Astrid Stawiarz

Michael Burry is one of the best investors of our time.

He is famous for predicting the great financial crisis and profiting off the housing crash of 2008. His hedge fund earned returns that outperformed the S&P500 (SPY) by nearly 150x since its inception until he closed it in 2008.

But that’s not all. He also made money shorting the tech bubble of 2021. He shorted Tesla (TSLA) and the ARK Innovation ETF (ARKK) among others.

He was also one of the early investors to buy into the GameStop (GME) saga. He bought it in the single digits before the short squeeze.

This track record has made him one of the most influential investors of our time. There are websites dedicated to his investing style and lots of investors closely follow his latest moves.

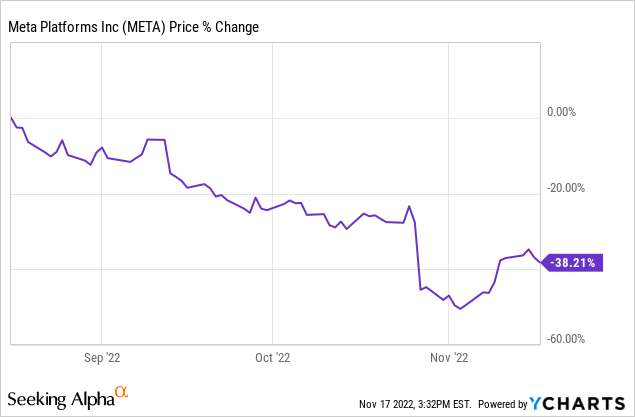

Earlier this year, he made a lot of headlines after he sold the majority of his portfolio, including Meta (META), Bristol Myers (BMY), and Cigna (CI), and once again, his timing couldn’t have been better as the market began to sell off soon after. META dropped particularly heavily:

But he didn’t actually sell everything!

The one stock that he kept is a real estate investment firm called GEO Group (GEO). It used to be a REIT and it specializes in the ownership and management of private prisons and mental health facilities.

And yesterday, his hedge fund disclosed its Q3 activity and we learned that he has recently quadrupled his holding of GEO.

Moreover, he also bought a large position in GEO’s close peer, CoreCivic (CXW), which is another former REIT.

Finally, he also established a new position in Charter Communications (CHTR), which is yet another real asset business, owning cable and fiber infrastructure.

GEO Group

Charter Communications

All in all, these three real asset stocks now represent 60% of his hedge fund! In addition to that, we know that he has a very significant portion of his personal net worth invested in farmland. (At the end of the movie ‘The Big Short,’ it says that the little investing that he does these days is in farmland and he later confirmed this in a separate interview)

So this begs the question:

Why is he investing so heavily in real assets?

Fortunately, he has given us some clues over the years in televised interviews as well as more recently on his Twitter.

I think that it boils down to three main things:

Reason #1: He fears inflation

This is the most obvious reason.

Burry has repeatedly expressed his fear that inflation could get out of hand.

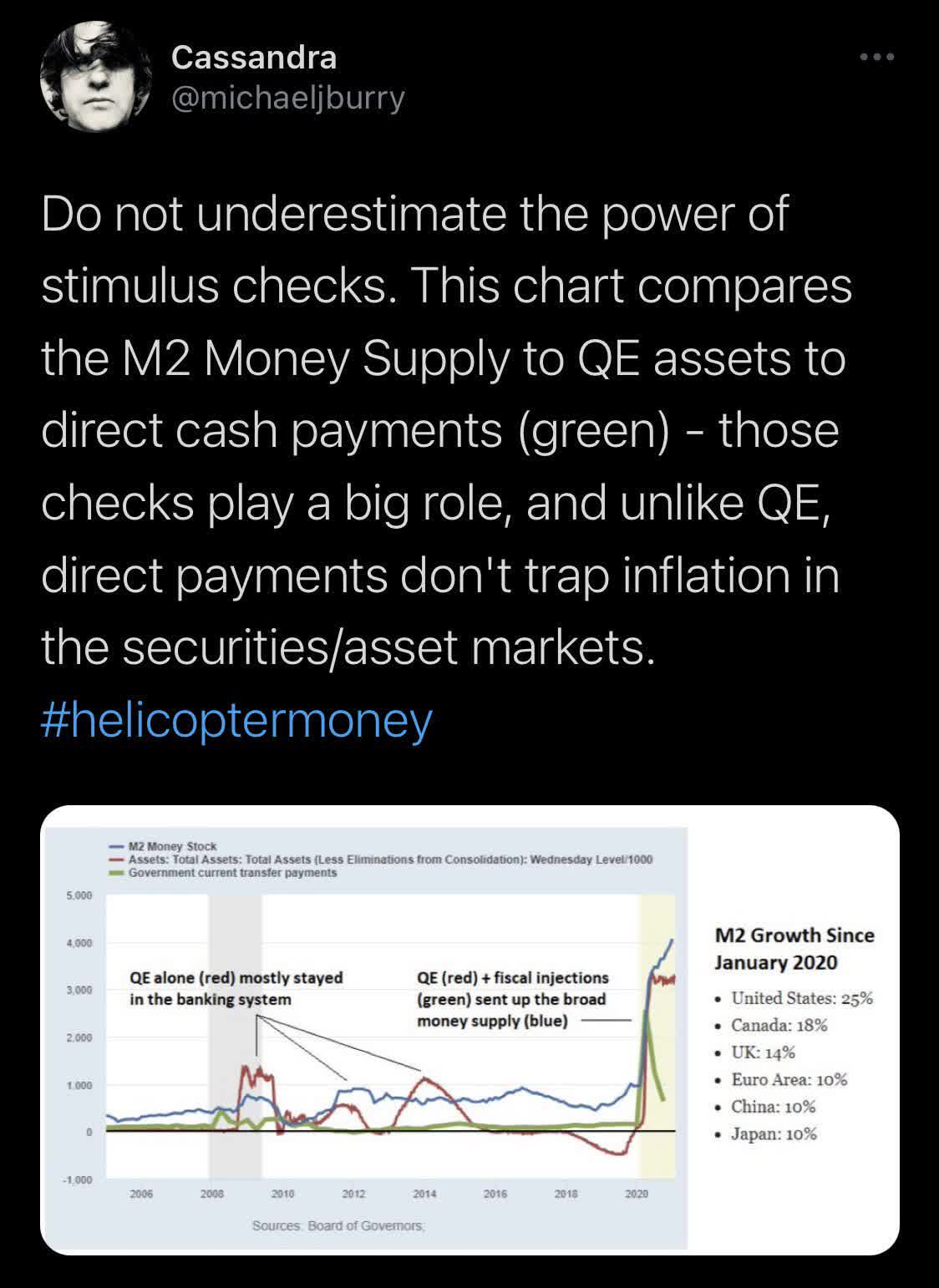

Here is one tweet:

