mofles

A company needing to raise cash in this market like fuboTV (NYSE:FUBO) faces a tough road ahead. The TV streaming platform doesn’t forecast being cash flow positive until 2025 placing the stock in a difficult position in this unfriendly market. My investment thesis is Bearish on the stock unless the company is able to obtain synergies with gambling to match the sports-first platform.

Cash Poor

fuboTV has such a bad cash position the company had to close the promising Fubo Gaming division with their own-and-operated Fubo Sportsbook. The company still plans to work on integrating gambling data into the virtual MVPD service focused on live sports in order to expand viewer ARPU without investing limited funds.

The company will save money, but the bigger issue is that fuboTV only has a cash balance of $307 million. The service is promising similar to Roku (ROKU) as the streaming market becomes fragmented and a vMVPD offers the ability to consolidate streaming services into one convenient platform for viewers.

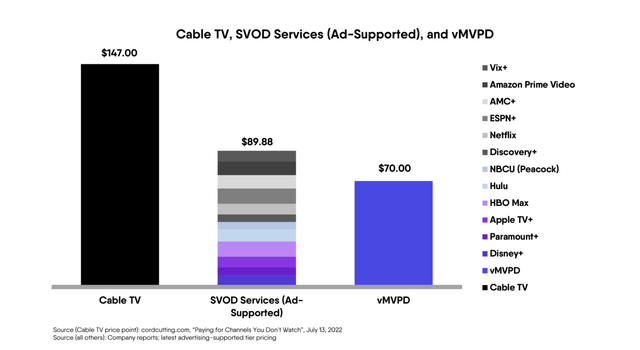

Though, the major problem is that these SVOD and MVPD services are charging far below the costs of cable TV. According to the sourced data, viewers were willing to spend $147 on average on cable and now only spend $70 a month on a vMVPD service like fuboTV.

Source: fuboTV Q3’22 shareholder letter

The viewers are saving monthly while corporations like fuboTV are struggling and Disney (DIS) had to re-hire Bob Iger as their CEO. The big question is whether viewers will stay with streaming services, if the services charge prices to cover actual costs.

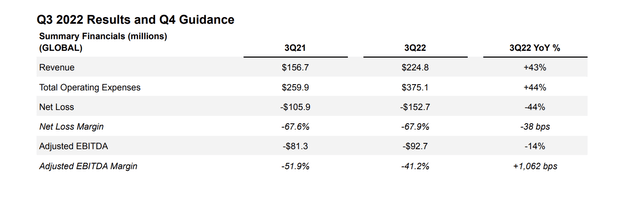

fuboTV forecast Q4’22 revenues will jump to $280 million after reporting a Q3’22 adjusted EBITDA loss of $92.7 million for a negative 41.2% margin. The business is only forecast to slow growth to only 20% when margins are very negative.

Source: fuboTV Q3’22 shareholder letter

The biggest red flag for a public stock is the following statement by CEO David Gandler on the Q3’22 earnings call:

Yes, so we haven’t given a sort of a rant, if you will, in terms of the investment in the sports. But what I would tell you, though, as you would suspect that it certainly extends our runway. And so I think what we’ve said historically, is that we have cash through 2023. And then our cash needs in ’24 are relatively modest, I would say in broad strokes, that ending or exited gaming would modestly extend that. And then I would also add, don’t forget that Q1 tends to be our highest cash use quarter from a seasonal perspective.

fuboTV has impressive subscriber growth with the total jumping to 1.2 million in Q3 for 31% growth. The company guided to Q4’22 subscribers at 1.37 million with revenues reaching $280 million for strong sequential growth.

In essence, the company is growing substantially even facing a scenario where advertising ARPU declined 12% YoY to $7.37 in Q3, but the management team discussed a strong September and prospects for a better holiday period. The key is that fuboTV already had a strong advertising business unlike most streaming services realizing the need to tap into the ad market with subscriptions that don’t cover costs.

The mounting problem is that 37% of TV consumption is already via streaming services. While fuboTV has some growth ahead, the company isn’t positioned very well when one realizes how the market shift from cord cutting isn’t in the early innings anymore.

Market Shift Needed

The stock only has a market cap of $550 million now with the dip below $3. The major reason fuboTV trades this low is the cash position combined with the ongoing large operating losses.

Any signs Bob Iger can change the pricing disconnect in the video streaming model at Disney could definitely provide a catalyst for fuboTV. In addition, if the company can actually start integrating gambling data into sports programming to obtain a higher ARPU, the stock could become appealing.

Otherwise, investors need to stay away from the stock regardless of the price. fuboTV burned $76.4 million in cash from operations in the last quarter and the upcoming Q1 is traditionally worse. The streaming platform faces a tough 2023 with any sizable cash burn placing the company in a precarious financial position until management can eliminate quarterly cash burn rates.

Takeaway

The key investor takeaway is that fuboTV hasn’t figured out how to turn booming subscriptions into anywhere close to a profitable business. The stock was intriguing for the gambling angle, but the elimination of that business due to cash concerns eliminates the most promising aspect of fuboTV.

Until the company figures out a new way to profit from the sports-focused video platform, investors should avoid the stock playing a dangerous game with limited cash and large cash burn rates.

Be the first to comment