piranka/E+ via Getty Images

Thesis

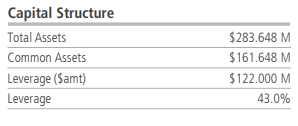

Neuberger Berman High Yield Strategies (NYSE:NHS) is a fixed income closed end fund. The fund has total return as its main objective, and invests the bulk of its cash in high yielding fixed rate U.S. bonds. As per its mandate, at least 80% of the Fund’s total assets will be invested in below investment grade (high yield) debt securities (including corporate loans) of US and foreign issuers. NHS is a classic high yield bond fund through its composition, but the CEF is particular through its build and leverage. The CEF runs a very high leverage ratio of 43%:

Capital Structure (Fund Fact Sheet)

For fixed income funds in the high yield space this leverage ratio is very high. We usually see figures around 30% here. The fund nonetheless is smart about the way it structured its leverage. The entire borrowing was done via term instruments:

Leverage (Fund Fact Sheet)

We see many CEFs doing Repo agreements or Total Return Swaps with shorter maturity dates. NHS has virtually termed out its entire leverage structure. To note though that the preferred shares are redeemable (mandatory) in August next year, which means the fund will need to raise new term debt at the time, or start rolling shorter dated borrowing structures.

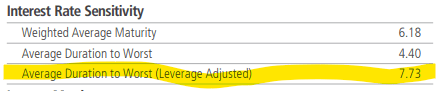

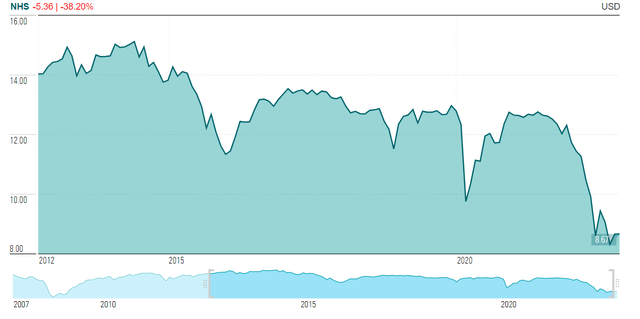

The fund has been severely pummeled in 2022 on the back of higher rates and risk-off markets. Duration is a large component for NHS, with the fund running higher than normal figures (7.7 years leveraged adjusted duration). The fund has had a robust historical performance outside of 2022, but given its structure, it represents a higher beta fixed income CEF.

Investors who are already in the fund should Hold, given the risk recovery that is likely going to occur in 2023. New money looking for fixed income exposure should be comfortable with the fund’s high leverage and duration.

Holdings

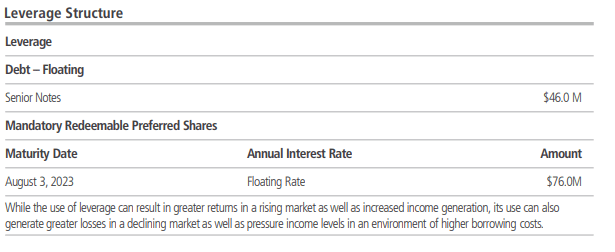

The fund holds mostly bonds:

Holdings (Fund Fact Sheet)

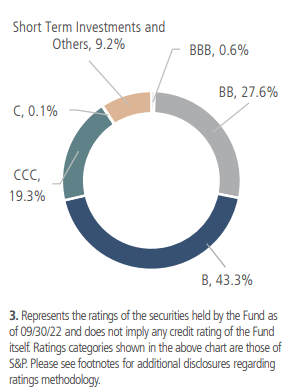

Over 88% of the portfolio is composed of bonds, with a very small sleeve for leveraged loans and short term investments. The majority of the collateral sits in the middle of the junk rated grid, being single “B”:

Holdings (Fund Fact Sheet)

The fund nonetheless has a sizable “CCC” bucket that clocks in at 19.3%. We do not like to see CCC-credits accounting for more than 10% of a portfolio, because that tilts the fund towards actual impairments in a recession, especially when leverage is layered in.

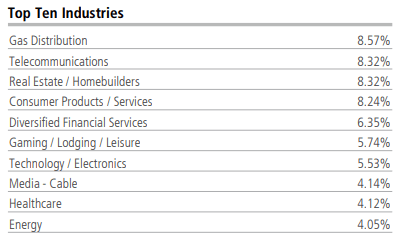

The fund has a granular build, with no industry sector exceeding a 10% threshold:

Top Industries (Fund Fact Sheet)

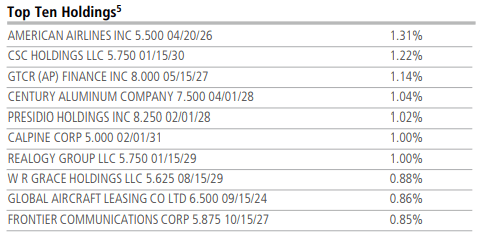

From a single-name perspective we see a continuation of the same theme, with individual names at under 2% of the portfolio:

Top-10 Holdings (Fund Fact Sheet)

What is particular about this CEF is its long duration profile:

Facts (Fund Website)

When adjusting for leverage, the fund runs a 7 year duration, which translates into a higher than normal sensitivity to interest rates. We do not usually see funds running such high duration profiles, especially in the fixed bond space.

Performance

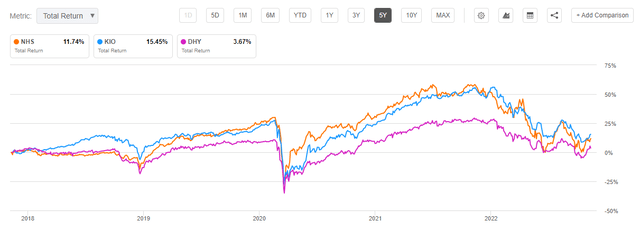

The fund is down over -26% year to date:

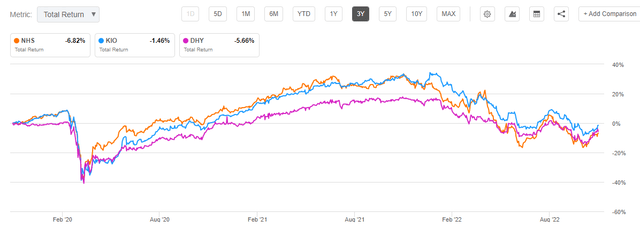

We are comparing NHS with a CCC heavy fund, namely KIO, and with a run of the mill high yield bond fund from Credit Suisse, namely DHY. Given its duration and leverage, NHS has performed in line with the very credit risky KIO so far this year.

On a 3-year timeframe all three funds have a similar performance from a total return perspective:

We can notice from the graph above how NHS, which is long duration, and KIO, which is long credit risk, outperform during the zero rates environment.

A 5-year timeframe paints a similar picture:

KIO and NHS are more volatile, but outperform in normalized economic environments.

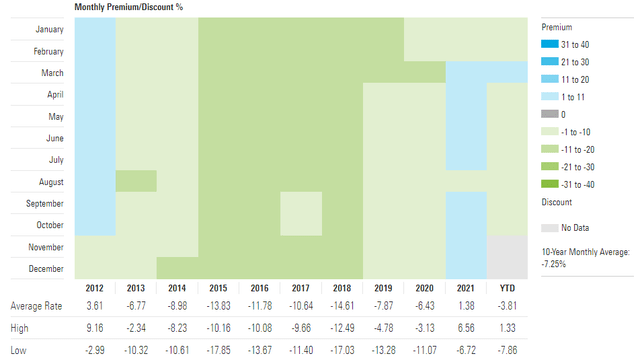

Premium / Discount to NAV

The fund usually trades at a discount to net asset value:

Premium/Discount (Morningstar)

We can see from the Morningstar matrix that NHS usually trades at an average discount of -7% to -10% versus its net asset value.

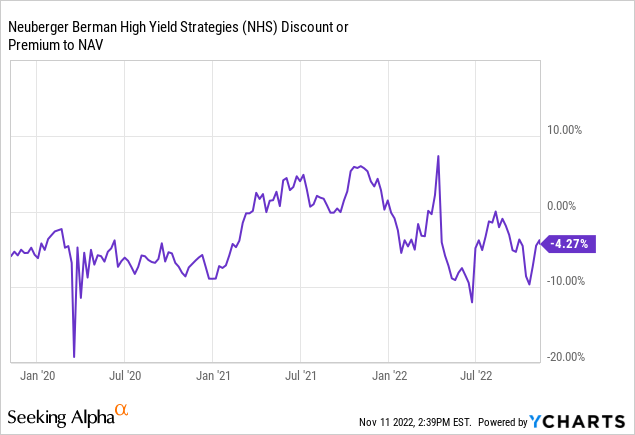

This year has seen some substantial swings in the discount:

Just like the other fixed income CEFs, NHS exposes a beta to risk market moves.

Distributions

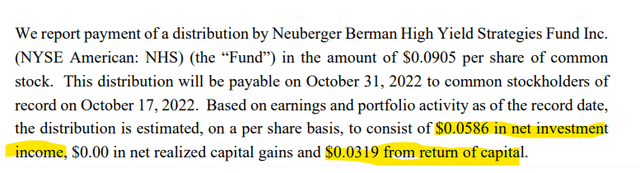

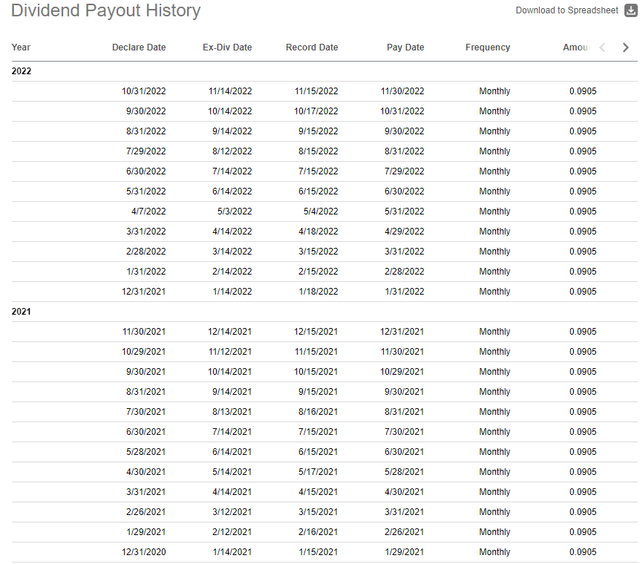

The fund has a managed distribution policy:

For the past 3 years the CEF has sent investors $0.0905 monthly. Currently only 60% is interest income, with the rest representing return of capital:

Section 19a Notice (Section 19a)

We can see this fund has been a heavy user of ROC in the past as well:

The fund exposes an annual NAV give-up of about -3.8% when looking back on a 10-year period. If we eliminate 2022, which is an outlier, the NAV give-up moves to a more palatable -1.6%. However, the fund does overdistribute, or does a poor job at its secondary trading in terms of creating NAV value.

Conclusion

NHS is a fixed income CEF. The fund focuses on U.S high yield, and specifically fixed rate bonds, which compose over 88% of its portfolio. The vehicle layers a very high leverage of 43% on top, to make it very credit sensitive, although the portfolio is overweight single “B” credits. The fund’s composition coupled with its very high duration have been the culprits for its -26% performance so far in 2022. NHS is a high beta fixed income CEF, and its performance has been reflective of its build. The fund’s 13% dividend yield is not currently covered, with 40% of its last distribution being return of capital. Investors who are already in the fund should Hold, given the risk recovery that is likely going to occur in 2023. New money looking for fixed income exposure should be comfortable with the fund’s high leverage and duration.

Be the first to comment