hrui/iStock via Getty Images

NextEra Energy, Inc. (NYSE:NEE) is a firm that generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. They focus on electricity generation from both renewable (wind, solar) and non-renewable (nuclear, coal, and natural gas) energy sources.

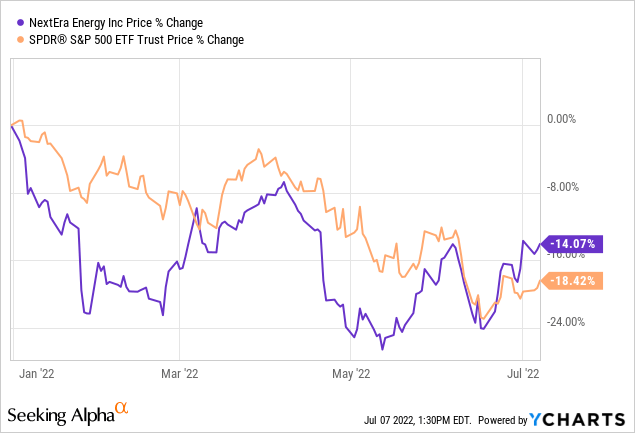

The company’s stock price has declined about 14% year to date, compared to the more than 18% decline of the broader market.

As investors often believe that utility companies could provide a certain level of safety in a volatile market, especially when consumer confidence is low, we believe that NEE is likely to keep outperforming the broader market in the near term.

In this article, we will take a look deeper at what could make NEE an attractive investment option now.

Energy transition tailwind

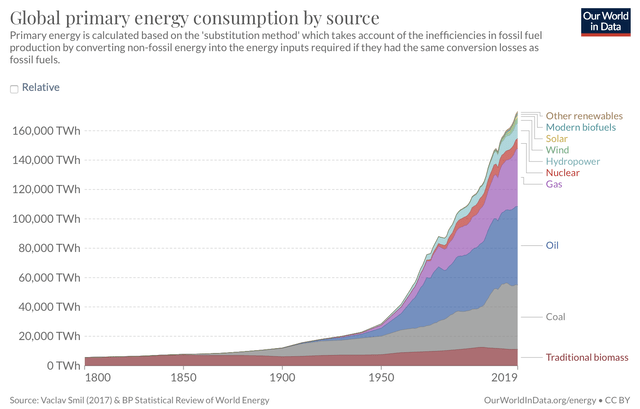

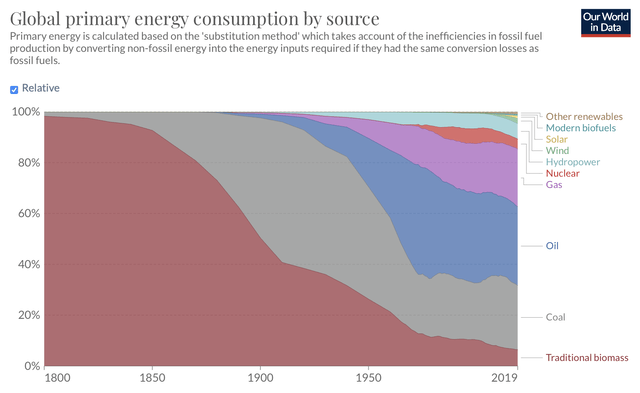

Our need for energy is higher than ever, and it is forecasted to grow further in the decades to come. Currently, most of the energy we use is generated from fossil fuels, including, for example, coal, crude oil and natural gas.

Global primary energy consumption by source (Ourworldindata.org) Relative global energy consumption by source (Ourworldindata.org)

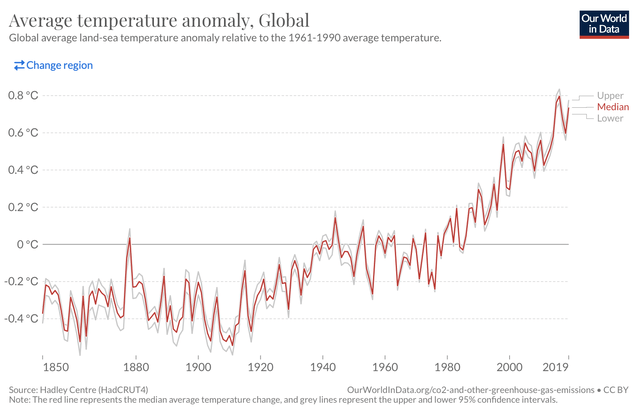

The growing consumption of energy, generated mainly from crude oil, coal, and natural gas, resulted in a significant increase in greenhouse gas emissions, leading to serious concerns about humanity’s negative impact on the climate.

