Justin Sullivan

Investment thesis

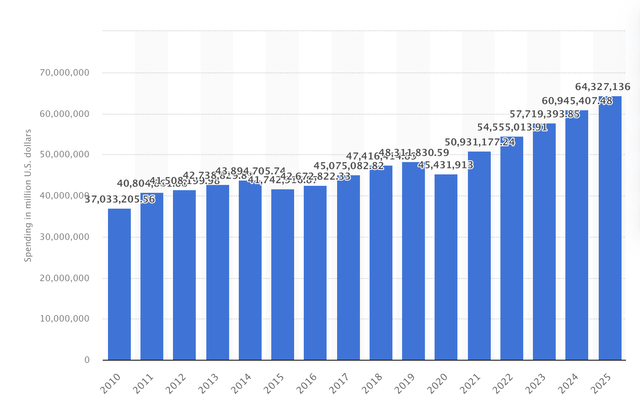

With total consumer spending reaching almost $51 trillion and expected to keep growing over the next couple of years to over $64 trillion by 2025, we could comfortably state this is a massive industry. Some companies established themselves as the true leaders within this industry. There is even political action to make the space (credit cards) more competitive and easier to enter for newcomers. Credit cards and debit cards are the most used form of digital payment (57% in the U.S.) and are replacing the use of cash (25% in the U.S.). Other fast-growing ways of payment are fully digital by the likes of FinTech companies, thanks to the growth of e-commerce (remaining 17%). It is important to know that paying with, for example, Apple pay, is still using your credit/debit card. Adoption of mobile wallets rose to a historic high in of 46% in 2020.

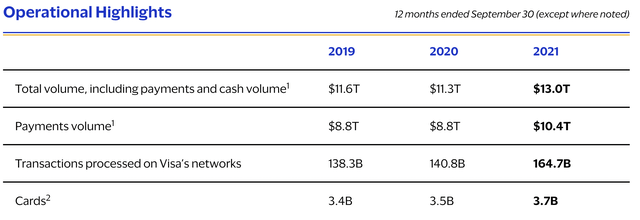

The industry is practically a duopoly. One of the two dominant players in this space is Visa Inc (NYSE:V). Visa processed a total of 164.8 billion transactions during 2021, with a total payment volume of $10.4 trillion. I believe the incredibly strong moat of Visa within the payment processing industry will support its growth over the coming years. With total transactions expected to grow and Visa exploring possibilities in other spaces while gaining market share, growth seems certain. I believe the transition from cash to digital payments is a huge tailwind for Visa. Its strong moat and position make it a value play in a fast-growing industry.

Visa is part of my 28-stock personal portfolio. In this article, I will show you why I own Visa, and why I recently bought more of the stock.

Visa Inc.

Visa is an American company operating in the financial services industry. The company is headquartered in San Francisco, California. Visa facilitates electronic funds transfers all over the world, primarily through Visa-branded credit cards and debit cards.

Visa was founded in 1958 by Bank of America (BAC). It was launched as the first consumer credit card program in the U.S. In 1974 the company expanded internationally and in 2007 the company we know now as Visa Inc. was formed. Nowadays, Visa operates in more than 200 countries and territories worldwide. Visa is being used and accepted by 14,900 financial institutions and has 3.9 billion credit cards, debit cards, and prepaid cards working worldwide. That means that on average about half the population has a Visa-branded card, which is just an insane moat. As mentioned before, Visa processed a total of 164.8 billion transactions in 2021 with a total payment volume of $10.4 trillion. It will be no surprise that, according to Kantar Branz, Visa is ranked 7th in global brand value with a brand worth of $191 billion. Visa has a market cap of $384 billion and has a total of 123,500 employees working in 123 locations around the world.

So, what does Visa exactly do?

Visa offers a comprehensive set of payment products and services. Visa-branded credit, debit, commercial, prepaid, mobile, and money transfer products are a leading choice of cardholders and financial institutions in 200 countries and territories. VisaNet also makes it possible for us to deliver the latest innovations for an increasingly mobile society, providing consumers with mobile financial services, such as mobile payments, money transfer and top-up services.

In simple words, this means Visa is the middleman between financial institutions and merchants. Visa earns its money by keeping a percentage of the payment amount from the merchant in exchange for using Visa’s broad international payment network. But why would you, as a merchant, choose to support a payment system which takes such a large percentage of your sales transactions? Well, merchants don’t really have a choice. It is a vicious cycle that supports the great moat for Visa.

As I mentioned before, a lot of financial institutions use Visa’s payment network and use their credit cards, because it has a strong proven track record. If you were a merchant and you would not support Visa payments, you would lose your customers because all those billions of Visa cards would not be able to be used in your store and therefore people would go to the competition where they can pay with their Visa card. Merchants are forced to support Visa cards to not lose traffic in their stores. A lot of merchants support Visa, and that gives financial institutions another reason to make use of Visa.

Visa also offers additional services, which brings me to the next subject. Visa works and reports in 4 different segments.

- Service Revenue: This segment mainly consists of the revenue it earned from providing services to support client usage of Visa’s payment services. This segment provides about 34% of the total gross revenue for the company.

- Data Processing Revenue: data processing revenue includes revenue generated as a result of the company’s clearing, settlement, authorization, value-added, network access, and other similar services. This segment accounts for approximately 38% of total gross revenue.

- International Transaction Revenue: International transactions are the best transactions for Visa because these carry the highest profit margin. It is exactly this segment that took a big hit during 2020 and the covid induced lockdowns. Revenue from this segment dropped by 50%. This segment accounted for about 23% of revenue and is recovering rapidly from covid.

- Other revenue: Visa earns additional revenue from license fees, value-added services, and more. These are grouped together as other and account for about 5% of Visa revenues.

Besides growing its total processed transactions and volume every year (except for 2020) Visa is also investing heavily in new growth areas. During Q1 of this year, Visa announced that it had acquired Tink. Tink is an open banking platform that enables banks, FinTech companies, and startups to develop data-driven financial services. Visa paid €1.8 billion for Tink.

Of course, it is also important to note that Visa was one of the first companies which suspended all operations in Russia in response to the invasion of Ukraine.

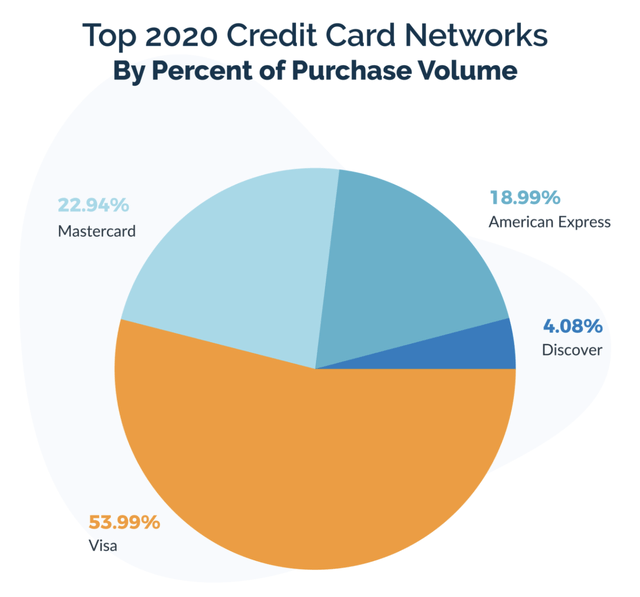

Visa’s credit network is its biggest business and strongest moat of all. In 2020 Visa was the largest credit card network by a far margin. The company had a market share of 53.99% and was therefore bigger than its main rival Mastercard Incorporated (MA).

Credit card market share (UpgradePoints)

Financial results

2021 was all about recovery for Visa. We do have to say that Visa did not drop a lot in revenue during 2020, dominated by lockdowns and covid. This is mainly because digital transactions got a huge boost thanks to a rising e-commerce market and people turning away from cash for hygiene reasons. Still, Visa did see a loss of growth during the year, mainly because people did undertake fewer activities and stopped traveling. This was a huge hit for Visa’s cross-border transaction numbers. During 2021, Visa grew its net revenues to $24.1 billion and GAAP net income of $12.3 billion. Yes, Visa has incredible margins. These numbers are up 10% and 13% YoY, respectively. Total payments volume bounced back by 18% to $10.4 trillion. Also, Visa returned $11.5 billion back to its shareholders in the form of dividends and share buybacks.

2021 was a strong year for Visa, and the company returned to its solid growth. You can see above; I mention net revenues. This is an important metric since Visa actually earned $32.5 billion from its services but needs to pay financial institution clients and strategic partners to grow payment volume and increase Visa acceptance. In 2021, Visa spend $8.4 billion on these client incentives.

Now, we fast forward to July 26th, when Visa reported its third quarter 2022 results. This quarter was dominated by high inflation, rising interest rates, and fears of a recession. Yet Visa did not see any impact on its business. Visa even saw an acceleration compared to 2021. Visa reported net revenues of $7.3 billion, showing 19% growth YoY. GAAP net income grew even faster, with 32% growth YoY and coming in at $3.4 billion. EPS rose by 33% to $1.98 per share. The main drivers for this growth were cross-border volume and processed transaction growth. With traveling bouncing back this year, it is no surprise that cross-border volume was a growth driver and a strong tailwind for margins.

Total payment volume grew by 12% and total cross-border volume grew by 40%. Total transactions increased 16% YoY.

Visa reported a free cash flow of $5 billion for the quarter and a total of $12.3 billion so far this year. The company returned over $3 billion to its shareholders in 3Q22 and $11,86 billion so far this year. This means Visa was able to fund its dividends and share buybacks by using its free cash flow generated this year. This shows dividends and share repurchases are well covered. This is what management had to say:

Against the backdrop of macroeconomic uncertainty, significant exchange rate headwinds and the suspension of our business in Russia, Visa had a very strong quarter, with net revenues up 19%, GAAP EPS up 36% and non-GAAP EPS up 33%. Sustained levels of growth in overall payments volume, cross-border volume and processed transactions demonstrated the resiliency of our business model. Consumers are back on the road, visiting various corners of the world, resulting in cross-border travel volume surpassing 2019 levels for the first time since the pandemic began in early 2020. While the economic outlook is unclear, we remain confident in our ability to execute with discipline and expand Visa’s role at the center of money movement.

Visa had a very strong first half of 2022 with growth accelerating despite all the economic headwinds for the company. With total travel numbers not yet back to 2019 levels, there is still some potential upside to cross-border volume and so an increase in margins for Visa over the next couple of quarters would be no surprise. We do have to take into consideration that FX headwinds and less consumer spending might also become a drag on the company’s results. For now, Visa looks very strong and well-positioned.

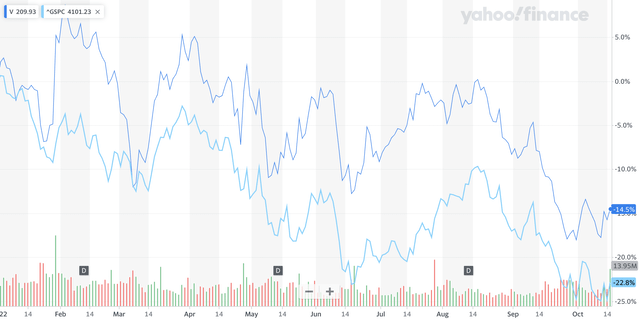

But despite the strong results for Visa so far this year, the stock price is still down by 14.5%. This drop in share price and growing financials, result in a lower valuation for Visa. Visa did still show its maturity and strong position by outperforming the S&P 500 YTD, which is down 22.8%.

YTD performance Visa vs S&P 500 (Yahoo Finance)

Balance sheet and valuation

Visa has a strong balance sheet with a lot of cash. The company has a total of $17.36 billion in cash and $23.79 billion in debt. This debt is well covered by its strong cash position and high margins in its business providing it with plenty of free cash flow. The valuation had always been more of a difficult point for Visa. Because it is a huge international firm with a strong moat, it deserves a higher valuation. Combining this with strong growth over the last few years and the valuation tends to go pretty high. The average forward P/E for Visa over the last 5 years was 32.22. The company is currently valued at a forward P/E of 24.91, which is almost 23% below its 5-year average. For valuation, Visa gets an F from Seeking Alpha Quant, but I think Visa is cheaply valued right now compared to its historical averages and strong, steady growth. The strong moat makes the company a safe high growing investment, worthy of a high valuation. I get that an economic slowdown is being priced in, but I think it dropped too much by now.

Visa also pays a nice dividend. The dividend yield is not very high at 0.81%, but dividend growth is excellent. The company has been growing its dividend by over 20% on average over the last 10 years. Over the last 5 years, Visa increased its dividend by an average of 17.84% and therefore receives an A+ from Seeking Alpha Quant. As mentioned before, the dividend is also very safe and fully covered by the company’s free cash flow (even including share repurchases). The payout ratio stands at 19.33% which also indicates a well-covered dividend for Visa, which can see plenty of growth in the future. Visa has been paying a dividend for 13 years now and increased it every single year.

Risks

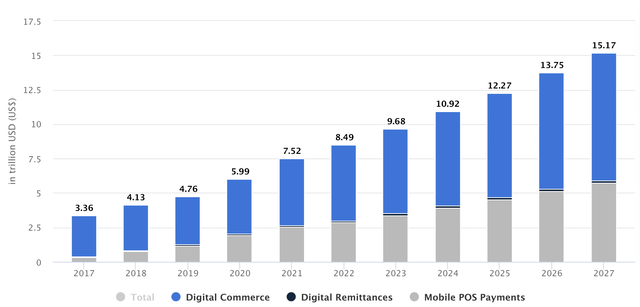

Despite its strong moat and great financials, Visa is not without any risk. The main risk for any company right now is a potential recession. Extreme inflation, high energy prices, a war in Ukraine, a trade war with China, and rising interest rates are all factors pushing down on the economy. Despite what everyone thinks they know; nobody exactly knows what’s going to happen over the next few quarters. Nowadays everybody in the comments and on the news seems to know exactly when the market is bottoming and where stocks are heading. I for one, do not know. The reality is that a potential recession is a threat to the business of Visa. During a recession, we will see less consumer spending (as we are already seeing). For a company earning its money through people spending it, less spending is obviously a strong headwind. For that reason, a slowdown in growth or even negative growth for a few quarters would be possible. Yet, I do not see this happening because of the strong tailwinds for the industry. I believe the shift towards digital, away from cash, is far from over as digital payments are still on the rise.

Digital payments growth (Statista)

I believe digital payments growth combined with a stronger share of cross-border transactions will neutralize the possibility of less consumer spending and so I believe Visa will be able to keep growing even under recessionary circumstances. Rate hikes and inflation are no threat to Visa and the loss of the Russian business accounted for less than a 1% loss. I do think Visa’s growth will slow down in the case of a recession, but I do think Visa will continue growing at a slower pace.

Bigger risks for Visa are competition and political pressure. Most recently, on July 28th, two U.S. senators introduced the Credit Card Competition Act of 2022. Two months later, earlier this month, the bill was introduced as a proposed amendment to the NDAA, but this ultimately didn’t make it into the draft of the bill. The bill was supposed to increase competition in the credit card industry with the hope of fees being lowered by the major players. These are the earlier fees discussed from which Visa makes most of its money. This bill would require banks issuing these credit cards to offer a minimum of two different credit cards, with only one being allowed to be Mastercard or Visa to also stimulate smaller player entries. The bill was supposed to bring down swipe fees for merchants and increase competition with the entries of smaller players. But as I said, the bill didn’t make it. It does show the political attention for the business of Visa. A total of $137 billion is yearly billed in swipe fees. This indirectly increases prices in stores because merchants must pass these costs on to their customers. It is therefore no surprise that there is political attention for this (with current extreme inflation). This is just one example of a lot of actions by governments to limit the power of Visa and Mastercard. Therefore, I see this as a significant risk for the business of Visa. If a bill such as the one mentioned above would be accepted, then this could have a significant impact on the dominance of Visa over the long term.

Another risk for Visa is competition from FinTech companies. Nowadays there is an increasing amount of FinTech startups diving into the profitable payments sector. These companies pose a threat to Visa by offering cheaper, faster, and better solutions than the use of credit and debit cards. Examples are Block (SQ) (Square) and PayPal (PYPL). These companies offer newer and more innovative solutions.

Visa will have to stay on top of current trends and keep innovating its business. M&A could be a crucial part of this, and Visa does have the cash for it. Do not get me wrong here, right now these companies are no direct threat to the business of Visa. The global moat of Visa is just too strong and merchants and financial institutions rely too much on Visa for now. Credit and debit cards are not wiped out in a few years, but I do see a future without any cards and that is something Visa will need to start thinking about.

Conclusion

I expect Visa to keep doing what they are doing because they are doing a great job. Visa is the biggest financial services company in the world and will remain the biggest for the foreseeable future. Analysts do expect revenue to slow down from over 20% to low double digits in 2023 and 2024. Yet, they believe, just like me, that growth will remain strong even if the economy might not be as strong. I do expect expectations to come down, mainly for 2023, to high single digits growth and then pick up the pace again in 2024. Visa’s valuation has already come down and so I believe a slowdown has already been priced in. Visa growing low double digits should be worth a P/E of 25 at the minimum.

Visa will remain a crucial part of the global economy and will take advantage of the growing global trend from cash to digital payments and GDP growth. We do have to keep an eye out for competition and Visa’s market share. I hope management will come up with a solid plan in time, to support growth vs these FinTech firms. Another thing to watch for is legislation and regulators targeting Visa’s dominance. It is no surprise that Visa has a target on its back, but I do not see any threatening regulations coming through any time soon. It is something to keep a very close eye on since it could oppose a serious threat to profitability over the long term.

I rate Visa a buy on strong growth, a fair valuation, and strong business fundamentals. The recent downturn in the stock provides a good buying opportunity.

Be the first to comment