JHVEPhoto

Newell Brands (NASDAQ:NWL) is saddled with high debt, inventories, and declining sales. The company is refinancing debt at a much higher interest rate. It will take a while to turn this ship around, and much may depend on recovery in consumer discretionary spending and moderation of inflation. For these reasons, the stock looks cheap at current valuations, and if the global economy takes a turn for the worse, Newell could get more affordable. I agree with the Seeking Alpha Quant rating that Newell’s dividend is at risk of being cut if the economic conditions and its sales deteriorate further. It may be best to watch the trend in economic growth, inflation, interest rates, and consumer spending before buying this stock.

Steady Decline in Revenue Growth and Profitability

Newell Brands has had a tumultuous year in 2022. The year started nicely for the company, with core sales increasing by 6.9% in Q1 2022 compared to the same quarter in the previous year. The company saw a deceleration in core sales growth in Q2 2022 when sales growth fell to 1.7% compared to the same quarter in the prior year. By Q3, the company saw a massive drop in core sales affecting every business division except its Commercial Solutions segment. The company’s Q3 2022 sales fell by 10.8% compared to the previous year. The poor showing in Q3 brought the year-to-date [YTD] sales growth to a negative 1.3%. North America was the worst performer, with sales dropping 15% in Q3 2022. The company’s Latin American business unit grew sales by 4.8%, providing some relief. APAC and EMEA saw sales decline of negative 4.1% and 3.3%, respectively.

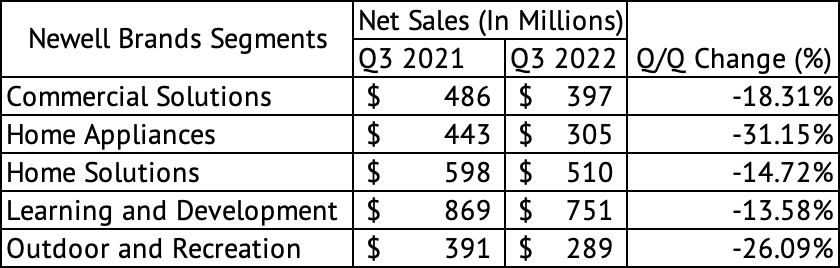

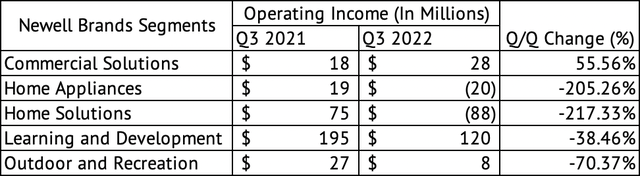

Every Newell operating segment suffered a double-digit decline in sales in Q3 2022 compared to the same quarter in 2021 (Exhibit 1). The decline in sales, coupled with high inflation and inventory, is decreasing profits. Commercial Solutions was the only segment to record a positive growth in operating income in Q3 2022 (Exhibit 2).

Exhibit 1:

Newell Brands Sales and Y/Y Growth Q3 FY 2021, 2022 (Newell Brands, Author Compilation)

Exhibit 2

Newell Brands Segment Operating Income Q3 FY 2021, 2022 (SEC.GOV, Author Compilation)

Newell’s Monthly Returns and Correlation with the S&P 500 Index

Since June 2019, Newell has returned an average of 0.58%. In about 75% of the months, the stock’s return falls below 6.2% with a very high standard deviation of 10% (Exhibit 3).

Exhibit 3:

Newell Brands Monthly Return Statistics [June 2019 – October 2022] (Data Provided by IEX Cloud, Author Compilation)![Newell Brands Monthly Return Statistics [June 2019 - October 2022]](https://static.seekingalpha.com/uploads/2022/12/10/saupload_04lfomtN3mViYNmWAm87MLCipD_hNhEvJ9g9p9ttaMEj-O3wPqbddWwUPBZ24hn3WSljxrq9dhAjjG4wQB19B_y9wW_7q31J3ZBM6_u4CJZqSq5S-E2V0y_iZNWIsAmu-4yXAio_sqD9URum_LAwumO8c3ymDUBnuFJ0w7pGlNk9Bx1U2H5jAiW3gtVFZQ.png)

The stock has a beta of 0.79, as measured by the linear regression of the Vanguard S&P 500 Index ETF (VOO) and Newell’s monthly returns. Yahoo Finance shows a beta in monthly returns of 0.84. The beta value for Newell tells us that the average monthly change in Newell’s stock price should be less than the S&P 500 index. Yet, the stock has lost 41% in the past year compared to 15.6% for the S&P 500 Index [as of December 10, 2022].

The stock’s monthly returns have a medium positive correlation of 0.44 with that of the Vanguard S&P 500 Index ETF. The linear regression model estimates that 17% of Newell’s monthly returns can be attributed to the monthly returns of the S&P 500 index. In short, S&P 500 index has a low influence on Newell. In theory, this should be good news in today’s volatile market, but that mild correlation has bought enormous losses for the holders of Newell stock in the past year. The poor performance of Newell Brands may be attributed to its declining sales, profitability, and high debt levels.

High Debt Load

As of Q3 FY 2022 [the quarter end date of September 30], the company had short-term debt obligations of $1.07 billion and long-term debt of $4.7 billion. Its net debt totals $5.13 billion after deducting cash and cash equivalents of $636 million.

In September 2022, the company redeemed $1.09 billion in 3.87% Senior Notes due April 2023. The company issued a $500 million principal amount of 6.375% Senior Notes maturing in September 2027 and another $500 million principal amount of 6.625% Senior Notes maturing in September 2029.

In essence, the company refinanced debt coming due early next year by issuing new debt at over 270 basis points higher interest rate than the debt that would have expired in March 2023. The company needs more operating cash flows to pay down debt, and its borrowing costs are rising. The good news for Newell is that in the next three years [2023-2025], it has a little over $700 million in debt due to repaying. In 2026, the company has to repay $1.97 billion in 4.2% Senior Notes. The company may have to refinance all or part of this $1.97 billion debt at a much higher interest rate. The company has nearly $3.3 billion in debt coming due between 2026 and 2029.

The company has generated a negative free cash flow over the past three quarters, and this lack of free cash flow may continue into the first quarter of 2023. The company’s unlevered and levered free cash flow is currently negative. If consumer demand remains weak, the company’s high debt levels and poor cash flows could mean more trouble. The company may be better off selling underperforming assets such as Yankee Candle to reduce cash drain and bring in some much-needed liquidity.

Indiscriminate Share Repurchase Hurts the Company

In 2018, the company made $1.5 billion in share repurchases while it had a net debt of close to $7 billion. During its repurchases, the company paid an average of $22.64 per share in 2018. The stock is trading at around $13 [a drop of 48% since 2018]. The reality is that most companies are lousy at buying back shares. They overpay for it, as seen in this example of Newell Brands.

Cash gives optionality to an individual or a corporation. If the company’s management had wisely spent the cash in 2018 to either pay down debt or save for a rainy day, they would have much more flexibility today. It may be wise to spend on some buybacks when the share price is a bargain and the company’s debt-to-EBITDA ratio is close to 2x. The company’s debt-to-EBITDA ratio is 4x [Source: Seeking Alpha/YCharts]. It is easy to focus on a short-term boost to earnings per share [EPS] at the expense of long-term value creation. The markets may even lift the share price when short-term performance is good. But, this is not a long-term sustainable strategy for any company.

Excess Inventory is a Drag on Margins

As of September 30, 2022, the company carried an inventory of $2.52 billion compared to $1.99 billion on December 31, 2021. The company has increased inventory by 26% while the stimulus-driven spending was fading, interest rates were increasing, and consumers were facing increased inflationary pressures on their budgets.

Some of these pressures, higher interest rates, and inflationary pressures are global phenomena that will disrupt discretionary spending for the next couple of quarters. In the face of faltering demand, the company may have little pricing power and resort to discounting to sell the excess inventory. The discounting could lead to further pressure on profit margins.

Conclusion

Investors should be aware of high debt levels coupled with slumping sales at the company. It is best to avoid the stock and revisit it in the middle of the first quarter of 2023. Meanwhile, investors should watch the trends in interest rates, inflation, and consumer spending for clues to where consumer discretionary spending is heading. Even if the U.S. economy avoids a recession next year, we may enter a period of sluggish economic growth for the rest of the decade. The fastest-growing region of the world may be Asia for the foreseeable future. If inflation moderates, Newell might find better growth opportunities there. Newell Brands has to prove that it has turned a corner in revenue growth and profitability before gaining investors’ trust.

Be the first to comment