David Commins

NexTier Oilfield Solutions Inc. (NYSE:NEX) recently reported an impressive increase in its revenue and EBITDA guidance. I don’t think that the market is fair with NexTier. Considering future expansion of the business with new products and new clients, I obtained a valuation that is higher than the current stock price. My discounted cash flow (“DCF”) model also reported a significant increase in future free cash flow and valuation with successful closure of M&A transactions.

Yes, there are risks from an eventual decline in demand and new environmental laws. However, the current price does seem low.

NexTier Oilfield

NexTier Oilfield Solutions Inc. is an oilfield service company operating mainly in the United States.

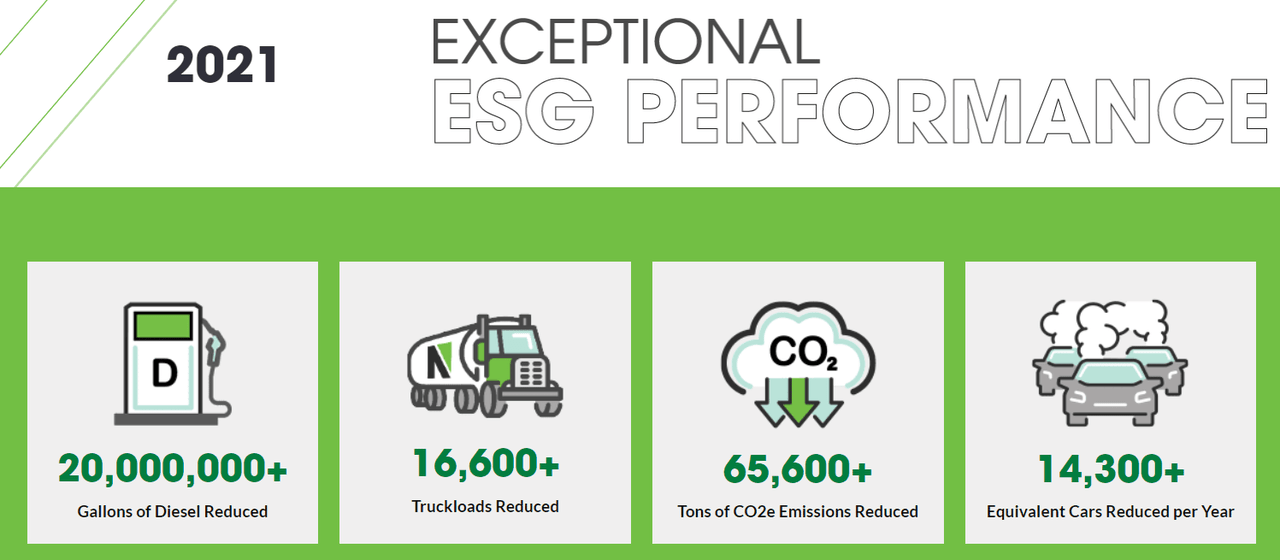

Going directly to the main point about NexTier, there are two main reasons to assess the company’s financial model. First, there is the recent ESG performance, which more and more investors are currently studying. NexTier is using fewer and fewer gallons of diesel, making use of less equivalent cars reduced per year. In this regard, management offers a lot of statistics on the company’s website:

Company’s Website

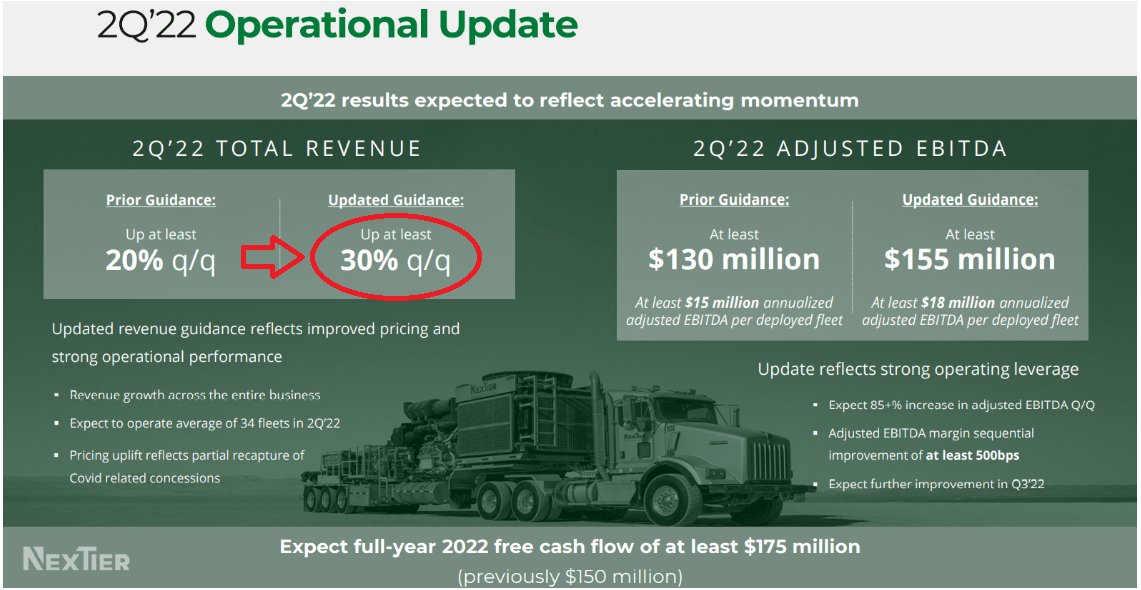

The second reason to assess NexTier relates to the most recent operational update and the company’s valuation. In Q2 2022, revenue growth guidance increased from 20% q/q to around 30% q/q. Besides, management also increased its adjusted EBITDA estimate from $130 million to $155 million, and noted 2022 free cash flow of $175 million. Considering the current valuation, I wonder whether the current price is appropriate.

