kynny

A Quick Take On Forza X1

Forza X1 (FRZA) has filed to raise $15 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company is developing electric powered boats to sell to consumers in North America.

FRZA has no track record of sales or growth, so it is difficult to estimate its trajectory in the near term and the company’s premium/luxury product faces headwinds in an economic downturn underway.

I’m on Hold for the Forza X1 IPO, although it may attract day traders looking for volatility and a low nominal price.

Forza X1 Overview

Ft. Pierce, Florida-based Forza was founded to develop and sell EV power boats for the consumer market in the United States.

Management is headed by Chairman and CEO Joseph C. Visconti, who has been with the firm since inception and is currently the president and CEO of the firm’s parent company Twin Vee PowerCats (VEEE).

The company’s primary offerings include:

-

FX1 Dual Console

-

FX1 Center Console

Forza has booked fair market value of $2 million in equity investment from parent firm Twin Vee PowerCats.

The firm will sell its boats through a dealer-based distribution network in North America and the Caribbean and through a direct-to-consumer platform.

Forza’s Market & Competition

According to a 2021 market research report by IDTechEx, the global market for electric and hybrid vessels will rise quickly to over $20 billion worldwide in 2027 for non-military versions.

The main drivers for this expected growth are environmental pressure against the use of ‘dirty ships’ with a single large ship emitting enormous amounts of pollutants.

Also, many new things are possible with EV marine craft, including increased autonomy, greater quiet, energy independence and faster acceleration.

Major competitive or other industry participants include:

-

Boston Whaler

-

Sea Ray

-

Mastercraft

-

Yamaha

-

Bayliner

-

Chaparral

-

Grady-White

-

Malibu

-

NITRO

-

World Cat

Forza X1’s Financial Performance

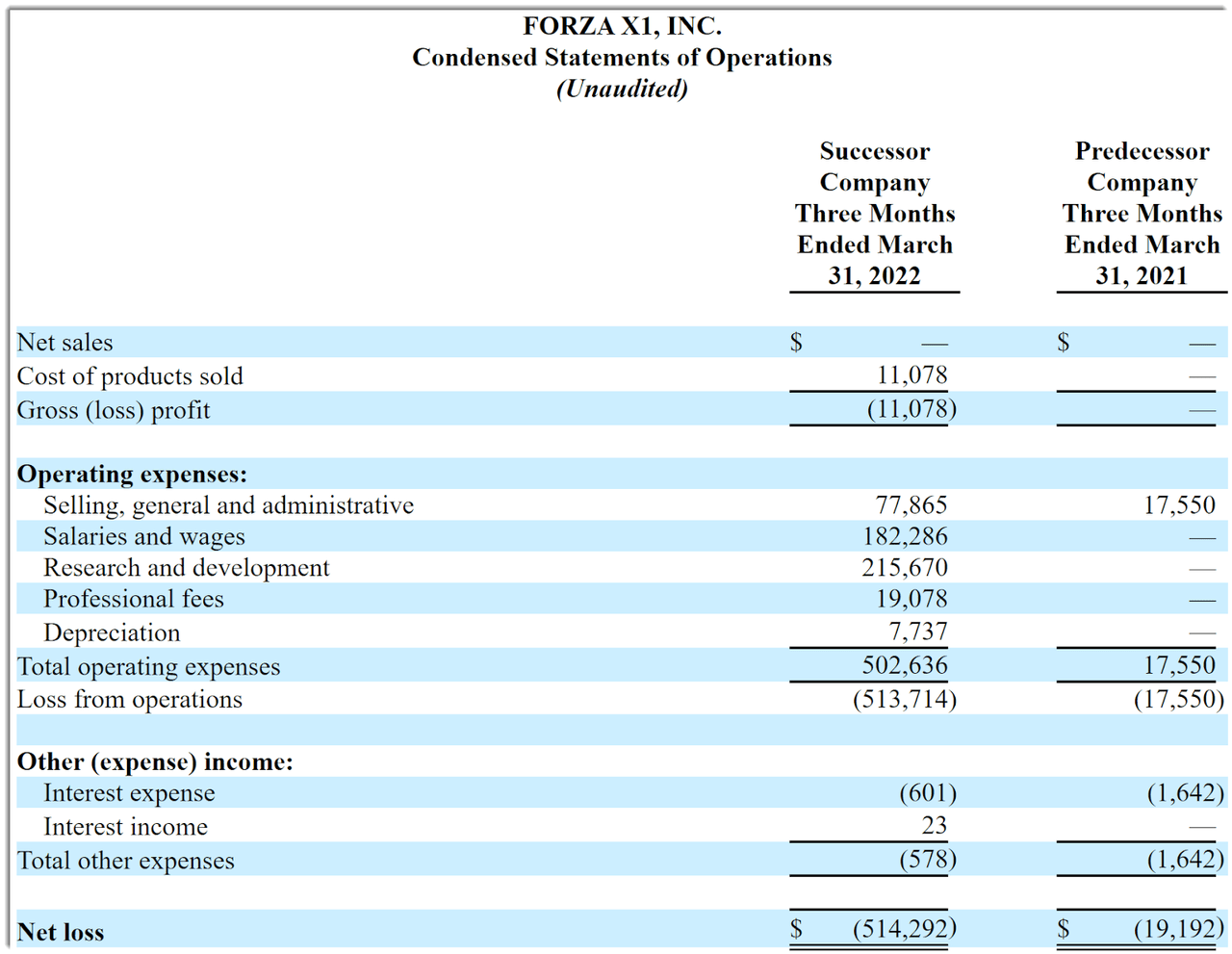

Below are recent relevant financial results from the firm’s registration statement:

Statement of Operations (SEC EDGAR)

As of March 31, 2022, Forza had $639,078 in cash and $120,388 in total liabilities.

Free cash flow during the three months ended March 31, 2022, was negative ($465,407).

FRZA IPO Details

FRZA intends to sell 3.0 million shares of common stock at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $15.0 million, not including the sale of customary underwriter options.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $36.4 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 30%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $8.0 million for the acquisition of property and the development of a manufacturing plant to build, design and manufacture our new line of electric boats;

approximately $2.0 million for ramp up of production and inventory; and

approximately $2.6 million for working capital.

Based on our current operational plans and assumptions, we expect that the net proceeds from this offering together with our existing cash and grant funding balances will be sufficient to fund our operating expenses and capital expenditure requirements for at least 12 months from the closing of this offering.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party to any material litigation or legal proceedings against it.

The sole listed bookrunner of the IPO is ThinkEquity.

Commentary About Forza X1

The firm is seeking to spin out from parent company Twin Vee PowerCats in order to begin manufacture of its line of EV recreational boats.

The firm’s financials show expenses associated with its development efforts but the company has not generated any revenue from the sale of products.

The firm currently plans to pay no dividends on its capital stock and anticipates that it will use any future earnings to reinvest back into its expansion activities.

The market opportunity for electric hybrid or pure electric boats and ships is expected to grow at a high rate of growth over the coming years due to increasing environmental pressure and other benefits of quiet and powerful electric drivetrain propulsion systems.

ThinkEquity is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (69.2%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook are the macroeconomic headwinds pushing down N. America growth estimates as well as raw materials and labor inflation, pushing up its cost of goods sold.

As for valuation, management is asking IPO investors to pay an enterprise value of around $36 million at the IPO.

Forza’s parent company Twin Vee PowerCats has performed poorly since its IPO in mid-2021 and I don’t have a specific reason as to why Forza should do better, given macroeconomic pressure on discretionary products, especially luxury lifestyle products.

Also, the firm has no track record of sales or growth, so it is difficult to estimate its trajectory in the near term.

Although the IPO may attract day traders seeking volatility with its low nominal price, I’m on Hold for the Forza X1 stock over the medium term.

Expected IPO Pricing Date: To be announced.

Be the first to comment