Global average temperature anomaly (Ourworldindata.org)

There have been many initiatives in the past, which we’re aiming to reduce our emissions and moderate the climate change. Perhaps one of the most well-known agreements of all is the so-called Paris Agreement.

Part of the solution could be transitioning partially or completely away from non-renewable energy sources. Energy transition is often defined as a process of replacing fossil fuels with renewable energy sources. Although the idea of energy transition is not new, in the current environment the process may be accelerated.

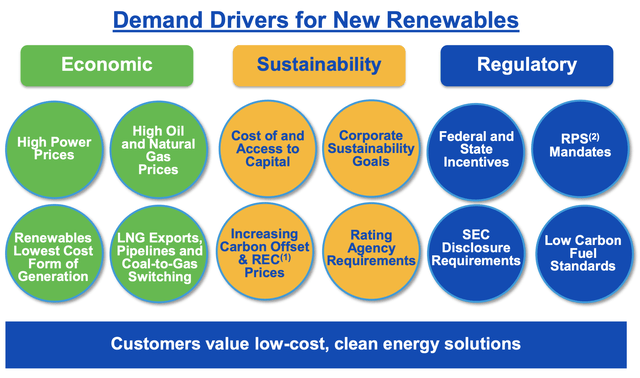

In their investor’s presentation, NextEra Energy has highlighted some of the key drivers, which could result in elevated demand for renewable energy sources.

Demand drivers for new renewables (NEE)

There are three key factors that broadly define the expectations of growing demand: economic, sustainability, and regulatory.

Although all three pillars are equally important, we believe that in the current market, the economic factor could be the strongest driver.

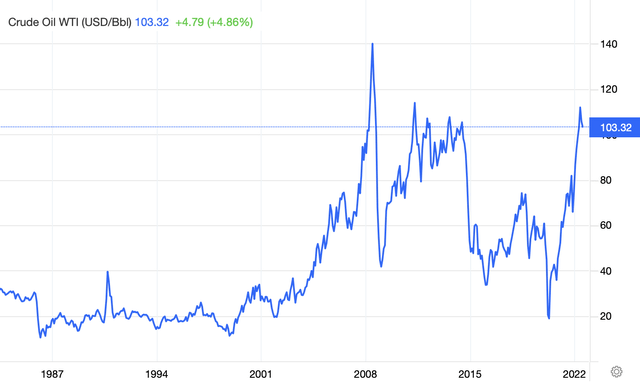

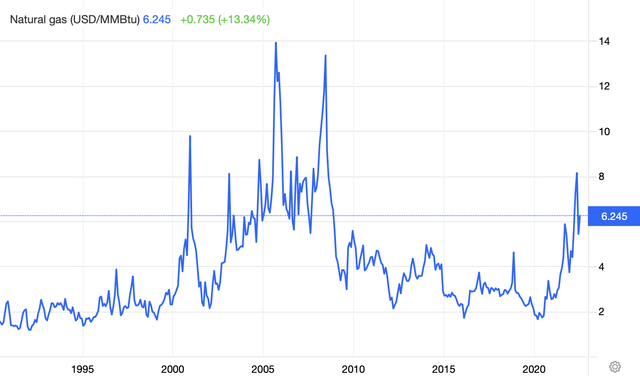

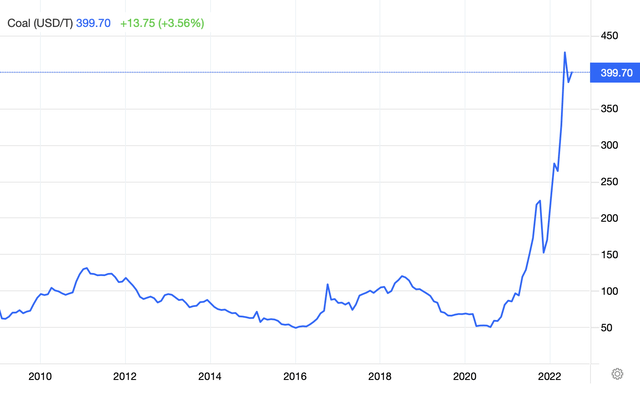

In 2022, crude oil, natural gas and coal prices have skyrocketed.

WTI price (Tradingeconomics.com) Natural gas price (Tradingeconomics.com) Coal price (Tradingeconomics.com)

These extremely high fossil fuel prices have also resulted in a significant increase in energy prices. Much of this price action was caused by the “reopening of the economy” after the COVID-19 pandemic and the ongoing geopolitical tension in the Eastern European region. As the duration of the conflict and its aftermath is highly uncertain, we believe that fossil fuel prices are to remain elevated for the rest of 2022. Although OPEC+ has agreed to increase oil production by a higher than planned amount in July and August, in order to increase supply and potentially reduce prices, there are several other factors which are causing the price levels to remain elevated. E.g., the incident in the Freeport LNG plant, and the uncertain energy security of Europe driven by the fears of supply interruptions from Russia.

In our opinion, when prices of fossil fuels are extraordinarily high, investments in renewable energy projects become significantly more attractive. This could eventually lead to a substantial share gain of the renewable energy sources in the energy mix.

We expect that NextEra Energy is well-positioned to be one of the key players of the energy transition story in the long run. For this reason, we believe that the stock could be an attractive buy for investors with a long investment horizon and with a focus on ESG.

Now, let us now take a closer look at what we like about NextEra Energy itself.

Performance during times of low consumer confidence

Consumer confidence is often regarded as one of the leading economic indicators, which could potentially forecast a change in the consumer spending trend in the near future.

During times of low consumer confidence, consumers often reduce their spending on durable, discretionary, non-essential goods. Either could either completely cut their purchases, delay the purchases, or shift to lower cost, more affordable alternatives. In such times, companies selling these kinds of products normally perform poorly in the stock market. On the other hand, there are sectors that appear to be less impacted by consumer confidence. Utilities is often considered to be one of these sectors.

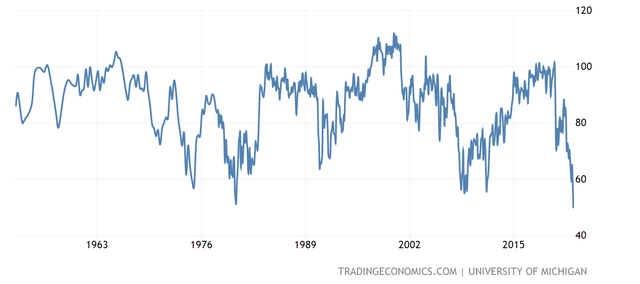

As the consumer confidence has been steadily declining in the past months, even falling below levels that we have seen during the 2008-2009 financial crisis, we believe it is important to consider adding firms to our portfolios that are relatively resistant to these kinds of changes.

U.S. Consumer confidence (Tradingeconomics.com)

So, how NEE has actually performed in the last 20 years during times of low consumer confidence?

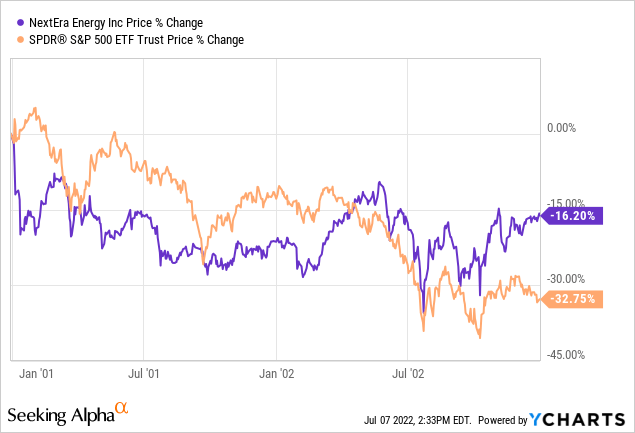

2001-2003

Both NEE and the S&P 500 (SPY) ended this period in negative territory. However, while the SPY declined by more than 32%, NEE’s price declined by “only” 16%.

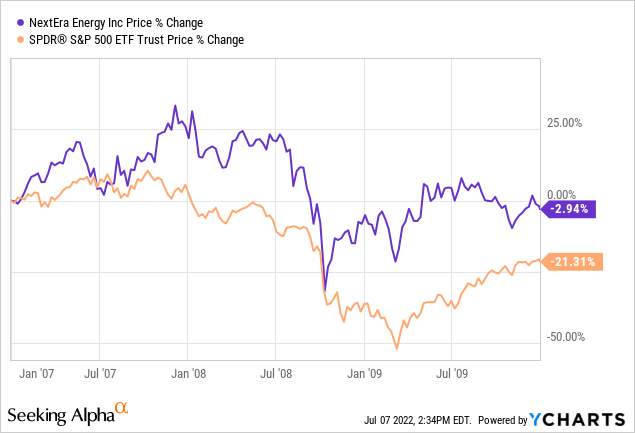

2007-2010

Between 2007 and 2010, the period in which the financial crisis also occurred, shows a similar trend to our first example. But once again, NEE has substantially outperformed the broader market.

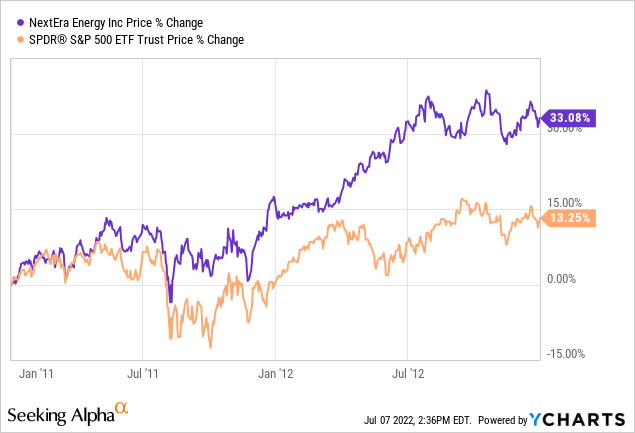

2011-2013

In this time frame, both NEE and SPY have increased in value. But once again, NextEra Energy has outperformed the broader market by gaining more than 33% in the period.

Although past performance is not always a reliable predictor of future performance, we believe that due to the energy transition tailwind, NEE is well-positioned to outperform once again in the current market environment.

Capital gain, however, is not the only source of return, when investing in NextEra’s stock.

Dividends

NextEra Energy has a strong track record of returning value to its shareholders in the form of dividend payments.

In fact, the firm has been paying dividends to its shareholders for the last 32 years consecutively, while they have also managed to increase the amount paid out each year in the last 27 years.

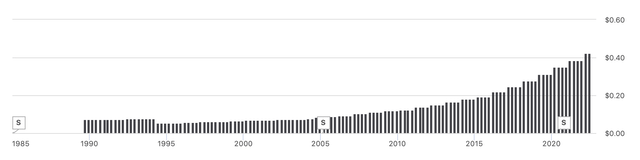

Dividend history (Seekingalpha.com)

Currently, the firm pays a quarterly dividend of $0.43 per share, which corresponds to an annual yield of 2.1%.

When considering investing in a firm for its dividends, it is crucial to understand whether these payments are safe and sustainable. Trailing twelve months, the firm has a Dividend Payout Ratio (TTM) (non-GAAP) of 62% and a Cash Flow Payout Ratio (TTM) of 39%, which are roughly in line with the utilities sector median. As we expect that the energy transition will benefit NEE in the years to come, we believe that the current dividend payment is safe and sustainable in the near future.

Key takeaways

We are bullish on NextEra Energy because of the tailwinds created by the potential acceleration of energy transition and the growing share of renewable energy sources in the energy mix.

Also, important to note that the firm has outperformed the broader market three out of three times during times of low consumer confidence.

Capital gains are not the only source of income to NEE shareholders. The firm has a strong track record of returning value to its shareholders in the form of quarterly dividends.

Be the first to comment