GlobalP/iStock via Getty Images

The iShares MSCI France ETF (NYSEARCA:EWQ) is not a bad way to play the European discount as an ETF investor. We’d always opt for specific picks, especially in France, but the EWQ gets you exposed in quite good-value markets without taking on much risk. Having traded down quite a lot YTD, and having points of resilience, for investors looking for higher margin of safety exposures the EWQ could be a reasonable thing to hold at quite a beefy allocation. As far as European markets go, France might be the most attractive in our eyes, so overweight it.

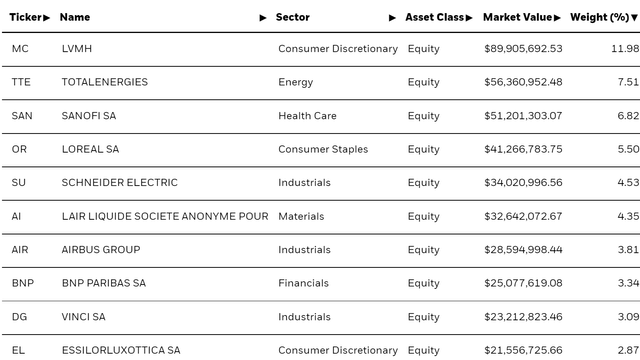

EWQ Breakdown

EWQ has some of the most recognizable companies in Europe, and in the current environment many of them end up playing quite well.

There is a large focus on consumer discretionary, but almost half of it is explained by the allocation to LVMH (OTCPK:LVMHF) which is the company that owns Louis Vuitton as well as other luxury brands. Just below it is TotalEnergies (TTE), and below that among other is Sanofi (SNY), Schneider Electric (OTCPK:SBGSF), L’Air Liquide (OTCPK:AIQUF), BNP Paribas (OTCQX:BNPQF) and Vinci (OTCPK:VCISF). All of these have at least a 3% portfolio allocation.

LVMH isn’t bad because of the exposure to high income customers and a brand value that makes is more defensible if even wealthy consumers become more discerning. Relative to other consumer discretionary companies like automotive, it has way fewer exposures, and are glad that it accounts for most of the ETFs consumer discretionary. The other consumer discretionary exposure is EssilorLuxottica (OTCPK:ESLOF), which again is pretty resilient even having a decent insurance business, but also very low cost production and a significant partnership with luxury brands that keeps it in that luxury category. Again, mitigated risk relative to the broader consumer discretionary category.

Total is energy exposed, and with Biden’s adventure to the middle east yielding very little, oil prices look to remain on safe footing. Sanofi is also resilient to recession fears, although admittedly it might have some issues with reliance on specific drug platforms that are nearing exclusivity cliffs. Schneider is a solid utility/enterprise solutions exposure, BNP benefits from the rate hiking environment and has always been a more solid European bank, Vinci is infrastructure and benefits from a high imputed NAV thanks to infra activity in red-hot private markets flush with cash, and Air Liquide has a very solid model. These all account for 50% of the EWQ and are all relatively safe.

Conclusions

While being resilient, some even with infrastructure economics, the multiple on the overall ETF remains pretty low at 13x. The yield over the last 12 months has been 6.62% as well. The dividends are nicely covered in the majority of cases as the fee is only 0.5%. Investors can get a slice of European markets, a little expensive to invest into individually sometimes, with quite limited fees and costs. They can do this to benefit from the prevailing discount on European assets relative to the US. Despite resilient exposures the ETF is down by 15% this year, around in line with general markets. Trading at a geographic discount and capable of reacquiring investor confidence in the face of a recession these assets look quite interesting. With the additional benefit of France having a much more shored up supply chain, and a penchant for integrating vertically or at least integrating with other French producers, there is that added benefit as well.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment