chonticha wat

The recent underperformance of gold has obviously affected the gold miners and Newcrest Mining Limited (OTCPK:NCMGY) stock. The shares of the Australian-based miner have recently touched their 52-week lows. I think gold’s underperformance is only temporary since a recession is likely near. Investing in Newcrest could eventually prove to be a good way to outperform the market. But let me explain this in some more detail.

Company’s overview and earnings

Overall, I have always advocated buying physical gold as the safest asset. However, my readers have been asking me if I like mining stocks. Well, in my view, gold miners are a much better way to outperform the market and not so much to play it safe. In other words, miners are traditionally much more volatile than the base commodity. That means they may help investors earn more money but, at the same time, carry more risks.

So, one of the sound stocks to park your free cash into could be Newcrest Mining Limited, an Australian-based gold miner that also extracts copper.

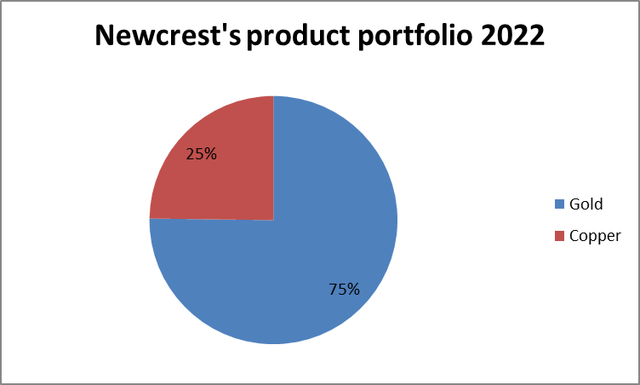

The company’s revenue as of 2022 was mostly due to gold. Newcrest extracted $3.515 billion worth of gold and $1.159 billion worth of copper. So, Newcrest does not depend as much on copper extraction for its revenues.

Prepared by the author based on the company’s data

That is a positive right now, given the fact copper is a highly industrial metal and the demand for it depends on the economic cycle. Right now, the economy is not doing great due to central banks’ hawkishness. So, the fact the company is less exposed to copper is probably good news.

It might be said that too much reliance on one commodity is bad. But gold prices are not particularly volatile. I would also say that gold is a great hedge against economic instability.

Newcrest’s financial profile is strong – it has plenty of cash. On 19 August 2022, the company’s net debt was $1.3 billion, its leverage ratio totaled 0.6 X, whilst the gearing ratio was 10.2%. That was all within the targets set by the management. Moreover, a net debt of $1.3 billion is good for a large company like Newcrest. The liquidity totaled $2.4 billion – this included cash and committed undrawn bank facilities. So, I can safely say the management’s financial policy is conservative. Newcrest also has access to significant gold reserves. Meanwhile, the company mostly operates in developed Tier 1 countries. Even more important seems to be Newcrest’s competitive cost position. It is the second-lowest-cost gold miner in the world. However, one of Newcrest’s main risks is its lack of diversification in terms of geographical locations.

As with any extraction industry, the production costs vary according to the mine they come from. However, on average in Newcrest’s case they are around $1,000 per ounce of gold, a good result even now when the gold prices linger between $1,600-$1,700 per ounce. My fellow Seeking Alpha contributor wrote a very good article, mainly devoted to Newcrest’s cost analysis.

Another advantage for the company’s stockholders is that Newcrest can afford to pay dividends. Its total dividends for the 2022 financial year totaled 27.5 cents per share. This leaves us with just over 2% in dividend yield, which is not brilliant but much better than nothing. What is more, an ability to pay dividends means the company is likely feeling confident about its cash position.

Competitors

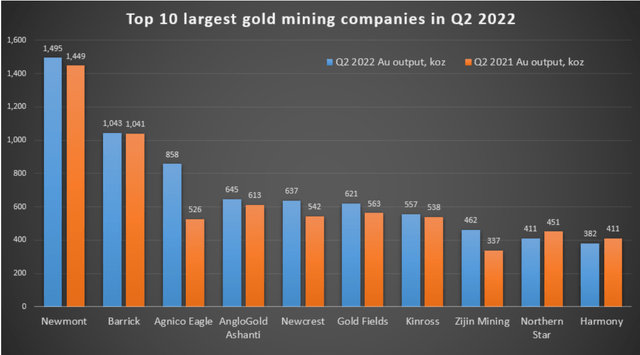

I decided to write about one of the largest gold miners in the world. In order to do so, I had a look at the diagram below showing the 10 largest mining companies in the world.

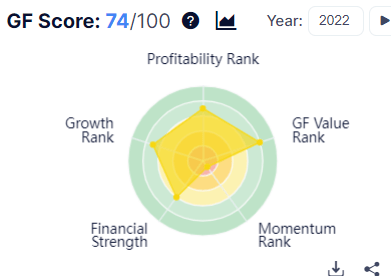

Here is why I chose Newcrest. It is sound in terms of profitability, it shows relatively good earnings growth, and is the champion in terms of value. Since the main purpose of the article was to show a company that would allow its stock buyers to take advantage of rising gold prices, I decided that value plays a very important role.

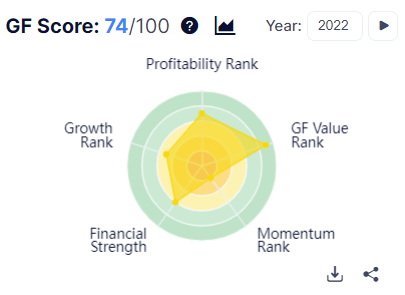

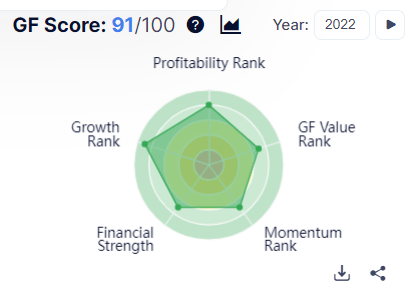

There were the two largest gold companies in the world on the list, namely Newmont Corp. (NEM) and Barrick Gold (GOLD). But these companies were worse than Newcrest in either value, growth, or technical analysis.

Newcrest’s relative overview

GuruFocus

Newmont’s relative overview

Guru Focus

Barrick Gold’s relative overview

GuruFocus

Agnico Eagle Mines (AEM) relative overview

GuruFocus

Agnico Eagle Mines, the third-largest gold miner in the world, is in a much better position than its competitors, including Newcrest. But in my opinion, AEM is unlikely to outperform the market since it is only “modestly” undervalued. As I have mentioned before, value matters.

AngloGold Ashanti Ltd. (AU) relative overview

GuruFocus

AngloGold’s indicators are almost the same as these of Newcrest, but AU is based in South Africa, a developing country, that cannot boast as much stability as Australia where Newcrest is based.

Gold price advantage

Another important stimulus for the stock price growth is the gold price advantage. In other words, any rise in gold prices will make a positive impact on Newcrest. As I have mentioned before, gold prices are less volatile than mining stocks. What is more, the costs of mining the base commodity are not so high for Newcrest. Right now the profit is not as high as it could be since the prices for the yellow metal are down somewhat. Imagine what could have happened if the gold prices went up to the levels seen in February this year or in the summer of 2020.

You might be wondering why I am saying this. After all, the Fed is quite hawkish right now and so are the other central bankers. But the problem is that this situation cannot last forever. After the global economy enters a serious recession, the central banks would have to react by easing the monetary conditions. That is good news for Newcrest since the realized price per ounce of gold would likely rise. After the monetary policy shift happens, the demand for industrial metals, including copper, would also rise. But a lion’s share of the gains would be due to the gold price rise.

Risks

Further monetary tightening is the main geopolitical risk, in my opinion. However, this too shall pass. In other words, the central banks would eventually have to stimulate their national economies. The economies would eventually enter hard times and in order to support them, the central bankers would have to get dovish.

The company also faces falling production and mine closures in some regions, not everywhere, of course. Most of these are due to the company’s logistics problems caused by the massive pandemic-induced lockdowns and sanctions against Russia. What is more, the fact Newcrest mostly operates in developed countries does not only suggest advantages to the company. That is because many Tier 1 countries are facing tight labor markets, which means the company faces difficulties to hire and retain its employees. Once these problems get resolved, Newcrest would substantially benefit from the commodity price advantage.

Valuation

It seems to me that Newcrest’s stock is not overvalued at all, and I will show you why.

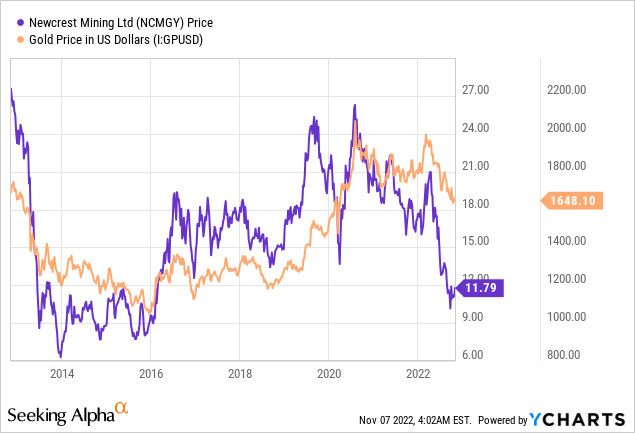

First, I decided to compare the company’s stock price history to that of gold. As I have mentioned before, the base commodity has been facing selling pressures for a while. But compared to Newcrest’s stock, gold has not lost much value at all. This is particularly true of the year 2022 where the disconnect between gold and Newcrest’s stock is so obvious.

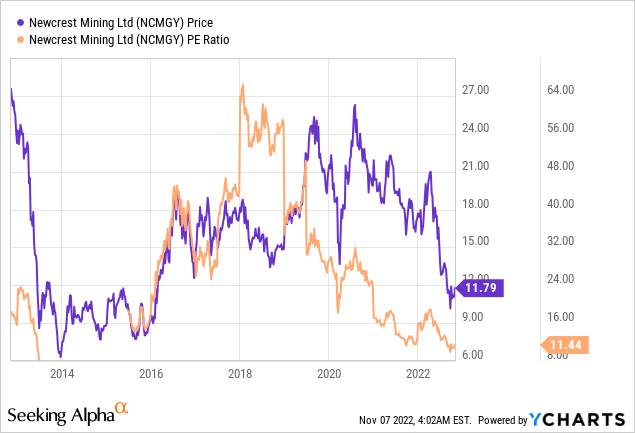

Let us also have a look at the company’s price-to-earnings (P/E) ratio. The data presented are due to Y-Charts. According to Y-Charts, as of the time of writing, Newcrest’s P/E is 11.44. That is not very low for a mining company but quite low for a company like Newcrest, given its P/E history.

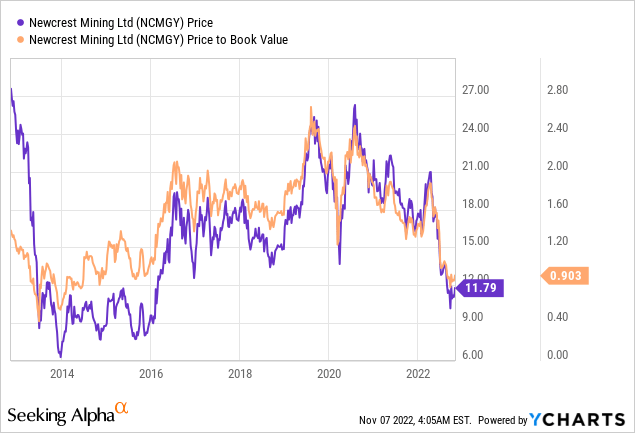

Newcrest’s price-to-book (P/B) ratio as of the time of writing is near its 5-year lows. According to Y-Charts, it is 0.9, even below 1. An indicator below 1 – 3 suggests the stock is undervalued.

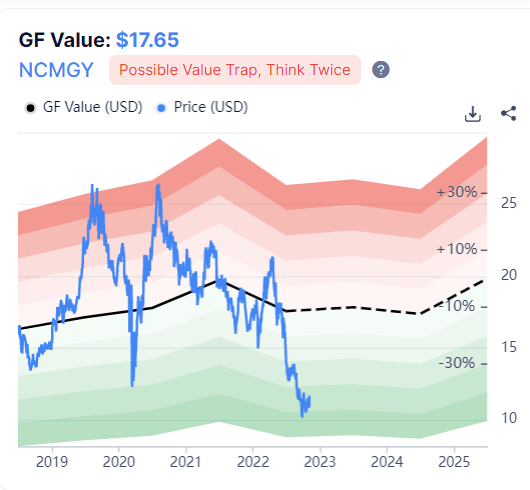

Even GuruFocus, what I think is a conservative and rather pessimistic website, suggests Newcrest is undervalued. On the website, the future net cash flow method is used to judge a company’s value. So, it is highly likely the current gold price is taken into account to estimate Newcrest’s future earnings. But even without taking this into account, Newcrest’s stock price should be $17.65, a substantial rise from the $11.79 stock price as of the time of writing.

GuruFocus

Conclusion

Although Newcrest Mining Limited is a company enjoying a strong financial position and is in some cases better than its peers, its shares are trading very low. I believe that investors’ critical attitude towards the company is due to their negative perception of gold as an investment asset. After all, monetary tightening by central banks is scary and bearish for precious metals. What is more, Newcrest’s stock is more volatile than the price of the base commodity. However, this will eventually change and the stock may reward its investors for their patience. I issue a “Bullish” rating on this Australian company.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment