CHUNYIP WONG

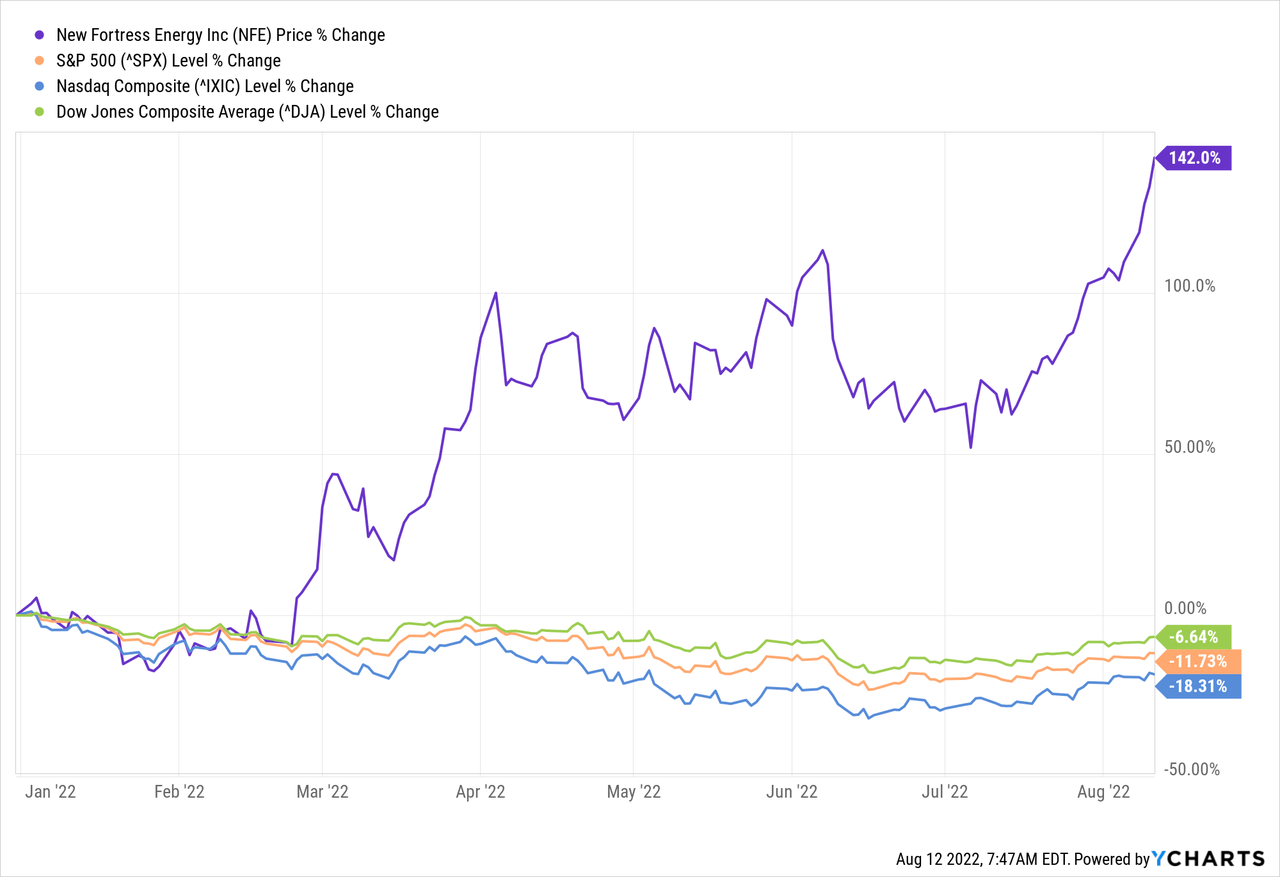

It has been a while since my previous bullish article on New Fortress Energy (NASDAQ:NFE) (date of publication: 24 January 2022, price at publication: $20.15). It is fair to say that a lot has happened since then. First off, the share price has almost tripled, from $20.15 to $58.41, despite a very turbulent macro environment battered by inflation, interest rate hikes, supply chain disruptions, war in Ukraine, COVID-19, and tensions between China and Taiwan (exacerbated after Pelosi’s visit to the island). Including dividends, the total return has been a whopping 191.52%, since my previous article, at a time when the S&P 500 has incurred losses. The strong outperformance is also evident on a year-to-date basis. Specifically, New Fortress Energy has skyrocketed 142% whereas the tech-heavy Nasdaq, S&P 500 and Dow Jones are all down 18.31%, 11.73% and 6.64%, respectively.

What a dramatic outperformance versus the major indices! The title of my previous article was telling: “New Fortress to Generated At Least $1 Billion in Annual Free Cash Flow“. The good news is that this title is quite conservative given the recent positive developments. New Fortress Energy is firing on all cylinders and the company is well positioned for exponential growth. It is no secret that the war in Ukraine has acted as a material tailwind for the LNG market, and New Fortress Energy is one of the major beneficiaries. All of a sudden, governments around the world, including the European Union, are taking about floating marine LNG terminals and solutions.

After almost a decade of heavy investments, in particular $8 billion (and counting) invested in building world-class LNG infrastructure assets around the globe, NFE is starting to enjoy the benefits. Until last year, generating attractive operating cash flow was a challenge for NFE, as the company was predominantly in its development phase. The main reason for this: it takes years to construct and develop assets, until they are operational with all safety measures in place, to reach income generation mode. In other words, NFE was burning cash from its operating activities, and, on top of that, the company had to manage a demanding $8 billion investment program. The good news: mission accomplished, and in style. The timing of the projects coming online couldn’t be better, as they will help NFE generate substantial operating cash flow over the years, which can be reinvested in a booming LNG market by getting involved in even more exciting high-return projects, such as the Fast LNG projects, and like this achieve a nice compounding effect.

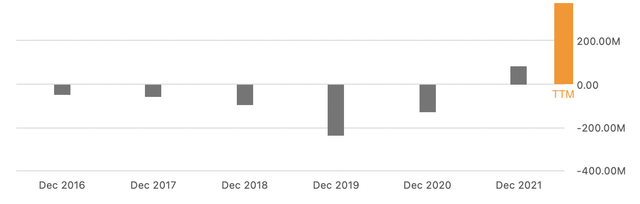

NFE’s Operating Cash Flow: 2016 to date:

As illustrated in the graph above, cash from operations was constantly negative until 2021, due to reasons discussed above (essentially NFE was in the development phase). However, as of 2021, operating cash flow has turned positive, to $84.8 million, and for the TTM (trailing twelve month) period operating cash flow has accelerated to $367.1 million. Next year, this figure is set to be even higher, above the $1 billion mark, as outlined in my previous article. In fact, the company now expects to be positioned to exceed its adjusted EBITDA Goal of ~$1.5bn+ on its core business in 2023, before taking into account the Fast LNG projects. This is important to emphasize as the Fast LNG projects are expected to be a major growth driver going forward (more on this below).

In any event, the company is making progress on all fronts. Regarding its core terminals and customers, in Mexico NFE entered into an LOI to expand and extend the contract with CFE to supply gas to multiple facilities in Baja California Sur. In Brazil, they are nearing completion of the Barcarena and Santa Catarina terminals (commenced construction on 605 MW power plant in Barcarena with 25-year PPAs indexed to JKM). In Europe, they agreed to lease an FSRU to Gasunie for a new terminal in the Netherlands, with expected start-up in Q3 2022, and in Ireland progress continues on the development of terminal and power plant.

What’s more, the progress on Fast LNG business is substantial. In Mexico they are deploying up to 4 x 1.4 MTPA Fast LNG units across 2 sites (in Lakach and Altamira) and in the U.S. (Louisiana) they received 92 comments on the initial permit filed on March 30, and the permit application was refiled in late July. There is continued progress on the first two units; both are expected to be ready to enter service in 2023.

On the balance sheet front, they signed an agreement to sell the Sergipe power plant for ~$1.3bn to Eneva, equating to ~$550M in proceeds to NFE, and signed agreement with Apollo to form an LNG marine infrastructure JV, equating to $1.1 billion in proceeds to NFE. These and other activities underway total ~$2bn of internally generated liquidity in 2022. Due to the above accomplishments, the Fast LNG CapEx is fully funded, thereby derisking the projects as much as possible.

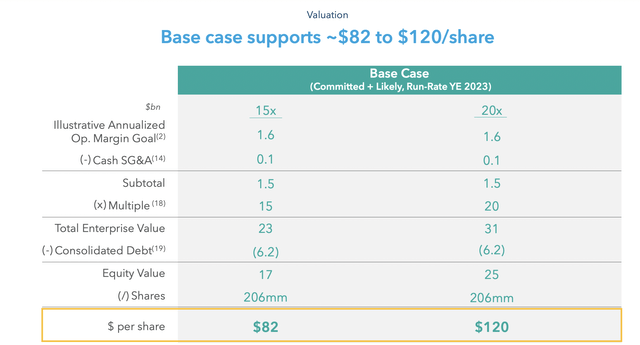

As a value investor, I tend to avoid situations of negative operating cash flows, but as of the beginning of this year we’re way past the era of negative operating cash flows. And the even better news is that operating cash flows are poised to increase materially, as discussed above. When I wrote my previous article back in January, I was projecting the operating cash flow to surpass $1 billion. At the time, the market cap was around $4 billion which I found very low versus the anticipated operating cash flow potential. Now, with the war in Ukraine as well as other geopolitical and energy security factors, the Fast LNG business has gained substantial momentum, along with the LNG space in general. Once the Fast LNG units come online, adjusted EBITDA is expected to increase materially; 2-3 times higher. Comparing this with the current market cap of ~$12 billion, one could argue that New Fortress continues to be cheap, despite the share price increasing by almost 3 times since January. Interestingly, I came across an NFE Annual Investor Update 2021 presentation which includes some base case scenarios for the share price. Of particular interest is slide 50 which provides an analysis supporting a base case valuation between ~$82 and $120 per share.

New Fortress Energy Updating the above scenarios with the recent positive information about the Fast LNG segment, which could boost adjusted EBITDA by 2-3 times, the base case of $125 seems like an easy target. But the analysis doesn’t stop here. One needs to add into the mix the substantial progress that NFE is already making with its green energy division called ZERO, which aims to provide carbon-free power by replacing fossil fuels with affordable zero-emission hydrogen. NFE is mostly an LNG company, at least right now, but I really expect NFE to become a major player in the hydrogen space as well. To this end, a few days ago, NFE entered into an agreement with Plug Power (PLUG) for a 120 MW hydrogen plant on the Gulf Coast. This facility is expected to be one of the largest green hydrogen plants in North America. As Wes Edens, NFE’s CEO, stated: Amid an increasingly favorable U.S. policy environment for hydrogen, we are focused on scalable solutions that have a real impact on decarbonization and believe we are uniquely positioned to be an early mover in this vast and rapidly evolving market. I completely agree on the notion that NFE is uniquely positioned to be an early mover in the hydrogen space. It is common knowledge that this is a market that is set to explode in the coming years, along with the green energy space in general. The Senate recently passed the climate bill, and the rush to renewable energy is on, unlocking $370 billion in funding for clean energy. I am confident that NFE will be a major beneficiary from this movement, given its first mover advantages. Therefore, I can only see massive tailwinds in the horizon, for both the LNG and hydrogen spaces. This means more projects and stronger cash flow generation, which in turn will lead to higher valuations. Let’s not forget how miserable the energy space was prior to COVID for years. Things have changed and a golden decade lies ahead for NFE.

Be the first to comment