lucadp

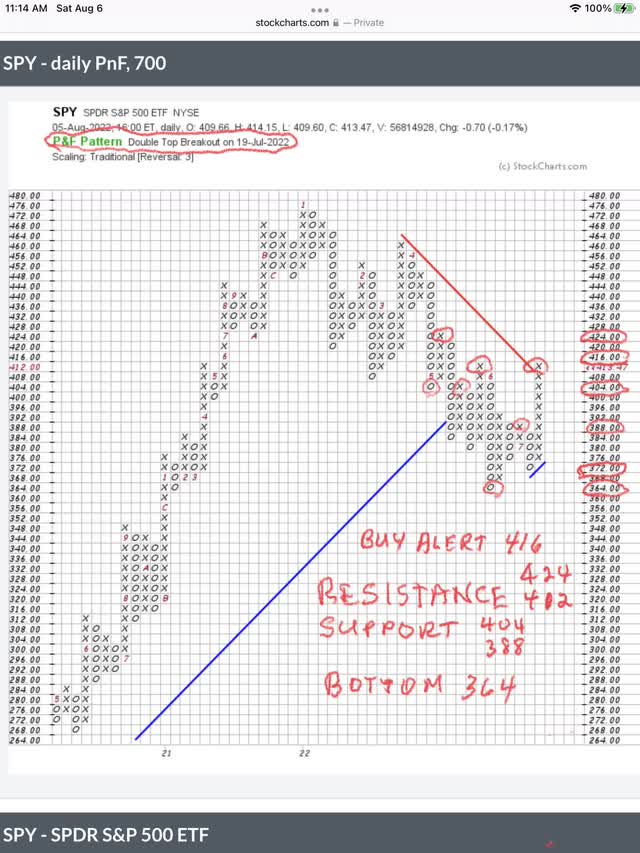

We have preset Buy and Sell alerts that Seeking Alpha sends out automatically and our next Buy Alert is set to go out when the SPY breaks above $416. That means a bullish, higher-high on the SPY (NYSEARCA:SPY) (Point & Figure chart shown below). We think this Demand is being fueled by good earnings and a roaring economy that is ignoring the signals of a coming recession. This alert, when triggered, will confirm the continued Demand we see on our other charts. We think the next upside targets are $420 and $424.

Will The SPY Go To $420?

Will price reach those targets? If Demand continues strong on the charts, price will go higher. We review these signals everyday and give the answers. As long as Demand is there, we are trading the long side. When the signals change next week or the week after, we will trade the short side. Our “game over” Sell Alert is set to trigger when price drops below $404. However, our daily SPY analysis will tell our readers long before this alert is triggered. The only exception would be a negative surprise.

What Did The Jobs Report Tell Us?

The jobs report on Friday turned the SPY negative on the open. If it were a big, negative surprise, price would have dropped below $404 and triggered our Sell Alert. As it turned out, price stopped dropping at $410 and spent the rest of the day recovering. Considering the continued, strong Demand showing on both the daily and weekly charts, the recovery on Friday was likely to happen.

What Is The SPY Telling Us?

As you all know the SPY is a leading indicator to any recession. This bear market is flashing “recession.” Investors feel the pain long before workers are unemployed and consumers stop spending. The Fed knows this and Wall St. knows this. Only the people on Main St. don’t know it, because of all the “Help Wanted” signs all over the place.

When Will The Fed Ease?

Why are we watching the jobs report? It only confirms what we already know. The “hope” is that a bad jobs report means the Fed won’t raise rates 75 basis points in September. That hope seemed to be scratched by Friday’s jobs report. The Fed will not ease based on the jobs report. It will ease when unemployment starts increasing above target levels. It will ease when inflation starts dropping towards the 2% target.

Good News Creates Technical Bounces

Other lagging indicators are corporate earnings. As long as there is full employment, more than full employment, consumers will spend. Corporate profits were not that bad, no recession yet. Inflation is pinching demand by the consumer, but the spending hasn’t stopped. Nobody is hurting yet, except the SPY. It knows what the Fed is going to do, namely keep raising rates until inflation turns down or unemployment increases dramatically. That is why the SPY is in a bear market.

Conclusion

We have no problem trading technical bounces, knowing that summer rallies come to an end. This one is close to an end. We know that when our $416 Buy Alert is triggered, the bounce is closer to that end and we don’t want to be trapped investing at the top of this summer rally. It’s a traders’ market. Our sell signals will tell our readers we are switching from long to short. Stay tuned.

Be the first to comment