Rachel Murray/Getty Images Entertainment

The Thesis

American Eagle has terrific brand power, online marketplaces, and products. The key now is for management to better allocate the company’s capital, manage inventory, restore cash flow, and improve the balance sheet. With prudent financial management, AEO will come out of this turbulent environment stronger. We’re watching management closely and looking to add on pullbacks. In the decade ahead, we project returns of 14% per annum for the one and only American Eagle Outfitters (NYSE:AEO).

Warren Buffett’s Advice On Brand Power

Buffett has weighed in often on the power of brands. In 1997, explaining his purchases of See’s Candies and Coca-Cola (KO), Buffett said:

“When you get into consumer products, you’re really interested in finding out: What is in the mind of how many people, throughout the world, about a product now, and what’s likely to be in their minds 5 or 10 or 20 years from now.”

Looking at American Eagle and Aerie, we know they’re strong brands now. Aerie’s been growing revenues at 31% per annum on its way to crushing Victoria’s Secret (VSCO) and capturing share of a $65 billion addressable market.

Aerie Brand (AEO 2021 Investor Day)

Victoria’s Secret’s sales have been declining as Aerie’s skyrocket. This may be just the beginning as Aerie’s marketing has struck a chord with today’s shoppers who prefer Aerie’s comfort, affordable prices, and all body size advertising. Meanwhile, women are voting with their feet when it comes to Victoria’s Secret’s air-brushed supermodels. Aerie’s global brand president said, “We are the anti-supermodel.” This is brand power at its finest, and we don’t expect Aerie to fade anytime soon.

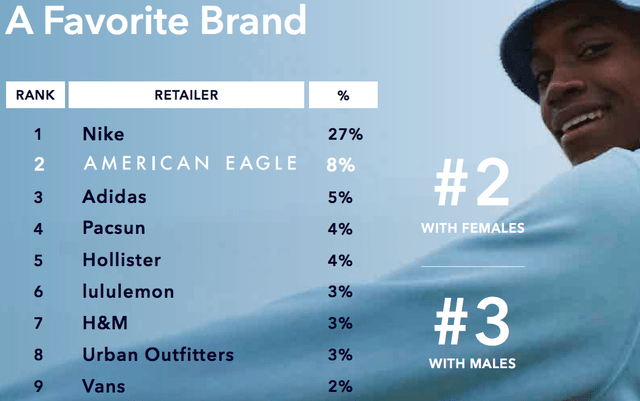

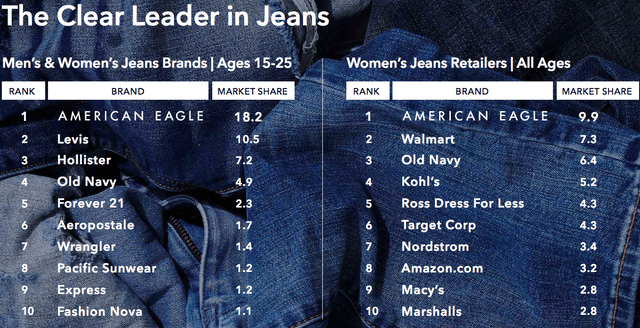

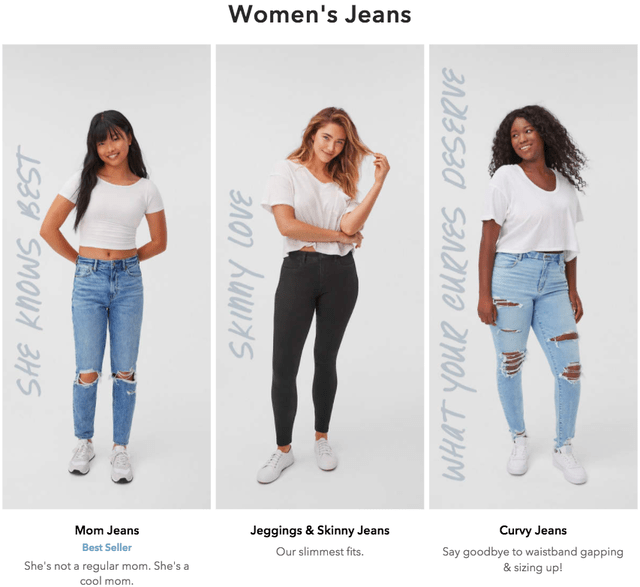

American Eagle is an iconic brand that’s withstood the test of time. It’s been a favorite brand of mine for more than a decade, and my finance buys jeans solely from American Eagle as their jeans just fit better than everyone else’s. And, we’re not alone. American Eagle sits next to Nike as a favorite brand, and is also the preeminent player in jeans:

Favorite Brands (AEO 2021 Investor Day)

Market Share – Jeans (AEO 2021 Investor Day)

This strikes us as a brand that has withstood the test of time and will continue to do so, as Buffet says, for the “next 5 or 10 or 20 years.”

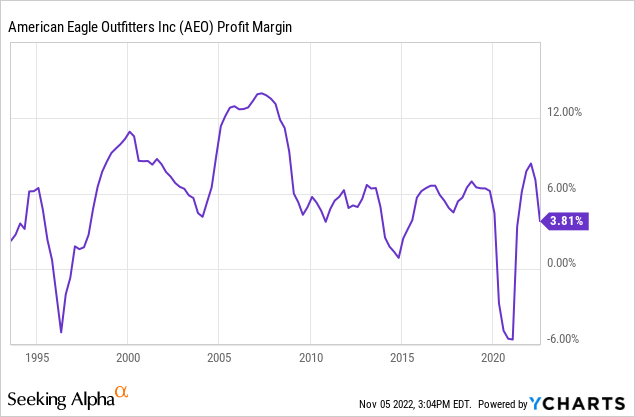

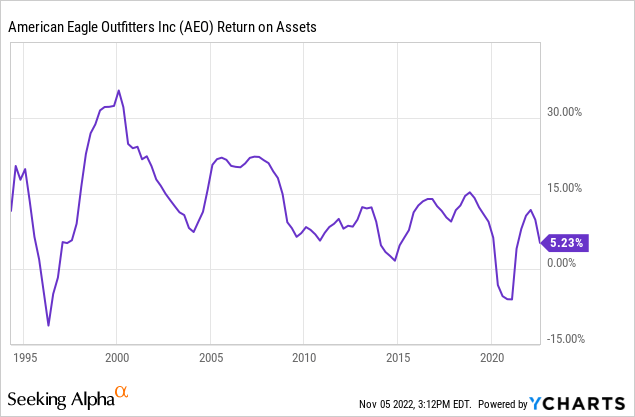

AEO’s Profitability

American Eagle’s been changing over the years to reflect changing consumer tastes. More and more consumers are choosing to shop for clothes online. Along with that trend, American Eagle’s strategically closing its least profitable stores and selling more and more products through its online marketplaces. The problem is, the old mall retail business was more profitable than today’s modern omni-channel business. You can see this in the charts below as AEO had superior profit margins and return on assets in the early 2000s:

The modern omni-channel business has averaged just a 4% profit margin and 7.5% return on assets (Over the past 5 years). Below, we’ve calculated AEO’s normalized earnings power using these averages:

| Metric | % | X | = |

| Normalized Earnings | $237 million | ||

| Profit Margin (5-Year Average) | 4.0% | $5.035 Billion Revenue | $201 million |

| Return On Assets (5-Year Average) | 7.5% | $3.629 Billion Assets | $272 million |

$237 million equates to $1.27 per share of normalized EPS, giving AEO a normalized P/E of 9x.

AEO’s Online Marketplaces

Don’t get us wrong here, AEO has a fantastic, user-friendly website and offers a superior online shopping experience to even that of Amazon (AMZN), in our opinion. We encourage you to check out the website for yourself.

American Eagle Website (AE.com)

We believe it’s time for American Eagle to be compensated for its e-commerce investments. Wages and gasoline prices have increased making the delivery of e-commerce goods more expensive. It’s time for American Eagle to raise its shipping fees. The company has incredibly strong brands and a superior online experience. The worst-case scenario is that increased shipping fees will drive more traffic to AEO’s physical stores.

Now, could AEO’s online marketplaces improve their profitability in the long-run? Yes. In the long-run, the delivery process will become more and more efficient. Some cities in China are already delivering packages via electric, autonomous vehicles. This eliminates the wage and fuel expense altogether.

In the meantime, we think physical stores will continue to drive the Aerie and American Eagle brands forward. The company’s aggressively opening new Aerie stores.

Some Positive Macro Trends

The U.S. dollar’s been appreciating against global currencies. This is a positive for American Eagle Outfitters which imports its clothes from China, India, and Vietnam. Cheaper imports means higher profit margins.

The falling price of cotton is another boon for manufacturing costs:

Price Of Cotton (Trading Economics)

Prospective Returns

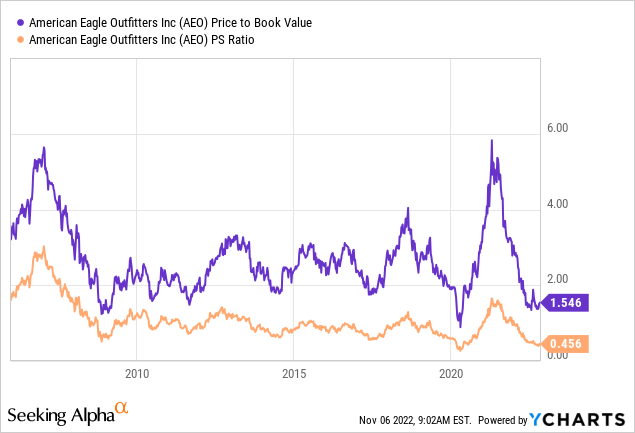

American Eagle is trading at valuations not seen since the Global Financial Crisis of 2008 and the pandemic lockdowns of 2020:

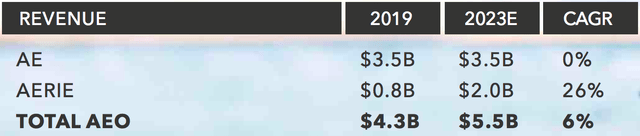

American Eagle’s revenue has been largely flat as the company closes the brand’s least profitable stores. Meanwhile, Aerie has grown revenue above 25% per annum for quite some time, but makes up a much smaller piece of the business.

Revenue Growth (AEO 2021 Investor Day)

Management plans to increase profits further by increasing margins as Aerie and the e-commerce business achieve economies of scale. Management also plans to reduce the share count and increase EPS through the use of share buybacks. While AEO could grow faster, we think EPS growth of 6% per annum is conservative as a base-case scenario. We expect the dividend of $0.72 per share to return in 2023.

| Normalized EPS | Expected Annual Growth Rate | 2032 EPS Estimate | Terminal Multiple | 2032 Price Target |

Annualized Returns (Dividends Reinvested) |

| $1.27 | 6% | $2.27 | 11 | $25 | 14% |

Risks

AEO carries a lot of long-term capital lease liabilities on its balance sheet in a challenging macro environment. Rising input costs (Shipping and wages) have been squeezing margins at AEO. While the company has ample working capital to pay its dues, inventory build-up and investments have burdened AEO’s cash flows of late. The company will need to prioritize cash flow generation over the holiday season while reducing its long-term liabilities. With the recent dividend cut, management’s prioritizing share buybacks and balance sheet strength.

Conclusion

Rising wages and gasoline prices have increased shipping costs for AEO’s online marketplace. At the same time, a strong U.S. dollar and falling cotton price should translate to lower manufacturing costs out of China, India, and Vietnam.

American Eagle enjoys a dominant position in the jeans market, while Aerie’s comfortable and inclusive products continue to resonate with customers, crushing Victoria’s Secret along the way. Aerie’s grown revenue at 25% per annum for quite some time. And, with a $65 billion addressable market, we don’t see it slowing down anytime soon. With a “strong buy” rating on the shares, we’ve been buying the colossal dip.

Be the first to comment