New Zealand Dollar, NZD/USD, S&P 500, Coronavirus, Fed – Asia Pacific Market Open

- New Zealand Dollar consolidating despite rather rosy local 1Q jobs report

- Wall Street trimmed gains, Fed may have cooled bets of a quick recovery

- Texas virus-related hospitalizations surged, AUD/USD eyeing sentiment

New Zealand Dollar Struggles Despite Relatively Rosy Jobs Data

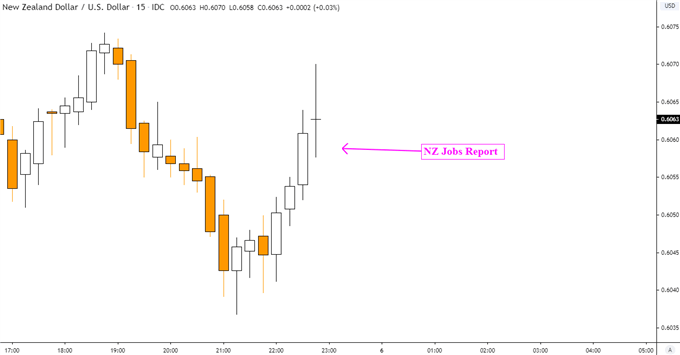

The New Zealand Dollar struggled to capitalize on a fairly rose local jobs report despite the coronavirus denting global growth. In the first quarter, New Zealand saw its unemployment rate climb to just 4.2% from 4.0%. Economists were anticipating this figure to rise to 4.4% instead.

Recommended by Daniel Dubrovsky

Forex for Beginners

Meanwhile the country unexpectedly saw employment growth at 1.6% y/y versus just 0.7% expected. That was the fastest pace since the fourth quarter of 2018. Average hourly earnings was also impressive at 1.4% q/q versus 0.9% anticipated. That was the most growth since the third quarter of 2018.

Despite the rather robust figures – all things considered – the New Zealand Dollar found little respite. That is understandable given that the data is unlikely to materially alter the near-term policy trajectory for the RBNZ. Rather, the focus for the sentiment-linked NZD/USD will likely remain on market mood.

Check out our newly-enhanced economic calendar for detailed overview of data releases

New Zealand Dollar Reaction to 1Q Jobs Data

Wednesday’s Asia Pacific Trading Session

S&P 500 futures are only pointing cautiously higher heading into Wednesday’s Asia Pacific trading session. In fact, stocks on Wall Street trimmed a lot of their gains into the close as the Dow Jones and S&P 500 ended the day +0.56% and +0.90%.

Comments from Fed Vice Chair Richard Clarida seemed to inspire risk aversion as he mentioned that the unemployment rate “is going to get very elevated”. He also added that it is “going to take time” for the labor market to recover.

Meanwhile Texas – one of the early states to relax lockdown measures – saw Covid-19 hospitalizations rise 1,888 in the biggest rise in 3 weeks. These developments may have cooled what was a more robust “risk-on” tone in markets, perhaps raising concerns over the speed of an economic recovery.

With that in mind, Asia Pacific equities may see a mixed session Wednesday. An absence of major economic event risk arguably places the focus for foreign exchange markets on sentiment. To that end, if fears of escalating US-China tensions continue rising, the sentiment-linked Australian Dollar could be left vulnerable.

What are some unique aspects of trading forex?

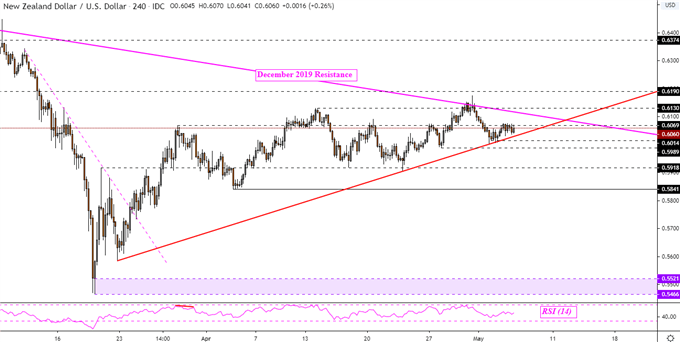

New Zealand Dollar Technical Analysis

On the 4-hour chart, NZD/USD continues to consolidate between converging trend lines. These are rising support from March and falling resistance from December, red and pink lines respectively. A push above immediate resistance at 0.6069 exposes 0.6130 while a turn lower through 0.6014 places the focus on 0.5989.

| Change in | Longs | Shorts | OI |

| Daily | 5% | 3% | 4% |

| Weekly | 7% | -14% | -5% |

NZD/USD – 4-Hour Chart

–— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment