krblokhin/iStock via Getty Images

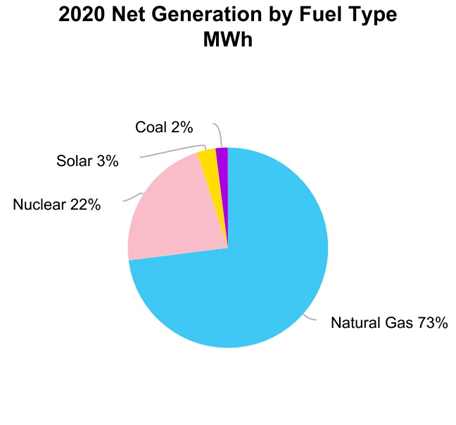

Although echoes of the failure to pass renewables-promoting Build Back Better and February 2021 Winter Storm Uri continue, the next expected big issue for utilities is inflation, perhaps offset by friendlier regulatory attitudes towards natural gas (and nuclear) generation of electricity. NextEra (NYSE:NEE) is already a low-carbon pro as almost three-quarters of its actual generation in 2020 was natural gas.

NextEra Energy is a holding company for a two-part regulated retail utility (Florida Power & Light and Gulf Power) and an unregulated generation subsidiary. Although Gulf Power merged into Florida Power & Light January 1, 2021, financials are reported separately throughout 2021. Thus, the three operations reporting segments currently are Florida Power & Light (FPL), a regulated utility serving 5.6 million customer accounts (11 million people) and the largest US rate-regulated retail electric utility; Gulf Power, a regulated utility serving 470,000 customers in eight counties in northwest Florida; and NextEra Energy Resources (NEER), an unregulated subsidiary that generates clean energy from solar, wind, and nuclear power.

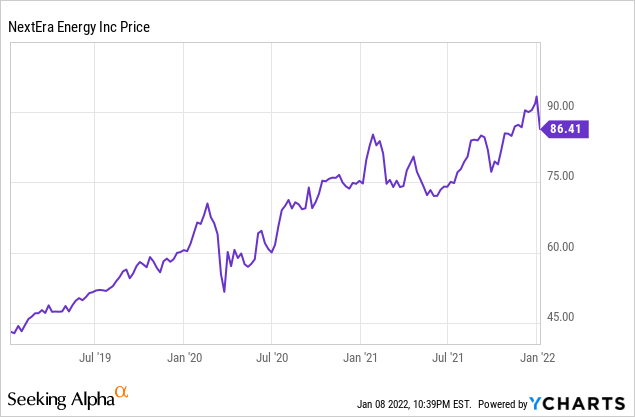

At a market capitalization of $170 billion and a beta of 0.30, NextEra Energy is less volatile than the overall stock market, a plus for investors seeking stability. However, its dividend yield is only 1.8% and like all utilities, it faces risks from inflation and rising interest rates.

Strong national and Florida state economic growth have boosted electricity demand. After a bump in gas prices, NextEra still has access to generous US natural gas reserves and production. Despite the non-passage of BBB, NextEra’s existing big slate of renewables development projects has significant momentum. Finally, the company is extending into water utility projects in what could be another key growth venture with strong potential.

Macro

The national economy is strengthening and the Florida state economy is booming. Growth in electricity demand is directly tied to economic growth, so FPL’s demand prospects are good.

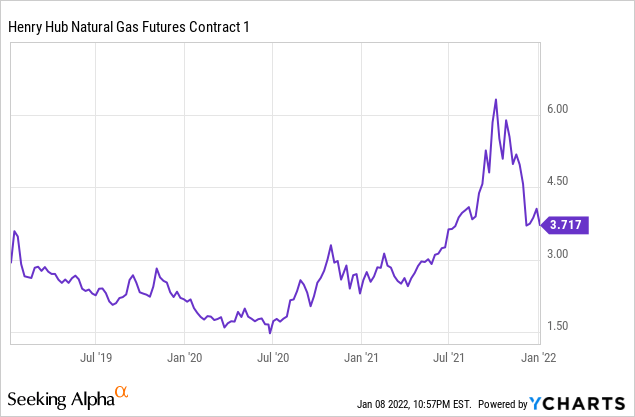

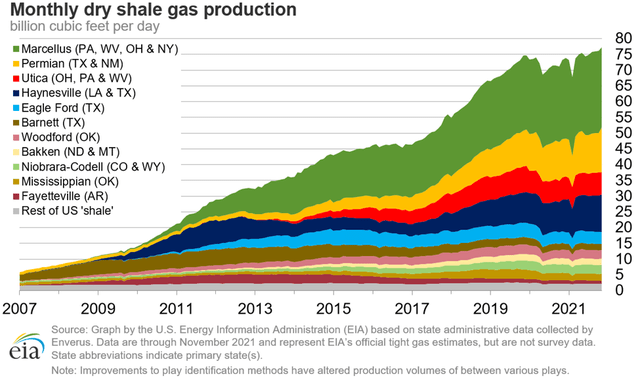

Natural gas peaked above $6.00/MMBTU during the fall of 2021, a negative for electricity generators like NextEra. However, US inventories and production rates have recently normalized back up to pre-Covid rates even after absorbing an extra 10 BCF/D of LNG export demand (about 10-11% of total US demand).

While the BBB bill, with an emphasis on spending for renewable projects, didn’t pass virtually every state continues to encourage the buildout of solar and wind capacity by its utilities-and NextEra is a premiere renewables project developer.

Third Quarter 2021 Results And Guidance

For the third quarter of 2021, NextEra’s GAAP net income was $447 million, or $0.23/share. Non-GAAP adjusted 3Q21 earnings were $1.48 billion or $0.75/share. The largest difference between the two is that adjusted earnings exclude the effects of non-qualifying hedges which was a $1.23 billion hit to income, only somewhat offset by a smaller income tax benefit of $325 million. Non-qualifying hedges divide into five parts, the largest of which are electricity-related positions and gas infrastructure related positions.

For the first nine months of 2021, NextEra’s GAAP net income was $2.4 billion or $1.20/share. Adjusted earnings were $4.2 billion or $2.13/share. Again, the largest difference between the two was adjusted earnings exclude net losses associated with non-qualifying hedges of $2.26 billion, with an offsetting income tax benefit of $551 million.

Cash flow from operations for the first nine months was $6.2 billion.

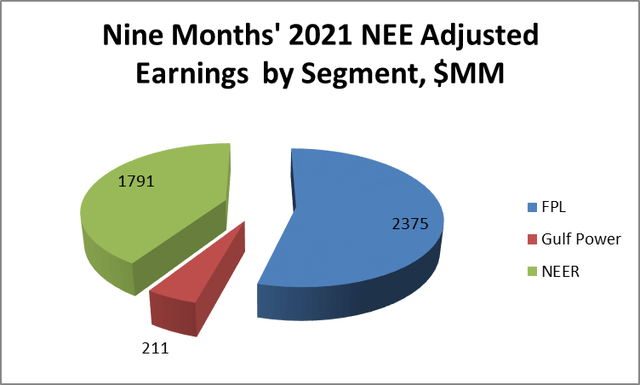

For 2021 NextEra Energy’s reporting is segmented into FPL, Gulf Power, and NextEra Energy Resources (NEER). Adjusted earnings for each segment for the first nine months of 2021 are shown below.

Credit: NextEra Energy and Starks Energy Economics, LLC

Company management forecasts adjusted EPS for 2021 to be toward the high end of $2.40-$2.54 and expects 2022 and 2023 adjusted EPS to be 6-8% above the 2021 level. The company also expects to grow dividends per share at a roughly 10% rate in 2022.

Natural Gas Prices

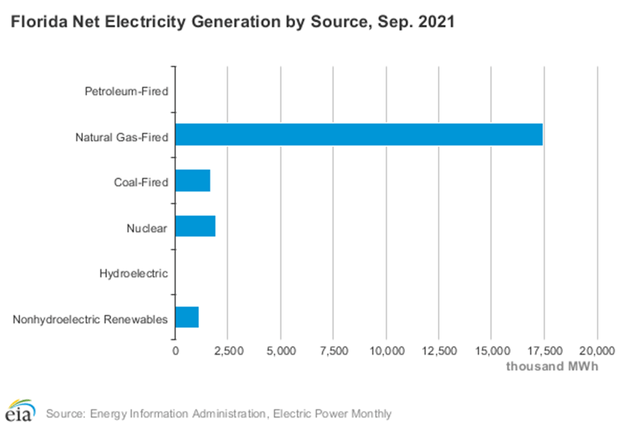

As the graph above suggests, natural gas is the primary generation fuel in Florida.

The Henry Hub (Louisiana) natural gas futures price for February 2022 closed at $3.92/MMBTU on January 7, 2022.

Higher-than-normal natural gas prices continued throughout 2021, as the month-ahead futures chart shows below, hitting an unseasonable high above $6.00/MMBTU in the fall as shortages in Europe and Asia were felt and US inventories were low. The Energy Information Administration (EIA) confirms higher gas prices led to higher wholesale electricity prices at major trading hubs during 2021, with the delivered cost of natural gas to electricity generators increasing from $3.19/MMBTU in January 2021 to about $5.04/MMBTU in 4Q21.

While US inventories are back up to seasonal norms, the desperate Asian and European shortages are being only partially met by LNG exports from the US and elsewhere.

The forward price strip drops seasonally to $3.67/MMBTU by May 2022: this is a higher spring shoulder base than in prior years.

Nonetheless, it is worth noting that US gas producers have ramped up with natural gas production back at 97.5 BCF/D due to higher output in the Gulf of Mexico, the Marcellus (Pennsylvania-West Virginia-Ohio), the Permian in west Texas and New Mexico, and the Haynesville in Louisiana.

Operations

NextEra Energy grew from a utility founded in 1925. The company is headquartered in Juno Beach, Florida and is among the largest global generators in the world of electricity from wind and solar power.

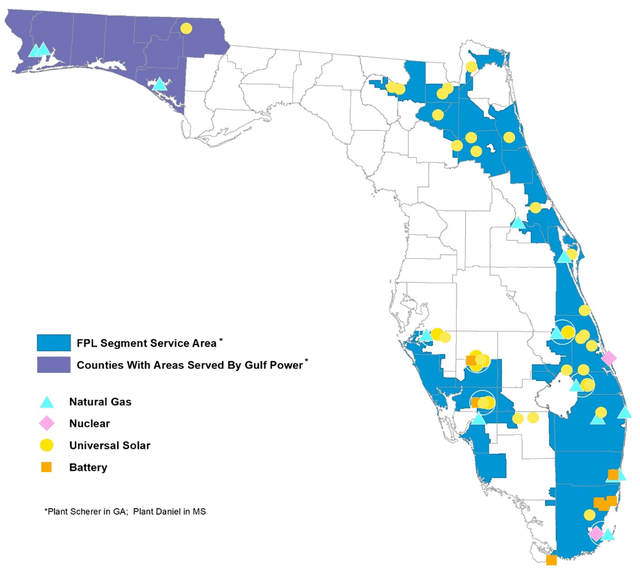

FPL. The illustration below shows the FPL service area (wholly in Florida), the counties in Florida served by Gulf Power, and the location of FPL generation units in Florida. Separate from NEER’s renewables, FPL owns 28,400 megawatts of generation capacity.

Credit: NextEra 10-K for year ending Dec. 31, 2020

FPL’s 2020 mix of (its own, not NEER’s) actual generation was 73% natural-gas-fueled. Similarly, nuclear-fueled generation was 22% of FPL’s mix, despite being only 12% of capacity. FPL owns four nuclear plants in Florida. One is scheduled for refueling and maintenance each quarter.

This provides a good environmental match for Florida, with large-scale, reliable, zero emissions nuclear and low-carbon natural gas.

From its 3Q21 investor discussion, NextEra executives note:

*Florida’s labor force participation rate has recovered to its highest level in nearly 18 months;

*3-month average of new housing starts was up over 40% year-over-year;

*in August 2021 there were twice as many housing starts in Florida compared to the average over the last ten years;

*Florida building permits are up 47% year-over-year;

*Florida’s retail sales index is up nearly 60% versus the prior year.

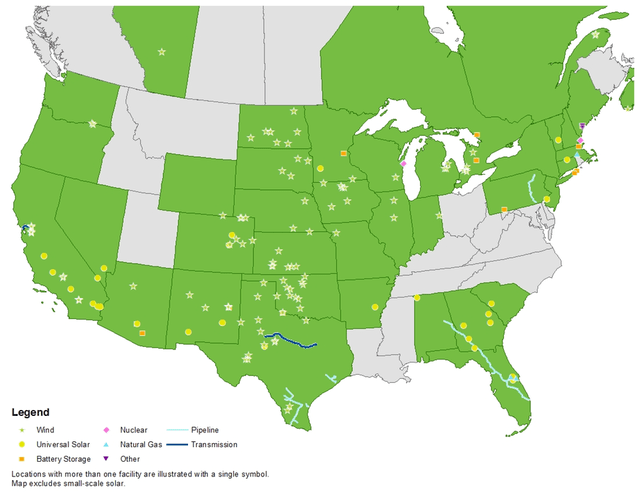

NextEra Energy Resources, NEER. NextEra Energy Resources owns numerous renewable generation units, many of which are illustrated in this map.

According to the company’s 2020 10-K, long-term contracts cover virtually all NEER’s generation capacity and/or output: “Contracted generation assets at December 31, 2020 represented approximately 21,983 MW of total net generating capacity.”

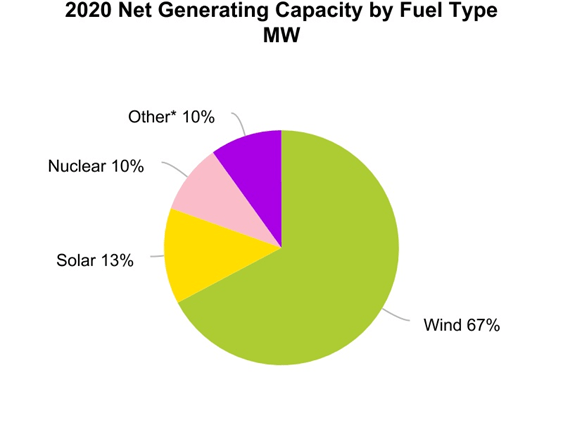

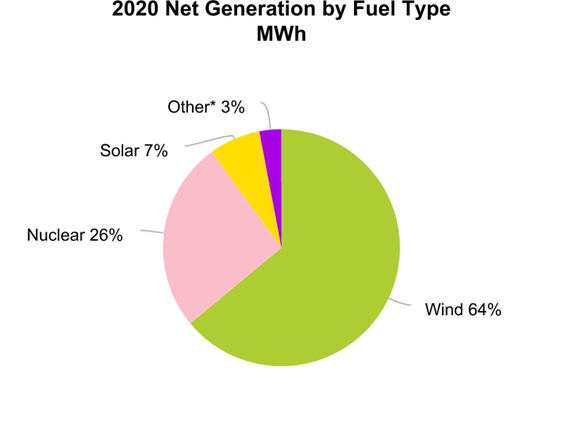

Comparing generation capacity to actual generation: the nuclear facilities saw more hours of sustained use.

As detailed in the 3Q21 presentation, NEER has more than twelve wind projects totaling 5823 megawatts and more than fifty solar projects totaling 9485 megawatts under development contracts, all for 2021-2024. Locations range from New York to California at least twenty states in between. A sample utility for whom NextEra Energy Resources is building renewable energy generation is NiSource (NI).

NextEra notes it has entered into an agreement to acquire a portfolio of rate-regulated water and wastewater utility assets in eight counties near Houston, Texas, and is helping a customer with a water reuse and reclamation project. This venture is incredibly timely: oil producers in west Texas are looking for recycle processes to replace volume-limited wastewater injection wells due to an increase in earthquakes. Due to oil and natural gas hydraulic fracturing, Permian operators generate millions of barrels a day of high-mineral, “salty” flowback and produced water. Now, some of this wastewater must be trucked or piped to wastewater wells further away or processed (cleaned) enough so it can be reused.

Governance

At September 26, 2021, Institutional Shareholder Services ranked NextEra’s overall governance as 2, with sub-scores of audit (2), board (7), shareholder rights (2), and compensation (1). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

As of September 2021, NextEra’s ESG ratings from Sustainalytics were “medium” with a total risk score of 27 (48th percentile). Component parts are environmental risk 12.9, social 8.2, and governance 5.8. The only negative factor noted is the company’s use of thermal coal. (However, use of coal for reliable baseload should be more popular, as it has become in Europe.) Controversy level is 2, or “moderate,” on a scale of 0-5, with 5 as the worst.

At December 15, 2021, shorted shares were only 1.1% of floated shares.

Insiders own a negligible 0.16% of stock.

NextEra’s beta is an attractive, stable 0.3: its stock moves directionally with the overall market but to a much smaller extent (less volatility).

Stock And Financial Highlights

NextEra’s January 7, 2022, closing price was $86.42/share, 92% of its 52-week high of $93.73/share. Its market capitalization is $169.5 billion.

Trailing price to earnings ratio is a sky-high 142 at the trailing twelve months’ earnings per share (EPS) of $0.61. Analysts’ average estimate for 2022 EPS is higher at $2.74/share for a forward price/earnings ratio of a 31.5.

At September 30, 2021, NextEra had liabilities of $94.4 billion, including $48.1 billion of long-term debt, and assets of $139.2 billion, giving a liability-to-asset ratio of 68%, standard for a utility.

With a dividend of $1.54/share, at the January 7, 2022, closing price the stock yields 1.8%.

NextEra has an average rating from fifteen analysts of 1.8, or “buy” leaning toward “strong buy.”

The ratio of enterprise value to EBITDA is 33, far above the preferred ratio of 10 or less: the stock is expensive relative to trailing EBITDA.

Positive And Negative Risks

Interest rate increases this year–with the Fed announcing it will raise rates up to three times starting in March–could impact NextEra and all utilities whose debt costs could rise. Moreover, higher interest rates could attract investors away from stocks with low dividends.

Labor, capital, and materials inflation prompting these rate increases is projected to continue this year. There is no certainty NextEra could raise rates enough to offset increased costs.

Florida growth could slow, and weather-like hurricanes–remains a significant risk factor.

Gas prices could rise again if higher production volumes meet increased demand from an improving industrial economy, extreme cold weather, or continued large liquefied natural gas exports to Europe and Asia.

A positive risk is the continued healthy increase of Florida’s population and economy.

Recommendations For NextEra

I recommend NextEra Energy to utility investors comfortable with the possible downside of inflation and interest rate increases in the utility sector. NextEra remains among the best utilities for its regulated FPL division in high-growth Florida and its experience and backlog as a renewables developer across the country for other utilities. Its venture into water and wastewater utilities in Texas comes at a very propitious time-just as Permian oil and gas producers need new solutions for millions of barrels per day of high-mineral, high-salt produced and flowback water.

More generally, NextEra has continued to prove the value of its operating model, with the split between renewable projects and a high-growth utility. Its price-earnings ratio is steep and its 1.8% dividend is small, albeit with an expectation of a 10% increase in the dividend rate in 2022. Given management’s expectations of increasing EPS at 6-8%/year, low-beta-stock seekers, ESG investors and some growth investors may continue to find this stock of interest.

NextEra fills a key niche as the country’s largest renewable power generator coupled with growing, consumer-friendly (less expensive) utility retail operations in the attractive Florida market.

Be the first to comment