Sezeryadigar/E+ via Getty Images

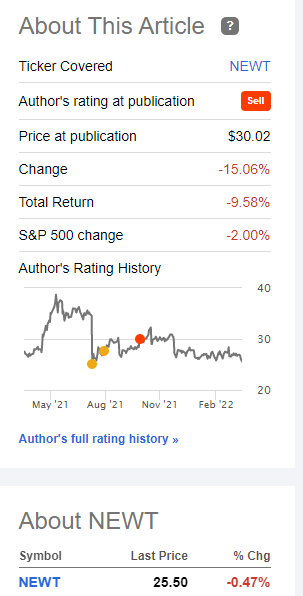

When we last covered Newtek (NASDAQ:NEWT) we played the traditional role of the wet blanket. In our piece, we told people that it was a good point to actually exit this Business Development Corporation or BDC. We felt things were stretched valuation wise and this was a “dead-cat-bounce” post the initial downdraft. We added,

We also have no idea what the dividend will be and we think that the maximum you will get is a $1.50 annualized once the transaction closes. The minimum will be closer to a $1.00 and investors might be “shocked” despite this being about the most well-telegraphed cut of all time. Whether you are looking for a BDC or a regional bank, there are better choices from a valuation standpoint. We would look to get more constructive on NEWT if it moves to $25.00.

Source: A Good Point To Exit

We look at where we stand on that call today and give you three reasons that we are upgrading this.

1) Target Acquired

NEWT’s business continued as usual while it waited to finalize its announced acquisition of National Bank of New York City. There is a lot of uncertainty around that deal. This extends from whether it will be approved, when it will be approved, and what the final form of the combined companies will be like. There is a lot more detail on this in the Q4-2021 conference call transcript and investors should definitely read that in its entirety.

In the interim NEWT continued to deliver excellent results that exceeded our expectations. Alongside all of this, NEWT actually came very close to our target of $25.00 by dropping 15.06% from the last article.

Returns Since Last Article (A Good Point To Exit)

2) Improving Outlook

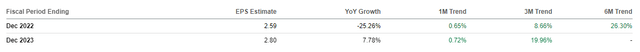

A big factor that drives stock performance is the change in earnings estimates. NEWT’s sell rating also had a fair bit of modeling built in on earnings for 2022 and 2023. Here, this has become an incredibly strong headwind to stay bearish. Both estimates for 2022 and 2023 have risen sharply.

NEWT Earnings Estimates (Seeking Alpha)

There is of course a good deal of uncertainty here as we have a clouded economic outlook coupled with extremely unclear timelines for the acquisition mentioned above. Nonetheless, NEWT’s long history of beating estimates makes us cautious to press our luck with the negative call. NEWT also guided for a dividend cut that was less onerous than we thought.

3) Valuation

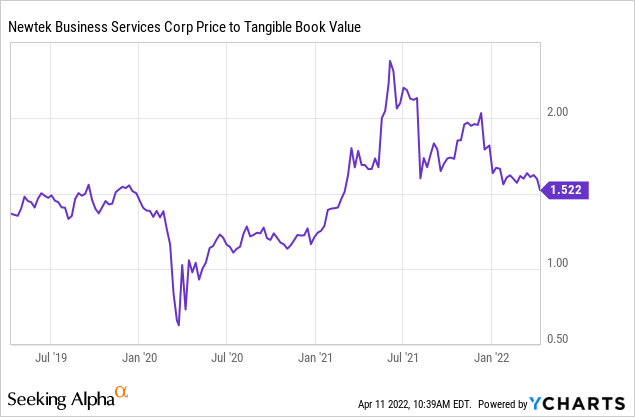

NEWT’s valuation has always been a challenging one to get behind. While it was structured as a BDC, the income was less subject to defaults and restructuring. Nonetheless, we felt that the upper end of what any sane investor should pay, should be 1.5x tangible book value.

We have got there again. At this point we can dial down the bearish rhetoric.

Outlook & Verdict

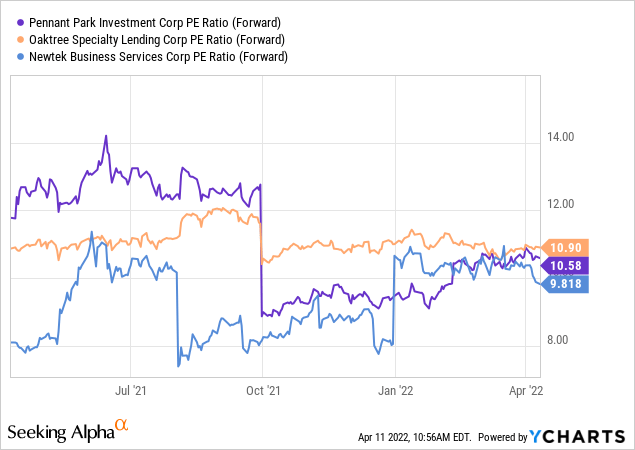

NEWT has delivered an outstanding total return as a BDC over the last few years. That excludes those though that went “all-in” at the peak when it was trading at 2.5X tangible book value. We see no problems with NEWT delivering 12-15% return on tangible equity over the next few years and that gets us to about $2.00 to $2.40 in earnings. So you can take that number and say the stock is cheap. In the financial sector though and especially among BDCs, most are trading at or around that valuation. We have shown a couple below alongside NEWT.

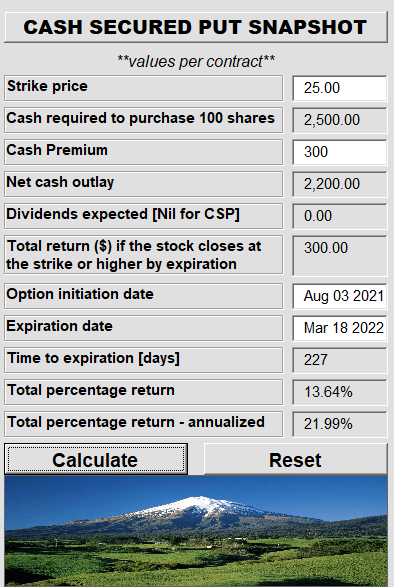

NEWT also has the murkiness associated with its acquisition and the future of the dividend policy. Most regional banks are now trading cheaper on price to tangible book and earnings compared to NEWT, so NEWT could catch up on the downside if the dividend policy disappoints. If we had to trade it on the long side today, we would suggest the same route we did last time. Back then we went with the $25 Cash Secured Puts, a choice we might add that handily outperformed a “buy and hold” strategy.

NEWT Suggested Cash Secured Put (Previous Article)

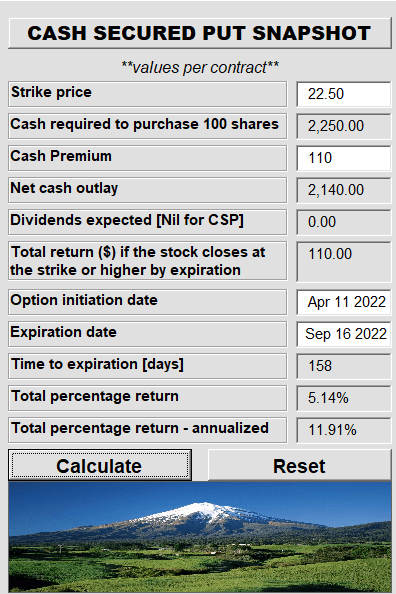

Today, we would look a little lower and go with the September $22.50 Cash Secured Puts. In this economic climate, we would want an additional margin of safety and hence we would navigate to a more defensive posture. You can get a 12% annualized yield here with a 12% cushion before you even start taking a loss on your position.

NEWT September Cash Secured Put (Author’s App)

That’s a win-win situation for us.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment