Justin Sullivan/Getty Images News

Walgreens Boots Alliance (NASDAQ:WBA) is a historically strong performer that has underperformed recently. WBA is currently reliant on the pharmacy segment as their primary revenue stream which is aligned for disruption by the current competitive landscape. WBA management appears to be leading well and is properly aligned to augment WBA. The future strategic goals of WBA may provide a new growth segment that could boost value substantially over the long-term. WBA is currently valued at $36.93 according to my assumptions using a multi-stage weighted dividend discount model (DDM). An entrance position may be available given the current momentum of WBA through the selling of put options.

Analysis Process

When attempting to analyze WBA, I focused my research on understanding the following questions to develop my assumptions for valuation:

- What is the current competitive landscape?

- How has WBA historically performed and the effect today?

- What are the future movements for WBA and is the management aligned properly?

I utilize the results of those questions to synthesize three potential scenarios for valuation. Then I corroborate that with the SA Quant Ratings and summarize on potential risks. I then discuss a strategy for establishing an initial position for the valuation price utilizing the selling of put options.

Competitive Landscape

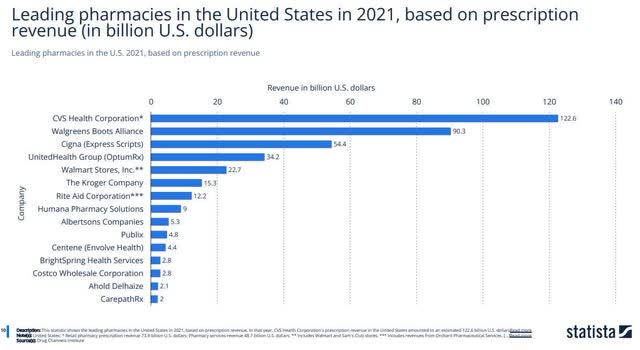

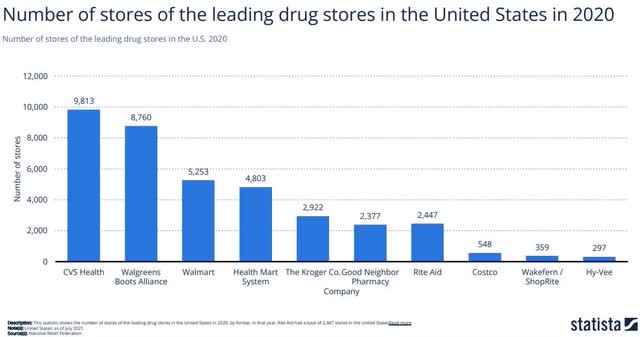

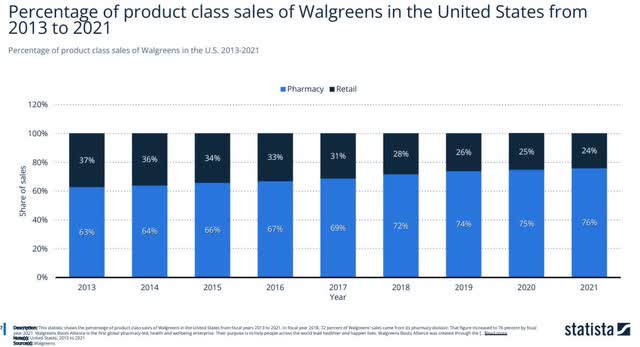

Walgreens Boots Alliance competes in the Pharmacies and Drug Stores Industry (NAICS 44611). Their primary revenue segments are in the United States and were divided into pharmacy (75.8%) and retail sales (24.2%) for FY 2021. This competitive environment has multiple layers of strategic groups in it, many of which augment their primary businesses with pharmacies. WBA competes against other large firms such as CVS pharmacy (CVS), Walmart (WMT), Kroger (KR), and Cigna (CI). Many of the competitors control large market shares of the prescription drug market (Figures 1 & 2). This excludes the online pharmacy market that has been growing with competitors like Amazon and other startups aggressively entering the market space.

WBA was the second leading pharmacy based on prescription revenue in 2021 with $90.3 billion dollars while CVS was the dominant player with $122.6 billion in revenue (Figure 1). WBA has the second largest U.S. footprint of drug store locations (8,760) in 2020 (Figure 2).

Figure 1. Leading pharmacies in the United States in 2021, based on prescription revenue (Statista) Figure 2. Number of stores inn U.S 2020 (Statista)

The U.S. pharmacy market was sized at approximately $560 billion in 2021 and is expected to grow at a CAGR of 6.3% into 2028 with a potential size of $861.67 billion. Some of the key drivers for the increased projected demand are disease prevalence, aging population, and increasing healthcare expenditures. The United States has had an overall increase in healthcare patient volume which naturally correlates with a higher prescription volume. These growth prospects moving forward lead to a more competitive landscape. WBA’s 2021 Annual Report offers insightful information into the risk and competitiveness of their industry.

Risk of new entrants

The risk of new entrants is high in the current retail-pharmacy industries. This is due to other well financed firms that can leverage their pre-existing business models to synergistically enter the market. New entrants may have this capability due to their current logistical capabilities and extensive capital. There are minimal switching costs for consumers who can change provider with fluidity. There is government regulation that might disincentivize new entrants since the laws on pricing could limit potential margins. New entrants could create price wars that damage the already tight margins without a considerable reapproach to cost cutting techniques and technology. A second layer of online pharmacy competition could decrease the retail-pharmacy market size. WBA is at a high risk for new entrants placing competitive pressures on their market share. Fortunately, WBA has a scale economy, has innovative strategies, and has large market share to help combat these threats.

Power of suppliers

The power of suppliers in the pharmacy industry is insubstantial. Large firms can backwards integrate into generic production and only the patent protected products have any negotiating leverage. There are also national and international suppliers which places pressure on the suppliers to be more amiable. WBA is at a low risk from supplier power.

Power of buyers

WBA sells to numerous wholesalers and retail customers. No single customer accounted for more than 10% of WBA sales. Most sales are covered by third-party payers like insurance companies and government agencies. This is a double-edged sword in the sense that it potentially gives the primary third-party payers leverage but the retail customers are generally indifferent since they are usually not covering the costs. WBA is at a low risk from buyer power.

Current competitors’ intensity

The retail pharmacy industry is highly competitive as represented above (Figures 1, 2). The industry growth is anticipated at a growth of 6.3% and the online pharmacy market is expected to expand rapidly which relieves some pressure on the current competitive environment to share a larger pie. The strongest competitors have different ways of offsetting their fixed costs which also helps ease the competitive pressure. There are many large companies with a large percentage of market share which intensifies the competitive effect since they are so reliant on those revenue streams. The online pharmacy is still a relatively new concept but will continue to gain momentum and increase competitive intensity into the future. WBA is at a high risk from competitive intensity.

Risk of substitutes

Pharmaceutical products are generally at a low risk for substitutes. The risk of substitute products is predominantly between “brand” name and “generic” when it comes to pharmaceutical products. For intermediate firms like WBA, the generic version of a drug has higher margins while bringing in lower revenue dollars.

Historical Performance

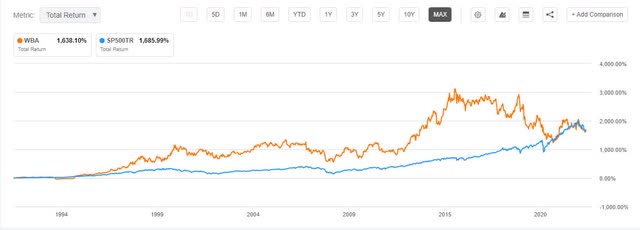

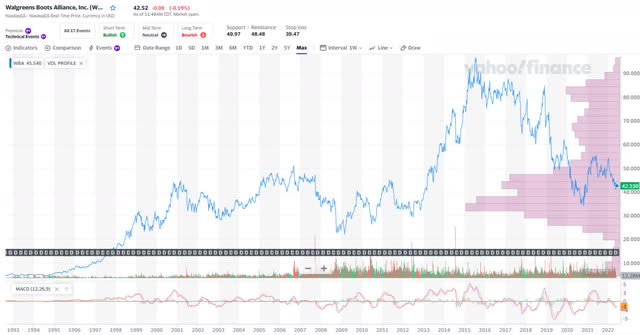

Walgreens has a strong history of performance. They outperformed the S&P 500 from approximately 1995 to 2020 (Figure 3). However, since the S&P 500 throttled positively the past two years coinciding with WBA’s serious underperformance, they have now approximately equalized their return over the shown period.

Figure 3. Total Returns vs. S&P 500 (TIKR Terminal)

WBA had a large increase in total liabilities in 2015 and the D/E ratio has shown an increase since (Figure 4). This may represent how management used capital structure and leverage to elevate the stock price over the same period. This may have helped WBA outperform over a short time period, but it has placed long term debt concerns that are effecting present day, the companies decisions, and performance currently. WBA currently has a Moody’s long term debt rating of Baa2 and a negative outlook along with a Standard & Poor’s rating of BBB and a stable outlook. As of March 30, 2022, these ratings place WBA in the domain of medium risk and investment grade.

Figure 4. Equity & liabilities (TIKR Terminal)

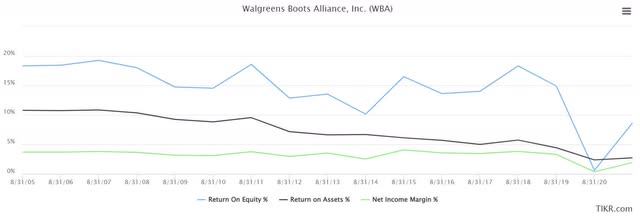

With the changes to capital structure augmented with the increase in annual revenues and consistent net income margins, the ROE stayed well above 10% until 2019 (Figure 5). The ROA has been consistently declining over the same period.

Figure 5. ROE, ROA, NI margin (TIKR Terminal)

WBA historically splits its U.S. revenue streams between two primary product classes (pharmacy and retail). WBA dependence on their pharmacy segment has been growing from 2013 to 2021 from 63% to 76% of total revenue in the U.S. (Figure 6). This trend shows a deepening entrenchment into a very competitive industry.

Figure 6. Segment revenue (Statista)

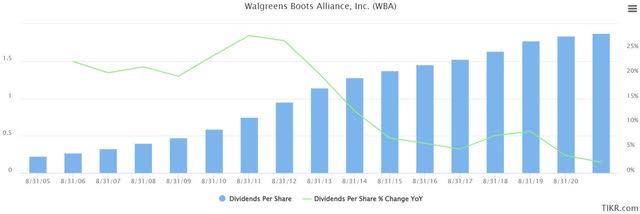

WBA has been providing a dividend to its shareholders for 45 years. The dividend growth has maintained an exceptional CAGR of 7.81% and 4.95% for the past 10 and 5 years respectively (Figure 7). WBA currently has a yield (TTM) of 4.43% which is higher than it’s 4-year average yield of 3.56%. The dividend growth rate has greatly reduced since the 2005-2012 period.

Figure 7. Dividend history and growth (TIKR Terminal)

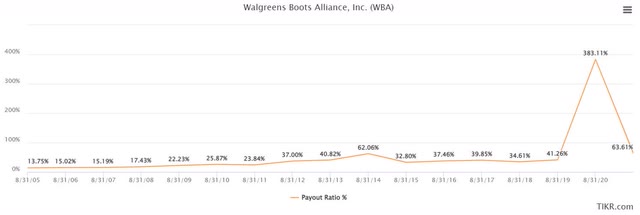

The payout ratio typically trends around 30-40% implying the dividend is usually well covered and has ample room for growth (Figure 8). The dividend aspect is appetizing for many investors and WBA has historically been a strong contender augmenting dividend focused portfolios.

Figure 8. Payout ratio (TIKR Terminal)

WBA has historically been a strong performer augmented by their dividend and growth. The past 3 years show a steep decline in the effectiveness of the firm. They have potentially over-leveraged themselves, entrenched deeper into a competitive market that is prime for disruption, and their profitability metrics are less than ideal. My perspective shows a firm that has deteriorated from their prime and needs new life to reinvigorate themselves or they may continue to deteriorate or stagnate for a prolonged period of time.

Future Direction

WBA is making big strategic shifts moving into the future and developing a healthcare segment. In their quarterly report ending 28 February 2022, they expressed large movement into their ambitious future direction. WBA is becoming a more comprehensive care center for consumers and have been positioning themselves accordingly. The plan is to become a “leading provider of local clinical care services by leveraging its consumer-centric technology and pharmacy network to deliver value-based care.” WBA is focusing on improving care, consumer health, and lowering their costs.

WBA created a new segment in fiscal year 2022 known as Walgreens Health. Walgreens Health “is a technology-enabled care model powered by a nationally scaled, locally delivered healthcare platform.” Walgreens Heath will integrate the WBA global scale with multiple health care capabilities and accelerate WBA into more than just a pharmacy with a retail component. The purpose of Walgreens Health is to improve health related outcomes and make healthcare more affordable and accessible at a more localized community level.

The Walgreens Health initiative has great potential. WBA as of August 2021 has access to approximately 78% of the U.S population within a 5-mile radius of any given WBA location and is positioned well to integrate healthcare into local communities. WBA has bought majority investments in Village Practice Management Company (VillageMD), Shields Health Solutions (Shields), and CareCentrix along with other investments to help actualize their future direction.

VillageMD is “a leading, national provider of value-based primary care services.” Shields provides innovative health care models and technology to elevate health system performance. CareCentrix is a leading independent home-centered platform that focuses on consumer outcomes. WBA plans to have 600 in-store VillageMD clinics by 2025 and 1,000 by 2027 with a focus on underserved communities. WBA anticipates this transition to stagnate growth until 2024 due to the large investments and debt that is required to reposition themselves. The management team forecasts the revenue growth to be in the 11-13% range after the transition which could be reinvigorating.

The success of this transition will dictate the longevity of WBA as a powerhouse company. The competitive landscape is to aggressive for WBA not to be proactive. They will either successfully adapt and accelerate into their new strategy, or they will fail to execute while their market shares get chiseled away. I do believe that WBA has the capability to execute on their future plans.

Leadership

WBA has a very broad and diverse leadership team that brings experience from multiple industries and walks of life. Multiple sitting Directors have elaborate experience in the healthcare industry as directors, executives, educators, and practitioners. The senior management has exceptional operational experience and provide a strong breadth of knowledge for WBA moving forward. While the Board and Executive team are all important members for the future of WBA. The CEO Rosalind Brewer joined WBA in March of 2021 and has built her capability from multiple roles at dominant companies throughout her career including Kimberly Clark (KMB), Walmart, and Starbucks (SBUX). Ms. Brewer ranks as one of the top most influential and powerful women in business, and having her leading the ship is very affirming.

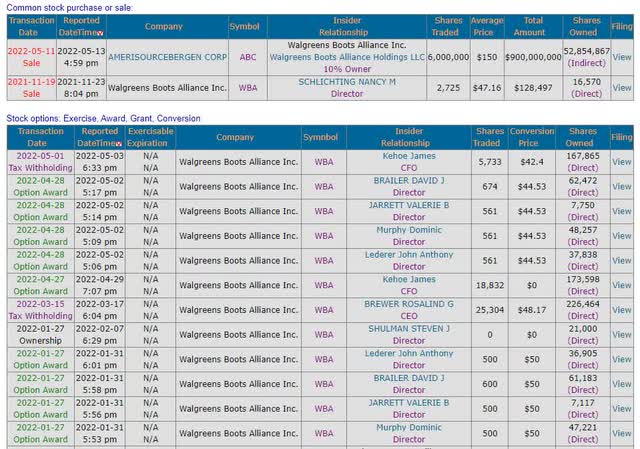

Insider Trading

The insiders at WBA do not seem to sell their holdings often which is insightful into the behaviors and perception of company leadership. WBA sold $900,000,000 worth of Amerisourcebergen (ABC) shares on May 11, 2022 (Figure 9). The public release from WBA states that the proceeds will be used “primarily for debt paydown and the continued support of its strategic priorities.” A director also sold 2,725 shares in November of 2021 at a price of $47.16 per share. I theorize that the management team thinks the stock price is currently undervalued and that they are considering the future of WBA safe enough to hold a portion of their wealth.

Figure 9. Insider trading (SecForm4)

Valuation

Assumptions

WBA has a strong opportunity to capitalize in the future. I do weigh the strategic shift favorably considering the recent historical performance and pressure from the current competitive environment.

I will utilize a multi-stage DDM because WBA has a historical performance of consistent dividends. A DDM allows for simpler estimations and a better integrated margin of safety since they have established consistency as their reputation.

The discount rate will be 9% for the model which is the current cost of equity (8.4%) augmented with a margin of safety. I will also assume the payout ratio remains constant. WBA has a strong history of dividends and will likely not cut their dividend unless there is an emergent situation requiring it. Their payout ratio is currently 33% and has room to safely increase at the current operating performance of the firm.

I will assume establishing a position before the August dividend. August is also typically the timeframe that WBA increases their dividend.

We will assume that the dividend growth rate will match the revenue growth rate of the firm. This does not factor in a variety of other estimate inputs like margin variance, share repurchases, etc. The assumption is the growth of the company will remain constant along with the payout ratio. Seeking Alpha consensus dividend estimates for 2023 show a growth rate of approximately 2.6%. This will be the initial growth rate inputted into the model until 2024 when WBA will begin to actualize their new strategy and increase their growth rate.

The three scenarios are as follows:

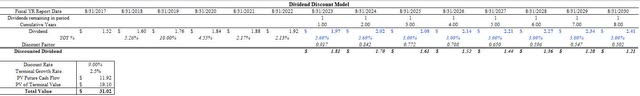

Scenario 1: WBA has a 2.6% growth rate until 2024. They can’t capitalize on their new competitive edge and growth remains slow. In this situation, the growth stabilizes at the long-term growth rate of a mature business of 3% over the short term and 2.5% in perpetuity. This scenario will be weighted as a 30% likelihood (Figure 10).

Figure 10. Dividend discount model scenario 1 (Author)

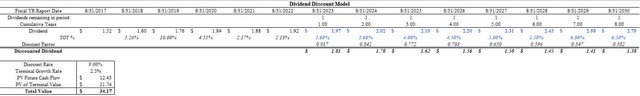

Scenario 2: WBA has a 2.6% growth rate until 2024. Walgreens Health gains momentum and becomes a profitable segment for the firm. The growth rate in the mid-term gains is positive but not at the expectation put forth by management. Since there is likely an experience curve and a heavy competitive environment to incorporate, 2025-2030 will show a 4% growth and increase by 0.5% until 2030 where the perpetuity value will be at 2.5%. This scenario will be weighted as a 40% likelihood (Figure 11).

Figure 11. Dividend discount model scenario 2 (Author)

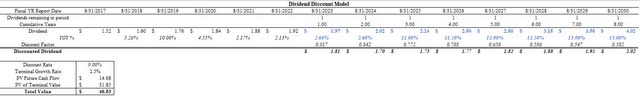

Scenario 3: WBA has a 2.6% growth rate until 2024. Walgreens Health moves strongly in line with the management team’s expectation of growth of 11% in 2025 to 13% in 2030. The business will grow in perpetuity at 2.5% afterward. This scenario will be weighted as a 30% likelihood (Figure 12).

Figure 12. Dividend discount model scenario 3 (Author)

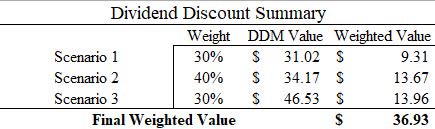

WBA is currently valued as a weighted average of the three scenarios presented. The purchase price goal is $36.93 which is about 10-15% lower than the current trading price (Figure 13). This valuation along with the current price signify a “hold” rating from my perspective. The assumptions were made off of my personal synthesizing of information, risk tolerance, and the valuation which is highly subject to input variables. This valuation may present as an opportunity in the near future since the stock price has had negative momentum over the short term. I theorize this momentum may create an entrance price for a long-term value play.

Figure 13. Dividend discount model summary (Author)

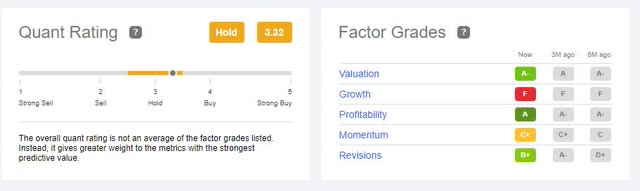

The current Quant Rating from seeking alpha also has WBA currently rated as a “Hold” with a rating of 3.3/5 (Figure 14). The analysts are estimating poor growth into mid 2023 meaning WBA may continue to trend downwards in stock price. WBA has had a poor momentum trend having dropped more than the sector median and the S&P 500 overall. The moving averages are trending downward with the 10-day ($43.12) < 50-day ($43.93) < 100-day ($46.22) < 200-day ($47.67), as of this writing.

Figure 14. Quant Rating (Seeking Alpha)

Risks

There are many potential risks associated with the WBA. Their primary pharmacy revenue segment is in a highly competitive industry that is susceptible to changes. WBA stock price recently has had negative momentum which could aggressively continue downwards over the short term. The current macro-environment may also create systematic risk through factors such as inflation, interest rates, and supply chain concerns. WBA has a large debt position that does have some exposure to variable interest rates. WBA might also fail in the future to execute on their Walgreens Health segment which has large opportunity costs and capital investments.

Potential Entrance Positions

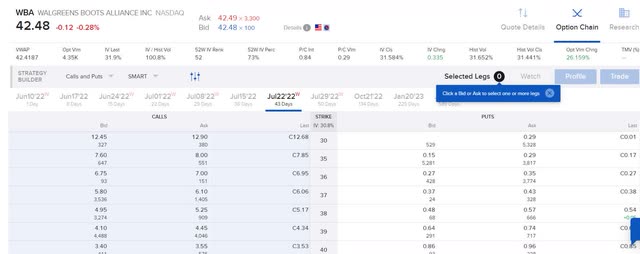

WBA is trading within a 10-15% range of my desired entrance price of approximately $37. There is a large volume of purchases in the $34 to $38 range, according to the volume profile on Yahoo Finance (Figure 15). WBA over the long term has not traded near these lows since 2020 and prior to that 2014. I speculate WBA may continue to approach these levels and may provide an entrance opportunity. We can utilize the selling of put options to collect a premium while we wait for our goal price to be achieved. As of the writing of this article, the $37 strike for 43 DTE on July 22, 2022, has a bid and ask price of $0.37 and $0.43 (Figure 16). This means that a mid price of $0.40 would create an annualized return of (365/43) * [($0.40*100)/$3,700] * 100 = 9.18%. It would create an acceptable return to allocate collateral of $3700 selling a put position with a premium (9.18% annualized) while patiently observing the price action.

Figure 15. Long-term price action (Yahoo Finance)

Figure 16. Selling puts 43 DTE (IBKR)

Conclusion

WBA has had a deterioration of performance over the past few years, but I think it has the mid- to long-term potential to take advantage of its strengths. WBA is entering into a new industry and potentially creating a powerful new revenue segment for itself. I think the current price action might move favorably toward my valuation price, creating an opportunity for entering a position over the long term. I currently rate shares as a “hold” and would shift that to a “buy” as they approach the current valuation price.

Be the first to comment