Anton Opperman/iStock via Getty Images

Our most recent article on Sibanye (NYSE:SBSW) covered its latest lithium expansion. In this article, we elaborate on some of the greater idiosyncratic risks the company faces in an attempt to inform investors as in-depth as possible.

This piece isn’t based on price discovery or sentiment. Therefore, I strongly encourage you to use this information as part of your holistic analysis instead of considering it in isolation.

So, without further ado, let’s get into it!

Sibanye Is A Union Outlier

Many of you might be familiar with Sibanye’s recent union struggles, in which its goldmines were isolated for three months amid wage strikes. However, it’s necessary to understand unions in South Africa and Sibanye’s relationship with them.

Without signalling out individuals/specific unions, Sibanye’s principal-agent struggles are apparently far more prevalent than other miners in the jurisdiction. South African unions can be cut-throat when your employees are loyal to the cause, and Sibanye’s sitting with just that.

Since a change in management in 2020, the company’s struggled with ongoing union issues pertaining to its PGM (platinum group metals) and gold operations. In addition, the company’s exposure to the Marikana mine leaves it in the firing line. The Marikana mine has been subject to controversy since the massacres of protestors in the 1990s and again in 2012. Social activists somehow hold Sibanye accountable for most of the controversy surrounding the Marikana mine, and the general atmosphere is gloomy. Has this filtered into its own labour force? I can’t say for certain, but I won’t be surprised.

Illegal Miners’ Target

Another big issue is the illegal mining ‘industry’ in South Africa. Illegal mining of precious metals is getting out of control in the nation, and based on the velocity of operations; these guys probably have some serious backers.

It’s relatively public knowledge that Sibanye recently had a few of its workers held hostage over two nights in its K3 shaft in Rustenburg by illegal miners. In addition, earlier this week, the company had to close its Soweto gold mining operations due to 100 illegal miners attacking the workspace.

I’m rather familiar with the local mining landscape, and it’s apparent that Sibanye’s the main target in the illegal mining space and among the unions. In fact, it’s believed that the two might be intertwined.

To paraphrase the recent concerns, below is a recent quote [regarding illegal mining & political climate] by Sibanye’s James Wellsted, published by Miningmx.

Sub-par Management

An additional issue that’s occurred from Sibanye’s side is its slightly lax management. We’re not only seeing this with its handling of the labor unions, but also in its corporate finance department, as the collapsed $1.2 billion acquisition deal with Appian Capital Advisory says a lot.

Sibanye and Appian were about to close a deal for the takeover of two of Appian’s mining companies, Atlantic Nickel and Mineracao Vale Verde. However, at the last moment, Sibanye pulled out of the deal, citing capital structure concerns. I mean, isn’t capital structure something you’re supposed to weigh up before making an official bid?

Additionally, Sibanye’s being drawn into a litigation fight with Appian Capital Advisory because of the debacle, which could end up costly to the mining house’s investors. All of this seems unnecessary, and questions about the firm’s top-level management must be asked.

Is The Risk Priced?

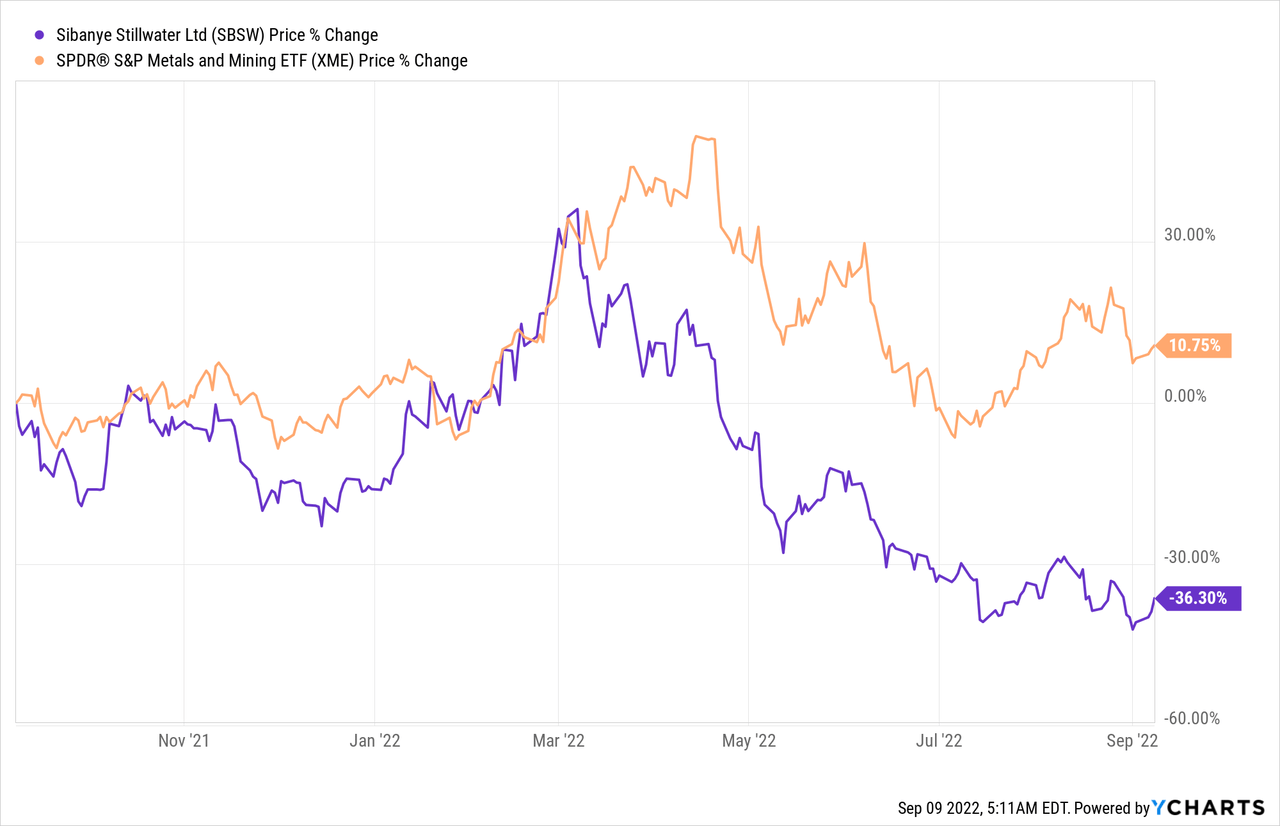

Based on Sibanye’s recent stock performance versus its peers, it seems as though Sibanye’s idiosyncratic risks over the past year, including labor issues, the Appian deal, and its PGM delays in the U.S. has been priced.

It needs to be considered that the company still pays a magnificent dividend and that it has a lot of latitude in the mining space with its 5-year EBITDA CAGR of 47.52%, conveying its cost advantages.

Thus, I’d say it’s for you as an investor to decide whether you think the firm’s idiosyncrasies will fade or not. In my opinion, it’s tough to tell; however, we’re giving Sibanye the benefit of the doubt until year-end.

Final Word

An in-depth look tells us that Sibanye’s struggling with management issues as the firm’s ongoing labor union fights, illegal miner clashes, and indecisiveness in its M&A department has led to a whirlwind of idiosyncratic problems.

As shareholders, we won’t be reactive for the time being and have decided to hold our long-term position in Sibanye until further notice. However, we no longer see it as a “best-in-class” mining stock.

Be the first to comment