Spencer Platt

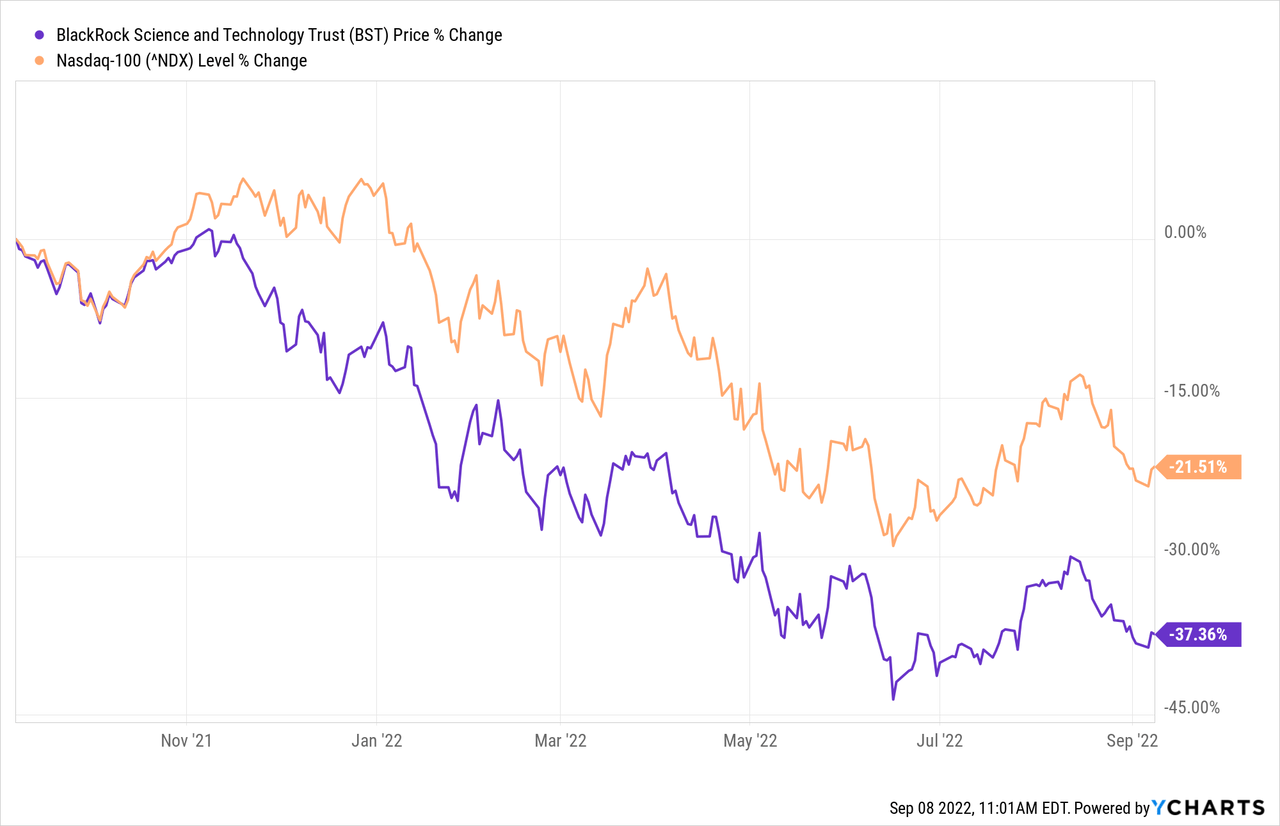

BlackRock Science and Technology Trust (NYSE:BST) has fallen significantly in 2022. While the fund has performed well historically, returning 14.25% p.a. since its inception in 2014, I do not see this historic success continuing for two main reasons.

- The Trust’s allocation leans relatively heavily towards financial technology and semiconductors, having significant positions in Visa (V), Mastercard (MA), Klarna (KLAR), ASML (ASML), Wolfspeed (WOLF), and Marvell (MRVL). Both industries have been hit hard recently for several reasons, but both are particularly threatened by a looming recession scenario and rising interest rates.

- Around 20% of the Trust’s NAV are preferred securities, mostly late-stage funding rounds. While not a threat in itself, the fact that 90% of these funding rounds occurred in late 2020 and 2021, the peak of venture capital funding, represents a threat to NAV in that valuations of privately-held companies have experienced down rounds recently as can be seen by the whopping 85% down round from Klarna. Further, picking up on the rising interest rates above, IPOs for many of these investments will be significantly delayed due to the current market environment.

For stated reasons and my belief that inflation and high-interest rates (4-5%) will likely stay for around two years, I give the Science and Technology theme fund of BlackRock a “Sell” Rating.

Overview

BlackRock Science and Technology Trust is a perpetual closed-end equity fund (‘CEF’), meaning that it raises capital once upon the initial public offering, and no new money will flow in, unlike for a mutual fund. The Trust will invest at least 80% of its total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range selected for their rapid and sustainable growth potential from the development, advancement, and use of science or technology.

Holdings

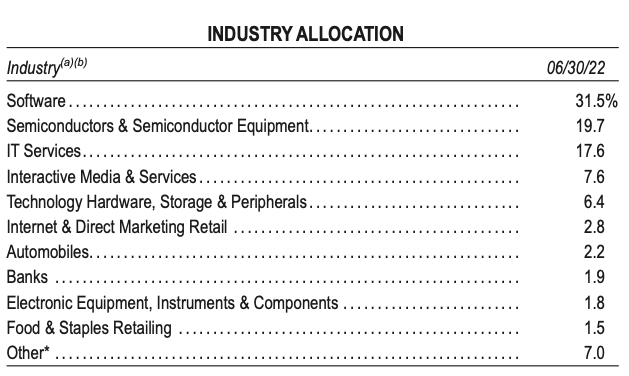

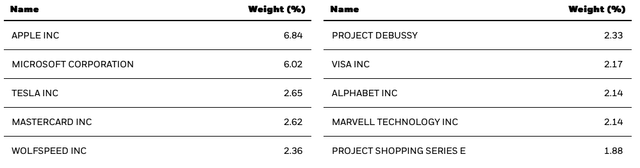

BST has a very technology-focused portfolio with 31.5% in Software, 19.7% in Semiconductors, and another 17.6% in I.T. Services. Together these three industries make up ~70% of the portfolio. The largest positions within the portfolio are Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA).

BST Industry Distribution (BlackRock Semi-Annual Report) Top 10 Holdings (BlackRock Factsheet)

NAV Premium/Discount

Open-ended funds can trade at a premium or discount to their net asset value (the underlying value of the stocks they invest in). Most CEFs trade at a discount, as underlined by a study conducted by BlackRock from Q2 2022, stating that the median discount amounts to ~7% over the last five years. While median discounts can be informative, it has been observed historically that CEFs trade at an individual premium/discount, meaning that CEFs trading at a 10% discount have historically remained around this threshold. CEFs do not always trade at par with their NAV and can be overall volatile, because of recent NAV performance, brand recognition, or changes in the attitude towards the investment theme. As of September 7th, BST trades at a 1.64% premium, which, given the reasons stated above, is a bit surprising as the discount tends to increase in a market downturn. While this has been the case for BST, with NAV down 33.99% and the market price down 40.01%, a slight premium persists. I think a discount will increase further throughout H2 2022, trending towards an at-par value relation to NAV.

Rising Interest Rates and Venture Investments

As mentioned in my thesis above, I expect interest rate hikes to continue for the foreseeable future and to remain at a level of ~4% for around two years. I do not claim to be a macroeconomic mastermind capable of forecasting when precisely the tipping point will be that rate hikes stop, since a plethora of factors influence this decision, among them the future development of the Russia-Ukraine war for energy prices as well as how supply chain constraints will continue to develop over the next 12 months. However, what can be said as of now is that rate hikes will continue in the U.S., and they have only just started in Europe, with the ECB announcing a 75 basis point rate hike just today. As is commonly known, this affects technology stocks the most as they have the highest growth estimates. While I am convinced that this has mostly been priced in for the common stocks the Trust holds, I do not think the same has happened to their venture investments just yet, with valuations potentially crumbling as was the case for Klarna, a whopping 2% of the portfolio, which had to suffer a down round of 85% and added liquidation preferences, favoring the most recent investor in case of bankruptcy. While evaluating each venture investment would not be feasible due to the unknown ticket size and stake, what can be said about their investments is that the tickets that were written mostly date to 2021 or late 2020, as stated in the semi-annual report. 2021 represents the peak of venture capital investing, with valuation having been at the highest they ever were. Private-market investments, unlike public market investments, are not continuously valued. As these ventures seek new funding due to the worsening IPO landscape, down rounds will most likely continue to occur, and with that, the value of BST’s investments will likely decline even further.

Conclusion

BST historically has shown superior performance in a market environment with near-0 interest rates. However, market conditions have worsened, putting the Trust under the gun, dropping 40% over the last year. I do not see a recovery for the underlying securities and find it more likely that NAV will fall further before a true bottom has been found. As mentioned a couple of times, the value of the Trust is significantly bound to future interest rate development and the fund’s ability to buffer the adverse effects with its options strategy.

Be the first to comment