CHUNYIP WONG

All Figures in CAD unless otherwise noted.

Overview

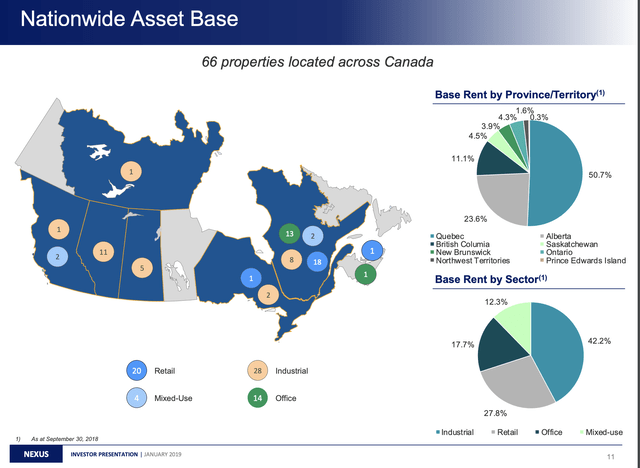

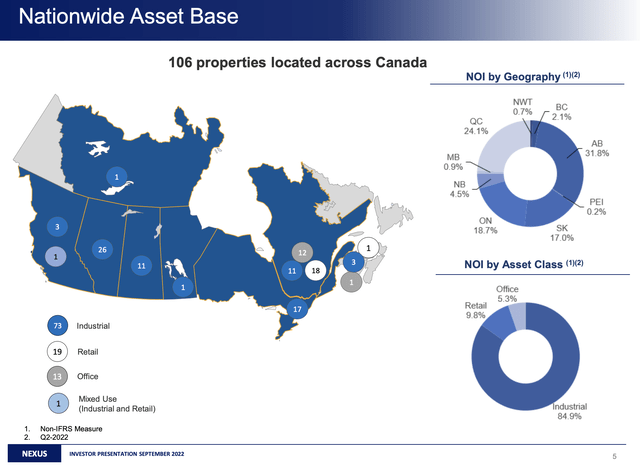

Nexus Industrial REIT (OTC:EFRTF) (NXR.UN:CA) is considered a diversified REIT headquartered in Oakville, ON. It owns 106 quality, commercial properties in the industrial, retail and office space. The REIT has quickly realized on its plans to transition to a pure-play industrial REIT which commenced a couple years ago. It has disposed of assets and recycled mostly into Class A properties. In 2019 the REIT only had 42% of base rent being generated from industrial space and 18% from the woeful office space but increased its proportion of base rents from industrial space to 85% while office space fell to just 5% of base rent at Q3 2022. 43% of base rent is generated from the provinces of Ontario and Quebec.

2020 Annual General Meeting (Nexus Industrial REIT)

September 2022 Investor Presentation (Nexus Industrial REIT)

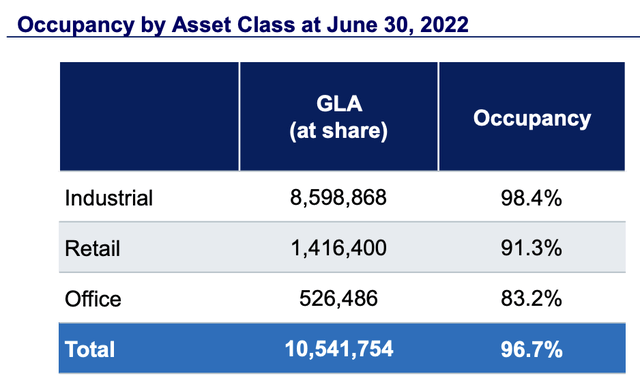

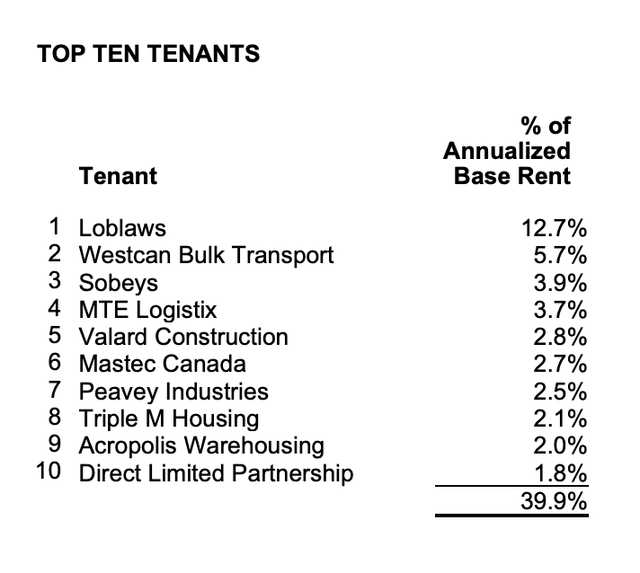

Nexus’ portfolio is comprised of 73 industrial properties, 19 retail properties, and 13 office properties. The industrial portfolio is comprised predominantly of single-tenant properties such as Westcan Bulk Transport (one of Western Canada’s largest bulk commodity haulers) which is 6% of rents and MTE Logistix which is a large 3PL and contract warehousing in Edmonton and Calgary. The retail assets are anchored by national grocery/necessities-based retailers with the largest tenants being Loblaw (OTCPK:LBLCF), Sobeys, and Shoppers Drug Mart.

Even the aforementioned woeful office portfolio is not that bad, as top tenants include, Sunlife, Xerox (XRX), The Notaries of Quebec, Public Works Government and Service Canada. The assets are mostly located in prime downtown Montreal locations and the weighted average lease term is ~7 years and the occupancy is still 83%.

September 2022 Investor Presentation (Nexus Industrial REIT)

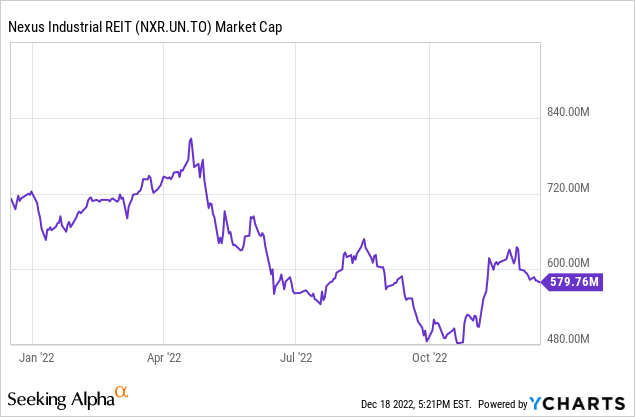

Given the REITs small size with a market capitalization of less than $600 Million, it actually has exceptional tenant diversification with its top 10 tenants accounting for only 40% of rents.

