booblik_uk/iStock via Getty Images

Co-produced with Treading Softly

The Russian-Ukrainian war continues to drag on into yet another calendar month. As it continues to be waged, we are also seeing a broader economic war being waged by the West against Russia. So far the goal of crippling the Russian economy heavily to stop its efforts in Ukraine has not brought the expected success.

It also has had impacts here at home. Europeans and Americans are seeing higher prices due to sanctions and the reduction in available resources. This means more money is chasing fewer goods. This is, in essence, the building block for inflation.

The Federal Reserve is finally raising rates to try to slow the movement of money and help combat inflation as it continues to ravage the wallets of the average American. Yet it seems entirely too little too late. Inflation is already embedded, and inflationary pressures from external sources like commodity prices rising are unlikely to be impacted by 0.25% or even 0.5% rate hikes.

So what can you do? Today, I want to give you a two-step game plan to help your portfolio be prepared to survive and thrive in the current environment. To do so, we need to invest counter-intuitively in fixed income as well as invest in commodities that win when inflation is out of control.

Let’s dive in.

Pick #1: BGR – Yield 4.4%

Energy is off to a big start in 2022. Prices were already going up for various commodities and the conflict in Ukraine only added to it. A lot of people are looking at the sector and seeing prices rallying and wondering if they are “too late”. After all, eventually, the Ukrainian conflict will be resolved for better or worse, energy production will pick up and prices will calm down.

Of course, all of that could very well take years. Energy is flush with cash right now, and we have seen energy companies taking a very sober approach to higher prices. They are not leveraging up like crazy and rushing to invest billions. Instead, they are expanding slowly and cautiously, this isn’t great for those paying at the pump, but is fantastic for the sector. With this kind of cautious expansion, we could see elevated energy prices for several years.

BlackRock Energy and Resources Trust (BGR) is a CEF that provides immediate diversification in the energy space. Its holdings include some of the largest names in oil and gas such as Exxon Mobil (XOM), BP (BP), Chevron (CVX), Total (TTE), and ConocoPhillips (COP), among others.

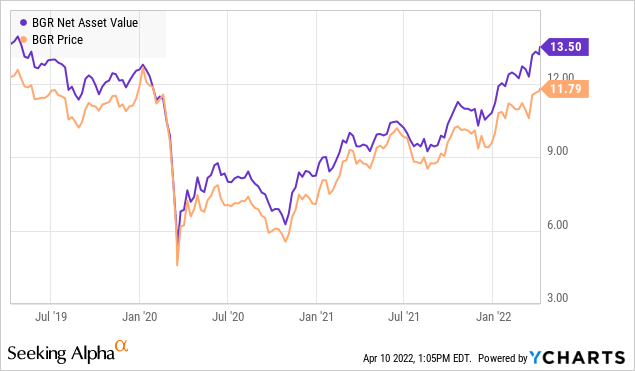

BGR is currently trading at an 11% discount to NAV, providing an opportunity to gain exposure to these companies at a discount. BGR recently hiked its dividend by 17% to $0.044/month and there is potential for more dividend hikes ahead. BGR’s NAV has fully recovered from the COVID collapse.

Before COVID, BGR’s dividend was $0.0766/month. With CEFs, it is very common for them to look to recover NAV before working on raising the dividend back up. The reason is, that the retained cash flow helps build NAV up more quickly. BGR’s last dividend raise indicates that it is happy with NAV recovering and is now willing to turn its attention back to the dividend. Add in that many of their holdings are likely to start hiking dividends more aggressively with oil prices being high, which will improve cash flow to BGR.

Over the coming year, we can expect BGR’s NAV to continue rising, its dividend to be raised and it is likely that the discount to NAV will diminish as well. This all adds up to a CEF that is an attractive “dividend growth” option with exposure to a sector we expect to remain very strong throughout the year.

Pick #2: PTY – Yield 9.5%

Going into the Federal Reserve’s meeting, fixed-income investments became oversold. Investors were selling bonds simply because rates were rising with no further thought or assessment of what fair value was. We argued that opportunities like PIMCO funds had sold off well more than was justified by a 0.25% raise, and the likely rate hike schedule the Fed would follow this year.

Sure enough, as soon as the Federal Reserve actually raised rates, PIMCO Corporate & Income Opportunity Fund (PTY) went from being down 16% year to date and rallied to close the quarter down only about 4%, which is the same amount as the S&P 500.

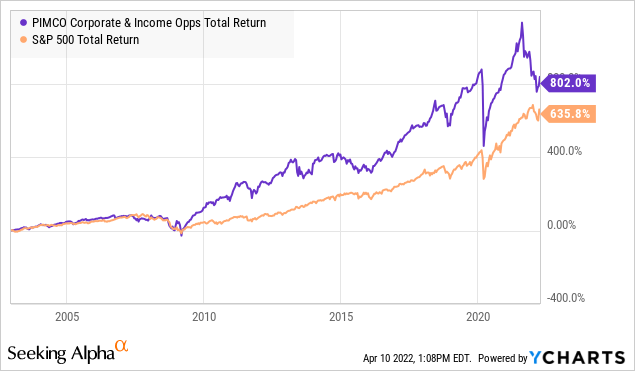

I’ve held and added to PTY for decades. Why? Because it is the best bond fund of all time. PIMCO is the best bond fund manager I’ve seen in my lifetime, and PTY is PIMCO’s single best-performing bond fund. This is a bond fund that has outperformed the S&P 500 during a time in history when the S&P performed above its average. Let me repeat that, a bond fund that has outperformed equities when equities have done quite well.

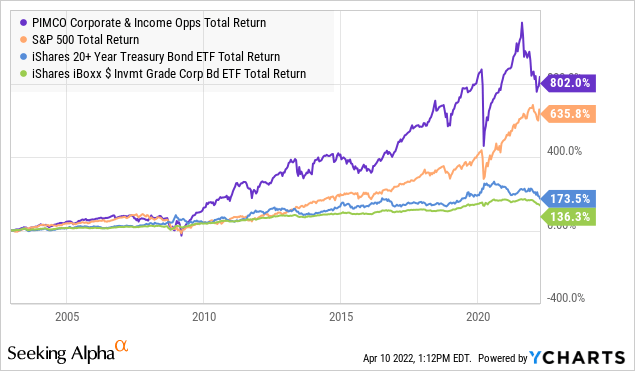

The wizards of smart will tell you that isn’t supposed to happen. Bond funds aren’t supposed to outperform equities. Here is a look at the same chart with some bond funds mixed in:

See those lines at the bottom? That’s how “bonds” are expected to perform. Now some gurus will tell you that you shouldn’t waste time with bonds in a rising rate environment and that you should put all your eggs into the equity basket.

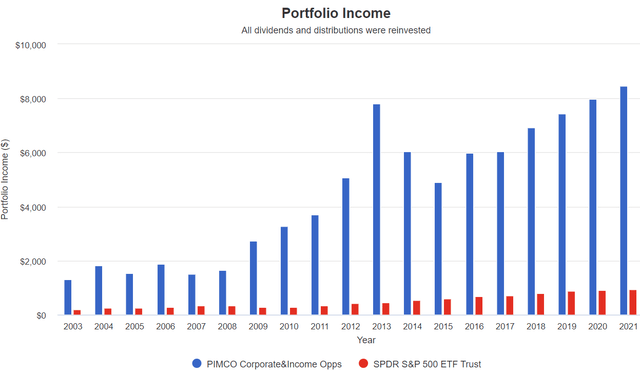

In the short term, these gurus are often right. As I said, I’ve held PTY since before the Great Financial Crisis. I’ve bought shares routinely. As dividends come into my account, PTY has been one of my top choices. Some of those buys looked genius when two weeks later the price surged up. In other buys, the price fell, sometimes dramatically shortly after I bought it. The gurus gleefully pointed and laughed. I just collected my dividends and bought a little more.

Today, I can’t really differentiate that much between my various tax lots. Some were at better prices than others, but over the years, time has passed and compounding has worked its magic. In the long-run PTY has outperformed, while most importantly providing me with an ample supply of recurring monthly dividends.

When the price drops, I buy. There is no reason to sell because my returns come as dividends, which grow and pile up over the years.

History suggests that the price of PTY is probably going to go up over the next year. I hope that it doesn’t because I plan on buying more. Whatever the price does, higher interest rates means higher income for PTY, and that means higher dividends for me.

Conclusion

With the war and sanctions driving inflation higher, BGR is set to be a big winner on a total return basis. Its yield remains lower than our normal target yields within the High Dividend Opportunities Model Portfolio; however, its ability to benefit from inflation and rising commodity prices has helped provide strength to our portfolio while producing a growing income. With commodities likely to remain high, we can expect more dividend hikes in the next few years.

PTY is managed by the best of the best in the fixed income space. We have shown how it out-performs in rising rate environments. You should always maintain exposure to fixed-income, and PIMCO has proven to be the most reliable manager in the space. Consistently beating equity returns over the long run. So when the market panics and throws out the fixed-income baby with the bathwater, I buy.

These moves can help your portfolio survive and thrive in the current paradigm we are living in. As income investors or retirees, we need to keep our eyes on the horizon, so we can adjust for the coming storms, while also keeping our eyes affixed on our field of income, so we can tend to current needs and issues. This two-part focus is part of how we created our unique Income Method, it has helpful guidelines and rules to make this as easy as possible.

Today, we have shared two opportunities to keep your portfolio growing and your income flowing. Your retirement is at stake with each choice you make. Make the best choices possible and enjoy your hard-earned income and hard-earned retirement!

Be the first to comment