Nordroden/iStock via Getty Images

The Q4 Earnings Season is finally underway for the Gold Miners Index (GDX), and one of the first companies to report was New Gold (NGD). The company had a mediocre year operationally with a miss relative to its guidance mid-point, but it was a challenging year with lower grades out of East Lobe, a tragic incident at New Afton, and delayed B3 permits. Fortunately, Rainy River ended the year strong, and the Blackwater stream sale has improved NGD’s balance sheet, ending the year with ~$480 million in cash. At a share price of $1.88, I don’t see enough margin of safety to justify entering new positions, but NGD is a name worth monitoring on pullbacks.

Rainy River Mine – Ontario, Canada (Company Presentation)

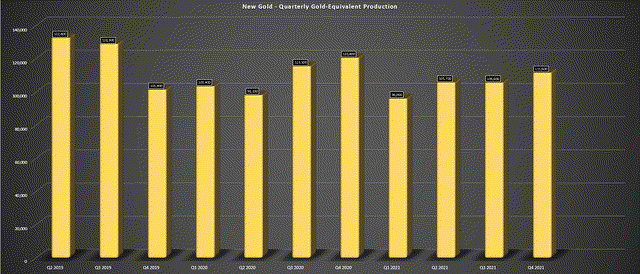

New Gold released its Q4 and FY2021 results last month, reporting quarterly production of ~111,600 gold-equivalent ounces [GEOs], a 7% decline from the year-ago period. This was driven by much lower production from New Afton, where the company saw lower grades and recovery rates on a sequential basis. The weaker production out of New Afton led to a miss on the company’s guidance mid-point of ~427,000 GEOs, with FY2021 coming in at just ~418,900 GEOs, down 4% year-over-year. Let’s take a closer look at the results below:

New Gold – Quarterly Gold-Equivalent Ounce Production (Company Filings, Author’s Chart)

As shown in the chart above, it was a very difficult year for New Gold operationally, with production falling off a cliff in Q1 to ~96,000 GEOs but steadily improving throughout the year. Unfortunately, the solid Q4 performance at Rainy River was masked by a much weaker year at New Afton, where GEO production was down 14% year-over-year due to lower throughput and grades. Not surprisingly, this translated to a sharp increase in costs at the British Columbia mine, with all-in sustaining costs soaring to $1,385/oz, up from $1,064/oz in FY2020.

While New Afton had a tough year with the delayed receipt of B3 permits and the tragic mud-rush incident early in the year, Rainy River had a better year (headwinds considered) and the FY2022 outlook is also solid. This is evidenced by Q4 production coming in at a very impressive ~70,500 GEOs, up more than 3% year-over-year. On a full-year basis, the asset was up against relatively easy comps due to a two-week shutdown related to COVID-19, but this was offset by much weaker grades at East Lobe, which impacted production.

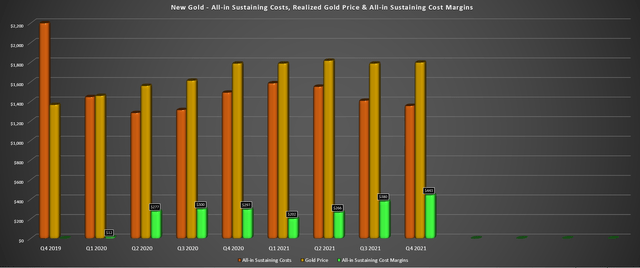

New Gold – AISC, Gold Price & AISC Margins (Company Filings, Author’s Chart)

Despite the hiccup, the operation saw a 4% increase in output to ~243,000 GEOs, with all-in sustaining costs improving to $1,415/oz (FY2020: $1,562/oz). This improvement in costs was despite a strengthening Canadian Dollar which was a minor headwind, offset by lower sustaining capital in the period. This improvement in costs led to increased margins year-over-year when combined with the expiration of gold hedges. As shown, Q4 all-in sustaining cost [AISC] margins came in at $443/oz, up from $297/oz in the year-ago period.

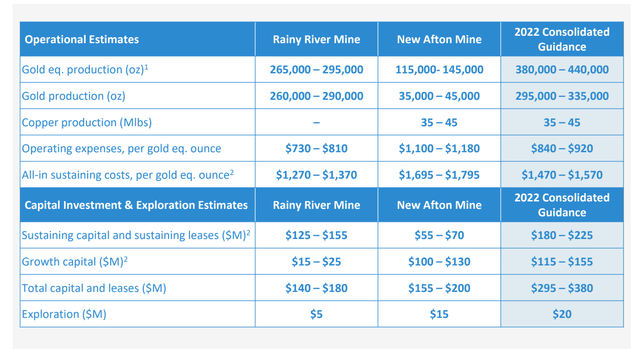

New Gold – 2022 Outlook (Company Presentation)

If we look ahead to FY2022, some investors might be disappointed in the outlook, given that production is expected to be relatively flat year-over-year at much higher costs. This is based on the current guidance mid-point of ~420,000 GEOs at all-in sustaining costs of $1,520/oz (FY2021: $1,463/oz). However, it’s important to note that this is mostly due to much higher sustaining capital and sustaining leases, which are set to increase to ~$203 million at the mid-point vs. $157 million last year. This increase is related to the completion of B3 development at New Afton, tailings management, and capitalized waste.

The good news is that costs will decrease in the second half of the year, with production weighted 45%/55% between H1 and H2 and sustaining capital declining in H2. The other good news is that investors can look forward to the commencement of mining at Intrepid Underground at the Rainy River Mine in H2. This will contribute to a much better year at Rainy River, with guidance sitting at ~280,000 GEOs at $1,320/oz vs. ~243,000 GEOs at $1,415/oz in FY2021. Looking ahead to FY2023, production will improve even further, with costs set to decline materially, assuming there are no further hiccups with East Lobe.

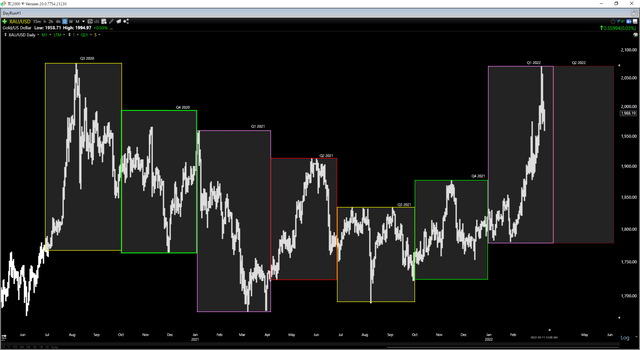

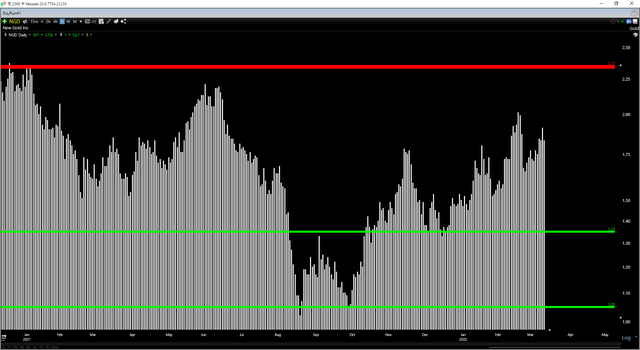

Gold Futures Price (TC2000.com)

The other good news, of course, is that the gold price looks like it will be a meaningful tailwind this year, a welcome development from a massive headwind in FY2021. This is a big deal for a high-cost producer like New Gold, where the company will see an outsized impact on its margins if the gold price can stay above $1,950/oz. So, while AISC is expected to increase by $60/oz in FY2022, it looks like New Gold could see a more than $125/oz improvement from the gold price, more than offsetting the increased costs. Let’s take a look at New Gold’s valuation below after the recent advance in the stock price:

Valuation & Technical Picture

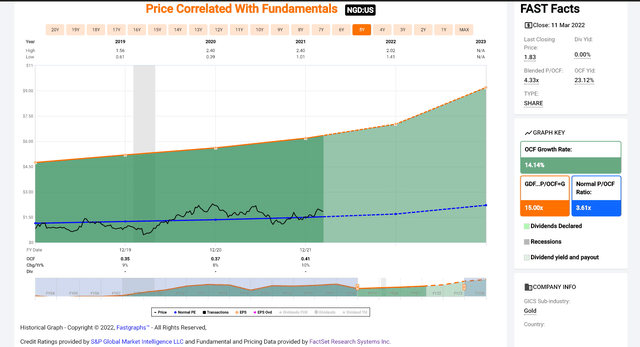

Looking at New Gold’s valuation below, we can see that the stock has historically traded at ~3.6x operating cash flow (5-year average), which is well below its peer group. This much lower multiple can be attributed to New Gold’s much higher costs, limited free cash flow generation relative to its peer group, and a weaker balance sheet. At a current share price of US$1.88, New Gold trades at ~4.5x trailing-twelve-month cash flow, which is well above its 5-year average.

New Gold – Historical Operating Cash Flow Multiple (FASTGraphs.com)

However, New Gold’s balance sheet is much stronger following the Blackwater transaction with Wheaton Precious Metals (WPM), and its free cash flow is expected to improve materially in FY2023, even if costs are set to remain elevated in FY2022 ($1,520/oz). If we combine this with gold prices sitting near all-time highs, I would argue that New Gold could justify a cash flow multiple of 4.0, which would be a 10% premium to its historical average.

Based on FY2023 cash flow estimates of $0.53, this would translate to a fair value of $2.12. This points to roughly 15% upside from current levels. However, I generally prefer to buy at a minimum 30% discount to fair value for higher-cost producers, meaning that the stock would need to dip below US$1.48 for me to become interested in starting a new position. Therefore, while New Gold does appear to have upside from here medium-term (assuming gold prices stay above $1,950/oz), I do not see this as a low-risk buying opportunity.

Moving to the technical picture, we can see that NGD has rallied sharply off its lows, but it’s now trading in the upper portion of its expected trading range. This is based on the stock trading at $1.88 vs. support at $1.35 and resistance at $2.35. Based on the current share price, this translates to a reward/risk ratio of 0.89 to 1.0, given that there’s $0.47 in potential upside to resistance and $0.53 in potential downside to support. The current reward/risk ratio corroborates my view that this is not a low-risk buy point for investors. For the reward/risk ratio to become compelling from a trading standpoint, NGD would need to dip below $1.50 per share.

Obviously, if gold prices remain elevated and continue to hang out above the $2,000/oz level, it’s unlikely that New Gold will pull back to support at $1.35. However, I would never pay up for a sector laggard simply because commodity prices are rising. Instead, I prefer to wait for a margin of safety or look for alternative names where there is a significant margin of safety. Hence, I continue to see more attractive bets elsewhere in the sector. One name that offers a meaningful margin of safety is Nomad Royalty (NSR), which trades at a P/NAV multiple typically reserved for producers despite having 80% plus margins.

Rainy River Operations (Company Website)

New Gold has made solid progress under CEO Renaud Adams, and while costs will remain elevated in FY2022 and well above the industry average (~$1,100/oz), the future looks much brighter post-2022. This is because we should see a meaningful increase in production at Rainy River, with costs set to decline below $1,000/oz. Hence, for investors looking for turnaround stories with improving cash flow profiles, NGD is one of the better stories. Having said that, I prefer to buy dips, not chase rallies, so I would need to see the stock dip below US$1.48 to become interested from a trading standpoint.

Be the first to comment