DNY59

The Tech Collapse

The Tech Giants started the earnings season with disappointing results. But instead of these reports resetting expectations lower, they opened up a can of worms (see “Fall of The Tech Giants“).

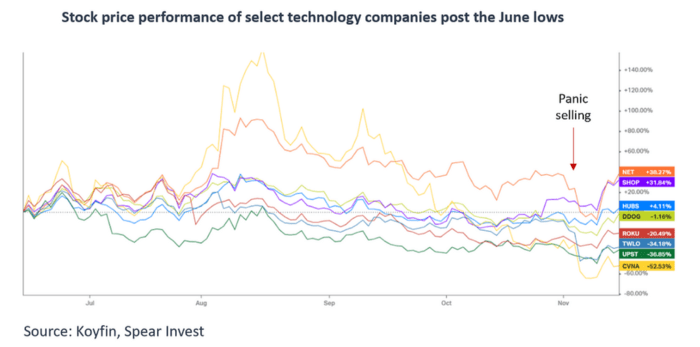

At a high level, while the valuation impact of higher rates is largely priced in, the recent move in interest rates to ~4% is just starting to get reflected in earnings. Overall, we expected revenue growth to be 5-10% lower than Street estimates across the board in CY23 driven by general caution as companies set their budgets ahead of a well-telegraphed recession (extended sales cycles etc.). The interesting point was that this 5-10% disappointment in top line growth caused many companies to decline 30-40%+, resulting in panic-selling across the board and creating many great opportunities.

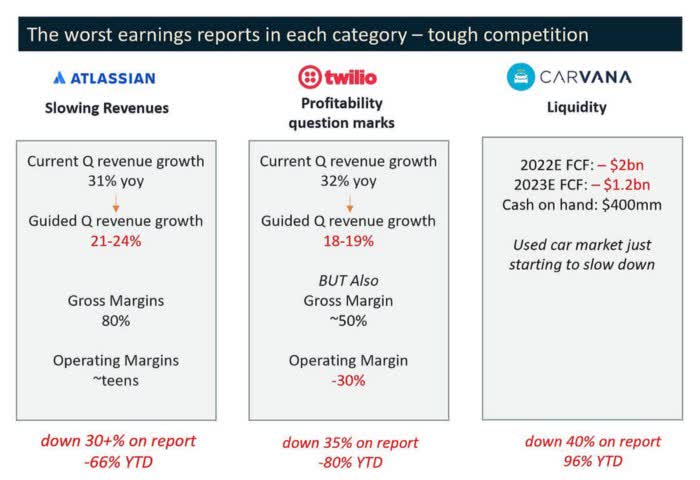

The challenges highlighted by this earnings season can be broken down into the following: (1) revenue growth slowdown (2) profitability question marks (3) liquidity.

In short, the first category may ultimately offer many opportunities, as investors are mis-modeling the medium-term growth trajectory (i.e., extrapolating from 1-2 weak quarters). The second and third categories are comprised of many challenged business models that may need significant turnarounds and restructurings (if they are to stay in business).

Here is a glimpse of some of the highlights this quarter:

Worst Earnings Reports In Each Category (Author)

1) Revenue growth slowdown.There is a significant difference in valuation multiples between companies growing 30%+ and companies growing in the high teens. Many tech companies that were growing 20-30% are now guiding to 10-20%, which is a problem. Investors are now confused, as traditional methods like revenue multiples don’t apply as easily if you are not growing.

As an example, Atlassian (TEAM) guided to revenue growth of 21-24% for the upcoming quarter vs. 30%+ previously. This sent the stock from trading ~15x to <10x EV/revenues. In this case, it will be crucial to understand if the slowdown is cyclical and the company will catch up the following year, or it is secular (growth rate reset). We don’t have a view.

This is an area of opportunity. Many companies are not growing because of tough comps, others because of recession fears, and some are facing secular challenges. Tough comps could turn into easy comps, but secular challenges are not easy to solve.

2) Profitability question marks. Now that companies are not growing at astronomical rates, the focus has shifted to profitability. For the first time investors are scrutinizing the different expense line items trying to understand a path to profitability. Again, commonly used principles such as “the Rule of 40” (Revenue growth % + FCF margins % of a successful business should exceed 40%) are not helpful if a company is growing at mediocre rates and has negative margins.

As an example, Twilio (TWLO) guided revenue down significantly, but in addition, the company has relatively low gross margins and consequently -30% operating margins and negative FCF. High teens growth and significantly negative margins do not sound particularly appealing at any valuation.

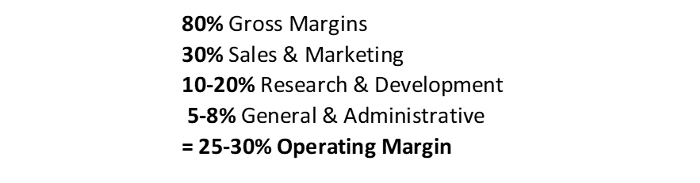

SaaS companies require significant sales and marketing, and these areas are not easy to cut without sacrificing growth. Consequently, companies with high S&M hoping to generate cash flow need to be starting with very high gross margins.

Below is a general framework that we use and thoughts on each line item:

Author

- S&M is hard to cut without sacrificing revenues. Ideally, you want to find businesses where products sell themselves (i.e., upgrades), they do not require big deployments, and have large installed bases of “fremium” customers that can become paying customers. Consequently, as revenue scales, S&M will become a smaller % of total revenue.

- While R&D is an area you don’t want to be cutting, there are many instances where it can be run more efficiently. Low R&D can also be a red flag.

- Most tech companies run relatively high G&A. There is significant opportunity to cut this from the high teens to 5-8%. Think cuts to free lunches, tap kombucha, organic pheasants, ping pong tables, etc.

The profitability framework is inherent in the business model, so unless there is a clear path to profitability or turnaround, we generally would stay away from non-profitable business.

3) Balance sheets and liquidity concerns. Many companies that had several billions of dollars on their balance sheets are now seeing that balance deteriorate after several quarters of cash burn. Once investors realize there is less than ~1 year of cash on the balance sheets at the current burn rate, stocks go into free-fall. An example here is Carvana (CVNA), once considered a low-risk gem, which is now scrambling to find sources of liquidity.

Moreover, there are many companies that take asset risk that may be overlooked by investors traditionally focused on evaluating companies on top line growth metrics. These businesses could face major writedowns.

We believe that many of these companies will need significant balance sheet restructurings and are therefore avoiding them at this point in the cycle.

Where are the opportunities?

Amidst this carnage, there were several decent earnings reports that did not initially get the credit. Here are a few examples:

- Datadog (DDOG) revenue grew 61% yoy in 3Q (vs. 74% last quarter), with 17% operating margin and 15%+ FCF margin. Guided to 4Q growth of ~40% on a tough 84% comp.

- Hubspot (HUBS) revenue grew ~31% yoy (+38% in CC), with 9% operating margin and 8%+ FCF margin. Guided to 4Q growth of 20.5% (despite 9% FX headwind).

- Cloudflare (NET) revenues grew 47% yoy, GMs 78.1%, operating margin 5.8% and ~flat FCF (-$4.6mm). Guided to 4Q growth of ~40%. Investors were initially disappointed by a “less than usual” beat, but not so bad in hindsight.

Overall, while panic-selling results in high correlations, i.e., babies get thrown with the bathwater, we have seen quite significant divergence post these sell-offs with good companies significantly outperforming the challenged business models.

Author

Macro Backdrop

The earnings-driven technology implosion was followed by panic buying over the past several days, after both inflation indices (CPI and PPI) came in slightly lower than expected.

Is inflation over?

We don’t think so. There are several categories, such as wages, that have significant lags and will continue to put upward pressure on inflation. This is why the Fed is so focused on the employment numbers which may take some time to ease (see section below). We don’t foresee the economy getting to the 2% target anytime soon.

That said, there is no question that economic activity is slowing and inflation numbers could continue to slightly surprise to the downside, giving the Fed ammunition to slow the rate of hikes. This is a major positive for technology stocks and could create a very favorable setup into next year.

We believe that the relationship between interest rates and technology valuations is not well understood by investors, potentially creating one of the best buying opportunities in decades.

How is employment data surprising to the upside despite massive tech layoffs

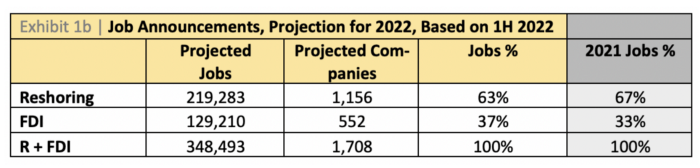

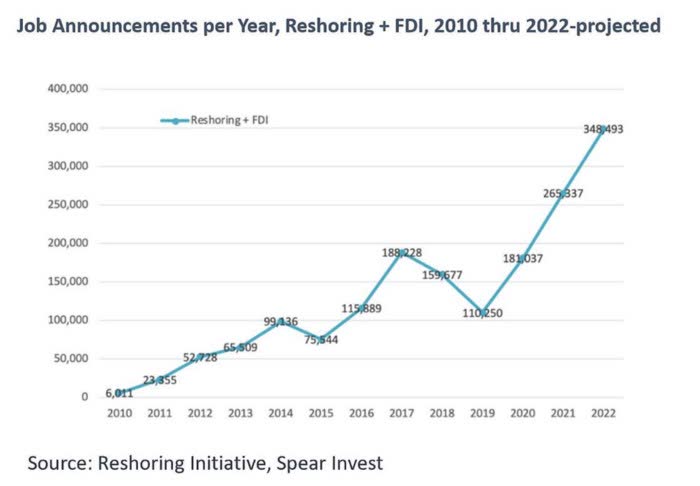

Tech layoffs have been well-publicized, but even if you add up all the announcements, with the most significant being Meta 11K, Amazon 10K, Twitter 3.7K, Stripe 1K, Salesforce 1K and several smaller ones (<1K), they only add up to 36K jobs, granted in a short period of time.

On the contrary, according to the Reshoring Initiative, re-shoring and foreign direct investment is projected to add 349K jobs in 2022. These jobs are mostly related to capex investments in semiconductor capacity (CHIPS Act), electric vehicle (EV) battery plants, other EV-related infrastructure (Inflation Reduction Act), etc. Consequently, despite significant Fed tightening through interest rates, there is still significant “stimulus” in the system creating support.

Author Author

We believe that productivity improvement through automation and AI will be the only way to sustainably address the labor shortage and wage inflation. We expect that industrial technology companies will be significant beneficiaries of this trend.

Disclosures

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment