halbergman

Dear readers/followers,

KION (OTCPK:KNNGF) (OTCPK:KIGRY) has been a fairly poor performer during this year, declining even further after my last review in the face of worsening macro. While I did not expect this degree of decline in the valuation, there are underlying reasons for it.

In this article, we’ll take a look at what we can expect going forward – and why I’m not materially adjusting my PT for the company at this time.

Revisiting KION Group

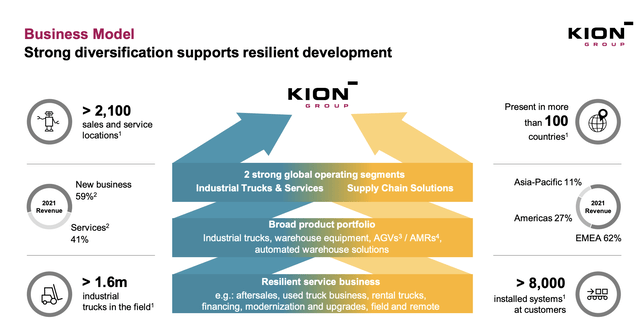

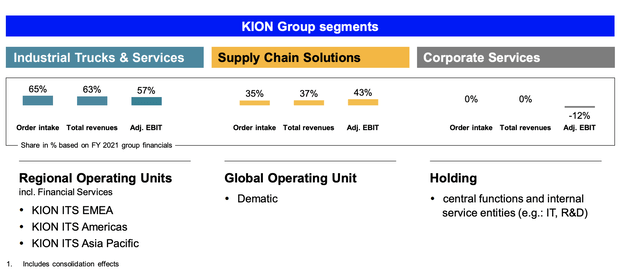

KION is the world leader in industrial truck solutions in EMEA and the global #2 in the same segment. It’s #1 in global supply chain solutions and can report an annual order intake climbing toward the €13B on an annual basis. This is a fundamentally attractive industry for a leader, where KION has been able to historically present margins of upwards of double digits.

The company does Industrial Trucks and automated warehouse and supply chain solutions, as well as the corresponding services, to keep these services and products working.

While 2022 so far has been a meager year, and trends promise for this trend to continue, the fundamentals of the company remain very solid. Managing close to a billion euros in EBIT from €12.5B in orders, and employing 40,000 people across the world, this company has one of the more attractive business models that exist in the segment.

From class-leading trucks to fully-automated warehouses without really any need for on-site personnel, this company does it all. It works with tailor-made electric and fuel-cell powered modern warehouse trucks and has an expertise in automation solutions that achieve efficiency increases and synergies, complemented by the full life cycle services the company offers.

Competition exists, but only large players really have the clout to move in these segments with any efficiency or sense. Toyota (OTCPK:TYIDF) is slightly larger, but beyond that, few measure up to KION. In terms of automation solutions, the company is the largest, with Honeywell (HON) in second place.

Here is how the company segments its business.

The company’s business strategy isn’t anything new. It’s focusing on profitable growth and maintaining market share while improving ESG and M&A’ing where possible. Nothing to really delve deep into because many companies have similar ambitions.

In terms of fundamentals, I will say the following. KION has a client retention rate of 99.98%.

That should really tell you all you need to know about the business and what it does, and how attractive it is. It’s also why I didn’t much care about the previous drop, and why I don’t even particularly mind this one. The time is now ripe to really back up the truck on KION Group – because the company’s challenges, as they are, are well-known.

The company is trying to address the myriad of issues it’s facing, including but not limited to:

- Inflation

- Pricing

- Supply chains/component availability

- Procurement inefficiencies

- Backlog inefficiencies/pricing

It can all be summarized into the simple fact that the company needs to adjust pricing for already-ordered/pay-for products while managing a myriad of inflationary and SCM-related challenges, none of which is easy.

EPS, FCF, and EBIT went negative in 3Q22. The only real positive from high-level numbers were revenues, which are up 5% YoY – but order intake and most everything else is down.

Despite this, KION actually managed to gain market share, and the order intake was, in the company’s own words, normalized. Shipments were solid, and the company guides for slow sequential margin improvement.

KION has addressed repricing with a 4th price increase as of last month, and all of the company’s contracts now include price adjustment clauses, with continued work on backlog repricing. While visibility for these adjustments isn’t yet 100%, things are looking promising.

However, even with that, KION does expect core segment growth that’s below its average for 2022 and 2023.

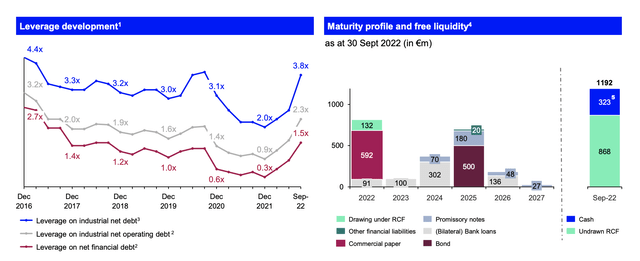

The current trends have caused the company to have to think ahead in a different way compared to what it usually does. KION has been stockpiling components in expectation of supply chain issues. This puts strain on working capital, and Free Cash flow, and is part of the reason why things are down here. The negative FCF also puts strain on net debt, which is up to a leverage of 1.5x as of September 2022, up from 0.9x from June. The company also has upcoming maturities in 2022, with commercial paper coming due. Cash remains available with almost €1.2B including an undrawn revolver, and more than enough cash to cover near-term obligations, but the company is in a materially more strained position than it was a year back or so.

The company is able to confirm the September outlook, but this outlook isn’t necessarily something to write home about and is the core part of what’s shaping the current company valuation.

Confirming outlooks is all well and good – but confirming this sort of outlook isn’t necessarily a net positive for the share price currently. The company expects Working capital needs to increase further going forward, and it’s also adding a new CFO and a new CPSO to join the company in the next year. All of these things are potentially, and very likely, influencing the share price at the current time.

These are what present the current negative trends for KION.

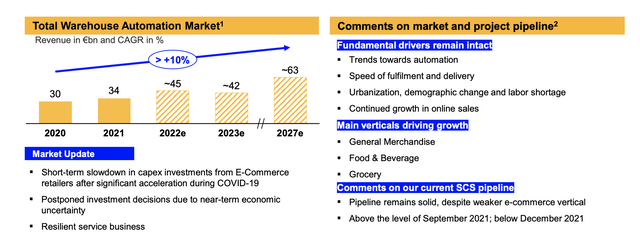

Still, no matter what the world does – these are services and “things” that the world needs. Structural demand drivers for the SCS segment are completely intact, and EBIT margins did not go entirely negative yet. The YoY margin changes are massive still, but this will normalize once supply chains normalize in turn.

Margins are really the problem at this time. And this problem is, in turn, driven by macro which the company has very limited control over. Net income remains quite stable, and the company continues to report an EPS of around €0.6 on a quarterly basis, bringing us to a run rate of €2.4.

This would ordinarily imply that the company’s dividend might be cut to be right-sized to the business’s payout ambitions. However, if we look at the records, this company is no stranger to allowing for a higher dividend even during times of lower earnings. I would say that there is the possibility that the dividend might remain stable for 2022 fiscal – but I would not count on it, nor do I invest in KION for the dividend alone. I do invest the dividend to remain mostly unimpacted at this time.

The basic thesis for investing in KION is sound. It benefits from structural trends and demand drivers such as demographics and sustainable solutions, it’s well-placed to grow as a result of increased demand in materials handling and investment into new technologies. It’s already in the field of sustainable ESG with its contributions from services and solutions and push for energy efficiency.

Let’s look at the current valuation perspective for this business.

KION’s (under)valuation

I’ve called the company undervalued a few times now – and this is not something that has changed for this particular time. The time here, as I see it, is the time to really “back up the truck” on KION as an investment, so that is exactly what I intend to do here.

Current analyst estimates call for the company to deliver revenues 10% above 2021. While margins will go down, with EBIT expected to touch 6-7%, this does not to my mind justify a 50%+ price drop. Note that the margin expectations of 6-7% are still very much the same as they were in the article.

The current pricing decline for this year is around 71%. I’ve experienced around 30-35% of that, depending on what part of my allocation I look at. But at this time, I do not see the company dropping materially lower without another catalyst, which I view as unlikely at this particular time.

Targets for KION less than a year ago came in at a range of €80 to €135, with an average of €108. Today the range is €17 to €55, with an average of €41. This perfectly illustrates the extremes of market overreaction, and why I am investing here. KION typically trades at P/E averages of 13-16x. The latest is around 12x P/E normalized here, and at trough, it was down to 8x.

Current analysts estimate the company to generate GAAP EPS of around €0.71/share, which would put it below the current dividend level (see above for my expectations for that). After that, the expectation is for this to normalize.

Analysts do expect a right-sizing of the dividend next year, to around €0.41, but for that to grow nearly 270% the year after.

KION will continue to sell products – just at a lower margin for as long as SCM remains impacted and input variables remain unfavorable. But this does not change the company’s overall appeal. Beyond 2022, the company is expected to grow earnings and revenues to around double that of 2022E by the time of 2026, as we saw above.

For KION, I use DCF, NAV, and peers as a method of evaluating. I’m not too keen on the ADR as I view it as too thinly traded – so I believe you should go for the native.

Nonetheless, the ADR is of course an option if you don’t want to trade the EU market directly.

For my DCF, I now employ a 7.5% WACC with a 4% risk-free rate and a 7% market risk premium with a beta of around 1.3. Based on that, and expecting sales growth around 3.5-4.5% and EBIT growth around 9-10% based on strong trends, we reach an implied EV value of close to €17B, which net of debt comes to a fair-value share price of around €95 – now impaired by about 20% by me as of this article.

Even with this increased impairment, this still implies a massive upside to where the company is currently trading – more than twice as high – but in case we do see this growth, that’s what the company, to my mind, is worth.

I still view this target as realistic for the long term, and I don’t see any reason to change it for what I view as shorter-term trends here.

Peers remain overvalued to KION. KION is trading at an NTM revenue multiple of 0.4X, while we look at peers like Toyota, Jungheinrich (OTC:JGHHY), Cargotec (OTCPK:CYJBY), and others that are trading at higher multiples. Toyota is still more than twice as high as this business, which does not compute for me in terms of what sort of upside Toyota’s limited market leader in industrial trucks grants the company.

I combine my peer targets, book/NAV targets, and DCF targets and come to around €78/share, but that’s as low as I’m willing to go on the KION Group – and that’s discounting it already. That’s. a €7 /share lowering from my PT, and that’s as low as I’ll go given the current book and SOTP values for the company.

Thesis

My thesis on KION is as follows:

- KION Group is an attractive capital goods play with an emphasis on intralogistics solutions, automation, and warehouse technologies – things like forklifts, to put it simply.

- The company is undervalued and forecasts imply a significant upside over the coming 5 years, with an upside of over 100%.

- KION is a “BUY” with a price target of €78/share.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

That means that the company currently fulfills all of my criteria for attractive valuation-oriented investing.

Be the first to comment