Joe Raedle/Getty Images News

Why has Nike stock been dropping?

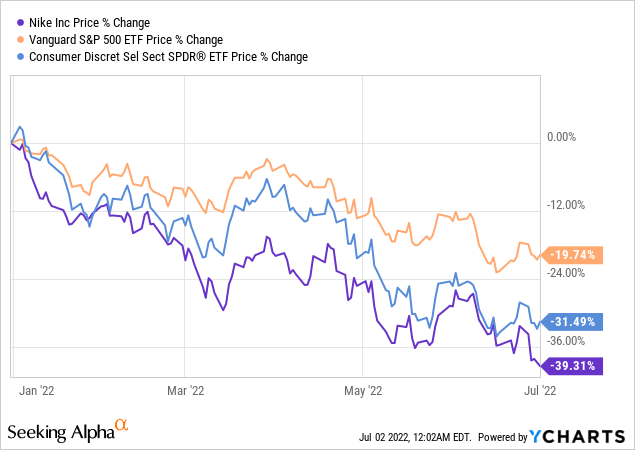

Year-to-date, NIKE, Inc. (NYSE:NKE) has fallen by almost 40%, a significantly larger drop than both the S&P 500 (VOO) and the Consumer Discretionary ETF (XLY) it belongs to.

Weakness in Greater China

For many years, China has been one of Nike’s growth engines. With the exception of Apple (AAPL), there have not been many others like Nike (see 2019 article, “Nike: A Rare China Success Story that can Last”). In their article, Urbem Capital very clearly laid out the growth story of Nike in China until FY19.

| Nike China’s Revenue Growth | Nike’s (ex-China) Revenue Growth | Nike China’s Share of Total Revenue | |

| FY2019 | 21% | 5.3% | 15.9% |

| FY2018 | 21% | 3.8% | 14.1% |

| FY2017 | 12% | 5.3% | 12.3% |

| FY2016 | 23% | 3.8% | 11.7% |

| FY2015 | 18% | 9.3% | 10% |

| FY2014 | 5% | 10.3% | 9.4% |

At that point, the future looked bright for Nike in China where a growing middle class population who began to prioritise a healthy lifestyle should provide a multi-year tailwind for the company. That thesis continued to play out in FY20 and FY21 with Greater China seeing faster revenue growth than Total Nike, 8% (compared to -4%) and 24% (compared to 19%) respectively.

The growth story turned in FY22, with growth slowing to 1% in Q1 and in the recent Q4 earnings, growth was -20%. From the recent Q4 earnings call:

Revenue declined 20% on a currency-neutral basis, and EBIT declined 55% on a reported basis. This follows the region’s most widespread COVID disruption since 2020, impacting over 100 cities and over 60% of our business.

This implies that Nike’s weakness in China is a result of the recent COVID induced lockdowns and restrictions, but that is not the whole story. Simply put, the local sports companies have been taking share at a rapid pace from Nike and Adidas as Chinese consumer preferences have shifted to supporting its own local giants. Anta saw revenue growth rise by 39% while Li Ning saw growth of 56% in 2021. (Source: Jing Daily) According to China-Britain Business Focus, domestic brands (such as Anta) have benefited from:

- Increasing preference (particularly young Chinese consumers) for local brands;

- More control of factories and stores (unlike Nike and other Western companies who use OEMs), being more agile allows them to bring a product to market in half the time;

- Increased quality of local brands, eliminating one of Nike’s biggest selling points.

As such, even with the relaxation of China’s lockdowns, it is unlikely we see Nike return to > 20% growth or even double-digit growth. After all, Nike’s Chinese rivals have continued to grow even through the lockdowns.

Recession fears in the US

Just half a year ago, Nike US’s growth made up for its Chinese weakness (see the Dec 21 Bloomberg article, Nike Gains as Growth in U.S. Helps Overcome China Collapse). However, in the recent quarter, US strength has faded, as revenue declined 5% and EBIT declined 18%. US should continue to be weak for Nike in the short term as it laps periods of strength amidst falling consumer confidence and growing fears of a recession. With North America and Greater China making up 60% of Nike’s revenues, Nike will continue to face headwinds.

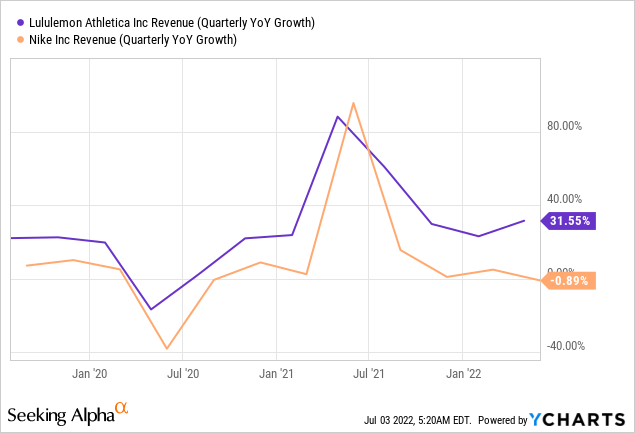

This is exacerbated by Nike’s broad customer base as compared to brands more focused on richer customers (e.g. Lululemon and Louis Vuitton) which have seen revenue growth continue to remain at elevated levels despite recession fears.

Bright-spots: DTC & Digital strategy paying off with higher gross margins, higher frequency of purchase & higher spend

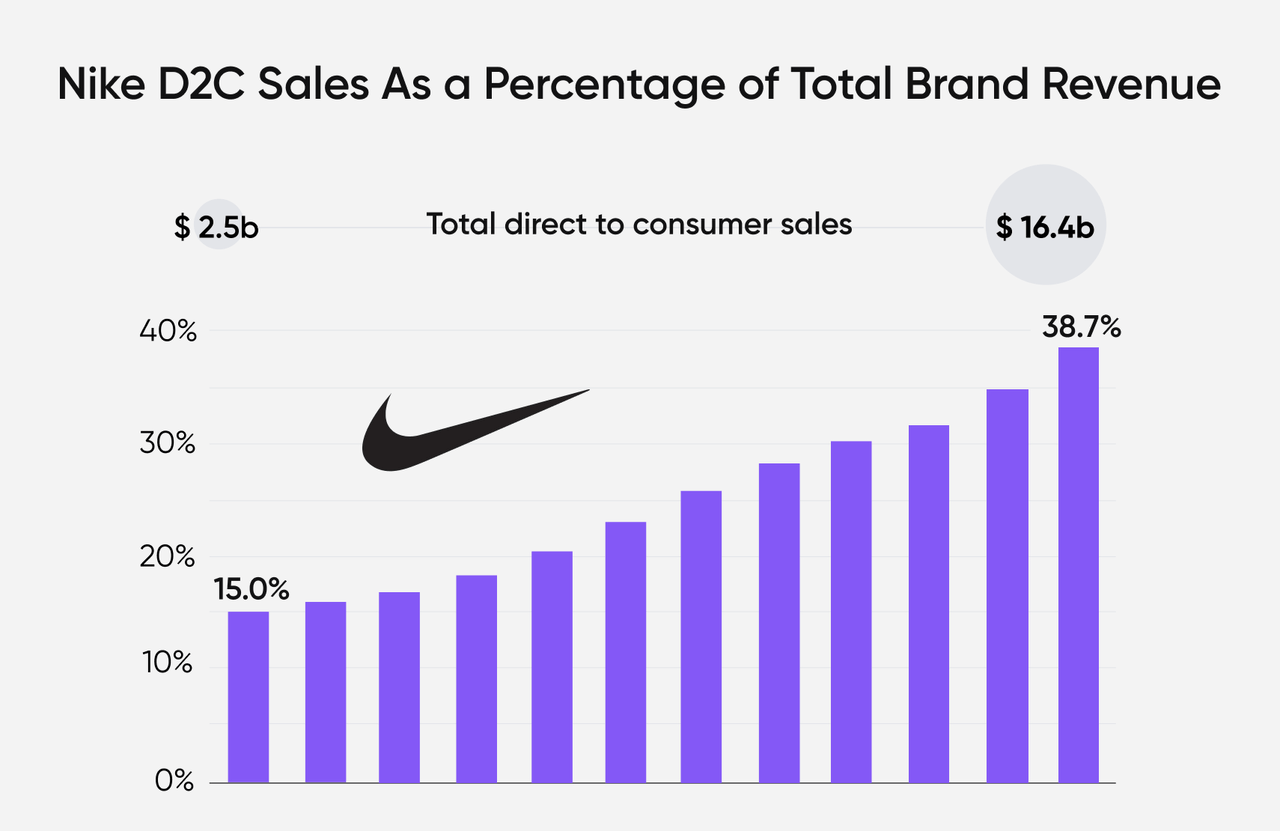

In 2017, Nike announced its Consumer Direct Offense (CDO) strategy shifting away from wholesale distributions (e.g. selling through partners such as Amazon) to ‘Direct to Consumer’ – DTC. This should allow Nike to maintain its relationship with consumers thus keeping control of the all important customer data information as well as the customer experience. Most importantly, this should result in higher gross margins.

Nike’s DTC strategy (i.e. NIKE Direct) has largely played out, as DTC share has increased to 38.7%, as it has cut off about 50% of wholesale distribution partners, e.g. Amazon and Zappos. (Source: Retail Touch Points)

Nike DTC Revenue (Fabric Inc)

Another key aspect of its DTC push is its emphasis on digital channels which should “create a much faster pipeline to better serve Nike’s customers personally, and at scale”. (Source: Fabric) Its goal was to achieve 30% digital share by 2023 but has already achieved that in 2021. According to John Donahoe, Nike CEO, “a consumer who connects with us on two or more platforms (e.g. Nike’s multiple apps such as SNKRS, Training Club, Run Club and flagship Nike app) has a lifetime value that’s four times higher than those who don’t.”

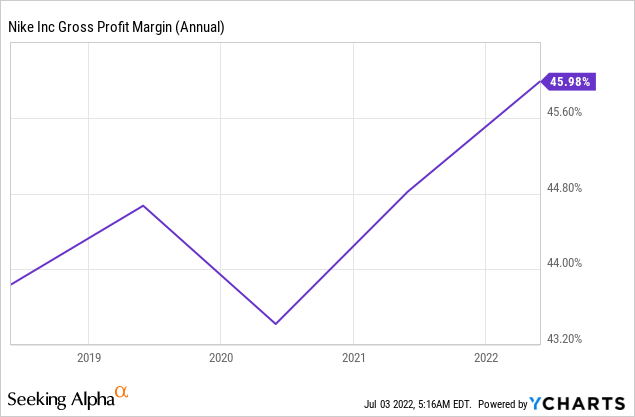

Nike’s success thus far with its Direct and Digital strategy has thus far translated into gross margin expansion, with gross profit margin hitting a 5-year high. This has thus far allowed Nike to offset supply side gross margin pressures from China and elevated ocean freight costs.

…Expanding margins that we saw both in NIKE Direct, in NIKE Digital and a higher full price selling mix overall, our gross margins would have expanded over 100 basis points in the fourth quarter … Since the year ’20, our gross margins are up over 260 basis points, and that includes in fiscal year ’22 a 100 basis point headwind from elevated ocean freight costs.

The low-hanging fruit/benefits from the DTC and Digital strategy appears to have been fully plucked, translating into higher margins, higher frequency of orders and higher average order values (AOV). Nike has implicitly agreed, with CEO John Donahoe’s 2020 strategy update – Consumer Direct Acceleration (CDA) as the “digitally empowered phase of our Consumer Direct strategy”, and aims to create “a clear and connected digital marketplace … more closely aligned with what consumers want and need”. This refers to Nike trying to engage consumers through non-traditional digital channels such as via Nike Virtual Studios, which creates Web3/Crypto products and experiences and Nikeland, the virtual world on Roblox which has been visited by 6.7 million players since its Nov 2021 launch.

These are important long-term strategies to meet potential customers where they are and increased engagement should eventually translate into revenue and profits. However, the key word here is long term and continued investments in this area should actually be a headwind to margin expansion.

Conclusion: Wait and see

While Nike continues to do well in certain areas of the world – double-digit currency neutral growth across Korea, Mexico, Southeast Asia and India and Japan, its major growth engines (US and China) have stalled and are unlikely to resume to growth soon. The lack of short-term catalysts is made worse in that I believe its DTC and Digital strategy have reached a (at least short term) plateau. As such, I would employ a ‘wait and see’ strategy towards Nike, see when China and the US return to growth and will there be continued gross margin expansion, etc, rather than catch a falling knife.

Be the first to comment