takasuu/iStock via Getty Images

Intro

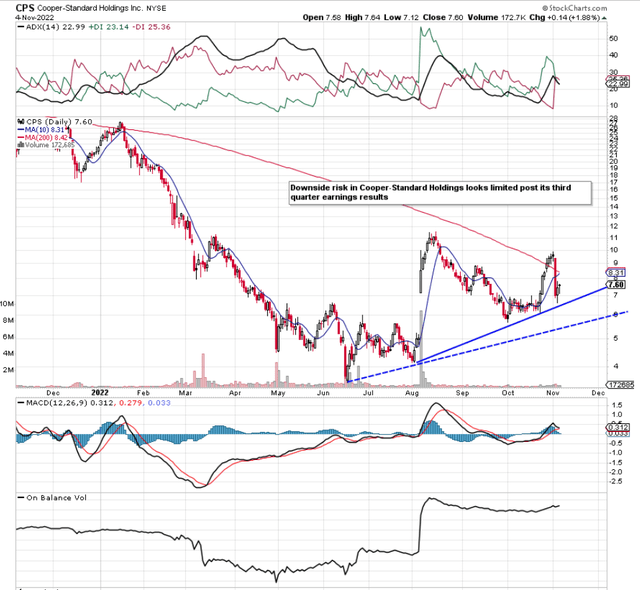

If we pull up a technical chart of Cooper-Standard Holdings Inc. (NYSE:CPS), we see that shares have some pretty significant downside support beneath the current prevailing share price. The company is just off the back of reporting its third quarter earnings numbers, where the negative GAAP number of -$1.90 per share actually came in better than expected on a higher sales total ($657.15 million). The real source of CPS’s recent momentum actually proceeds from its second quarter earnings results (announced in early August) when the company announced a resounding earnings beat. This was the inflection point for CPS, as we can see below by means of the significant increase in buying volume post that particular report.

CPS Technical Chart (StockCharts.com)

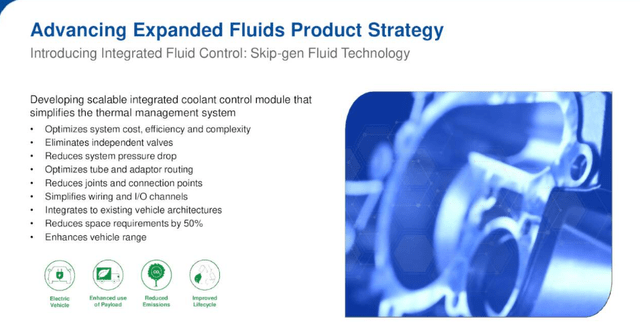

Furthermore, in terms of the company’s third quarter earnings announcement last week, we witnessed nothing in the report which would point to a stalling of momentum here. We saw a sound performance with respect to cutting costs, with innovation remaining at the core of the company. From sound progress in the company’s thermoplastic thermal management initiative to more improvements in the company’s fluid handling segment, as we can see below. Furthermore, the company has a clear runway of growth in its sealing business, where its frameless technology is driving new order growth. The clear benefit here from a financial standpoint is that the revenue per customer is much higher from this technology compared to its traditional counterpart.

CPS Q3 Earnings Presentation (StockCharts.com)

Suffice it to say, given the company’s innovation and momentum discussed earlier, CPS is now in the enviable position of reporting growing margins, which are resulting in higher forward-looking earnings estimates. Furthermore, shares remain relatively cheap, as we see below.

Value

Although CPS may not be profitable from a bottom line earnings standpoint, the company’s assets, sales as well as cash flow remain extremely cheap both compared to the sector at large as well as the company’s 5-year average multiples. CPS now reports a trailing 12-month sales multiple of 0.05, a book multiple of 0.72, and a cash flow multiple of 3.73. The one outlier with respect to CPS’s valuation is indeed its debt profile and the refinancing of its term-loan facility. It is crucial that this gets done sooner rather than later, which essentially lets the market know that operations will continue as planned and product innovation will remain at the core.

Margin Growth

In the recent third quarter, CPS reported a gross profit of $38.6 million on sales of $657.2 million. These numbers equate to a gross margin of 5.8% which is well ahead of the 4.18% average over the past four quarters. In fact, the Q3 gross margin print is the best number since Q1 in 2021 when the same metric surpassed 10% (less than double what was reported in Q3 2022). However, it is interesting to note that shares of CPS were hovering around $35 a share (more than four times the prevailing share price) in March 2021. Furthermore, it is not just the gross margin that is improving but also the SG&A costs ($45.3 million) that have contracted to a level that we have not seen for some time. Suffice it to say, it will be interesting if management’s impressive cost-cutting initiatives can continue as they have done, as more inroads here will lead to sustained margin expansion.

Earnings Revisions

The significant improvement in forward-looking earnings revisions is the final piece of the jigsaw from a bullish perspective. We state this because earnings are the primary driver of stocks on Wall Street, and the market finally seems to be pricing in the potential of CPS’s very cheap sales. Full-year sales are now expected to come in at approximately the $2.55 billion mark, with the company’s fourth quarter adjusted EBITDA margin expected to be meaningfully higher than the third quarter. Remember, these trends have been achieved in a high inflation environment, so some softening in the inflation rate should result in further margin expansion.

Conclusion

To sum up, CPS’s momentum in its technicals, its low valuation, the expanding margins, and the bullish forward-looking earnings revisions all lend themselves to higher prices in this stock going forward. We look forward to continued coverage.

Be the first to comment