pcess609/iStock via Getty Images

Introduction

I’ve been excited to write this article for a number of reasons. The first reason is that we will be discussing a stock that offers everything I’m looking for in a high-quality dividend growth stock. NextEra Energy (NYSE:NEE) offers a decent yield, high dividend growth, low volatility, and outperformance. All of it is backed by a strong fundamental business. The second reason is that because of these qualities, it’s a perfect stock for a wide range of investors including myself as NEE combines upside growth potential and limited downside.

So, let’s get to it!

Why Low Volatility Dividend Growth Is So Important

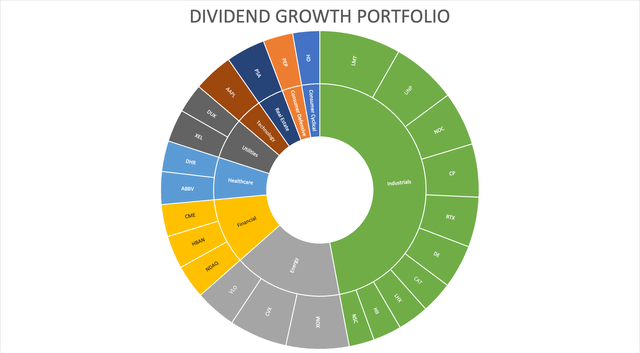

Let me start this article with a lecture on why low volatility investing is so important. While I own a wide variety of different dividend (growth) stocks, I’ve increasingly focused on buying low-volatility dividend growth.

This is my portfolio:

If you are familiar with my articles, you probably know where this is going. However, it’s just too important to not include a theoretical background in this article – especially because NEE is indeed one of the best places to be. The title isn’t clickbait.

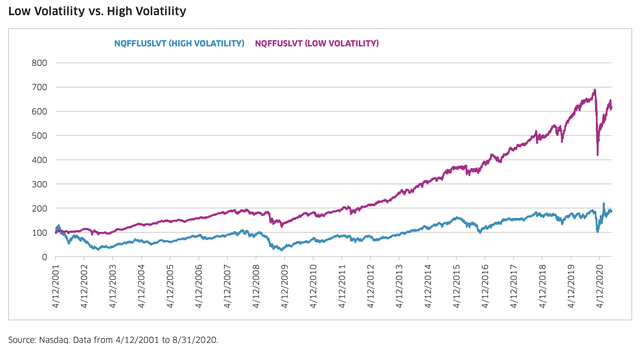

Basically, low volatility generates outperforming returns. Normally, one would think that high volatility gets that job done better because higher risks should lead to higher returns. On a long-term basis, that’s not the case.

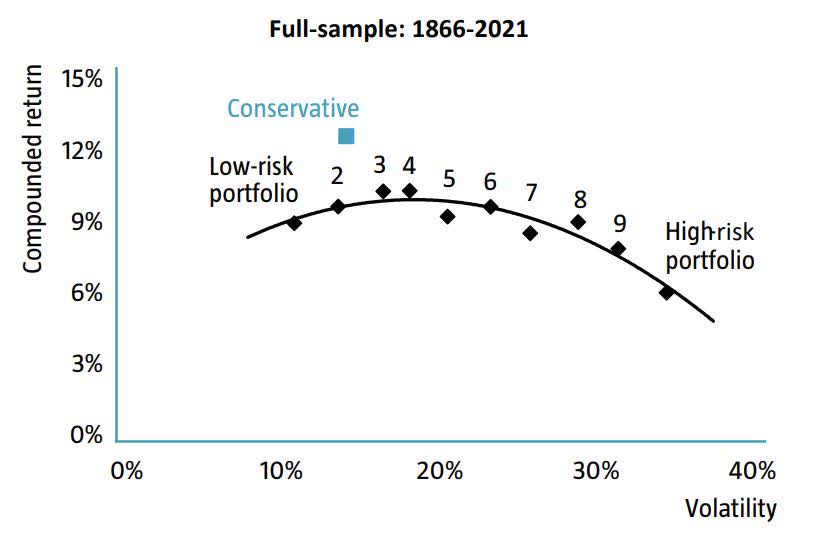

As the chart below shows, the higher the volatility, the lower the compounded return. The performance really starts to drop when volatility exceeds 25%.

ROBECO

In this case, outperforming returns are caused by downside protection.

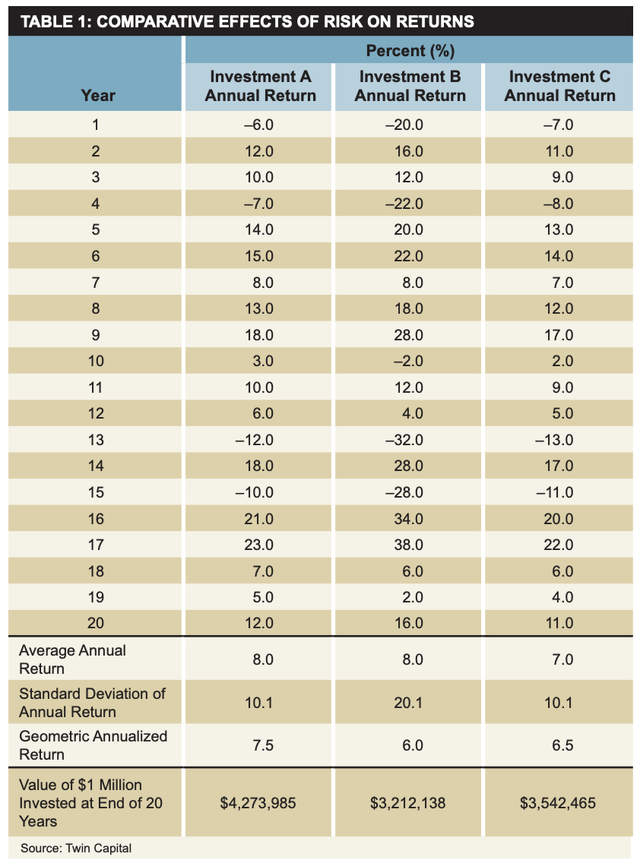

The table below comes from a 2013 article published in The Journal Of Investment Consulting, Geoffrey Gerber explains why dividend growth is such a good defensive equity strategy.

He concludes that:

Reduced-volatility equity strategies utilizing dividend growth in the stock selection process are shown to have historically provided a boost to risk-adjusted performance.

As the table shows, investment A had the highest return as it turned $1.0 million almost into $4.3 million. This portfolio had a high annual return and a low standard deviation. Even investment C outperformed investment B despite a lower annual average return. The key was lower volatility.

The Journal Of Investment Consulting (Raw Data: Twin Capital)

In other words, even if a dividend stock does not outperform during (every) bull market, outperformance during bear markets gives investors an edge.

In light of this, Nasdaq also looked into this issue finding that:

Aside from the 1-year data, the low volatility strategy has had superior risk-adjusted returns on a 3, 5, 10-year, and since inception basis. This shows that low volatility is better at providing long-term capital appreciation compared to high volatility strategies, which makes low volatility a critical investment factor to consider.

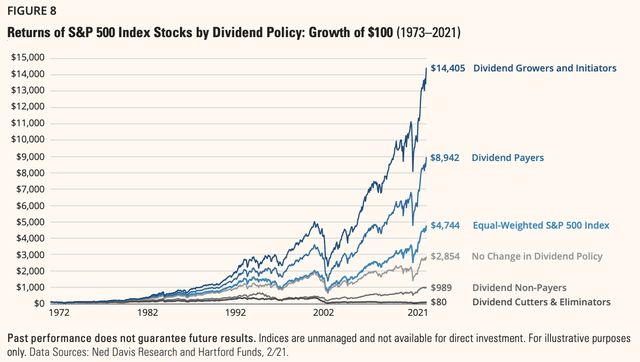

Moreover, and with regard to dividend growth, it’s fair to say that a sample of quality dividend growth stocks is able to beat the market. Going back to 1973, dividend growth stocks beat the (equal weight) market by a mile.

Essentially, a dividend is a stamp of approval. It means a company is doing well and able to let shareholders benefit. In this case, I’m not talking about companies that pay dividends with borrowed money. These “bad apples” are quickly punished by the market and made irrelevant.

Companies that are able to grow dividends on a consistent basis prove that they can survive the test of time, letting investors benefit from consistent growth. That’s an even bigger stamp of approval. Also, it often helps investors protect income against inflation.

That’s where the quality aspect comes from, which helps companies to beat the market in tough economic times – that’s when most bear markets occur.

Needless to say, an anti-cyclical business model makes the probability of low volatility even higher. After all, if a business is not expected to see a decline in sales when economic growth falls, investors will cause the stock to do rather well.

So, that’s where NextEra comes in.

NextEra’s (Green) Outperformance

With a market cap of $179 billion, Juno Beach, Florida-based NextEra Energy is the largest regulated electric utility in the United States.

According to the company:

[…] NEE’s segments for financial reporting purposes are FPL and NEER. NEECH, a wholly owned subsidiary of NEE, owns and provides funding for NEE’s operating subsidiaries, other than FPL and its subsidiaries. NEP, an affiliate of NextEra Energy Resources, acquires, manages and owns contracted clean energy projects with stable, long-term cash flows.

NextEra Energy

FPL (Florida Power & Light) is the largest vertically integrated electric utility in the United States, measured by MWh sales.

Moreover, FPL is considered to be one of the best utility franchises in the United States servicing 5.7 million customer accounts. The utility company aims to keep utility bulls among the lowest in Florida – for residential customers.

NextEra Energy

Next Era Energy Resources (part of NEET), is the world leader in electricity generated from wind and solar sources. As of December 31, 2021, the electric generation was 28 megawatts. 20GW was provided by wind energy, followed by 4GM of solar, 2GW of nuclear energy, and 2GW from natural gas/oil sources.

NextEra Energy

In order to achieve the Paris Climate Agreement goals for 2050 (full decarbonization), the US economy will need at least 7 thousand GW of renewables and storage capacity. In 2020, that number was 170 GW.

Roughly half of this is expected to come from wind power. Hydrogen is expected to be roughly 10%.

NextEra is actively pursuing hydrogen opportunities as it has the infrastructure to produce green hydrogen. NextEra is also aggressively investing in new businesses to expand its clean energy footprint. Last month, the Wall Street Journal reported that a Nebraska-based startup looking to produce hydrogen with natural gas while capturing its emissions is getting funding from major players in the industry:

Investors including BlackRock Inc. and NextEra Energy Inc. are putting more than $300 million into Monolith, valuing the company at more than $1 billion. The investment adds to a summer flood of money that is trying to turn hydrogen into a pillar of the energy transition.

Needless to say, NextEra is one of the cleanest utilities in North America. In 2005, the company was 37% “cleaner” based on its carbon dioxide emissions. In 2020, the company was 47% cleaner than the average electric power company. During this period, clean electricity generation has grown by 75%.

Now, before I continue to talk about the energy transition, let me show you why one of the key reasons why I am writing this article, in the first place.

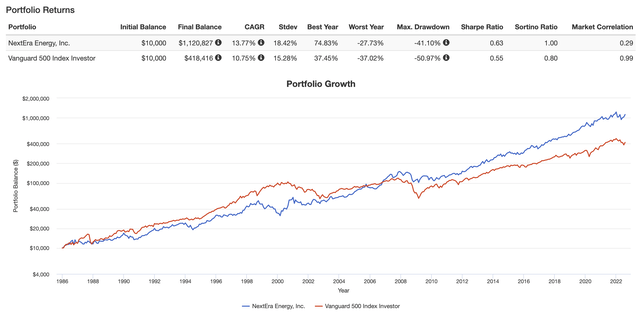

Since 1986, NEE shares have returned 13.8% per year. That beats the S&P 500 by 300 basis points per year. That’s a big deal. Even more important, the standard deviation was just 18.4%, barely higher than the S&P 500’s standard deviation, despite comparing a single stock to a diversified basket of 500 stocks. Hence, the company scores high on a volatility-adjusted basis as well (Sharpe/Sortino ratios).

In this case, it’s important to mention that this outperformance has continued in recent years. Whether it’s a 3, 5, or 10-year time horizon, NEE has outperformed the market with subdued volatility.

This outperformance is not just caused by the trend in renewables. It’s provided by the way NextEra generates tremendous value for shareholders, despite sky-high investment needs.

Ignoring everything the company invested prior to 2019, the company expects to invest more than $60 billion of capital from 2019 through 2022.

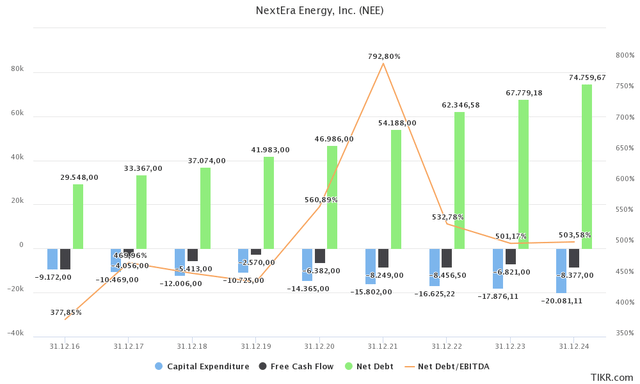

The chart below shows what that looks like. In 2016/2017, the company did close to $10 billion in annual CapEx, which is a lot by any standard. However, in the years ahead, these numbers are expected to rise to more than $20 billion (per year). As the company is unable to pay this out of pocket, it needs new debt. After all, free cash flow is in deeply negative territory. It needs funding for CapEx and for its dividend. As a result, the company is expected to end up with close to $75 billion in net debt in 2024. That would be an increase from less than $30 billion in 2016. However, the debt ratio is not expected to grow above 5.0x in the years ahead, which is good news.

There’s more good news as the company is generating value with new debt.

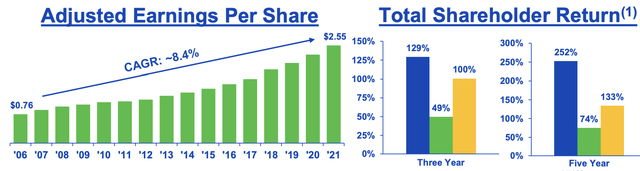

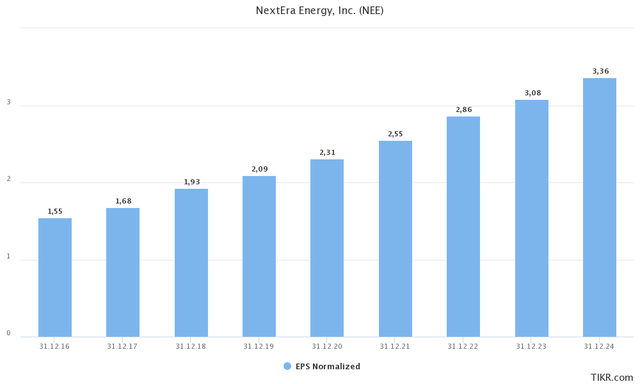

Between 2006 and 2021, the company grew earnings per share by 8.4% per year. Please note the PER SHARE part as this incorporates stock dilution as a way to provide funding. The good news is that stock dilution is limited. The company mainly uses debt funding as the number of shares outstanding has increased by just 4.2% between 2017 and 2021.

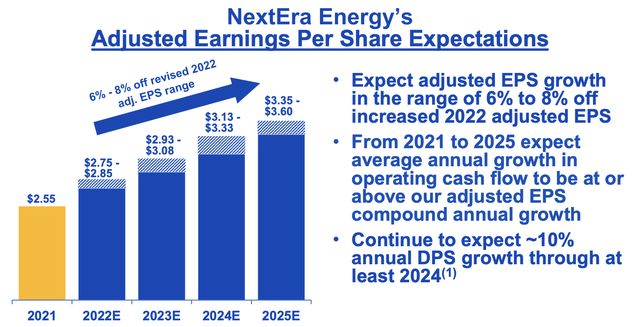

With that said, the company expects to maintain high EPS growth until at least 2025.

This is expected to pave the way for a continuation of its impressive dividend growth history, which I will discuss next.

The NEE Dividend

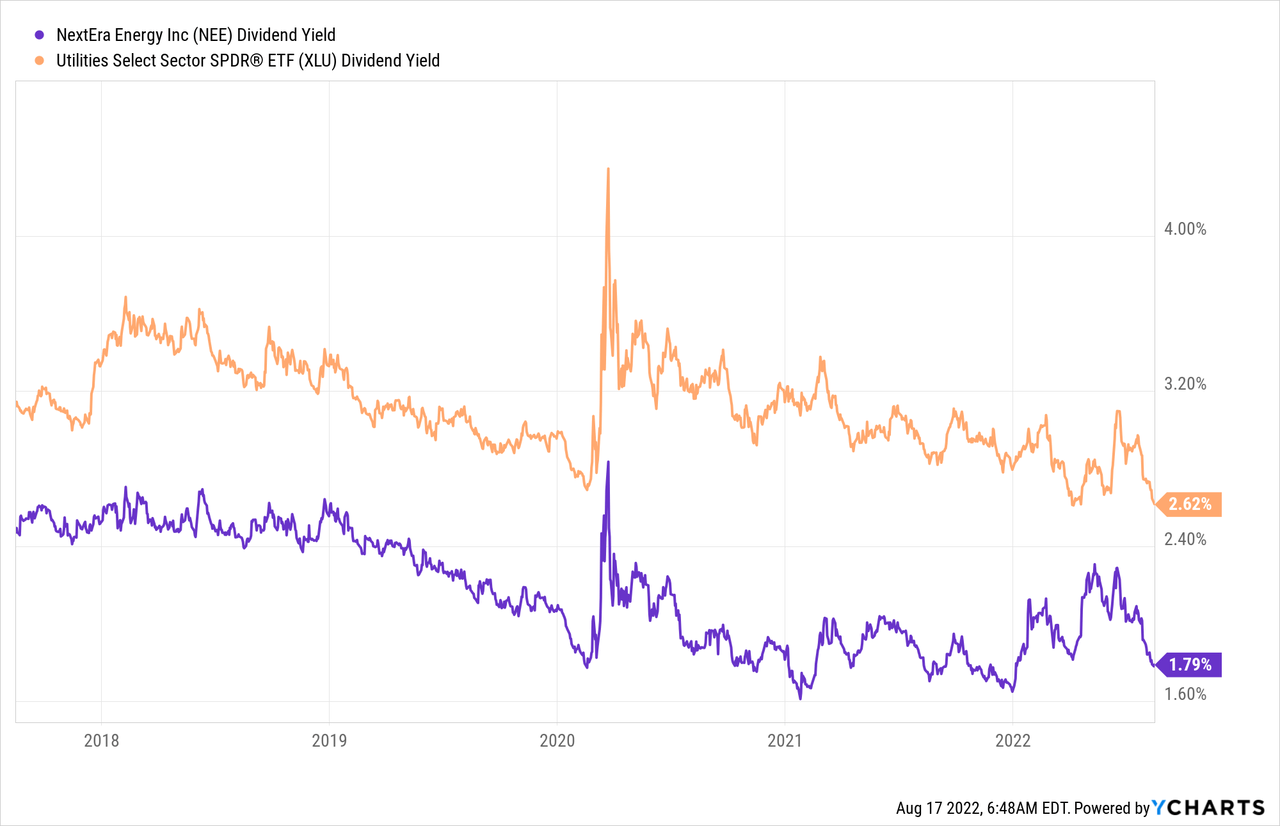

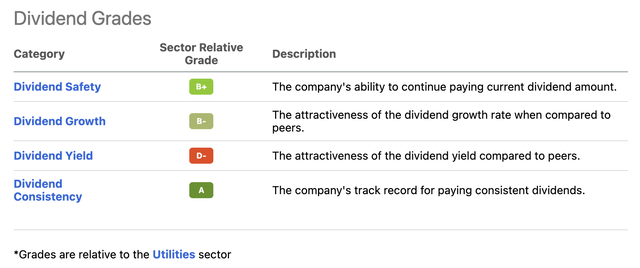

Looking at the NEE dividend scorecard, we see that the grades are great when comparing NEE to its utility peers. The only thing that immediately catches one’s eye is the low dividend yield grade.

First of all, the utility sector is typically a place where people go for high yield. The same goes for sectors like energy or real estate.

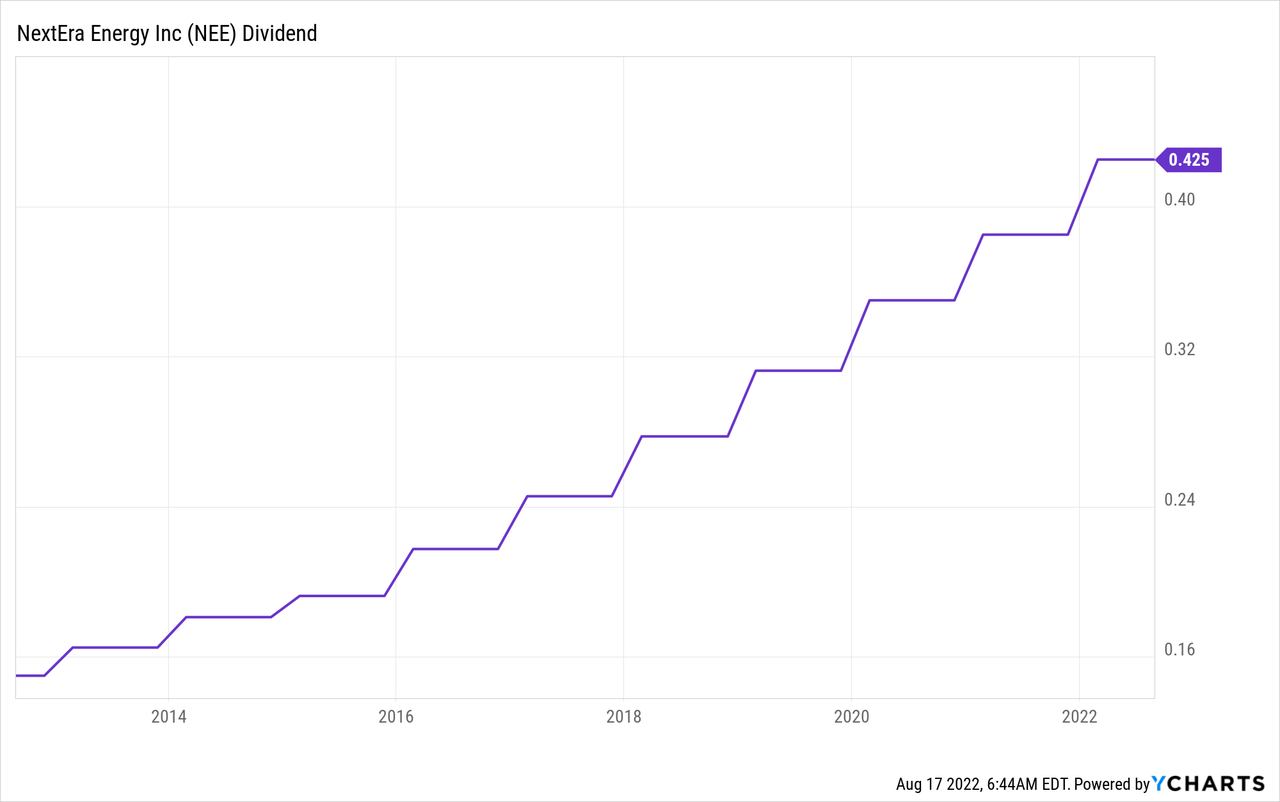

Second of all, NEE isn’t a high-yielding stock at all. The company currently pays a $0.425 quarterly dividend. That’s $1.70 per year per share. This implies a 1.90% dividend yield using the current stock price of close to $90.

While this is bad news for investors who depend on high income, it’s backed by strong and consistent dividend growth. Over the past 10 years, the average annual dividend growth has been 10.9%. The three-year average is 11.1%, which shows that dividend growth is consistent.

Moreover, management is likely going to stick to 10% annual dividend growth in the years ahead. That’s a good deal. It turns a 1.90% yield into a 4.9% yield on cost 10 years from now.

While I understand that 4.90% ten years from now does not sound as attractive to most people as I’m thinking right now. However, the “average” utility right now is yielding less than 2.8%. I happily give up 100 basis points worth of annual dividends for the sake of a (much) higher (expected) total return. But that’s just my strategy.

So far, NEE would be the perfect fit for my portfolio. There’s just one problem. Finding an entry is hard.

Valuation

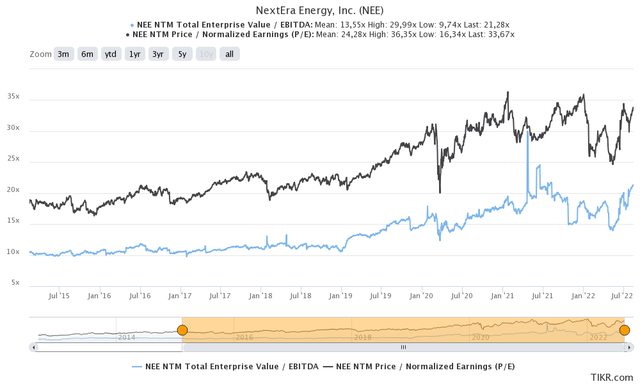

NEE is one of these stocks that never seem to be cheap.

The company has a decent dividend yield, high dividend growth, a future-proof business model, plenty of growth opportunities, and management that is capable to turn these opportunities into shareholder value. Also, its business isn’t cyclical. So, there aren’t a lot of reasons for investors to let NextEra fall to levels that can be considered to be “cheap”.

The company is trading at 30x next year’s expected normalized EPS of $3.08.

Moreover, the company is trading at 18.9x next year’s expected EBITDA based on its $255 billion enterprise value. This value is based on its $179 billion market cap, $67.8 billion in expected 2023 net debt, and $8.2 billion in minority interest.

That’s not cheap, but it’s OK given long-term double-digit EBITDA growth.

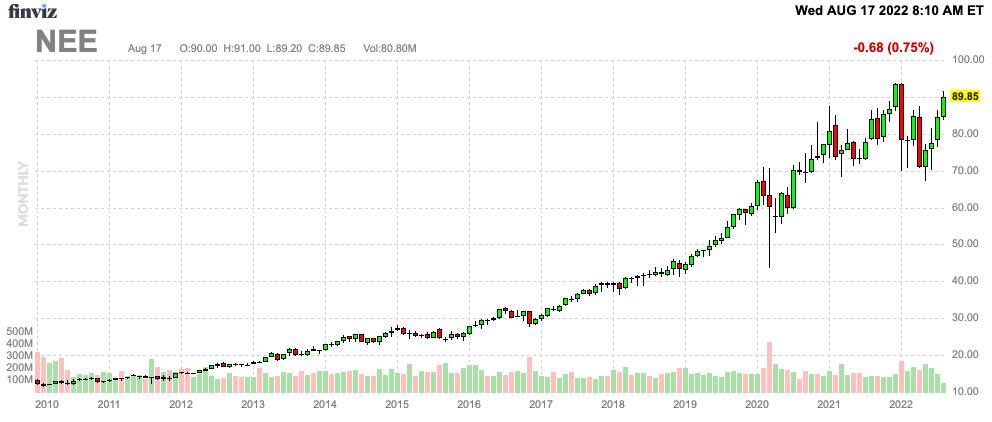

FINVIZ

With that said, finding an entry is hard. The stock is hovering close to its all-time high after briefly falling below $70 four months ago.

I would be highly interested if the stock were to fall towards $80/$75 again.

In general, I believe that NEE is a good stock to “just buy” and add on weakness whenever it occurs on a long-term basis. The risks are limited and any downside offers opportunities.

Takeaway

In this article, I discussed a stock that I don’t own, but which fits perfectly into my portfolio. Investors looking for dividend growth, outperformance, and stability need to consider buying NextEra Energy.

The company is as good as my bullish title suggests. NEE has a low-volatility profile, outperforming capital gains provided by strong EPS growth, a healthy balance sheet, and a future-proof business model.

Despite high investment demands, the balance sheet is healthy and every dollar of new debt generates shareholder value.

The only downside is that the valuation isn’t better than “OK”. Hence, I advise investors to buy in intervals. Buy a little bit now and add gradually using stock price weakness.

Other than that, I’ve little doubt that NEE will remain a fantastic place for total returns on a very long-term basis.

(Dis)agree? Let me know in the comments!

Be the first to comment