kmatija/iStock via Getty Images

Co-produced by Austin Rogers

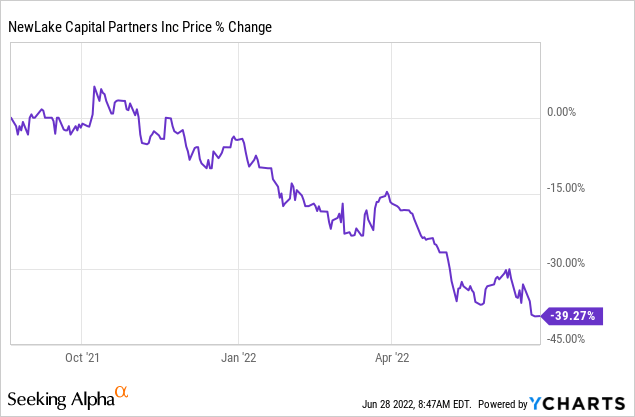

Since triple-net lease cannabis REIT NewLake Capital Partners, Inc. (NLCP) completed its initial public offering in August 2021, the OTC-traded stock has shed one-third of its value.

There are a few points to note about this big drop in NLCP’s share price.

- NLCP apparently IPO’d at a good time. The company raised a little over $100 million in August 2021 by selling 3.9 million shares at a price of $26 per share. If NLCP had waited, it probably would have raised less money at a lower stock price, so the timing appears to have actually been quite good for the IPO.

- The further the price drops, the higher NLCP’s cost of equity goes. Since the REIT does not have an at-the-market equity issuance program, it would need to work with an investment bank to perform equity issuance in big tranches. After such a big loss since the IPO, there is at least a strong psychological hesitancy about securing such an equity issuance deal.

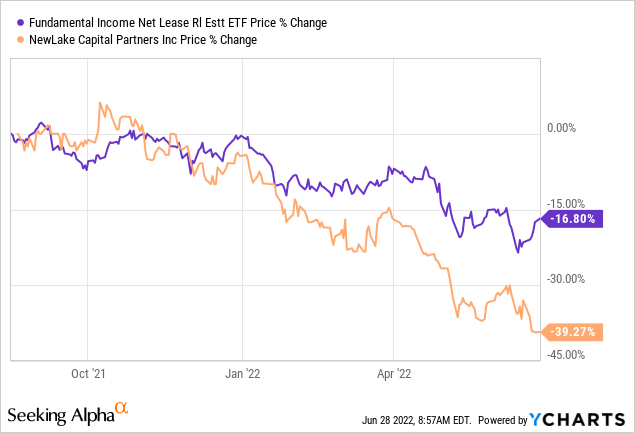

- All net lease REITs have sold off since August 2021. Since NLCP is both a small-cap (~$395 million market cap) stock and only traded over-the-counter, it is not surprising to see it sell off more severely than the average for net lease REITs.

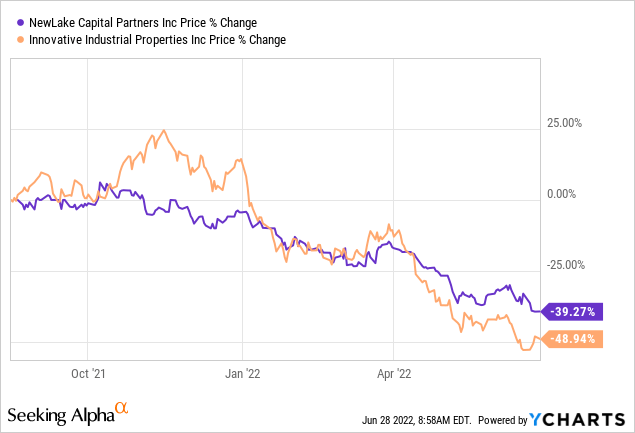

Despite how painful NLCP’s share price decline has been for shareholders, the selloff has actually been worse for its NYSE-listed peer, Innovative Industrial Properties (IIPR) since August 2021.

