Georgijevic/E+ via Getty Images

Singular Reasearch

NexTech AR (OTCQB:NEXCF): Charting Its Own eCommerce 3D Dimension; Initiate with a Buy-Venture rating.

NexTech AR Solutions Corp. (CSE: NTAR; U.S. OTC: NEXCF) presents a unique Augmented Reality and Metaverse pure-play investment opportunity. Largely based on its differentiated 3D modeling offerings, NexTech is building its own niche in the eCommerce market. We initiate with a Buy-Venture rating and a $1.50 price target.

|

52-Week Range |

$0.25 – $1.74 |

Total Debt |

$0.08 million |

|

Shares Outstanding |

101.25 million |

Debt/Equity |

0.4% |

|

Insider/Institutional |

13.7%/86.3% |

ROE (LTM) |

NM |

|

Public Float |

90.3 million |

Book Value/Share |

$0.19 |

|

Market Capitalization |

$72.63 million |

Daily Volume (90-day) |

167,026 |

|

FYE Dec |

FY 2021A |

FY 2022E |

FY 2023E |

||

|

EPS ($) |

ACTUAL |

CURRENT |

PREVIOUS |

CURRENT |

PREVIOUS |

|

Q1 Mar |

$(0.09)A |

$(0.06)A |

$(0.04)E |

||

|

Q2 Jun |

$(0.08)A |

$(0.05)A |

$(0.04)E |

||

|

Q3 Sep |

$(0.09)A |

$(0.05)E |

$(0.03)E |

||

|

Q4 Dec |

$(0.07)A |

$(0.05)E |

$(0.02)E |

||

|

Year* |

$(0.33)A |

$(0.21)E |

$(0.13)E |

||

|

P/E Ratio |

NM |

NM |

NM |

||

|

Change |

NM |

NM |

NM |

||

|

FYE Dec |

FY 2021A |

FY 2022E |

FY 2023E |

||

|

Revenue ($ mil.) |

ACTUAL |

CURRENT |

PREVIOUS |

CURRENT |

PREVIOUS |

|

Q1 Mar |

$7.73A |

$3.48A |

– |

$2.14E |

– |

|

Q2 Jun |

$6.09A |

$3.23A |

– |

$2.60E |

– |

|

Q3 Sep |

$5.74A |

$2.91E |

– |

$4.69E |

– |

|

Q4 Dec |

$6.38A |

$2.10E |

– |

$8.39E |

– |

|

Year* |

$25.93A |

$11.73E |

– |

$17.82E |

– |

|

Change |

46.6% |

(54.8)% |

– |

51.9% |

– |

Investment Thesis

Toronto, Canada based NexTech AR Solutions Corp. engages in the acquisition, development, and commercialization of augmented reality [AR] technology.

Although the Company started as an eCommerce franchise, it is now essentially focused on commercializing AR technology, thereby making it a quintessential augmented reality focused company. The Company offers several applications/platforms under the NexTech Metaverse Suite/AR umbrella:

- ARway, a Unity-based platform that uses AI to scan and recognize surroundings for 3D spatial mapping

- Map D, a virtual events platform that allows organizers to create, host, and manage live events

- ARitize Maps allows users to spatially map their location and populate it with interactive 3D objects, navigations, wayfinding, audio, etc.

- ARitize 3D for eCommerce, an end-to-end AR platform that enables users to embed a 3D model in a product page on an eCommerce website

- ARitize Swirl, a swirling (rotating) 3D item for the header page of an eCommerce website

- ARitize Social Swirl, a social media AR filter designed to promote and visualize eCommerce products

- ARitize Ads, an ad solution for captivating 3D ads

- Toggle-3D, an offering that enables the conversion of CAD files into 3D/AR models at scale

- ARitize Decorator, an offering that enables to virtually preview home furnishing and decor in a desired location

- ARitize Holograms, a human hologram creator mobile app

- ARitize CPG, an interactive AR hologram app

- ARitize Portals, an offering that transports users into new environments using AR

- ARitize Capture, an offering that allows users to create 3D AR photo realistic models from their smartphones

- ARitize Play, an offering to experience AR technology

NexTech AR Solutions Corp. & Singular Research

The Company’s applications/platforms under the NexTech Metaverse Suite/AR umbrella are uniquely suited to cater to the eCommerce market and thereby help its clients keep pace with the evolving needs of current retail end-consumers.

The Company’s eCommerce platforms include vacuumcleanermarket.com (a vacuum cleaner retailer focused on residential vacuums, supplies, and parts, which is operated through a retail location and online sales channels), infinitepetlife.com (a health food supplement for animals, which is operated through online sales channels), Trulyfesupplements.com (a health supplement online store), and nextlevelninjas.com (a platform that provides services to eCommerce vendors). While the product revenues from the eCommerce segment contributed to the initial phase of the Company’s growth, management plans to divest this business completely to exclusively focus on AR.

NexTech AR Solutions Corp. & Singular Research

The Company was incorporated in 2018, and its shares trade in Canada on the Canadian Securities Exchange under the trading symbol “NTAR” and in the U.S. on the OTCQB under the trading symbol “NEXCF.”

We initiate coverage with a Buy-Venture rating and a $1.50 price target.

A Recent Value Accretive Corporate Development: ARWay is Put On The Way

The Company has successfully spun off ARWay as a separately publicly traded company (under the ticker symbol ARWY on the CSE), hoping for a higher valuation for this niche technology. Management believes that ARWay’s next generation spatial computing platform for the real-world metaverse can drive rapid revenue growth by acquiring new customers that need innovative AR experiences and mapping solutions. The spinout will provide a stock dividend of four million shares for all NexTech shareholders on a pro-rata basis, while the Company will retain 13 million of the common shares.

We appreciate the logic of a spin-off in terms of unlocking valuation of an enterprise, even though, in our view, the capital markets remain tight at this time. If the Company can accomplish this value enhancing corporate development successfully, it will be able to unlock an additional long-term source of capital. Additionally, NexTech will be able to save about $1.2 million per year in operating expenses by spinning off ARWay. Furthermore, we believe the spin-off will help ARWay’s management to exclusively focus on the Indoor Positioning & Navigation (IPIN) segment of the AR market and thereby position itself to dominate this market. The Indoor Positioning and Navigation market is currently estimated to be around $11 billion per year and is projected to grow at a compound annual growth rate of 42%. As discussed in the following section, though the larger eCommerce market and NexTech’s addressable markets are large and growing rapidly, IPIN’s growth rate is a magnitude higher, and hence ARWay’s exclusive IPIN focus will be a strategic advantage, in our view.

ARWay’s Wayfinding applications lever visual marker tracking to offer a no-code, no hardware, no BLE beacon, spatial computing platform. For its customers, ARway’s offerings can create precise and robust navigation without any on-site hardware installation and ongoing maintenance. ARWay’s offerings are user-friendly and extremely easy to use. For example, its mobile app can help anyone quickly spatially map their location, populate it, interact with interactive 3D content, and experience augmented reality navigation. While ARWay provides pre-loaded 3D objects, the creators can also upload their OBJ/GLB files (a standardized file format used to share 3D data) to create their own 3D objects to enrich their Metaverse. Additionally, the users can publish and share their Metaverse with others to experience.

AR Technology is Key to the Rapidly Growing eCommerce Market

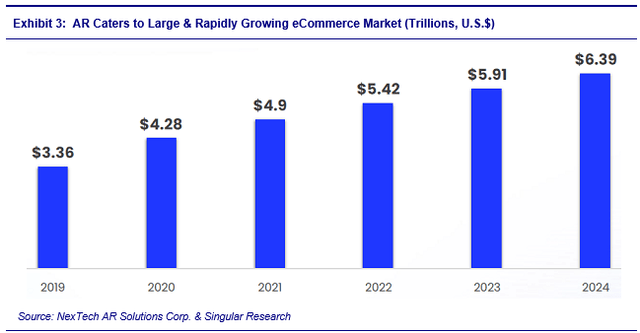

The eCommerce market has been growing rapidly and the pandemic has created even more demand by increasing market share gains from brick-and-mortar retail. With sales over $5 trillion per year globally, the eCommerce market has grown rapidly to become one of the largest markets in our economy. Nevertheless, as shown below, after growing in high double digits (around 30%) until 2020, the growth has slowed down to the mid-teens recently and is projected to settle to high-single digit growth in next five years.

NexTech AR Solutions Corp. & Singular Research

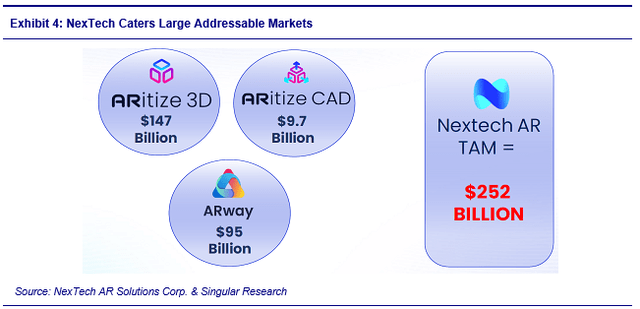

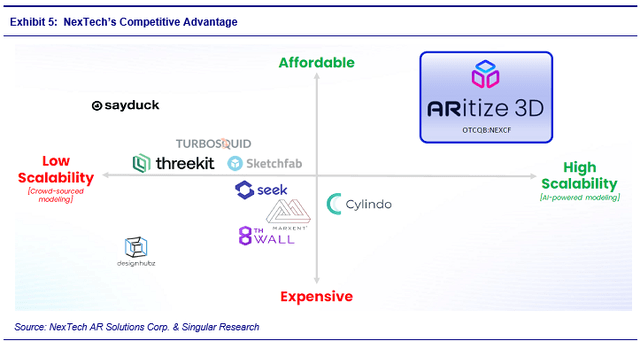

To sustain its current massive size and its continued market share gains from brick and mortar retail, eCommerce players have to rely on new technologies that enhance its offerings and support its current customers’ demands. Among technologies that cater to eCommerce players, NexTech’s AR offerings and Metaverse suite are one of the most prominent among its competitors like DesignHubz, 8th Wall, Seek, Sketchfab, Threekit, Turbosquid, Sayduct and Cylindo. AR and 3D models help customers experience “try-before-you-buy.” The demand for this virtual experience has been broad, from utility items like furniture to high-end retail luxury goods. NexTech’s offerings deliver higher Click-Through Rates, thereby increasing Conversion Rates of online shopping transactions and substantially decreasing Return Rates. Similarly, the Company’s offerings increase engagement of new customers, which is especially important for adoption and penetration of new products. Importantly, NexTech offers solutions for retailers (e.g., ARitize 3D) and manufacturers (e.g., ARitize CAD). With availability on major eCommerce platforms like Shopify, BigCommerce, and WooCommerce, the Company’s AR and 3D offerings have gained significant adoption. As shown below, we believe NexTech is becoming an important component of the $5 trillion per year eCommerce market and estimate its Total Addressable Market to be around $250 billion per year.

NexTech AR Solutions Corp. & Singular Research

NexTech’s Competitive Advantage: Lowest Cost & Highest Versatility

The Company is only one of the few publicly traded AR pure plays. NexTech’s current pure-play competitors are small private companies. On the flip side, large, mega-cap conglomerates do not seem to be interested in committing to developing Augmented Reality as an eRetail offering. Therefore, we believe the Company has the wherewithal to dominate the AR and the larger Metaverse space in terms of the eCommerce end market. As shown below, most of its competitors are small private players that rely on “crowd-sourced modeling” for their offerings, whereas NexTech’s offerings are Artificial Intelligence [AI] based. Reliance on AI, helps the Company provide offerings that are better priced than its competitors, thereby offering its eCommerce customers lower costs. Similarly, its offerings are scalable, which make them suitable for a wide range of eCommerce customers from the players that cater a niche market to the ones that offer one of the largest scales of eRetail.

NexTech AR Solutions Corp. & Singular Research

As shown below, due to its advantages in scale, pricing, and versatility, NexTech’s offerings have gained wide adoption. Currently, the Company has over 100 customers, with varying demands, differing complexity, divergent end-markets, and wide-ranging advertising budgets. With its AI enabled products, we believe NexTech is the only company that can cater to varying and evolving demands of a diverse, dynamic, and cost-conscious eCommerce clientele. Therefore, we believe, NexTech is the only company that can serve extremely divergent customer demands: as few as 100 models (which is the case for most of its customers), to about 500 models (a small minority of its customers), to over 5,000 models to its largest customers like Kohl’s and Napa Auto Parts. Apart from the differing volume of models demanded by its customers, the Company is able to cater for a differing set of complexity demanded by the customers. Therefore, we believe NexTech is positioned to gain share in the rapidly growing Augmented Reality niche of the eCommerce market.

NexTech AR Solutions Corp. & Singular Research

As shown below, due to its ingenuity and versatility, NexTech’s offerings are compatible with a variety of eCommerce platforms. While the Company has proven that its apps can easily integrate with the following platforms, we believe the versatility of NexTech’s offerings are not limited to the following vendors.

NexTech AR Solutions Corp. & Singular Research

Amazing Amazon

Q3:22 has become a milestone in the Company’s corporate journey – by landing Amazon as a customer. After a long, intrusive, and comprehensive testing, which extensively drilled NexTech in both quantitative and qualitative aspects of its offering, NexTech landed arguably the holy grail of eCommerce. Beginning in Q3:22, Amazon is expected to start contributing to the Renewable Software Licenses revenue stream. In fact, with about $200,000 in revenues as its first quarterly contribution (Q3:22), the Amazon revenue stream would add materially to the Company’s top-line and quite substantially to its bottom-line.

We believe the Amazon win has both practical and strategic value. While active contribution to the Renewable Software Licenses revenue stream helps the Company’s top-line, Amazon’s revenue also gives NexTech’s margins a much-needed boost, making its operations more profitable. Strategically, landing Amazon has provided the Company added visibility in the AR marketplace, giving its Research and Development team more experience in gainfully satisfying testing requirements of prospective customers. As shown in Exhibit 8, Amazon has 95 million subscribers in the U.S. alone, which is approximately 77% of all U.S. households, so exposure to Amazon’s customers would turbocharge NexTech’s development effort, widening the scope and complexity of its offerings. But even more importantly, Amazon has opened the Company’s offering to vendors and merchants that use Amazon’s platform. In the illustration below, Amazon has 1.5 million active sellers, several fold more registered sellers – all of which are potential NexTech future customers. Most importantly, we believe, the Company can ride this Amazon win to make its presence felt beyond Amazon’s ecosystem and into the broader eCommerce arena.

Partly from the Amazon revenue stream, we project the Renewable Software Licenses segment to grow very strongly – over four times in 2023, as shown in the Revenue & COGS Exhibit on page twelve.

NexTech AR Solutions Corp. & Singular Research

Financials

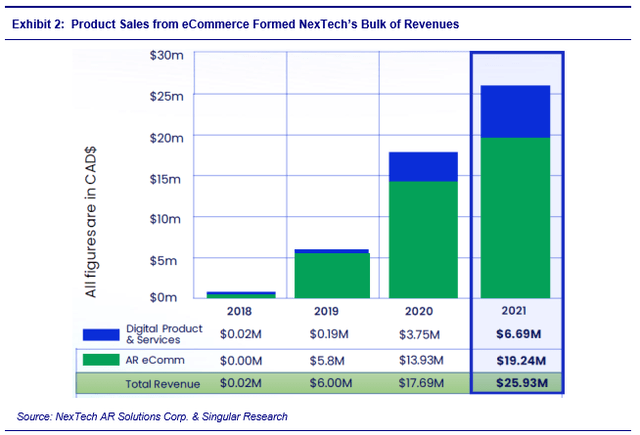

As shown in Exhibit 2, the Company was built on eCommerce-based Product revenues, going from nothing (in 2018) to $19.2 million in FY:21. However, as shown in the Revenue & COGS Exhibit on page twelve, this revenue stream has been declining precipitously since Q1:21, partly due to global supply-chain issues and partly due to the mellowing of Pandemic induced eCommerce tailwinds. After declining 50% in FY:22, we project that the Company will be practically out of this segment by the end of FY:23 (as management has decided to exit this segment).

Meanwhile, the Renewable Software Licenses segment will grow by leaps and bounds. Partly due to reclassification of revenues from the Technology Services segment but mostly due to new customer acquisitions – most prominently Amazon. After growing a robust 149% in FY:22, we project this revenue stream to accelerate to 393% growth in FY:23.

As a result of swapping eCommerce Product revenues for Renewable Software Licenses revenues, the Company’s business model will exhibit a sea change. Its gross margins will swell, from 38% in FY:21 to 47% in FY:22, and by the end of FY:23 to 61%. With the spin-off of ARWay, as discussed in the next section, Research and Development expenses will decrease. Similarly, the Company will enjoy some leverage in SG&A, as the top-line starts to pick up in Q3:23. We model the Company’s Sales and Marketing expense (as a % of Revenues) to decrease from 65% in 2021 to 57% in 2022 and 30% in 2023. Additionally, we expect the Company to enjoy some leverage on Research and Development costs.

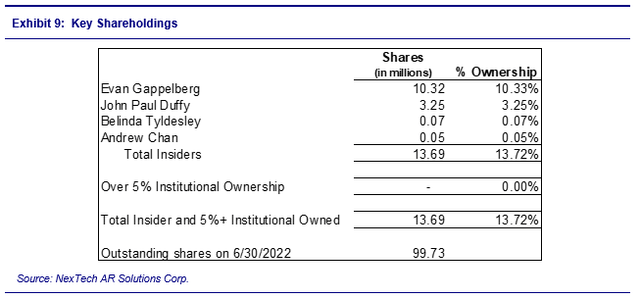

Management and Shareholders

The Company is led by CEO and Co-Founder Evan Gappelberg. Mr. Gappelberg is a serial entrepreneur who has created, financed, and operated several start-ups. His entrepreneurial ventures include EG Products, a company that created the first LED light-up toy and commercialized this product broadly leading to adoption by prominent customers like Disney and Universal Studios and placement with major retail channels like Macy’s and Walgreens. Additionally, he played an instrumental role in taking Take-Two Interactive Software, Inc. (a leader in the Electronic Gaming and Multimedia industry) public and making it a successful enterprise. He also has had a prominent Wall Street tenure that included investment banking experience (bringing several technology companies to market) and investment management tenure (managing a hedge fund).

NexTech AR Solutions Corp.

Investment Risks

- The Company’s transition to a services-based business model (essentially based on the rapid growth of the Renewable Software Licenses segment) and away from its current eCommerce Products based business model could face operational hurdles.

- Though AR is gaining momentum, its usage is still with the early adopters, so it is hard to predict the rate of penetration of this technology among the broader eCommerce customer base.

- Some of the Company’s customers are large mega-cap public companies with multi-million dollar budgets and Information Technology specialists who could internally develop and source NexTech’s offerings.

- As pandemic-related social-distancing requirements have mellowed, businesses have returned to normal operations and customers are shopping at brick and mortar retail, thereby decelerating the demand for virtual products and capabilities. The disappearance of pandemic-related tailwinds has adversely affected eCommerce companies’ top-line growth momentum, which is also reflected in their compressed valuation. We believe this phenomenon will adversely affect the eCommerce industry in the near-term.

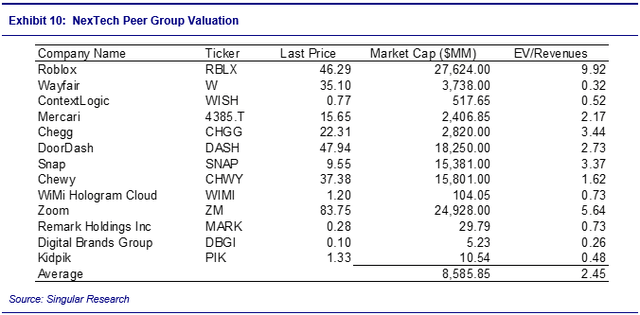

Valuation

We value NexTech using a revenue multiple analysis method. As discussed earlier, all of NexTech’s direct competitors in the AR space are private companies. Therefore, for the sake of valuation we have assembled a group of public companies that are either involved in AR or have exposure to Metaverse technology. Most of these companies utilize AR/metaverse technology to serve Internet Retail end markets, but some also serve Conferencing and Electronic Gaming industries. As shown below, the multiples of most of the peer group are depressed partly due to the current interest rate/macro-economic environment and partly due to revenue headwinds (and difficult comps) these companies are facing from the post-pandemic stimulated revenue surge. Nevertheless, NexTech’s case is different as the Company is exiting the eCommerce Product based business and entering the service-only and differentiated AR and Metaverse space. As shown in the Revenue and COGS Exhibit, we project the Company’s Renewable Software Licenses segment to grow by almost 400% in 2023 and essentially account for almost 100% of NexTech’s revenues. Most of the comparable companies are not experiencing such a surge in top and bottom-line growth. Moreover, the Company has spun off ARWay as a separately publicly traded company, which could be substantially value accretive for NexTech. Therefore, we ascribe NexTech an EV/Revenue multiple of 9.50x (its 2023 revenues), almost a 300% premium to the 2.45x average for the group of companies, as shown below. Based on a 9.50x EV/Revenue multiple, we value NexTech at $1.50 per share, which represents a 146% appreciation potential to the stock’s current price.

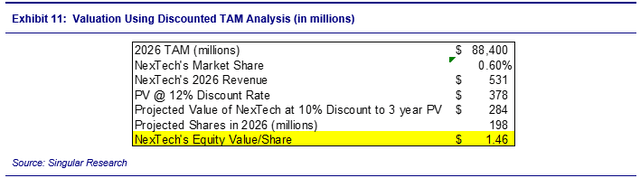

Singular Research

As an alternative valuation methodology, we attempted to value NexTech using a total addressable market [TAM] analysis. According to Markets & Markets Research Pvt Ltd, the Augmented Reality Market was valued at U.S.$23 billion in 2021 and is expected to reach U.S.$88 billion by 2026, witnessing a CAGR of 31%. We project NexTech to be just 0.05% of this market in 2023. However, we project NexTech to grow much faster than the market from 2023 onwards. If we assume the Company attains a modest 0.6% share of the TAM in 2026, its revenues will amount to $531 million. Discounting this figure back to 2023 (3 years), with a 12% WACC, we project that the present value of NexTech’s potential 2026 revenue to be $378 million. Discounting this value at 10% to reflect NexTech’s challenging odds of realizing this level of revenues provides a projected value for the Company of $284 million. Dividing this figure by our projected outstanding shares at the end of FY:26 yields a per share value today of $1.46 per share. We believe using FY:26 projected year-end shares outstanding is a conservative valuation approach that accounts for the expected growth in outstanding shares.

Singular Research

Be the first to comment