NicoElNino

The market is going through a period of extraordinary uncertainty. Though, currently, it appears that the market is staging a comeback in the hopes of a Fed pivot. The renewed optimism was triggered by the inflation print for the month of October at 7.7%, which was slightly less than the expected 7.9%. But we think that the market is getting ahead of itself, and we may not see a Fed pivot in a real sense for some time. So, more than likely, it would prove to be a bear market rally and will likely fizzle out. All that said, no one can be certain how the market is going to behave in the next week or the next six months.

In good times, a vast majority of investors (many of them in their 401Ks) invest in broad market indexes. With broad indexes, you invest in good, average as well as bad companies. Sure, if you are young with a long time horizon and if you are investing at regular intervals, this strategy should turn out to be okay. At least, you would get the average market returns, if not better. However, the problem with market indexes is that there is no escape from a roller-coaster ride with the extreme ups and downs of the market, and many people do not have tolerance for deep drawdowns and, many times, resort to panic selling exactly at the wrong time. Moreover, this strategy may not suit or work very well for retirees and investors in their 50s or older.

On the other hand, income investors, including retirees who live off that income, have an additional problem. Since they need to withdraw income on a regular basis, they may be forced to sell when the prices are low. Even if they do not withdraw income, more than likely, they don’t have the luxury of adding fresh money to take advantage of lower prices, as and when that happens. Retirees can also face the problem of sequential risk if the market happens to go into a deep correction for multiple years in the early phase of retirement, as it did during the period 2000-2003.

The other model that is often referred conservative and safe for retirees is the 60:40 stock and bond allocation model. However, we find two problems with that model. The year 2022 has shown that, at times, bonds can go down along with stocks, and then there is no escape from the deep drawdowns that can take years to come back even. The other problem that is often overlooked is that it compromises growth on 40% of your assets.

This is why we wanted to work on a strategy that could counter some of these thorny issues, and that’s how the Near-Perfect Portfolio, or NPP, strategy evolved.

The NPP strategy described in this article should be of interest to any long-term investor, but especially to the following audiences:

- Income and conservative investors who don’t like the roller-coaster ride of the stock market and rather sleep relatively well even during the depth of a correction.

- Retirees or near-retirees may want to avoid the sequential risk of the stock market.

- Folks who are already 50-plus or approaching 50 would prefer a strategy that would offer lower volatility while maintaining higher returns in the long term.

- Investors who want to take control of their investments and are prepared to spend at least a few hours a month managing their portfolios.

That said, everyone’s situation is different, and one size does not fit all, so it is always a good idea to analyze any new strategy and see if it would suit your specific goals, needs, and temperament.

We started to write about this portfolio strategy that we like to call NPP (Near-Perfect Portfolio) strategy in early 2020. Since nothing is perfect, especially so in the investment world, hence the name Near-Perfect Portfolio. In fact, it is hard to find anything that is even near-perfect, so sure, we are aiming high. Generally speaking, we’re looking for a strategy that performs reasonably well during the bull markets, preserves capital when the market throws a fit or performs poorly, and provides a decent enough income stream on a consistent basis. This is the basis of the Near-Perfect Portfolio.

We follow the NPP strategy in our Marketplace service, “High-Income DIY Portfolios,” but from time to time, we like to provide updates and the progress of the NPP portfolio here on the SA public platform for the benefit of our regular readers. As usual, we will provide an overview of the performance and a broad comparison of our NPP strategy vis-à-vis the S&P 500 (based on back-tested data as well as our live performance since January 2020). In the end, we will provide a sample NPP 3-bucket portfolio for the benefit of new readers. Also, we are providing a new Rotational strategy as well for the current uncertain times.

Why Do We Need a Strategy like NPP?

Here are some of the key reasons:

- We want a strategy that can avoid (to a large extent) the roller coaster ride of the stock market and index investing.

- It is almost impossible to predict the market correctly, so we would want a strategy that works fairly well in most environments.

- The S&P 500 had an extraordinary streak of high performance during the past 13 years (prior to 2022), and it is unlikely to continue in the next decade. We want a strategy that could adjust to such a scenario.

- If you are a retiree or near-retiree or otherwise a conservative investor, you cannot afford large or deep drawdowns in your portfolios, as that may require years to come back even. Also, fresh retirees would like to avoid the risk of a “sequence of returns” at all costs.

- The S&P 500 currently provides a yield that is less than 1.6%, so index investing would not be an ideal option for most income investors. We want a strategy that could provide a respectable 5% income if needed.

- We want a strategy that produces low volatility (ideally less than 60% of the S&P 500) preserves capital, provides a decent income, and reasonable total returns over the long term.

So, in brief, we think a conservative investor or a retiree would want low volatility, minimal drawdowns, consistent income, and decent growth on the overall value of the portfolio to meet inflation and support 30-40 years of retirement. This is exactly the objective of the NPP strategy that you would see in a comparative analysis of the NPP strategy and the broader market index like the S&P 500 in the next section.

Goals of Near-Perfect Portfolio

To summarize, we expect our Near-Perfect Portfolio to achieve these three objectives:

- Preserve capital by limiting the drawdowns to less than 20%.

- Provide a consistent income of roughly 5% to those who need to withdraw.

- Grow the capital for the long term at an annualized rate of 10% or better (including the income).

We must caution that these strategies need some work on an ongoing basis and may not suit highly passive investors. In addition, they require patience.

NPP: A Combination of Divergent Strategies

We are currently in an environment that is testing the limits even for diversified portfolios. We need to diversify not only in different sectors of the economy but also in different types of asset classes. The stock market is inherently volatile, so we also have to structure our portfolios in such a way that we can avoid high volatility. High volatility and deep drawdowns bring in all kinds of emotions and issues, including selling at the wrong time, fear of missing out, and above all, overall low performance. So, for additional protection, we recommend diversifying in terms of types of investment strategies. We try to combine strategies that are likely to perform in divergent ways under different market conditions. This helps bring down the portfolio volatility and improve overall performance. The NPP portfolio combines monthly rotational strategies with some buy-and-hold DGI (dividend growth investing) and high-income strategies to perform well under different market conditions.

Performance Behavior of NPP Strategy During Bull & Bear Markets

Before you adopt a new strategy, it is important to see how that strategy would have behaved in the past over a long period of time under different market conditions. So, it may be beneficial to readers, especially those who are new to the NPP approach, to discuss the past performance and behavior of our rotational and buy-and-hold portfolios under different market conditions since the year 2008. Moreover, this will demonstrate how rotational portfolios can act as a counterbalance to buy-and-hold portfolios during tougher times. We run and manage many such rotational portfolios and several buy-and-hold portfolios inside our Marketplace service.

Note: All the tables and charts included in this article are sourced from Author’s work unless specified otherwise underneath the image. The stock market data, wherever used, is sourced from public websites like Yahoo Finance, Google Finance, Morningstar, etc.

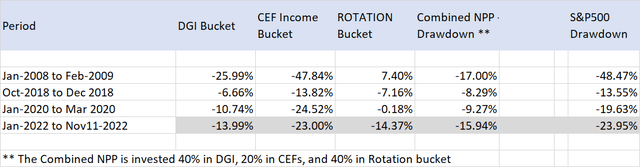

Comparison of drawdowns for NPP Strategy versus the S&P500:

Everyone’s situational and emotional makeup is different, so it is important to know your tolerance for drawdowns and deep corrections. During the good times, it is natural that most folks do not think much about drawdowns. However, corrections and resulting drawdowns are part of investing in markets, and they do happen with regular frequency. So, it is of paramount importance to know your risk tolerance and have an idea about how much of a drawdown would be tolerable. For retirees and near-retirees, in addition to the level of tolerance to drawdowns, there is always the inherent risk of negative sequential returns during the early years of retirement. Broad market indexes like S&P 500 had a drawdown (loss from top to bottom) of over 45%, 50%, and 30%, respectively, during the dotcom crash (2000-2002), financial crisis (2008-2009), and Covid-19 crash (Jan-March 2020). So, it may not be very frequent, but it does happen at least a couple of times in a decade. Sometimes a downturn can end quickly, as we experienced during the Covid-19 crash, but at other times it can be long, slow, and painful, for example, like what we witnessed from 2000-2002.

So, let’s compare the drawdown performance of our NPP strategy and the S&P 500 during some of the worst times during the last 15 years (based on backtesting). We are not in a position to go beyond 2008 due to a lack of reliable data, but at least it would cover the financial crisis and a few other deep correction periods.

List of drawdown timeframes:

- Jan-2008 to Mar-2009 (Financial and Housing crash)

- Oct-2018 to Dec-2018 (Crash of 2018)

- Jan-2020 to Mar-2020 (Pandemic crash)

- Jan-2022 to Nov. 11, 2022 (the current period)

Table-1:

As you can see above, the drawdown of the NPP portfolio was less than half of the S&P 500 most times. During the current downturn, it is about two-thirds of the S&P 500’s drawdown. However, the current downturn is still in progress, so it may be premature to draw any conclusions.

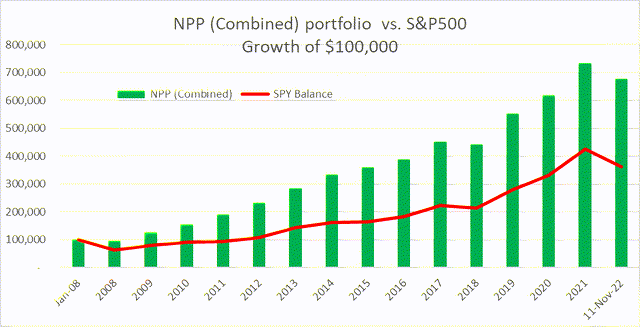

Combined Portfolio [NPP] Performance:

Below is the performance of the combined NPP strategy and comparison with the S&P500 (based on backtesting results since 2008). We will then provide more details on the three components of the NPP portfolio.

Table-2:

|

As of 11-NOV-2022 |

CAGR** |

|

CAGR of DGI bucket since 2008: |

13.63% |

|

CAGR of CEF-High-Income bucket since 2008: |

10.14% |

|

CAGR of ROTATION bucket since 2008: |

14.72% |

|

CAGR of Combined NPP portfolio since 2008: |

13.73% |

|

CAGR of the S&P 500 since 2008: |

9.02% |

** CAGR – Compound Annual Growth Rate

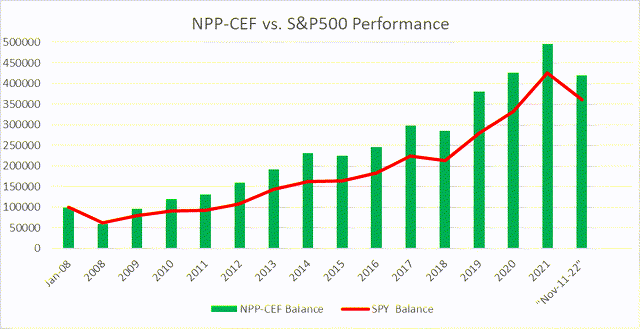

Chart-1: The Combined NPP portfolio vs. S&P 500 (from Jan 2008 to 11-Nov-2022)

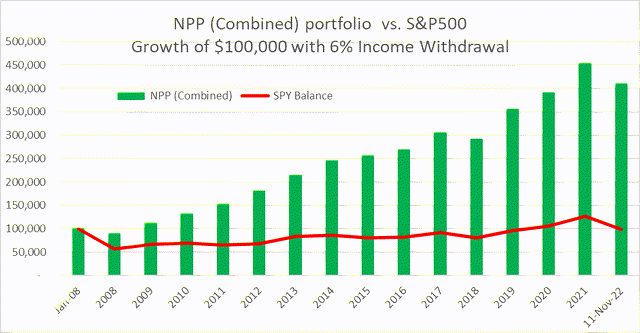

Chart-1A: The Combined NPP portfolio vs. S&P 500 ( with 6% Income Withdrawals)

Now, the below chart is the same as above but with a 6% withdrawal (inflation-adjusted) each year from the portfolio. It is amazing to see how the S&P 500 could never really recover from its drawdown in 2008 due to annual withdrawals, in spite of an extraordinary bull run between 2010 and 2021. However, the NPP portfolio did pretty well during the same circumstances, with the same amount of withdrawals. The difference is due to much smaller drawdowns in the case of NPP in comparison to S&P500.

Chart-1A:

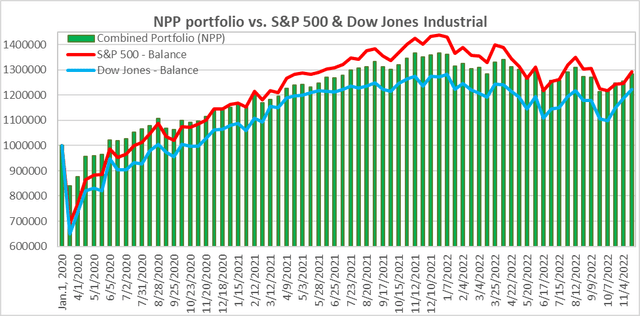

Below is the chart from the “live performance” of the NPP Portfolio since Jan. 2020. (Since this comes from our Marketplace service, it takes into account 6 Rotational portfolios and 3 Buy-and-hold portfolios). In practice, an investor would just need two buy-and-hold buckets and one (or maybe two) rotational buckets. In the chart below, you will notice that at the market bottom in March 2020, S&P 500 and Dow Jones were down nearly 30% and 35%, respectively; however, NPP was down only about 15%.

Chart-2:

3-Bucket NPP Portfolio (An Example Portfolio)

In this section, we will provide an overview of each of the three buckets and their individual performances vis-à-vis the S&P 500.

Bucket 1: DGI Bucket (40% of the assets)

Bucket 2: Rotational Bucket (40 – 45% of the asset)

Bucket 3: CEF High-Income Bucket (15 – 20% of the assets).

Bucket-1: DGI-Core

For the purpose of this article, we will focus on individual DGI stocks; however, more passive investors could make this portfolio entirely of some select dividend ETFs (exchange-traded funds). Also, in the case of individual stocks, a DGI portfolio should hold roughly 15-25 individual stocks from various sectors and industry segments of the economy to form a diversified DGI (dividend growth investing) portfolio.

This is our long-term buy-and-hold bucket. It will be our core investments in solid, blue-chip dividend stocks. It’s relatively easy to structure and form this bucket. For our sample portfolio presented below, we will look for companies that are large-cap, relatively safe, and have solid dividend records. Most of them will likely provide a high level of resistance to downward pressure in an outright panic situation. We will present 15 such stocks based on our past research, current dividend payouts, and a high level of dividend safety. There are many more equally good companies out there, and readers could add/replace them as per their own research and preference, but dividend safety and sustainability should be the main focus.

The goals of the DGI Bucket are:

- Long-term investments 3%-4% dividend income

- Long-term total return in line with the broader market

- Drawdowns to be about 70% (or less) of the broader market

For this part of the portfolio, our focus is to select stocks that tend to do well in both good times and during recessions/corrections. This is especially important if you are a retiree. Please note that this is just a list for demonstration purposes, and there can be many other stocks that could be equally qualified.

Stocks selected:

AbbVie Inc. (ABBV), Amgen (AMGN), Clorox (CLX), Digital Realty (DLR), Enbridge (ENB), Fastenal (FAST), Home Depot (HD), Johnson & Johnson (JNJ), Kimberly-Clark (KMB), Lockheed Martin (LMT), McDonald’s (MCD), Altria (MO), NextEra Energy (NEE), Texas Instruments (TXN), and Verizon (VZ).

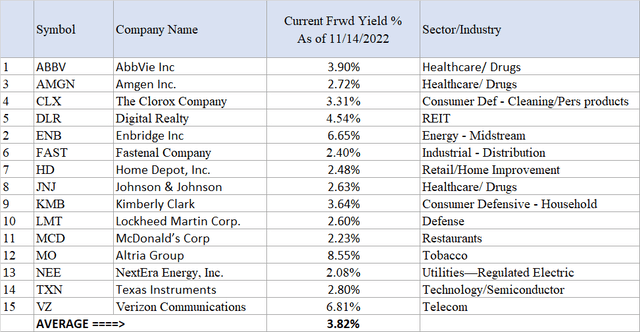

Table-3:

The average yield from this group of 15 stocks is quite attractive at 3.82% compared to 1.56% from S&P 500. If you still have some years before retirement, reinvesting the dividends for a few years would take the yield on cost up to 5% easily.

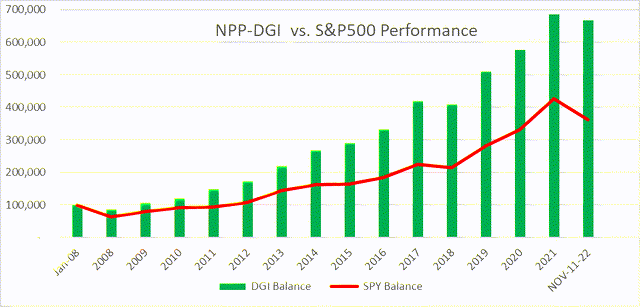

Chart-3:

Note: For performance analysis, ABBV was replaced with its parent co. Abbott Labs (ABT), prior to the year 2013 (prior to spinoff).

Bucket-2: Rotational Bucket

This is our insurance bucket (or hedging bucket), which should preserve our capital in times of crisis or panic. In addition, it should reduce volatility, provide a very decent return, and some of them could provide a good income as well. In the long term, we expect this bucket to outperform the S&P500 in terms of total returns.

Along with the DGI portfolio, this bucket is an essential part of our overall portfolio. Investment in stocks is inherently risky, and the Rotational strategies provide the necessary hedge against the risk without compromising on growth. They bring the overall volatility of the portfolio down and limit the drawdowns in a panic or a major correction scenario. The biggest advantage is that they let the investor sleep well at night. They bring a level of assurance that helps the investor to maintain calm and stay invested in good times and bad.

Just like most things in life, these strategies can have some downsides as well. First, these strategies require some regular work on a monthly basis. Also, they are most suitable inside a tax-deferred account as they require monthly trading. Many times, the market can have frequent whipsaws (change in direction) in an overall stagnant market, which may cause the Rotation strategy to give negative returns even though the market may be flat.

One can start with one rotation strategy, but as one gains more experience and confidence, one could diversify into multiple strategies. We provide eight such strategies in our Marketplace service, but for most folks, a couple of such strategies should be more than enough.

Note: A word of caution for new investors – just because we’re allocating 40% of the portfolio to this strategy, we are not recommending that you change to this strategy overnight with large sums of money. Rather, it should be done gradually over time in smaller steps, and one should preferably use more than one such strategy.

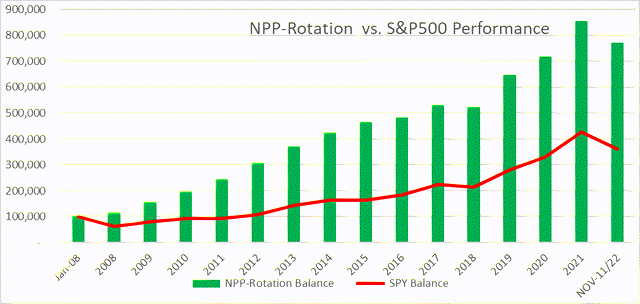

A Rotation Strategy for the Bull as well as Bear markets:

In the Rotational bucket, we normally rotate between a fixed set of securities on a periodic basis (usually a month), based on the relative performance of each security during the previous period of defined length.

This portfolio is designed in such a way that it aims to preserve capital with minimal drawdowns during corrections and panic situations while providing excellent returns during bull periods. Due to much lower volatility, this portfolio is likely to outperform the S&P 500 over long periods of time. However, it may underperform to some extent during the bull runs.

The strategy is based on eight diverse securities but will hold any two of them at any given time, based on relative positive momentum over the previous three months. Basically, we will select the two top-performing funds. The rotation will be on a monthly basis. The seven securities are:

- Vanguard High Dividend Yield ETF (VYM)

- Vanguard Dividend Appreciation ETF (VIG)

- iShares MSCI EAFE Value ETF (EFV)

- iShares MSCI EAFE Growth ETF (EFG)

- Cohen & Steers Quality Income Realty Fund (RQI)

- iShares 20+ Year Treasury Bond ETF (TLT)

- iShares 1-3 Year Treasury Bond ETF (SHY)

- ProShares Short 20+ Year Treasury Bond ETF (TBF)

Chart-4:

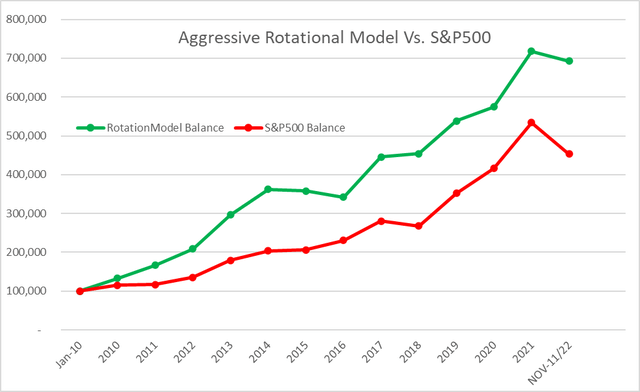

An aggressive version of the above Rotational model:

In this model, we will try to make it more aggressive but more adaptable to handle bear markets.

In the list of securities, we will add two more securities:

The rest of the model remains the same as the original model. The backtested performance is presented below from Jan. 2010 to Nov. 11, 2022.

Chart 4B:

Bucket-3: CEF High Income Bucket

Earning a high enough income while preserving the capital and getting a decent total return has been a challenge for much of the last decade. That’s where CEFs (Closed-End Funds) and this high-income bucket fit in. However, we recommend that they be part of a broader overall portfolio with limited exposure. The purpose is to boost the overall yield of the broader portfolio to over 5%.

Many people believe that anything high yield tends to be high risk. To some extent, it is true, and it does apply to CEFs as well. So, investors should recognize that investment in CEFs can be relatively high-risk. The reason is that some of these securities use leverage to generate high income, and as we know, leverage works both ways. However, there are ways to have some exposure to high-income securities but still be able to mitigate the risk. The idea is to invest in a diversified list of CEFs from various asset classes. So, we will recommend limited exposure in this bucket, up to a maximum of 25% of total investment capital.

For high income, one has to essentially look at investment vehicles like REITs (Real Estate Investment Trusts), mREITs, BDCs (Business Development Companies), MLPs (Master Limited Partnerships), and CEFs (Closed-End Funds).

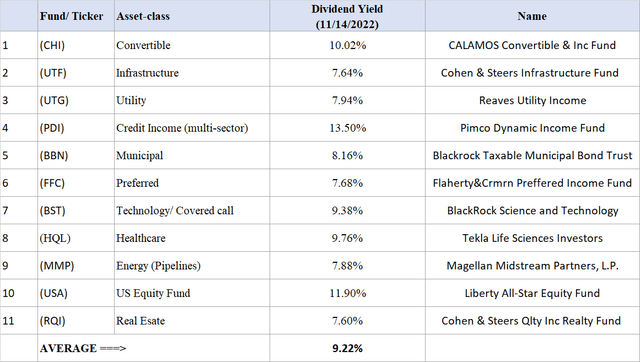

We present here a set of 11 high-income investment funds; most of them are CEFs. However, one of them is an individual stock (Magellan Midstream Partners (MMP)), being a partnership. Please be aware that a partnership usually issues a K-1 form (partnership income) at tax time instead of dividend income.

Below are some of the best funds within each asset class. The average yield of the portfolio presented below is very attractive at roughly 10.10%.

The funds/securities that we would consider in a long-term portfolio would be: (CHI), (UTF), (UTG), (PDI), (BBN), (FFC), (BST), (HQL), (MMP), (USA), and (RQI).

Table-4:

Chart-5:

Note: For performance analysis, a couple of funds did not have a history prior to 2013, so they were suitably replaced for the prior period.

Concluding Thoughts

Obviously, the market is going through a period of very high uncertainty and volatility. It is almost impossible to say with any accuracy or conviction if we have already seen the bottom of this cycle. No one can predict where the market will be next week, month, or next year. All that said, the risk to the downside appears to be much greater. There is a very high probability of a recession in the next six to 12 months. If markets were to go down another 20 or 25% from here, most folks are going to see their portfolios lose even more.

So, the question is how to preserve wealth to a great extent now without compromising or missing on the upside whenever that happens. We believe our NPP strategy addresses some of these questions and issues squarely and rather successfully. What we need is a well-rounded, diversified, and multi-asset investment strategy. NPP is one such diverse investing approach with three baskets, which should provide lower volatility, wealth preservation, and long-term growth. Above all, the combined portfolio should generate a very decent income of 5% and provide protection from bigger drawdowns.

We recognize that the approach outlined in this article may not be appropriate for everyone. These strategies require a long-term investment horizon, discipline, and some time and effort on a monthly basis, especially in managing the Rotational part of the portfolio. Also, the Rotational strategies don’t work very well in a taxable account. They work best inside a tax-deferred account. The main idea of this series of articles is to get the readers to think, explore and research a multi-basket investment approach.

Be the first to comment