There are three basic reasons why NLCP’s stock price has dropped so severely since its IPO:

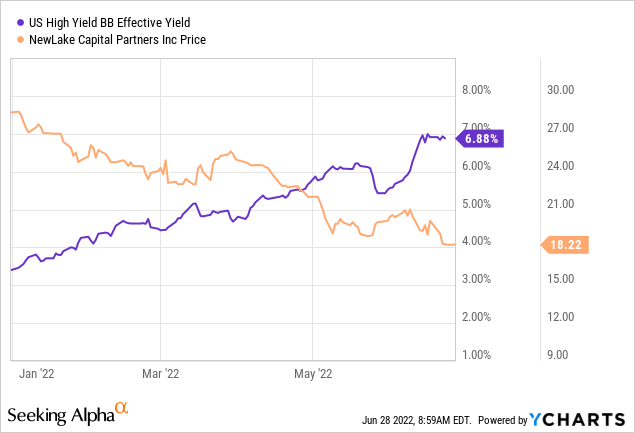

First, interest rates have nearly doubled from where they were when NLCP IPO’d. If NLCP were to raise debt, it would be priced at a sub-investment grade credit level. Thus, it is no surprise that NLCP’s stock price has moved in an almost mirror opposite pattern as the effective yield on BB-rated bonds.

Second, there have been elevated discussions in the U.S. Congress about marijuana legalization or liberalization in the last year or so.

In the past, we have warned not to take too seriously the bills that pass the House of Representatives, because the Senate is deeply divided on marijuana policy and unlikely to come up with 60 votes to pass any related legislation anytime soon. Democratic Senate Majority Leader Chuck Schumer stated recently that he is in discussions with Senate Republicans to pass a bill, but the fact that Schumer is not planning to introduce such a bill to the floor until August signals that he is not optimistic about it passing before the November 2022 election.

The problem, as we have said before, is that Democrats want to include social justice measures into marijuana legislation, while Republicans want a much simpler bill that excludes these social justice measures. Republicans refuse to vote for an expansive bill, while Democrats refuse to vote for a pared-down bill.

However, there has been increased momentum to pass the SAFE Banking Act before the midterm elections. Why? Well, federally insured financial institutions are discouraged from doing business with cannabis companies since they engage in the sale of a product that is still federally listed as a “schedule 1” drug on par with heroin, ecstasy, and meth.

That means cannabis dispensaries are unable to take payment from credit cards, which are issued by federally insured institutions. As such, they are cash businesses that typically hold a tremendous amount of cash in stores, making them a target for thieves. Recently, robberies of cannabis dispensaries have escalated, leading to multiple shootings at these stores.

In the wake of this rise in armed robberies, both state governments and banking industry executives have strenuously lobbied Congress to pass the SAFE Banking Act.

Cannabis crime wave boosts banking prospects on Capitol Hill (AP Photo / Carlos Osorio)

This proposed bill, which has already passed six times in the House of Representatives, would open the door to federally insured financial institutions, allowing cannabis operators to expand borrowing from banks and dispensaries to accept credit cards as payment for products.

Republican Senator Steve Daines says that there are enough votes to pass the SAFE Banking Act this year if Senate leaders decide to put it to a vote.

With such extreme political polarization in the Senate, however, there remains a significant chance that lawmakers are unable to agree on the bill in its final form. As more Republicans are coming around to it, some progressive Democrats are vowing not to vote for it without social justice measures, which Republicans likely won’t be willing to support.

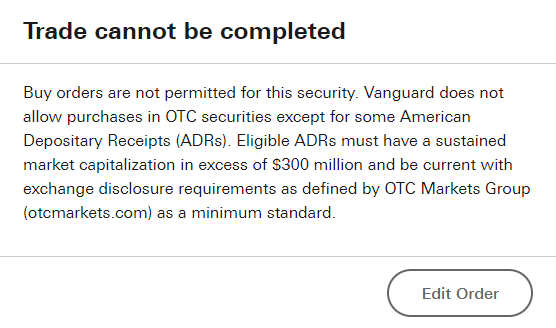

The third reason why NLCP’s stock price has performed so poorly is that investment brokerage houses have increasingly restricted trading in the name. This is true of some of the biggest brokerage firms, in terms of retail investor assets under management.

I (Austin) have made multiple limit order purchases of NLCP stock in the past, but recently, when I have tried to put in a buy order in my Vanguard account, this message appears:

Vanguard prevents trading NLCP (Vanguard )

Undoubtedly, the inability of many retail investors to buy NLCP in their brokerage accounts decreases demand for the stock, which diminishes the number of potential buyers on dips.

With all of the above said, we remain bullish on NLCP, for multiple reasons:

- We believe interest rates as well as inflation (as measured by the CPI) are near a peak and should begin falling soon.

- We actually believe the passage of the SAFE Banking Act would be good for NLCP, because it would improve the health of its tenants and make the NYSE or Nasdaq more likely to allow the stock to uplist onto one of their exchanges. Uplisting would open the door to a wave of new stock buyers.

- Two-thirds or more of the American public support legalization of marijuana at the federal level, which means that the SAFE Banking Act will likely pass and be signed into law eventually.

- NLCP is extraordinarily cheap: 10.0x FFO, based on analysts’ consensus FFO per share forecast of $1.77 for 2022, for a company with near double-digit annual growth prospects. Eventually, we believe that the company will reprice at 16-22x FFO, unlocking 50-100% upside from today’s share price.

- NLCP pays you to wait: The current dividend yield is nearly 8% and it is well covered and set for rapid growth.

If interest rates keep rising and legislation remains unchanged, NLCP’s stock price may continue to slide. But we are not market timers, nor are we Washington D.C. insiders. We do not know for certain what interest rates will do, nor what the US government will do.

What we can do is perform a bottom-up analysis of NLCP to assess the company’s quality and growth potential, to which we turn now.

NewLake Capital: Top Cannabis REIT of the Future

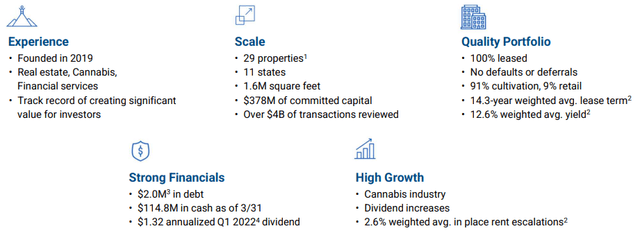

Founded in 2019, NLCP has quickly scaled up from zero to 29 properties. The portfolio was acquired at a high weighted average yield of 12.6% and boasts a long, 14-year weighted average lease term. On top of that, leases are structured to have 2.6% annual rent escalations.

NewLake Capital business model (NewLake Capital)

Though NLCP has deployed some of its cash since the above image was created, the REIT still has almost $100 million available to deploy, very little debt, and a recently secured five-year credit facility of $30 million with a 5.65% interest rate locked in for three years.

Most of the portfolio’s rent comes from cultivation facilities, which are huge industrial properties with highly specialized and expensive interior buildouts. A little over 10% of rent comes from retail dispensaries, which could theoretically be re-leased to a non-cannabis tenant fairly easily if need be.

Cultivation facility owned by NLCP:

Cannabis cultivation facility (NewLake Capital)

Retail dispensary owned by NLCP:

Retail dispensary (NewLake Capital)

The benefit of cannabis cultivation real estate is its mission-criticality, while the benefit of dispensary real estate is its fungibility.

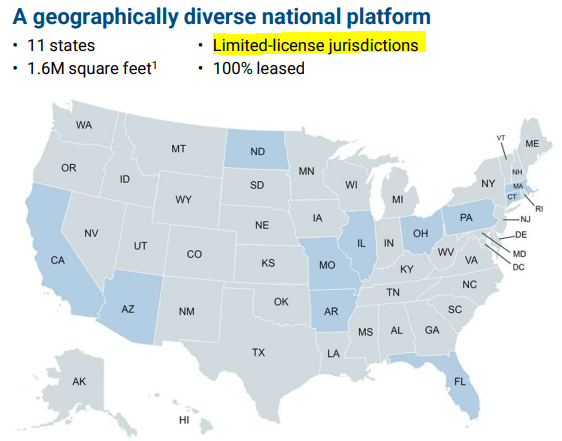

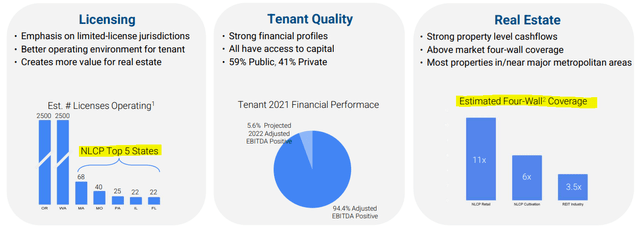

One of the primary strengths of NLCP’s curated portfolio of properties is its particular geographic concentration. Among the states that have legalized marijuana, there is a great disparity in the number of licenses issued to cannabis operators. NLCP focuses on states that have issued a limited number of licenses so as to ease the level of competition their tenants face.

NewLake Capital focuses on limited license jurisdictions (NewLake Capital)

In states with fewer licenses, the value of each cannabis property is more valuable.

Many worry about the financial health of cannabis operators, because it has taken a long time for them to become profitable. For years, the level of cash burn experienced by operators remained quite high, and they were sustained only by a favorable capital market environment.

Fortunately, NLCP has chosen its tenants well, as nearly 40% are already cash flow positive (no cash burn), and another 6% are projected to become cash flow positive this year. That number should tick up further over time.

NewLake Capital portfolio (NewLake Capital)

Notice also from the above image on the right that, despite some tenants remaining in cash burn mode at the corporate level, rent coverage at NLCP’s properties is ultra-high: 11x for retail properties and 6x for cultivation properties.

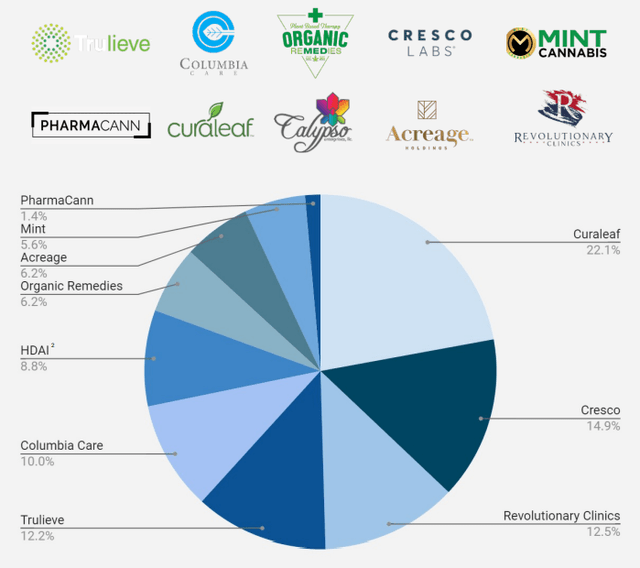

Make no mistake, though – despite the cash burn that pervades the industry, NLCP’s tenants are among the strongest in the cannabis space. Curaleaf (OTCPK:CURLF), NLCP’s top tenant at over one-fifth of rent, has one of the strongest balance sheets in the industry and ended Q1 2022 with $234 million of total liquidity.

NewLake Capital tenants (NewLake Capital)

Curaleaf’s revenue rose 20% year-over-year in Q1, and adjusted EBITDA grew 16%.

Likewise, Cresco Labs (OTCQX:CRLBF), NLCP’s second-largest tenant, is another leader in this market, with the top-selling vape and concentrates brand. Cresco also boasts the most sales of any licensed operator in Illinois and Pennsylvania and the second most sales in Massachusetts.

Much the same could be said of NLCP’s other tenants, which are mostly industry-leading multi-state operators.

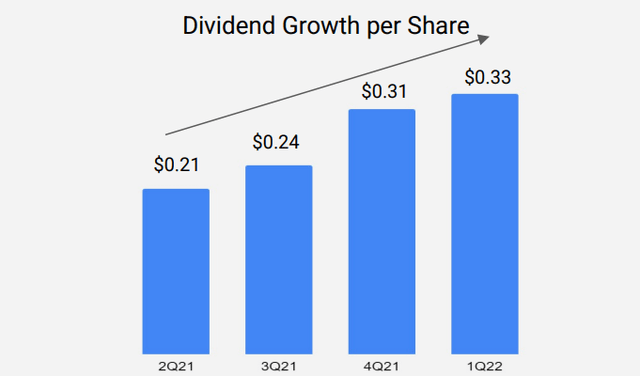

As the IPO proceeds have been steadily invested, NLCP has bumped up its quarterly dividend four quarters in a row and since NLCP has a lot more capital to allocate, we can expect more of the same in the coming quarters:

NewLake Capital dividend growth (NewLake Capital)

Bottom Line

Even with a depressed stock price, NLCP has proven with its recent $30 million credit facility that it is able to raise capital at low enough costs to continue growing its portfolio.

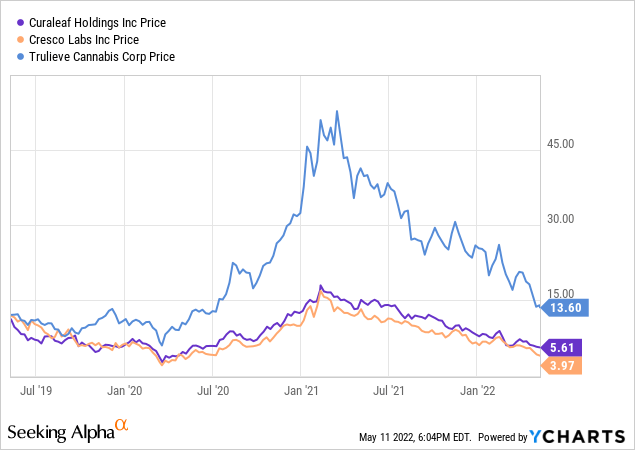

What’s more, with interest rates relatively high and cannabis MSOs’ stock prices performing poorly (see the chart below), it is likely that NLCP’s tenants will look to raise capital via sale-leasebacks:

Cannabis companies suffer a sharp drop in 2021 and 2022 (NewLake Capital)

When it comes to potential legislation in Congress, it is important to remember that there are both pros and cons to the SAFE Banking Act for cannabis REITs. And for NLCP in particular, there is the huge (potential) pro of uplisting to the NYSE or Nasdaq, which would open the door to a wave of new buyers.

The SAFE Banking Act would also surely increase cannabis operators’ revenues by making their products purchasable via credit cards. Moreover, it would decrease losses from robberies and probably lower operators’ insurance expenses associated with the potential for losses from theft.

Many commentators have noted that SAFE Banking would also open the floodgates for capital to flow into cannabis real estate and drive down cap rates. But the reality is that cap rates have been compressing for cannabis real estate for years now. Capital has been increasing in this space even without SAFE Banking.

Moreover, SAFE Banking would almost surely lower the cost of debt and equity for cannabis REITs like NLCP as well. So, if cap rates rapidly compress lower, we will likely see their cost of capital drop as well. The average investment spread between cap rates and weighted average cost of capital may narrow, but there will still be plenty of attractive opportunities for REITs like NLCP to pursue.

Could NLCP’s stock price continue to drop? Yes. Especially with multiple brokerages (like Vanguard) preventing investors from buying shares.

But if fundamentals ultimately win in the end, NLCP should prove to be a phenomenal investment… eventually. With a clear path to rapid growth, a discounted valuation multiple, and a near 8% dividend yield, we expect NLCP to become one of our most rewarding investments over the coming years.

Be the first to comment