NexTier Investor Relations

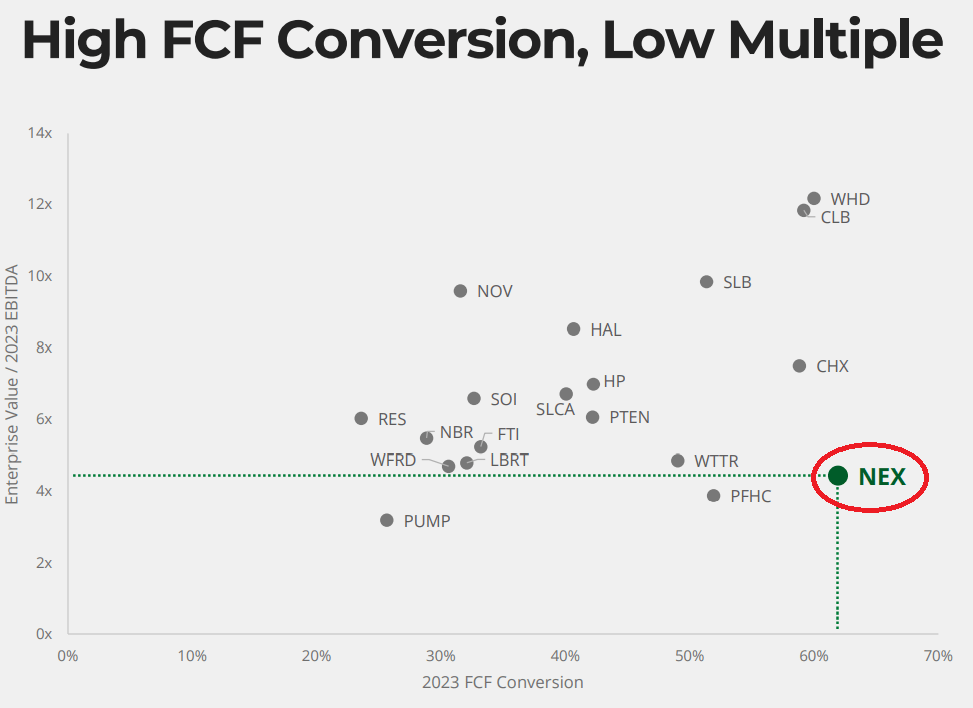

With regards to the current valuation, the chart below motivated my research about NexTier Oilfield. Note that the company is trading at 4x-6x EBITDA with many peers trading at more than 10x, and NexTier’s FCF Conversion is among the largest in the peer group.

NexTier Investor Relations

Expectations Would Imply Extremely Appealing Opportunities In 2022, 2023, And 2024

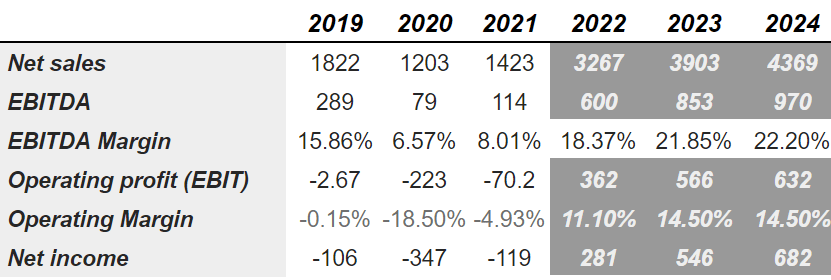

Investment advisors out there believe that the company’s net sales will grow from close to $3 billion in 2022 to more than $4 billion in 2024. The EBITDA margin would also grow from 18% in 2022 to 22% in 2024, and the operating margin would stay at close to 14% in 2024.

marketscreener.com

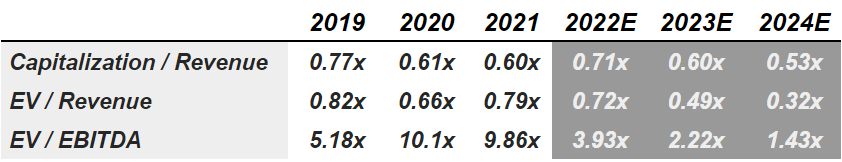

With the impressive increase in EBITDA and revenue, estimates include valuations of close to 1.43x in 2024 and 2.22x in 2023. Under these numbers, I would say that the company is quite undervalued.

marketscreener.com

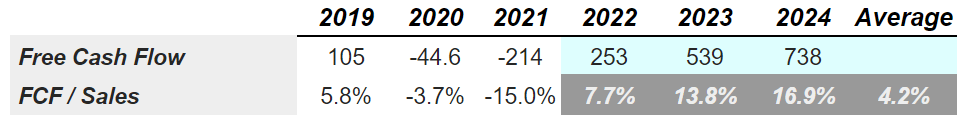

Let’s keep in mind that the FCF would grow from $253 million in 2022 to about $738 million in 2024. Considering these figures, I decided to execute a few DCF models to understand whether NexTier Oilfield could be interesting for seeking alpha investors.

marketscreener.com

Balance Sheet

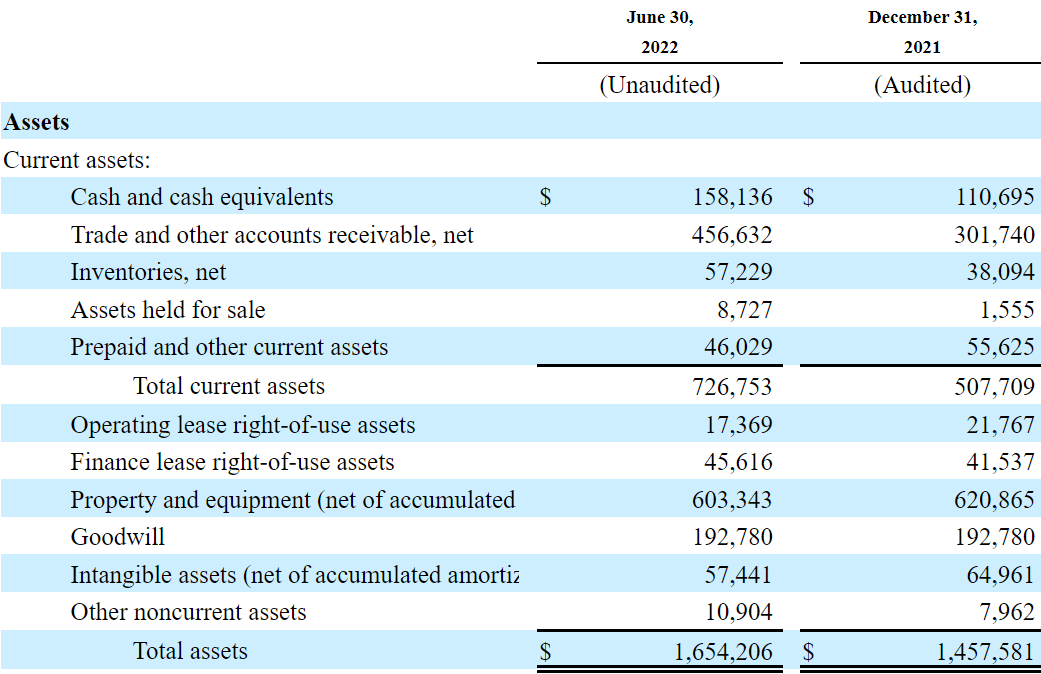

As of June 30, 2022, cash is equal to $158 million, and the asset/liability ratio exceeds the 1.5x mark. I believe that the company’s balance sheet is in good shape.

10-Q

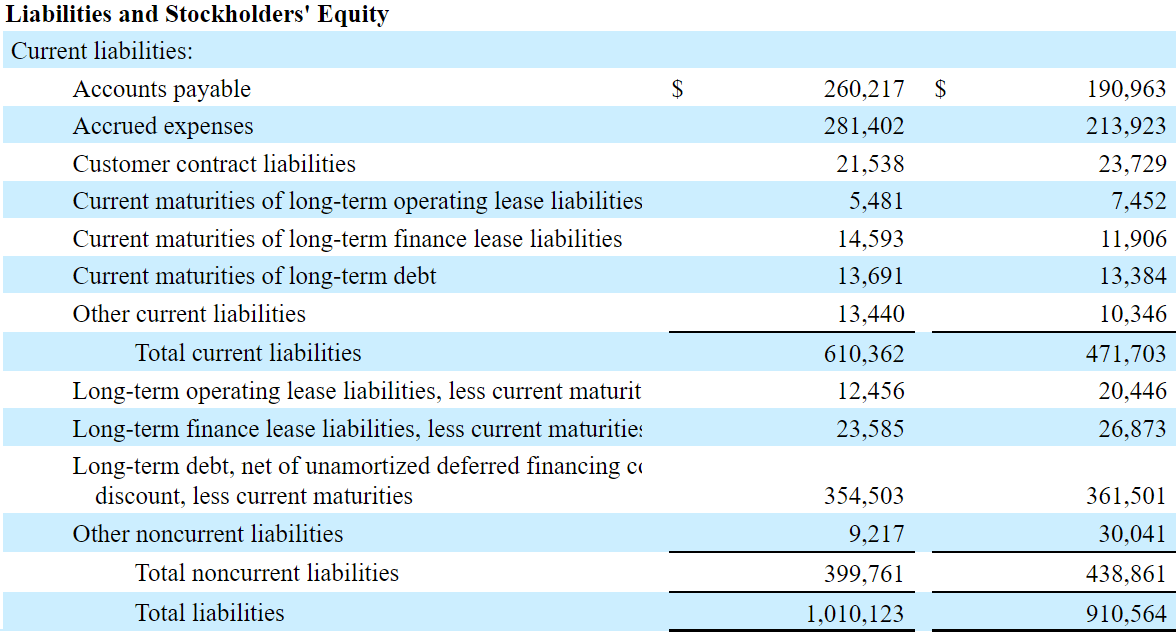

Including financial leases and financial debt, I obtained total obligations of $406 million. Considering that estimates include 2024 free cash flow of more than $700 million, I don’t think that the debt is worrying at all.

10-Q

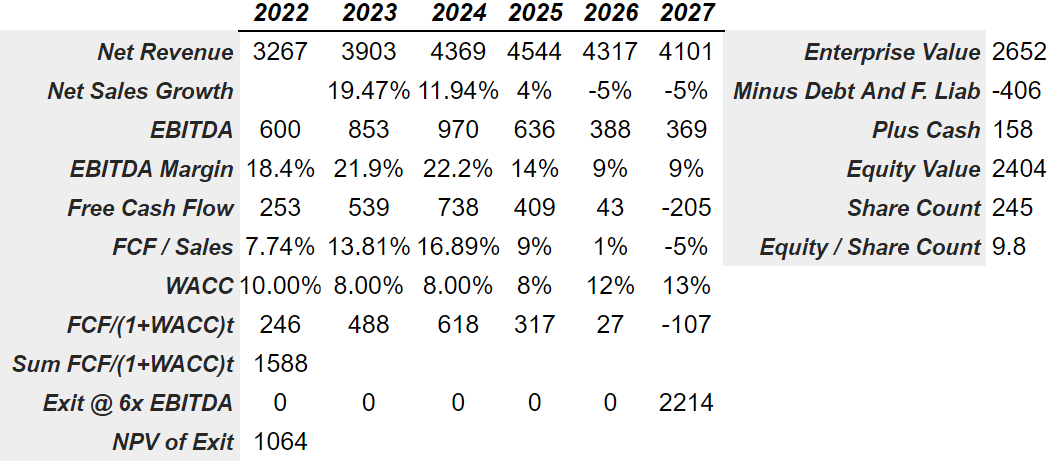

My Base Case Scenario Would Lead To A Valuation Of $9.8 Per Share.

Under my base case scenario, I assumed that the company will likely develop and expand relationships with existing and new customers. As a result, revenue will likely trend north. Besides, in my view, economies of scale could play a major role as the number of customers would increase. The EBITDA margin could increase over time.

If NexTier also invests to enlarge driving efficiencies, and new products are offered in the company’s digital platform, existing customers may spend more. I also believe that management could have many revenue opportunities through an enlargement of the power solutions offering. The company gave many examples of the new incoming improvements in its corporate documentation.

We believe our digital program, continued investment in diesel substitution (such as dual fuel capabilities), and our integrated natural gas treatment and delivery solution are important to achieving emissions reductions initiatives, both for us and our customers, and provide a competitive differentiating factor. Source: 10-K

I do think that NexTier Oilfield may suffer from the concentration of clients. In 2020 and 2021, the company reported a few customers responsible for a significant amount of revenue. Under this scenario, I assume that NexTier Oilfield will work with many more clients, which may offer more negotiating power. As a result, in the future, the EBITDA margin may increase.

For the year ended December 31, 2021, revenue from one customer individually represented approximately 14% of the Company’s consolidated revenue. This customer represented $193.4 million of our consolidated revenue in the Completions Services segment. For the year ended December 31, 2020, two customers individually represented more than 10% and collectively represented 29% of the Company’s consolidated revenue. Source: 10-K

If we use the estimates given by other investors and conservative sales growth in 2025, 2026, and 2027, I obtained 2027 revenue of $4.101 billion. I also assumed a 2024 EBITDA margin close to 22% and a decline in the margin to 9% in 2027. Finally, I also assumed that the FCF could decline from almost 17% in 2024 to -5% in 2027.

Under this case scenario, my model also included a somewhat growing weighted average cost of capital to 13%, which implied a discounted sum of free cash flow close to $1.58 billion.

I believe that the median of the industry is close to 6x EBITDA, so I used this multiple for an exit in 2027. The NPV of the exit would stand at $1.06 billion. If we sum the exit value and future free cash flow from 2022 to 2027, the enterprise value would be $2.652 billion. Subtracting the net debt, I obtained a valuation close to $9.8 per share, which I believe is quite conservative.

Arie’s DCF Model

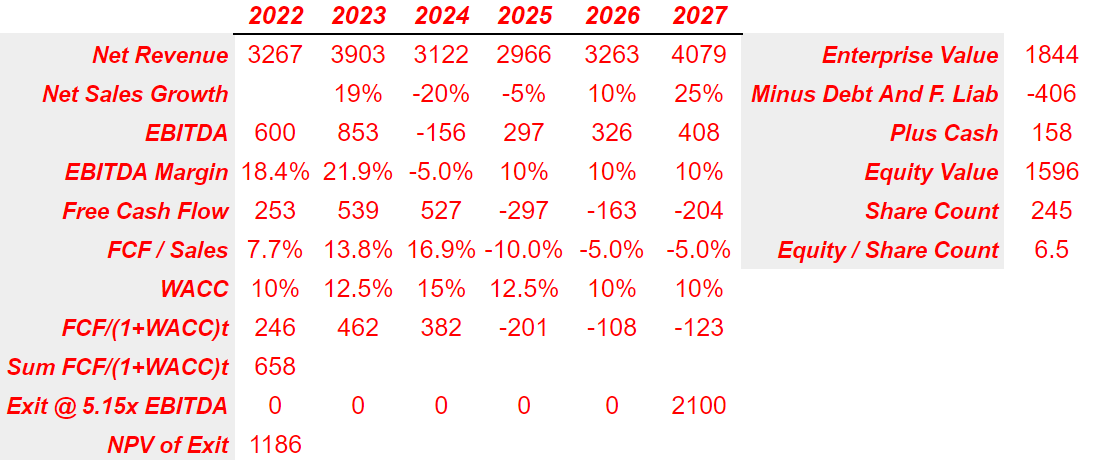

Worst Case Scenario

Under my worst case scenario, NexTier Oilfield may suffer a decrease in capital expenditure and exploration and development investments in the oil and gas industry. Let’s note that it may happen, and management warned several times about it in some corporate documents. As a result, I believe that clients would hire NexTier Oilfield a bit less, which would cause a significant decrease in sales growth and FCF margins. The stock price would decline:

Our business is cyclical, and we depend on the willingness of our customers to make expenditures to explore for, develop and produce oil and natural gas from predominantly U.S. onshore unconventional resources. Source: 10-K

NexTier Oilfield could also suffer from excess supply of equipment in the industry. If many actors in the oil and gas sector lower their activities, companies offering services may have too much equipment left. As a result, perhaps management may have to lower their prices, which would lead to a decrease in the free cash flow margins and the EBITDA:

This excess supply of equipment may result from many factors, including without limitation, a low commodity price environment, increase in the construction of new equipment, or reactivation and improvement of existing equipment. Excess capacity may result in substantial competition for a diminishing amount of demand and/or significant price competition, which could have a material adverse effect on our results of operations, financial condition and prospects. Source: 10-K

Finally, changes in environmental laws, labor laws, or any other regulations could affect the way NexTier Oilfield runs business. As a result, management may have to invest quite a bit to supervise its operations or even make changes in the equipment used. If the profitability declines, I would say that the demand for the stock may do so as well.

Our activities are subject to a wide range of national, state and local environmental, occupational health and safety laws and regulations. In addition, customers maintain their own compliance and reporting requirements. Failure to comply with these environmental, health and safety laws and regulations, or failure to comply with our customers’ compliance or reporting requirements, could tarnish our reputation for safety and quality and have a material adverse effect on our competitive position. Source: 10-K

In the worst case scenario, I assumed sales growth of -20% in 2024 and -5% in 2025. I also assumed a decline in the EBITDA margin from 21.9% in 2023 to 10% in 2025, 2026, and 2027. I believe that using a FCF/Sales margin around -10% and -5% in 2025, 2026, and 2027 could also happen. With these assumptions, I obtained an enterprise value close to $1.85 billion, equity value around $1.5 billion, and an equity per share of $6.5.

Arie’s DCF Model

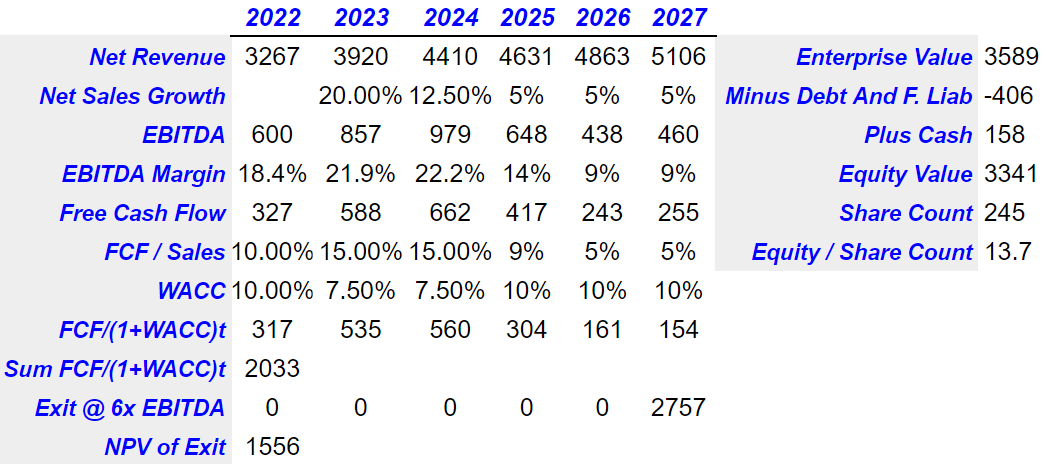

Best Case Scenario

Under my best case scenario, I assumed that NexTier Oilfield will successfully close new transactions, and the merger integration will be done successfully. In this regard, let’s note that the acquisition of other companies is included in the strategy of NexTier Oilfield. The company has signed large business combinations like that of C&J or Alamo.

Part of our strategy is to continue to expand our scope and customer relationships, increase our access to technology and to grow our business, which is dependent on our ability to make acquisitions that result in accretive revenues and earnings. Source: 10-K

Under this case scenario, I assumed net sales growth of 20% in 2023 and growth of 12.5% in 2024. With a FCF/Sales margin of 10% in 2022, 15% in 2023, and 15% in 2024, I obtained free cash flow close to $535 million in 2023 and $560 million in 2024. Summing everything up with a discount close to 10%-7.5%, I obtained a NPV of the exit of $1.5 billion and a total enterprise value of $3.5 billion. Finally, the equity value per share would stand at close to $13.7.

Arie’s DCF Model

Conclusion

NexTier Oilfield Solutions recently reported an impressive increase in its revenue guidance and EBITDA guidance. I believe that the creation of a sufficient number of new products and expansion of new relationships with new customers will likely drive the FCF/Sales margin north. Under a case scenario that includes successful closure of acquisitions and new transactions, my DCF model resulted in a valuation of $13.7, which is significantly higher than the current market price. Yes, there are certain risks from a decrease in demand for oil and gas services, too much supply of equipment, and concentration of clients. However, even considering the risks, the price is too low.

Be the first to comment