2022 Q3 MD&A (Nexus Industrial REIT)

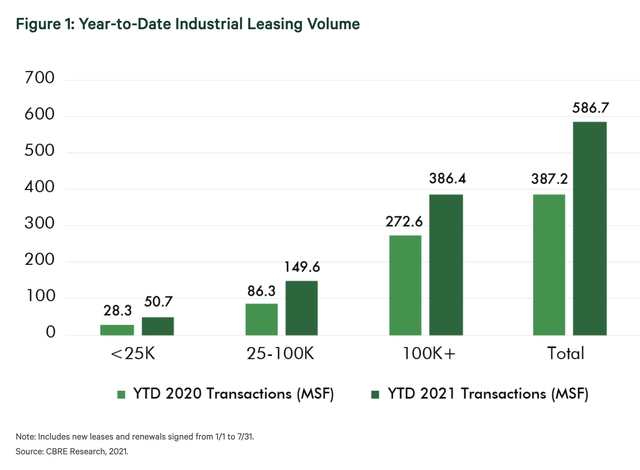

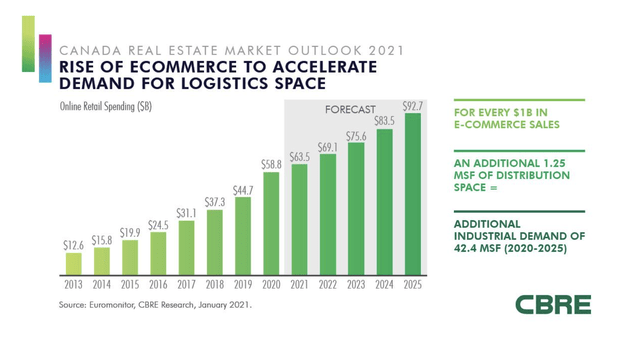

Warehouse leasing is seeing major tailwinds. Since 2021 tenants have been leasing warehouse space at faster rate to hold more inventory as transportation costs have been growing at a faster pace than lease rates. In addition, CBRE expects online spending by Canadians to reach $92.7 Billion by 2025, net-new warehouse requirements from ecommerce-related demand are expected to exceed 40.0 million sq. ft. over the next five years.

So Much Demand, So Little Space (CBRE)

Rising Transportation Costs Help Fuel Record Warehouse Leasing Pace (CBRE)

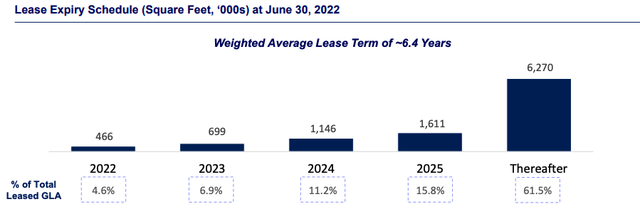

The weighted-average lease term is perhaps a little conservative as only 11.5% of properties come up for renewal before the end of 2023. The leasing spreads will be quite large as their current rent/sf is low at $4.25/sf due to Striker Corporation (SYK) which is renting at an extremely low rate, but renewals for Q4 2022 will likely be at rates greater than $7/sf. This was mentioned by the CFO in the Q3 2022 Investor Call.

September 2022 Investor Presentation (Nexus Industrial REIT)

We already are seeing evidence as the Q3 2022 MD&A states:

Q3 2022 Same Property NOI of $12.9 Million increased by $0.3 Million or 2.1% as compared to Q3 2021. The increase being primarily driven by rental steps and CPI increases at REIT’s industrial properties, as well as lease renewal lift, offsetting vacancy at one of the REIT’s industrial properties and an office property.

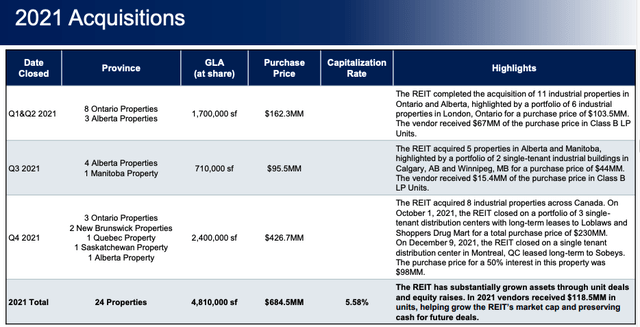

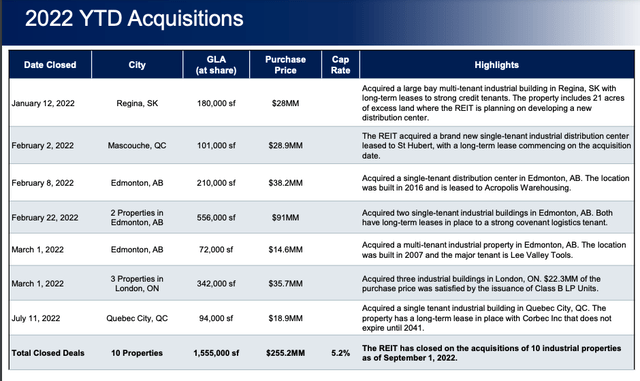

The REIT has been quite active on the acquisition front the past year and a half with spending $940 Million on 6.4 Million square feet at cap rates of 5-6% which compares favourably to their cost of debt at 3.3%.

September 2022 Investor Presentation (Nexus Industrial REIT) September 2022 Investor Presentation (Nexus Industrial REIT)

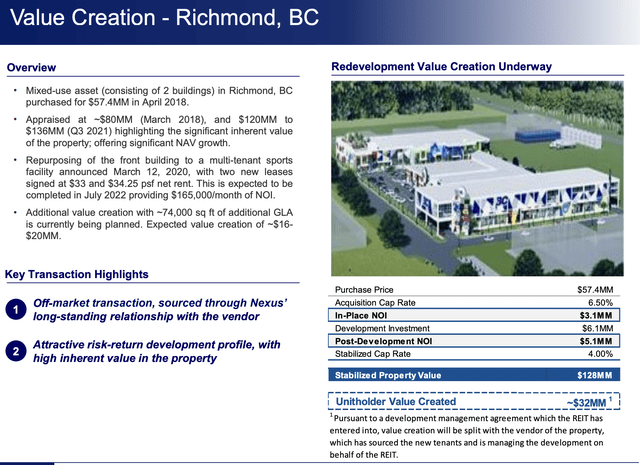

On March 16, 2020, the REIT entered into a development management agreement with the vendor of the REIT’s Richmond, BC property. The REIT is redeveloping approximately 60,000 square feet previously occupied by an industrial tenant. The developer is managing the redevelopment and has secured new tenants for the space, and the REIT has entered into lease agreements with these tenants. The REIT is responsible for the costs of the redevelopment, which have been capped at $6.1 Million. The REIT will construct an approximately 70,000 square foot addition at the property. The developer will secure tenants and manage the construction. The REIT will split the value enhancement of the property, measured as the difference between the fair value of the property following completion of each of the redevelopment and the addition, less the REIT’s total cost of the property.

The first $20 Million of value enhancement is for the benefit of the REIT. The next $20 Million of value enhancement will be for the benefit of the developer. Any value enhancement in excess of $40 Million is to be split equally between the REIT and the developer. The redevelopment has the potential to increase unitholder value by $32 Million.

September 2022 Investor Presentation (Nexus Industrial REIT)

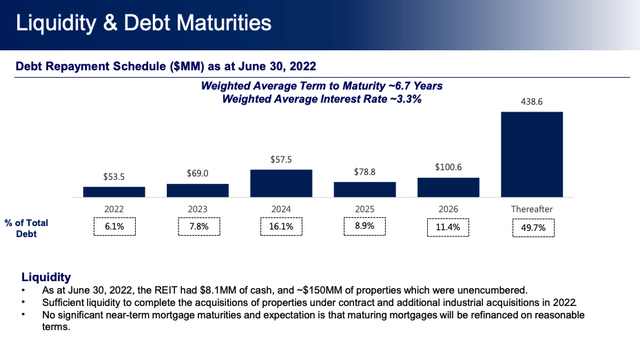

The REIT also only has less than 15% of debt coming due before 2023 and a 6.7 weighted average maturity on debt so NOI should see minimal decreases due to interest rate increases that are expected over the next couple of years.

September 2022 Investor Presentation (Nexus Industrial REIT)

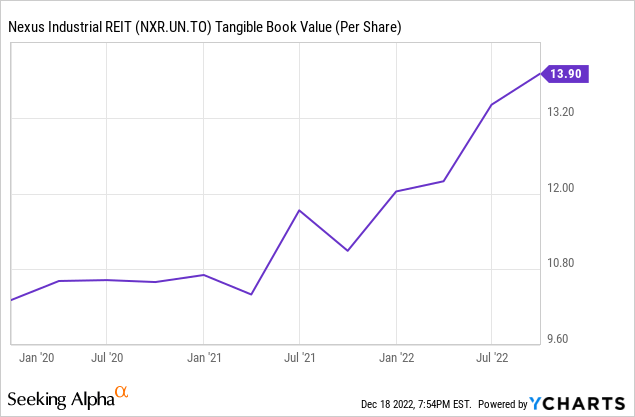

Valuation

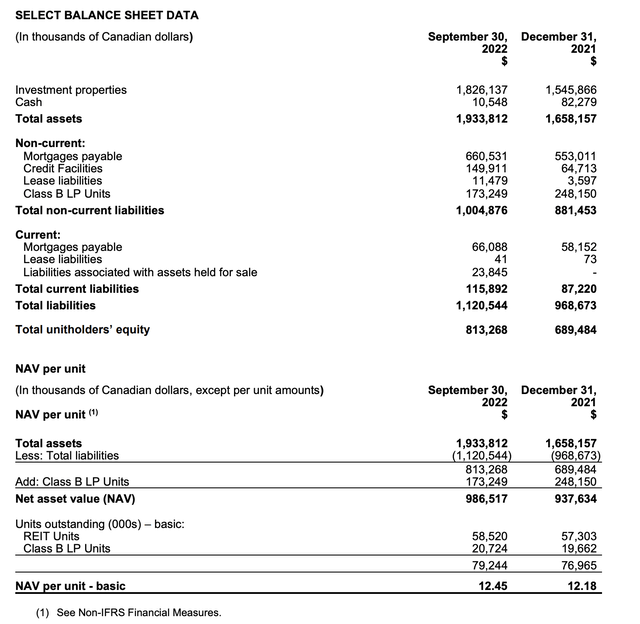

The REIT reported a NAV/share of $12.45 at Q3 2022 which is a 2% increase from December 2021. This is still admirable given the $40.2 million of fair value write-downs primarily related to capitalization rate expansion for certain industrial properties ($34.3 million), retail properties ($2.9 million) and office properties ($3.0 million), and $7.9 million related to transaction costs and acquisition accounting adjustments on properties acquired during the year. Write downs were offset largely due to increases in NOI from CPI and “renewal lift” and acquisitions completed since December 31, 2020 generating $32.2 million of incremental NOI.

2022 Q3 MD&A (Nexus Industrial REIT)

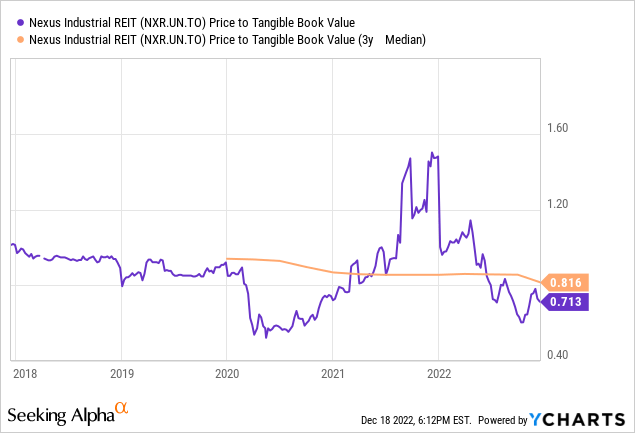

The REIT still trades at an attractive ~21% discount to NAV and well below the 3-year median discount.

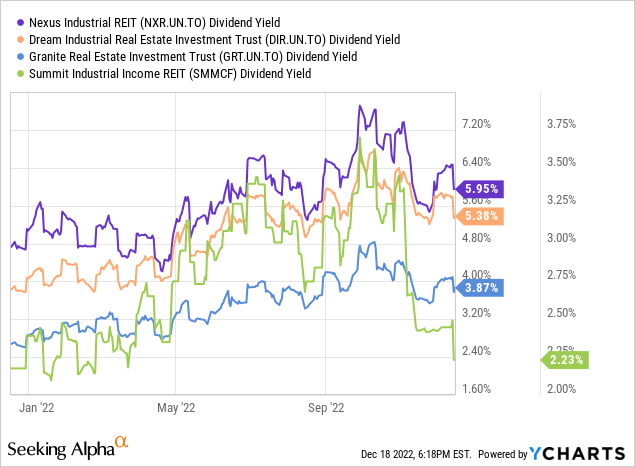

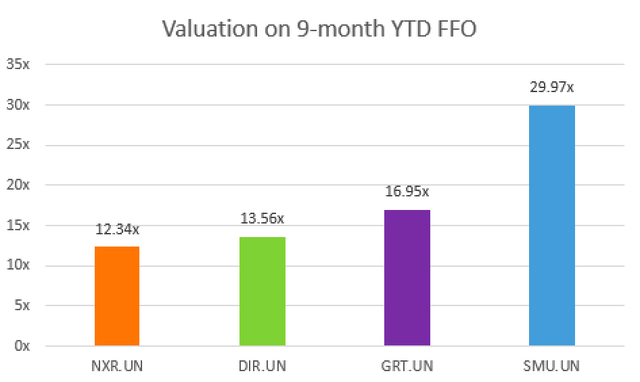

Relative to its peer group its 6% dividend yield is among the highest although only 58 bps higher than Dream Industrial REIT (DIR.UN:CA) which is another Industrial REIT I am quite bullish on. NXR also has the lowest valuation based on its annualized 9-month FFO but is also not much less than DIR.UN.

Author’s Table (Corporate Filings)

Risks

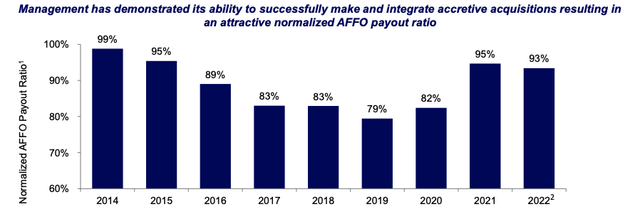

The payout ratios have been impacted by these acquisitions but I don’t see this as cause for a dividend cut. The payout ratios in 2021 and YTD 2022 have been impacted by the $288MM equity raises in 2021 and the cash has not been fully redeployed. The REIT amended an existing revolving credit facility, increasing the credit facility from $40 Million to $140 Million and has a minimal amount drawn against it and $10 Million in cash which makes a distribution cut all the more unlikely. I would not expect substantial dividend growth in the near term as management has indicated none of the recent acquisitions will be accretive until at least the second half of 2023.

September 2022 Investor Presentation (Nexus Industrial REIT)

The more concerning aspect is the equity offering prices to acquire properties over the past year and a half. Below is a summary of the transactions from their corporate filings:

- February 10, 2021 – NXR enters into an agreement to sell to a syndicate of underwriters led by BMO Capital Markets and Desjardins Capital Markets on a bought deal basis, 3,700,000 units of the REIT at a price of $8.20 per Unit for gross proceeds of approximately $30 Million.

- March 4, 2021 – NXR announced today the closing of its previously announced public offering of trust units of the REIT to a syndicate of underwriters led by BMO Capital Markets and Desjardins Capital Markets, and including iA Private Wealth Inc., National Bank Financial Inc., RBC Dominion Securities Inc., TD Securities Inc., Scotia Capital Inc., Echelon Wealth Partners Inc., and Raymond James Ltd. on a bought deal basis. A total of 4,255,000 Units were issued at a price of $8.20 per Unit pursuant to the Offering for total gross proceeds to the REIT of $34,891,000.

- August 23, 2021 – NXR announced today the closing of its previously announced public offering of trust units of the REIT to a syndicate of underwriters led by BMO Capital Markets and Desjardins Capital Markets, on a bought deal basis. A total of 9,918,750 Units were issued at a price of $11.30 per Unit pursuant to the Offering for total gross proceeds to the REIT of $112,081,875.

- November 22, 2021 NXR announced today the closing of its previously announced public treasury and secondary offering of trust units of the REIT to a syndicate of underwriters led by BMO Capital Markets and Desjardins Capital Markets, on a bought deal basis. A total of 12,650,000 Units were sold at a price of $12.85 per Unit pursuant to the Offering.

- December 1, 2022 – NXR announces that it has entered into an agreement to sell to a syndicate of underwriters led by BMO Capital Markets on a bought deal basis, 7,300,000 trust units of the REIT at a price of $10.30 per Unit for gross proceeds to the REIT of approximately $75 million.

- December 8, 2022 – NXR announced today the closing of its previously announced public offering of trust units of the REIT to a syndicate of underwriters led by BMO Capital Markets, on a bought deal basis. A total of 8,225,000 Units were issued at a price of $10.30 per Unit pursuant to the Offering for total gross proceeds to the REIT of approximately $81 Million.

What do you notice about these transactions? The persistent issuance of equity under NAV (aside from August and November of 2021 as those raises were at fair prices). Most of the offerings included warrants as well which have the potential to be even more dilutive. Given the fact that share issuances have not been dilutive to this point I can give them a free pass and raising equity below NAV may be in part due to rising interest rates.

The REIT intends to use the $156 Million net proceeds from the offerings in December to fund the acquisition of two new-build institutional-quality single tenant industrial distribution properties currently under contract totalling approximately 330,000 square feet, and for general business purposes. The acquisitions are located in the Greater Toronto Area and Greater Montreal Area and are currently under construction. Management expects a 6% plus cap rate on these acquisitions which is well above the current weighted average portfolio rate so have significant potential to be accretive.

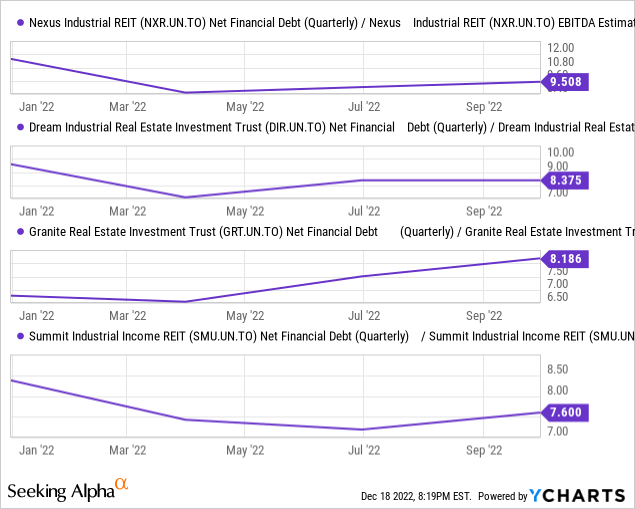

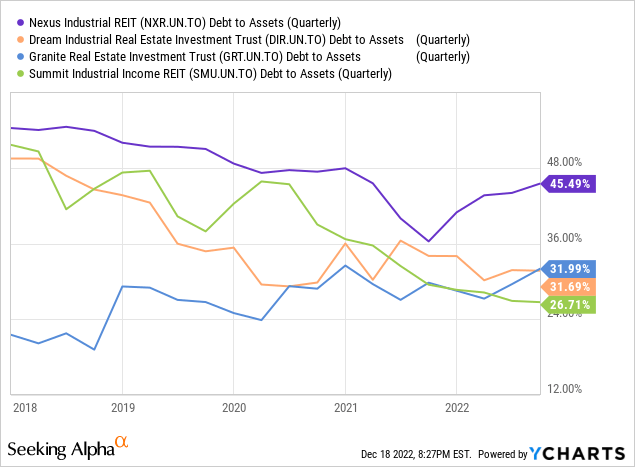

The REIT is also a little more leveraged on both a Net Debt/EBITDA and Debt/Assets basis than its counterparts which makes the NAV more sensitive to inputs. Repayment shouldn’t be an issue for the REIT with 50% of debt up for renewal after 2027 and it has $150M in unencumbered assets.

Verdict

The REIT certainly looks cheap and would still be an excellent pick for income investors. It should gain greater institutional interest largely due to its partnership with RFA Capital, a real estate investment and management company that is also the largest shareholder which has allowed the REIT to access off-market deals and allow for multiple expansion.

The discount to NAV more than offsets these risks associated with this stock as the potential for a recession seems more than baked in. That being said I think DIR.UN has comparable upside for even less risk.

Be the first to comment