for Nikola, as the ability to deliver products off of its manufacturing line is the only way to capitalize on growth opportunities discussed in the earlier section, and unlock greater value ahead.

Fundamental Analysis

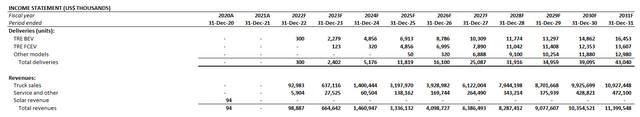

Considering Nikola’s U.S. production plan, as well as aspirations to penetrate the European market with its product pipeline of Tre BEVs (U.S. SOP 2Q22; EU SOP 3Q23), Tre FCEVs (U.S. SOP late 2023; EU SOP early 2024), and ultimately, a next-generation long-haul/sleeper with up to 900 miles of range on a single charge, we are expecting truck sales to top $3.2 billion on deliveries of more than 11,800 units by mid-decade. Volumes are expected to further expand towards more than 43,000 units by 2031, generating annual truck sales of more than $10.9 billion.

This is consistent with Nikola’s long-term business growth plan, which consists of continued manufacturing capacity expansion and production ramp-up at its Coolidge, Arizona and Ulm, Germany facilities over the longer-term. The growth projections applied are also in line with current market expectations for commercial EV fleet take-rates to expand at a CAGR in the mid- to high-teens through 2030. Paired with accompanying service and other sales, Nikola is expected to generate total revenue of more than $98.9 million by the end of the year, with further expansion towards $3.3 billion by mid-decade and $11.4 billion by 2031.

Nikola Revenue Projections (Author)

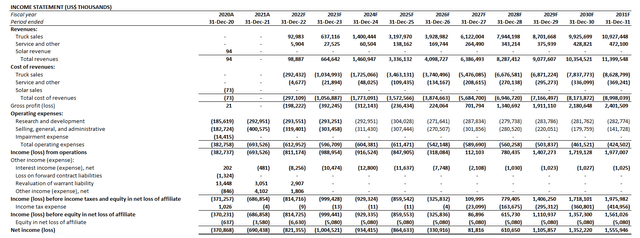

From a cost perspective, gross and operating margins are expected to remain in negative territory in the near future. Specifically, gross margins will get worse in 2H22 as a result of interim financing support extended to Romeo Power under the acquisition plan, as well as broad-based increases to input costs, offset by Nikola’s ongoing efforts in mitigating logistics expenses through supply chain localization.

Operating costs pertaining to research and development efforts are also expected to remain elevated through mid-decade to support the planned launch of the Tre FCEV next year, and the long-haul/sleeper truck in 2025. Gross profit realization is expected to materialize thereafter, which is consistent with management’s expectations for the Tre BEV to achieve 20% gross margins by 2025, and the Tre FCEV to achieve 20% gross margins by 2026. As a result, net losses are expected to remain elevated through 2023 and narrow towards 2026, with nominal profit realization of $81.8 million to begin in 2027.

Nikola Financial Forecast (Author)

Nikola_-_Forecasted_Financial_Information.pdf

NKLA Stock Valuation Analysis

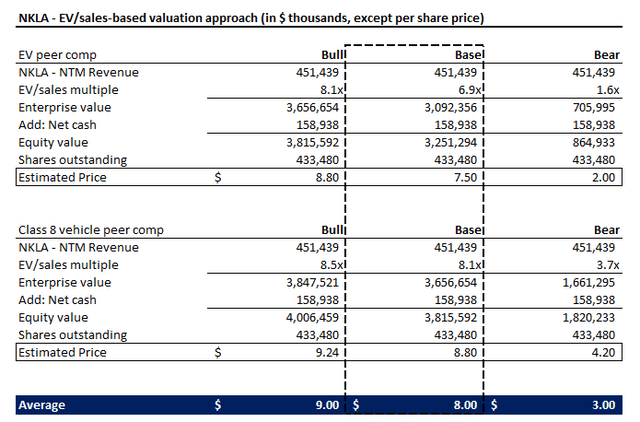

Drawing on the foregoing qualitative and fundamental analysis on Nikola’s underlying business, we have set an $8 near-term price target for the stock. This would imply upside potential of 30% based on the shares’ last traded price of $6.17 on August 25.

Nikola Valuation Analysis (Author)

The price target is derived using a multiple-based valuation approach. Specifically, we have equally weighed Nikola’s projected near-term valuation based on 1) NTM EV/sales multiples observed across its EV pureplay peer group with similar growth profiles, as well as 2) NTM EV/sales multiples observed across its legacy commercial trucks OEM peer group with similar growth profiles. The equally-weighted method was applied to better reflect Nikola’s valuation prospects ahead of opportunities across the high-growth EV segment, as well as broad-based commercial fleet demand.

Nikola Valuation Analysis (Author)

Conclusion

While our near-term price target for the Nikola stock points to valuation upside, we continue to caution volatility ahead given elevated execution risks remain for the underlying business.

Specifically, outside of broad-based macro uncertainties weighing on today’s market climate, Nikola will likely be required to achieve delivery volumes of at least 300 vehicles by the end of 2022 to unlock further valuation upsides, which makes 2H22 a critical period for the stock and underlying business. If Nikola fails to deliver on this near-term catalyst on investors’ watchlist, the stock will almost absolutely trend lower. And there is a probable risk of this mishap occurring, considering the meaningful ramp-up in production volumes required between 3Q22 and 4Q22 in order for Nikola to achieve its annual delivery target – not to mention ongoing supply chain constraints across the broader automotive industry as well, which remain very much fluid and could potentially threaten to derail the emerging truck-maker’s near-term growth plans.

As suggested in the foregoing analysis, the growth opportunity is up for grabs, but it will be up to Nikola to prove that it can capitalize on it.

Be the first to comment