Michael Burry Twitter

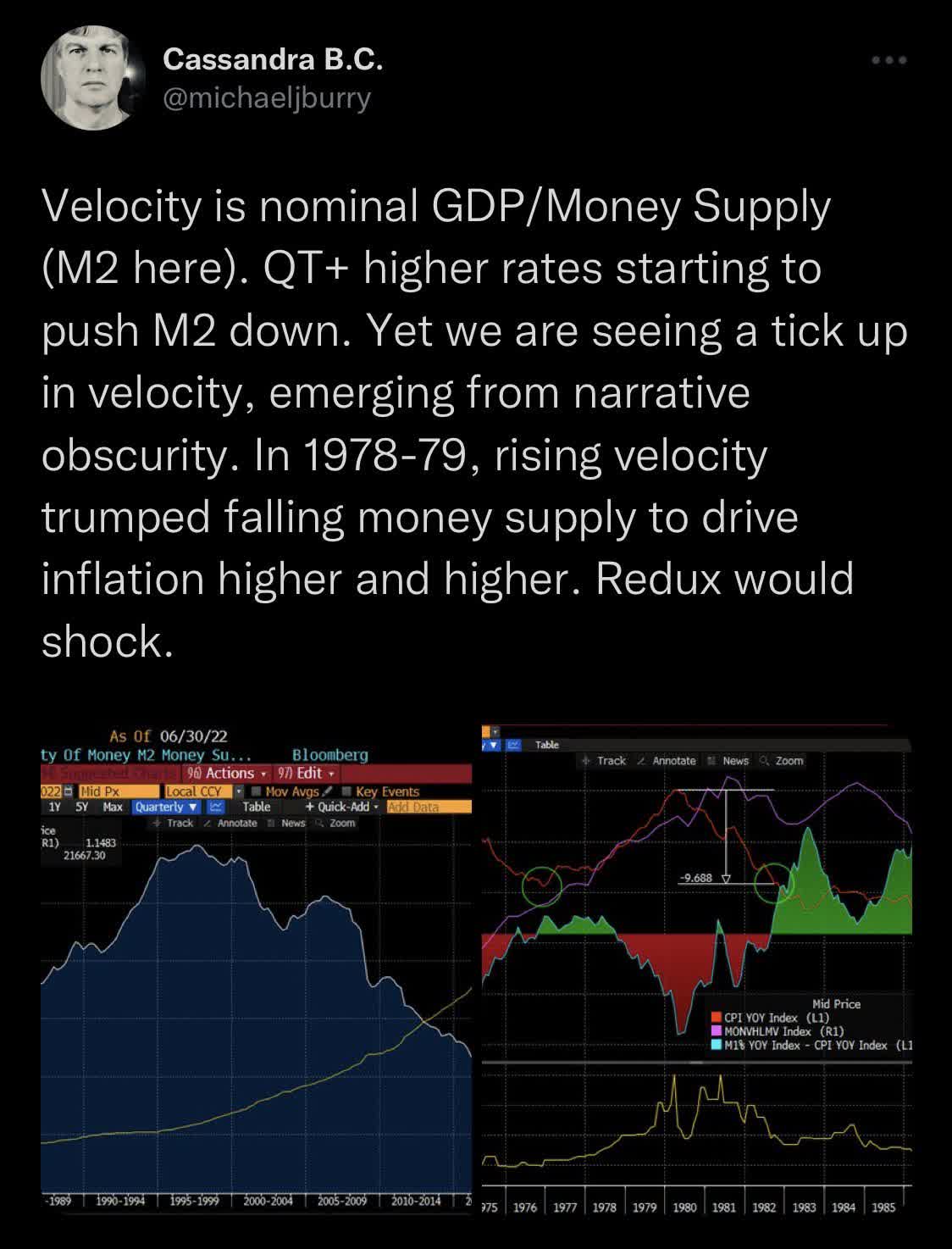

Here is another one:

