monsitj

Investment Thesis

A. O. Smith’s (NYSE:AOS) stock has corrected significantly as the market is worried about the company’s China exposure and the potential impact of the lockdowns there on Q2 22 results. However, with the situation improving and the Chinese economy reopening, things should improve from 2H FY22 onwards. For the North America segment, the increase in prices across the business portfolio, strong demand for water treatment products, and strong order backlog for the boiler products should drive the company’s sales growth. The margins should sequentially improve thanks to the price increases and supply chain constraint easing. In the long term, the company is focusing on strategically acquiring water heater and water treatment assets to expand its business portfolio, and organically, AOS is working towards innovation and new product development across its product line.

Revenue Outlook

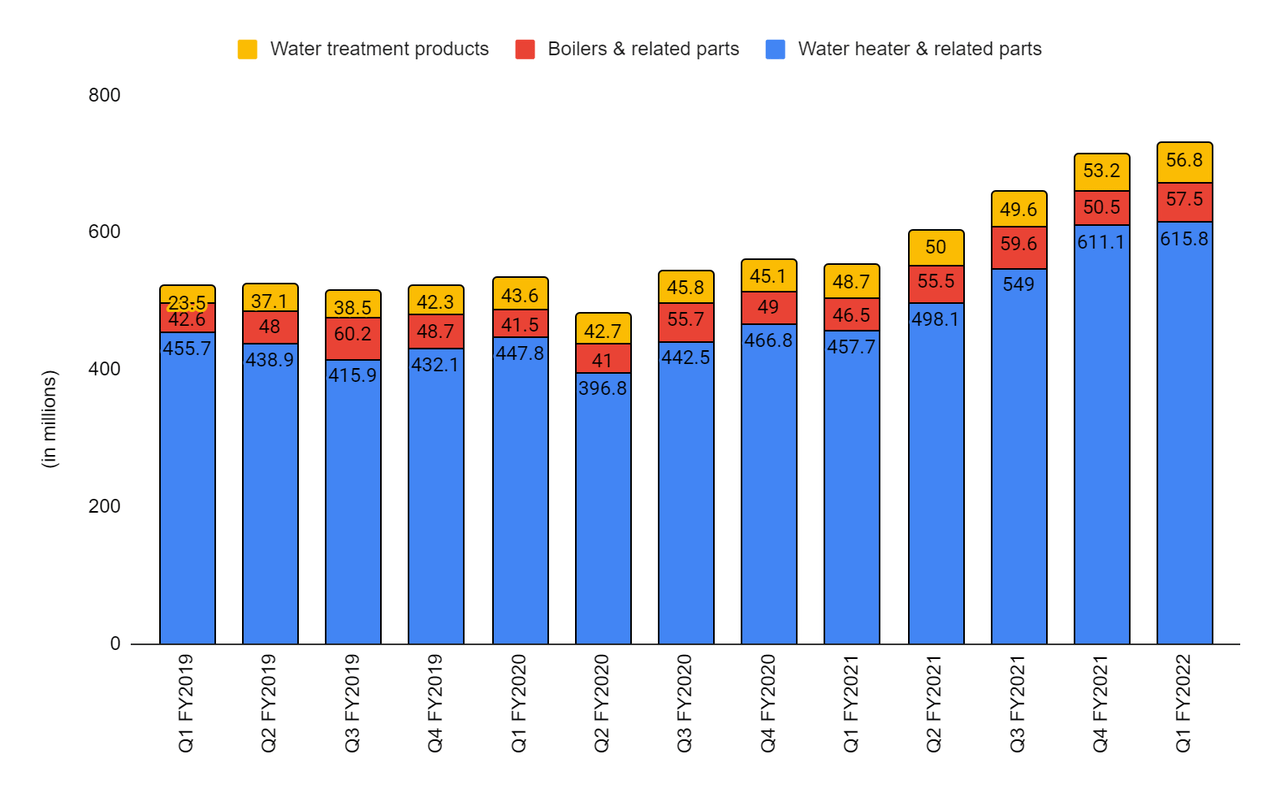

The company’s net sales in the North America segment have grown at a good pace in the last four quarters. This growth was primarily due to the price hikes that the company implemented to offset the inflationary costs. Pricing contributed almost 90% of the sales growth in the last two quarters. In Q1 FY22, sales grew 32% Y/Y (organically 28% Y/Y) to $730 mn benefiting from pricing actions, mainly on water heater products. Higher volumes in boilers and water treatment segments also benefited the sales, which were partially offset by lower volumes of commercial water heaters.

AOS North America segment revenue growth (Company data, GS Analytics Research)

Due to component shortages for some gas products and a regulatory change that affected orders for large electric commercial products larger than 55 gallons, the commercial water heater industry in North America saw lower sales volume. This regulatory change is expected to increase the efficiency of water heaters by adjusting flow rate, KW, and wattage, which require a different SKU. On the manufacturing side, the company was ready for this regulatory change, but it caught itself off guard when it came to distribution. AOS had to update its customers regarding its new SKU which resulted in lower sales in January. The sales started improving in late February and reached the prior-year run rate in March. This is expected to further normalize through the remainder of the year, which should bring back sales volume in the company’s commercial water heater business.

The supply chain constraints in the Residential market improved sequentially in February and March of 2022, which reduced the lead times, improving the shipments. The lead time in April was 20 days in the North America residential water heater business, compared to 40 days or more during the tougher times. The company is targeting 15 days lead time in both the Residential and Commercial businesses.

Within the North America segment’s water treatment business, the company is taking an omnichannel approach to increase its market share through innovation, product development, and acquisition opportunities. The company is making strategic acquisitions that are accretive to its earnings and will return its cost of capital in three years. The company entered the water treatment market in North America with the acquisition of Aquasana in 2015. Since then, AOS has made four additional acquisitions, with Atlantic Filter Corp. being the most recent in June 2022. The company is expecting the sales of the water treatment business in the North America segment to grow 13% to 14% Y/Y in FY22 as the demand for healthy and safe drinking water is expected to remain strong.

The sales of boilers in the North America segment grew 24% Y/Y in Q1 FY22, driven by price increases and demand for energy-efficient products. The company ended the quarter with a record backlog, largely composed of condensing boilers. The company is experiencing strong demand for these market-leading, energy-efficient boilers, which should be beneficial for the company’s revenue growth in FY22. The demand for condensing boilers has been increasing as the shift towards energy-efficient products has increased.

The company implemented multiple price hikes in 2021 to offset the inflationary cost environment, benefiting the company’s sales growth in Q1 FY22. So far in 2022, the company has implemented price hikes between 2% and 12% across different products in North America. This should continue to benefit the sales growth in FY22. The company’s Commercial water heater sales should also continue to improve as the year progresses. While the North America residential water heater sales volume should decline as the housing industry normalizes after the very strong last two years, it should be more than offset by pricing actions and sequential improvement in commercial volume.

Revenue growth of Rest of the World segment (Company data, GS Analytics Research)

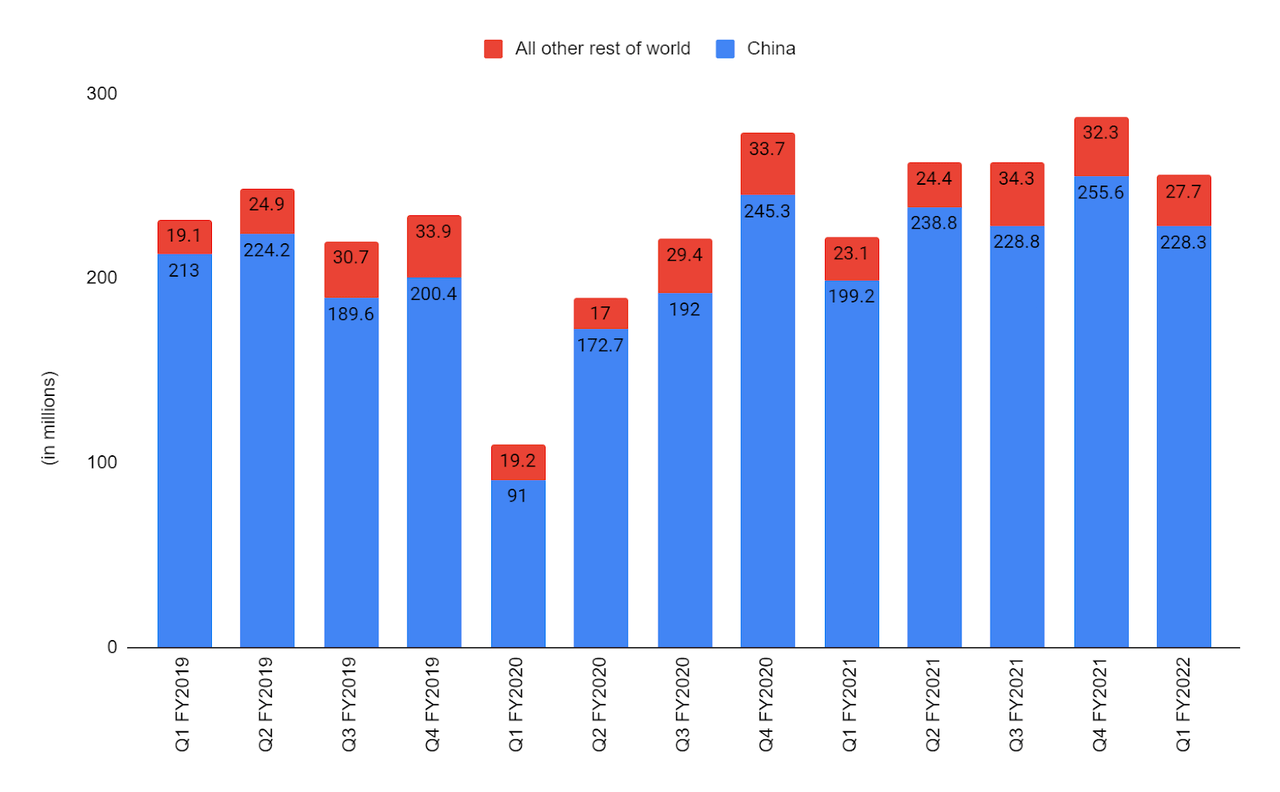

Internationally, the Chinese market, which comes under the Rest of the world segment and contributes ~90% to the segment’s revenue and 23% of the total company sales, grew by 14.6% Y/Y last quarter. This was primarily due to the favorable mix and higher sales of commercial water treatment products and replacement filters. The company was proactively working with its distributors to ship products into the market before the potential Covid-19 disruptions. This benefited the company’s sales in the quarter Q1 FY22. This pre-shipment along with Covid-related lockdowns should impact the sales in Q2 FY22. The company is expecting this to improve in the second half of FY22. Consumer demand in the third quarter should be similar to that of the first quarter and should normalize in the fourth quarter. As a result, the company has reduced its Y/Y guidance for sales growth from 5% growth to flat in local currency for FY22 at the time of the Q1 FY22 earnings release.

Longer-term, the company’s strategy remains intact to invest in lower-tier cities and monitor the productivity in Tier 1 and Tier 2 cities. AOS plans to open counters in these lower-tier cities compared to the storefronts in Tier 1 and Tier 2 cities to reduce costs and increase return on investment.

The company has lowered its Y/Y sales growth range guidance for FY22 from 16%-18% to 14%-16%. The decline in guidance is due to the volume headwinds in China and the slow start of the commercial water heating business. However, the company’s sales growth is expected to benefit from the price hikes and volume trends are also expected to improve in the back half of this year as supply chain constraints ease, large commercial water heater sales improve, and conditions in China improve. In the longer term, the company is focusing on innovation and product developments across its product portfolio to expand its business organically. The company is also focusing on strategic acquisitions that are accretive to its margins and return its cost of capital in three years.

Margins

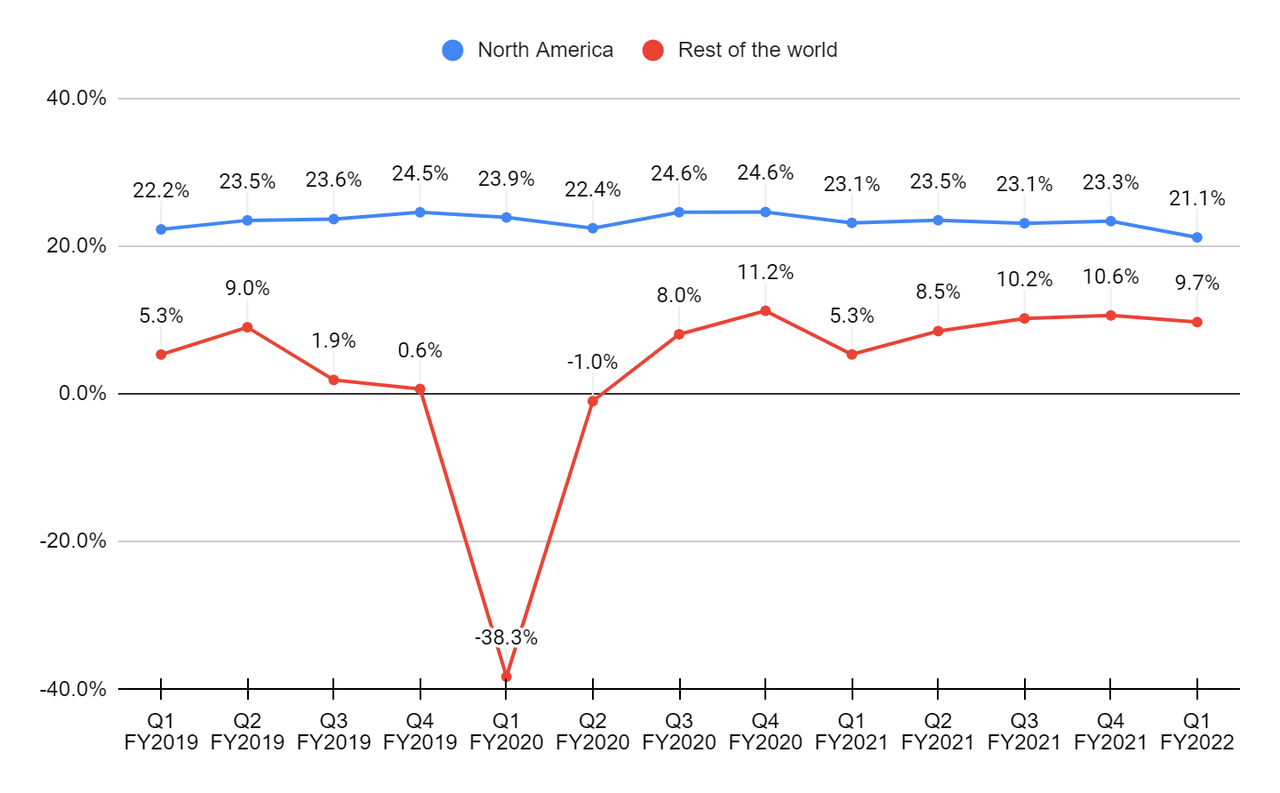

The adjusted operating margin in the North America segment had been between 22% and 25% from 2019 to 2021, but in the last quarter, it dipped to 21.1%. This decline came from the lower volumes in the commercial water heating business, and some of the margin pressure came from the higher steel costs and other commodity costs. The rest of the world segment margin took a major hit during the Covid period, but has regained pre-Covid levels and has been improving since then. However, in the last quarter, the margins declined sequentially due to inflationary costs.

AOS’s adjusted segment margins (Company data, GS Analytics Research)

Looking forward, the margins of the company should benefit from the multiple price hikes that it has implemented across its business portfolio. Apart from this, the higher efficiency condensing boilers are high-margin products and should be accretive to margins as the company has a record-high backlog of these products. This should somewhat make up for the lost margins from the commercial water heating products. As a result, the margins of the North America segment should improve sequentially. In China, margins are expected to be impacted in Q2 due to the headwinds related to the Covid lockdowns, but as the current situation in China is normalizing, we should expect the second half of 2022 to improve sequentially.

Valuation & Conclusion

AOS is currently trading at a P/E of 16.37x FY22 consensus EPS estimate of $3.54 and a 15.26x FY23 consensus EPS estimate of $3.80, lower than the five-year average forward P/E of 23.10x. One of the major concerns which has resulted in significant correction is investor fear surrounding its Chinese exposure and the impact of Covid-related lockdowns and pre-shipment of inventories to distributors there. I believe long-term investors can use this opportunity to buy the stock at low valuations. While the Chinese lockdowns and related disruptions are expected to impact AOS this year, it is unlikely to continue for long. Hence, I believe the recent correction is a buying opportunity.

Be the first to comment