Michael Burry Twitter

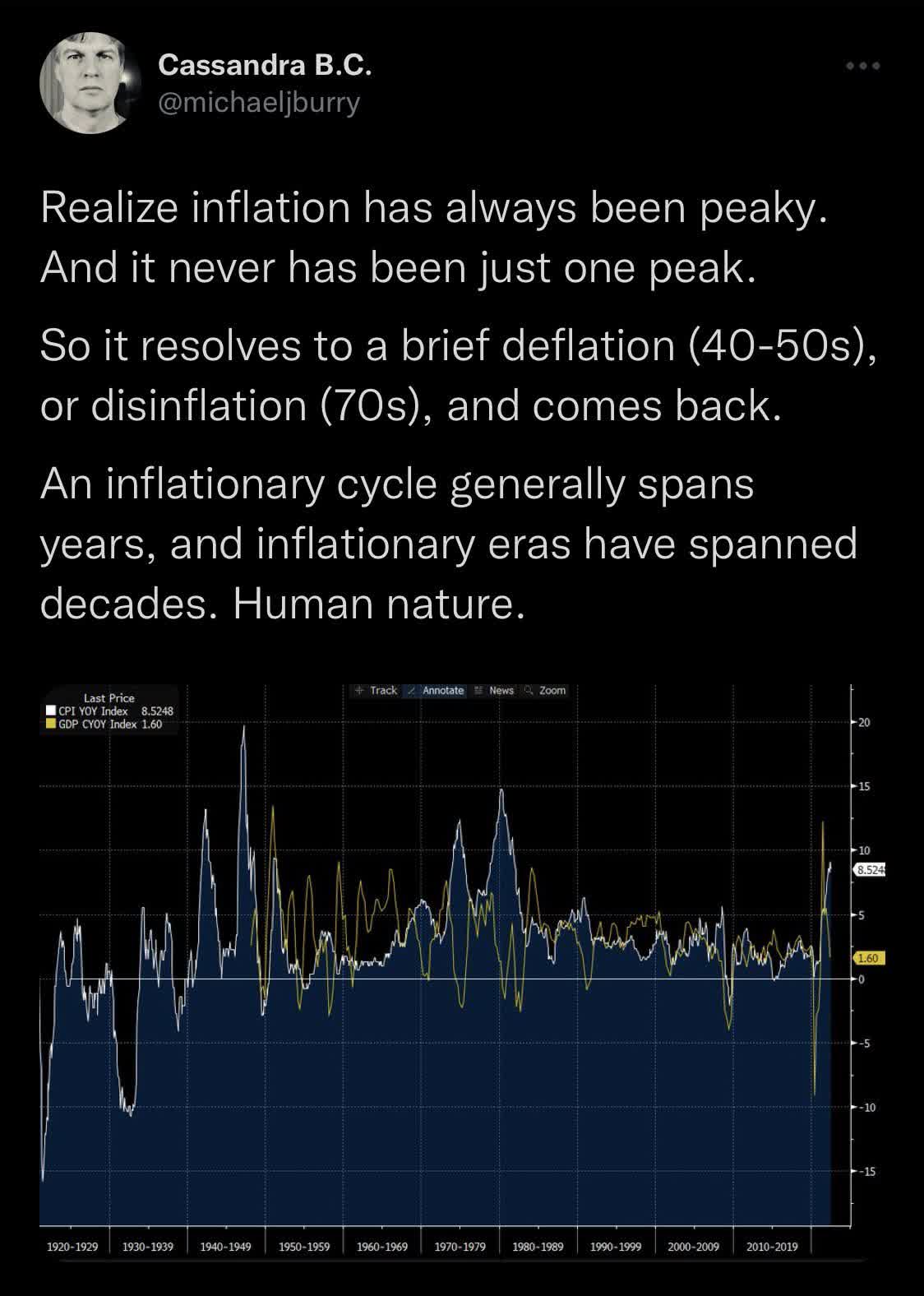

Another one:

Michael Burry Twitter

And one last:

Michael Burry Twitter

You get the point. He fears the impact of inflation and believes that this period of high inflation could last for a lot longer.

He is seeking protection from that and there is nothing better than real assets.

Whether inflation is hot or not, we will still need private prisons, mental health facilities, communication infrastructure, and farmland.

These are all absolutely essential to our society and their value cannot be inflated away.

Their revenues and the value of their assets rise with inflation, profiting their owners in the long run. Meanwhile, their debt is being inflated away so the impact on their equity value is amplified.

Just to give you an example, Farmland Partners (FPI), the biggest farmland REIT, recently noted that the value of farmland is up 20%+ over the past 2 years. This is mainly because the high inflation has resulted in materially higher rents. They are busy hiking rents by 15% right now and since they always have no expenses, all of it falls straight to the bottom line.

The takeaway is that if you fear inflation like Burry, you want to invest in real assets that are limited in supply, always in demand, and essential to our society. Surprisingly, there are lots of REITs that are today heavily discounted despite profiting from inflation.

Reason #2: Real assets offer better downside protection

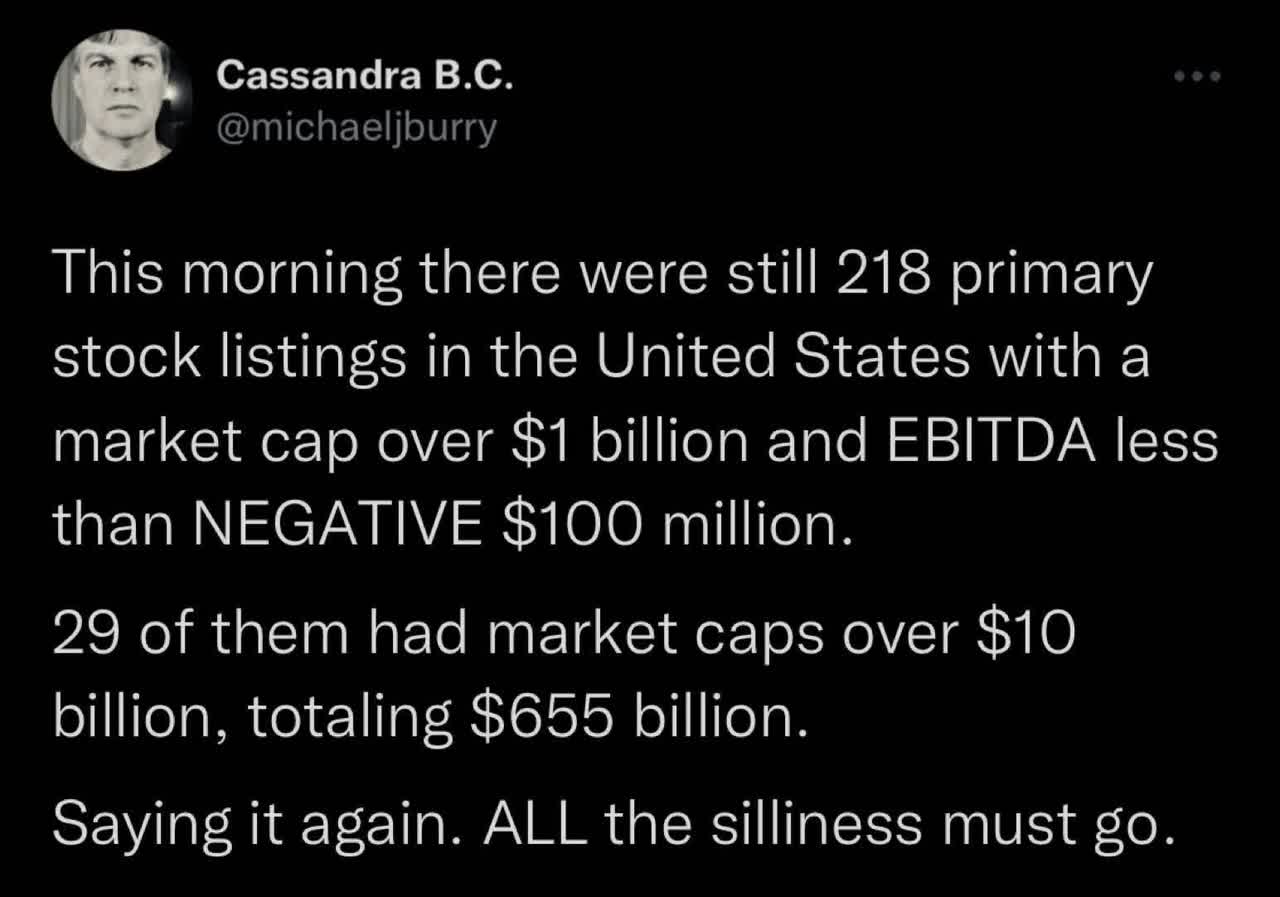

Burry has also warned us of a “mother of all crashes”. He believes that all the speculation in tech stocks (QQQ), crypto (BTC-USD), and growth stocks in general, will end with large losses:

Michael Burry Twitter

The low interest rates and inflation led to unsustainable valuation multiples for a lot of stocks. The only reason why they could justify their huge valuations was that money was practically free and you could value future expected earnings far into the future since inflation was low.

But with inflation now at ~8%, the value of future earnings that are expected in a decade or two from now has become a lot lower:

Michael Burry Twitter

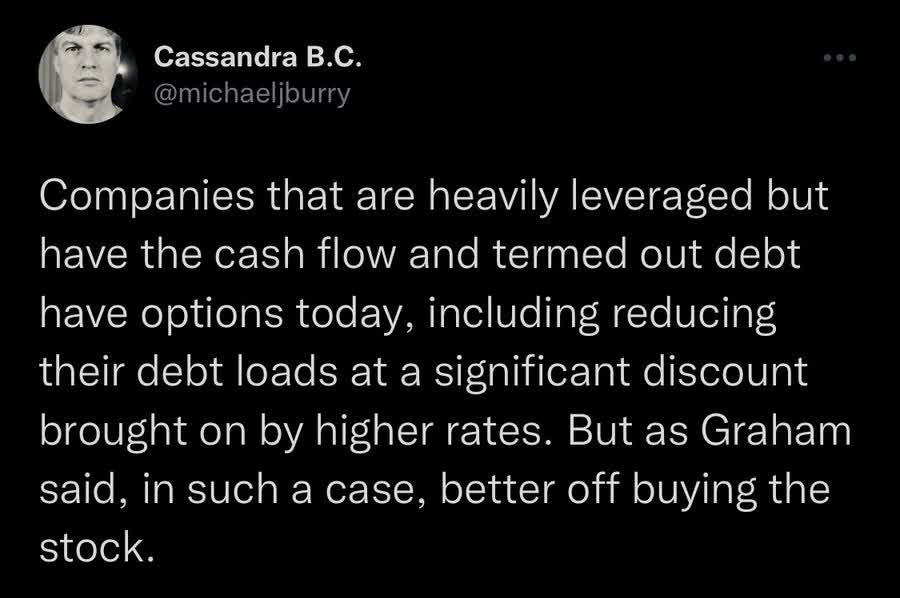

This has a much larger impact on the value of growth companies and crypto than on the value of real assets.

This is because real assets generate a lot of cash flow already today and, unlike growth stocks, they are not valued based on some potential profits that are expected decades from now.

Besides, as we noted earlier, real assets provide a natural hedge against inflation since it increases their earnings power and replacement value. This superior downside protection appears to be one of the reasons why Burry invests so heavily in real assets.

Reason #3: Real assets offer high upside potential

The market has strongly favored growth stocks over the past years. They would get all of the attention and investors poured lots of money into them.

This left real assets and other value stocks behind.

But this is now changing and the opposite is starting to happen. Present earnings have suddenly become very important due to high inflation and rising interest rates. Investors are selling growth and capital is expected to start shifting more heavily towards value stocks, including real assets, which are best positioned in this environment:

Michael Burry Twitter Michael Burry Twitter

In early October, Burry compared the current market to the dot-com bubble, spelling doom for growth stocks while saying that value was about to take off.

More demand for a limited number of high cash-flowing value stocks should push their valuation multiples higher, even as their cash flow rises with the inflation, amplifying the upside potential even further.

So all in all, real asset stocks appear to offer better risk-to-reward, and this is particularly true if you fear inflation.

How Much Should You Invest in Real Assets and How?

That’s a very personal question.

It depends on your objectives, tolerance for risk, needs for current income, and also your outlook on the markets.

Personally, I invest about 50% of my net worth into real assets and real asset-heavy stocks that are highlighted at High Yield Landlord.

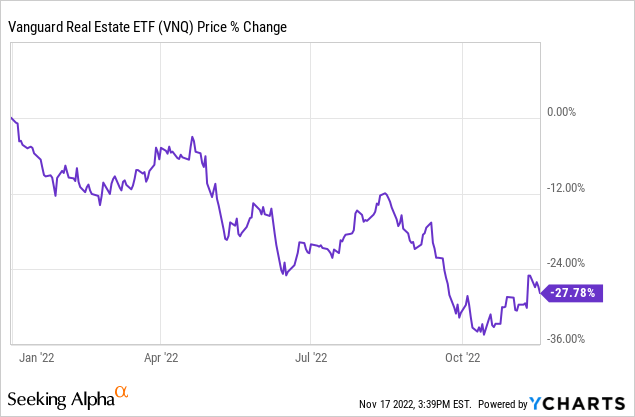

I get most of this exposure via REITs (VNQ), which are publicly listed real estate investment vehicles. Until recently, GEO and CXW (which represent 50% of Burry’s portfolio) were still REITs as well.

I invest so heavily in REITs because I think that they offer the best risk-to-reward in today’s market. They have dropped heavily in 2022 due to concerns about rising interest rates, but the market appears to have overlooked that REITs are some of the biggest beneficiaries of inflation.

Their debt is low in most cases and their maturities are long. So the impact of rising rates is very manageable since their rents are rising at the fastest pace in years right now.

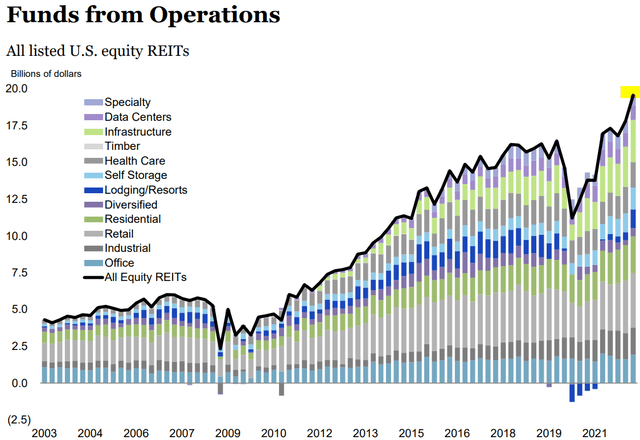

Take a look at the sharp contrast between the rapidly growing cash flow and their crashing share prices:

This disconnect between fundamental and share price performance is an opportunity for long-term investors.

You now have the opportunity to buy high-quality apartment REITs at a steep discount to their net asset value even as their cash flow keeps on growing.

I like GEO and CXW but I think that there are better options out there.

One example in which we are heavily invested at High Yield Landlord is a small-cap apartment REIT called BSR REIT (OTCPK:BSRTF) that specializes in Texan apartment communities. Its rents are growing by around 10%+ right now, but it is priced at a 35% discount relative to the value of its assets. In other words, you get to invest in its portfolio of Austin, Dallas, and Houston apartment communities at 65 cents on the dollar and get the added benefits of liquidity, diversification, and professional management for free on top of that.

BSR REIT

Another one that we like a lot is EastGroup Properties (EGP). It specializes in urban, last-mile distribution centers. They are typically in in-fill locations of rapidly growing sunbelt markets, which result in high barriers to entry, high occupancy, and strong pricing power. The growth of Amazon (AMZN) like companies has greatly boosted the demand for distribution centers and it is allowing EGP to hike its rents by ~20% as leases expire. Its fundamentals are today stronger than ever, but it is temporarily priced at a 30% discount to net asset value.

EastGroup Properties

I just don’t know anything better to buy today. These undervalued REITs allow me to invest in inflation-protected, rapidly-growing real assets at a steep discount to fair value. I think that the downside is limited due to the strong fundamentals and already discounted valuations, but the upside potential is significant in today’s inflationary world. Finally, I also get paid while I wait for the upside. Our Core Portfolio at High Yield Landlord currently has a 10% cash flow yield and it pays a 6% dividend yield. It makes our returns less dependent on the unpredictable nature of the market.

It appears that Michael Burry has come to the same conclusion.

Bottom Line

Michael Burry’s hedge fund is today 60% invested in real asset-heavy stocks, and he also has a large chunk of his personal wealth invested in farmland and other real assets.

I don’t think that this is a coincidence. He has repeatedly warned us about the impact of inflation and the risk of growth stocks.

Interestingly, there are other legendary investors who are also turning to real asset-heavy stocks to find value in today’s world. Bruce Flatt’s Brookfield (BAM) and Steve Shwartzman’s Blackstone (BX) have both acquired many REITs this year, noting that publicly listed real estate vehicles are today undervalued relative to the value of the real estate that they own.

I am doing the same on a smaller scale.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment