Dr_Microbe

Thesis Overview

The most profitable investments in microcap stocks are made when businesses reach inflection points, then go on to deliver years of organic growth and inflect to profitability. I believe that NeuroMetrix (NASDAQ:NURO) is at that turning point.

After a long history of losses and shareholder dilution from spending on R&D that didn’t work and attempts to sell medical devices that were not successful, NURO now has a clean capital structure and balance sheet with a proven business that is scaling with strong unit economics.

NURO has a promising medical device called DPNCheck, which is used for early disease detection of diabetic polyneuropathy (DPN) and is sold to Medicare Advantage (MA) insurers with >80% of revenue from consumables. They are following the same business model as Semler Scientific (SMLR), who built a strong business by showing MA insurers that early disease detection leads to better patient outcomes, lower cost to serve patients, and increased revenue for the MA insurers through appropriately risk-coding patients. DPNCheck launched in 2011 and has grown at a >20% CAGR in recent years to $7.4m revenue in 2022. That >20% organic growth is set to continue indefinitely at ~80% gross margins. Most importantly, DPNCheck’s go-to-market is very efficient because they sell at the top level to UNH and HUM, who then push down to their organization.

DPNCheck’s consistent growth and strong unit economics has been masked by NURO’s Quell product which the company sells direct-to-consumer as an over-the-counter (OTC) medical device for pain management. The company created a slick product that works well and grew it to ~$14m of revenue in 2017, but had to spend aggressively on online advertising and TV ads to get that growth (negative unit economics). In 2018, management realized their market efforts were not going to pay off for Quell because the market for TENS-like devices is too crowded, so they stopped advertising. That led to revenue declining to <$2m in 2022, which is now mostly consumable pads that are ordered by customers and paid through credit card (no insurance pay).

Management pivoted the strategy for their Quell device to focusing on gaining breakthrough designation by the FDA for patients with Fibromyalgia. 10 million Americans suffer from debilitating pain from Fibromyalgia. Quell may receive FDA clearance for the device for patients with Fibromyalgia in late 2022 and begin marketing to physicians in early 2023. Having a physician prescription means they can pursue insurance reimbursement which results in a much, much higher revenue per device than selling in the highly competitive over-the-counter market. Zynex sells a prescription pain management device, but sells primarily through physical therapists and does not have specific indications or data supporting efficacy, like Quell does.

The takeaways are that NURO’s revenue growth is accelerating. After revenue declines in 2018-2020 from unprofitable Quell OTC revenue falling, NURO grew 12% in 2021 and will grow 12% in 2022. I expect revenue growth to accelerate to >20% and maintain that growth for several years, primarily from DPNCheck.

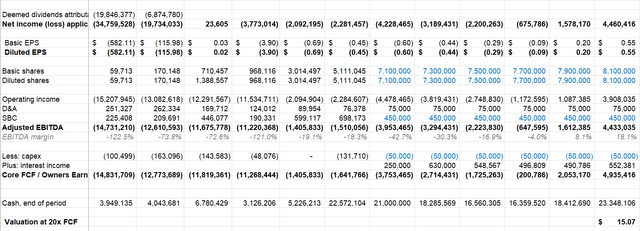

After significant losses from Quell advertising, NURO raised highly dilutive preferred capital in the 2016-2018 range (please refer to NURO’s form 10-K filings for details). After cleaning up the cap structure, NURO raised over $20m through DRIP equity raises (selling shares directly into the market) in 2020 and 2021 (including some very attractive sales prices last year when the stock price spiked >$10/share). All this leads to an ugly and messy past, in which the share count has gone way up and the stock price way down. However, I believe that evaluating the business based on current facts, shows that NURO is an undervalued med device company that is well capitalized to pursue this growth. The company now has a clean capital structure with 7.1m shares and 0.5m options for management, no debt, no preferred, no warrants, and $23m of cash. I expect NURO to burn $3.8m in 2022, $2.7m in 2023, $1.7m in 2024, and $0.2m in 2025. Then it should start generating cash, with +$2.1m in 2026, +$4.9m in 2027. I model trough cash of $16m in 2025.

On profitability, I expect the business will generate $5m of free cash flow in 2027 and be worth 20x FCF plus net cash, which gives a value of $15/share. Studying Semler’s history, once the business crossed $14m in revenue, it inflected to profitability and never looked back. DPNCheck currently has $7.4m in revenue, and I expect it to cross that threshold exiting 2025. SMLR has proven how strong the unit economics are in this business with 37% EBITDA margins in 2Q22.

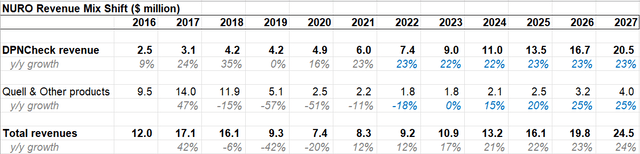

Revenue Mix Shift Well Underway

Higher quality, more profitable DPNCheck revenue is replacing negative margin Quell revenue (when including expensive marketing spend in the past).

As rev mix continues to shift, the growth will accelerate and the business will reach profitability.

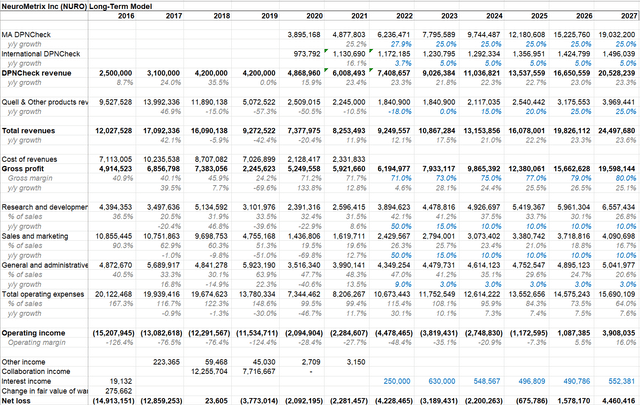

Company Filings and My Projections

The path to $5m of FCF is driven by (1) organic growth in DPNCheck (2) gross margin improvement from mix shift to higher margin DPNCheck (~80% GMs) (3) steady opex growth.

DPNCheck Notes (lots of details – ok to skip)

- DPNCheck is an easy-to-use screening tool for diabetic polyneuropathy (DPN). Provides rigorous and numerical analysis that is consistent and repeatable. DPNCheck accurately measures nerve conduction. Prevalence of DPN is high in people >65 years of age. The DPNCheck device reads out a number which is a spectrum with a cutoff – if below that number, then the patient has DPN. Then the doctor needs to do further work to determine if diabetic, rheumatoid arthritis, alcoholic, etc.

- The doctor can take preventive measures with the patients, which saves the MA insurer money. MA insurers receive a capitated payment, so make more money when they control costs.

- DPNCheck also acts as a revenue source for MA insurers, increasing the capitated payment by risk-coding the patients. Those risk codes can add >$3k of revenue per patient per year, resulting in a return on investment for the MA insurer >>100%. 20-30% prevalence of poly neuropathy, <5% of patients are getting HCC codes for that. There is an opportunity for MA insurers to properly risk-code their covered lives so they are appropriately compensated for “sicker” patients.

- Common diagnosis codes using DPNCheck are:

- HCC75 – rheumatoid arthritis, pre-diabetes. To bill this, the doctor needs to write it up and then treat it. DPNCheck is a screening mechanism that identifies which patients the doc should more closely evaluate.

- HCC18 – diabetes with complications

- Current standard of care is tuning fork, reflex hammer, crude pressure sensing device. Known to get many false positives. Not analytical and precise and easy to document. DPNCheck gives a readout of a number, which can be monitored over time. Also, with DPNCheck symptoms are not required to identify a potential problem and take preventive precautions.

- DPNCheck has impressive clinical ROI and financial ROI. Semler has grown because they have done a good job with both of these and getting the message out to MA insurers.

- DPNCheck has 4 people in marketing, sales, and customer success, three of whom were hired in early 2022 (exec mgmt was running the business before), including hires from Semler. They have the team they need to execute now – no more plans for hiring for DPNCheck.

- My guess is that the largest customers, similar to SMLR’s largest customers, are OptumCare UnitedHealth Group (UNH) and Humana (HUM) which are the two largest MA insurers, that together hold 40-50% of the MA market. DPNCheck grows approximately 20% from existing customers alone (net revenue retention 120%). Having UNH and HUM as customers, basically gives DPNCheck a license to hunt – the sales are made at the medical group level. United has 5m MA covered lives and hundreds of thousands of clinics.

- Semler has a nicely integrated software system into the MA insurers’ electronic health records (EHRs), which allows for significant automation and data analysis of the population. DPNCheck is working on rolling out these features by the end of 2022 – direct integrations into all major EHRs.

- DPNCheck is mostly in clinics, but also has some HRA business that is indirect (referred from MA insurers).

- The revenue is very stable in this business. But the growth can be sporadic when a new customer onboards 150 new locations.

- Long sales cycle, but keep on growing with existing customers.

- 80% consumables, 20% device sales. Sells the device for $1,500 (typically 1-2 devices per clinic) and sells the consumables for $20-25. One consumable is used for each patient tested. Generally patients are tested once per year.

- International business – Japan, China, a little in Europe. DPNCheck selling prices are higher in the US and the unit economics work the best for U.S.-based MA insurers.

- 26m people with MA insurance. At 10% market share, do 2.6m tests per year at $22 per test = $57m revenue potential for DPNCheck.

Quell Notes (lots of details – ok to skip)

- Management stopped advertising Quell’s over-the-counter (OTC) devices in 2018, given the marketing efforts were not generating an attractive return. They still have a stable base of Quell users that order replacement supplies. This is cash pay, typically with a credit card. Most of Quell revenue is now from sale of replacement electrodes that consumers order.

- The new strategy for Quell is to get breakthrough designation from the FDA for Fibromyalgia which impacts 10m Americans. Address pain and the symptoms of Fibromyalgia. Could replace 3 drugs that are currently used to treat Fibromyalgia.

- After Fibromyalgia, Quell could get approval for CIPN – 700k patients on chemotherapy.

- Physicians will write a prescription and Quell will get reimbursement. Initially, it could be cash pay. Over time, Quell may shift into selling through the same value-based care channels (MA insurance) as they sell DPNCheck.

- Possible to get FDA approval in 2H22 and begin commercializing in 1Q23. We have randomized control data showing the efficacy of the device. The device is safe and is being used by thousands of patients through the over-the-counter market.

- Math on the upside case: 10m patients x 1% penetration x $1k ASP = $100m rev potential. I am modeling modest growth in this business – if they execute, this is all upside to my estimates

- Zynex (ZYXI) is old style med device, 400 reps. No specialization. Insurance sometimes covers it, sometimes not. I’ve used both devices personally, and the Quell is much better – sleeker, has an app with data, looks like a modern medical device. Functionally, they are both TENS units that provide electrical shocks to help manage pain.

Other notes

- Parts shortages for DPNCheck, resulting in paying premiums for circuit boards, capacitors, plastic inserts, etc compressed NURO’s gross margins in 2Q. LT in mid-70s, rising toward 80%.

- 2022 investing in sales and R&D for DPNCheck which compressed margins a bit in 2022.

- Opex is $10-11m run-rate and may grow gradually from there, flattish to slightly up

- Interest Income on cash – with rates on their way to >4%, NURO may generate >$0.5m of interest income per year, which is $0.07 of EPS.

- Given history briefly described above, NURO has significant net operating loss carryforwards of $138m Federal and $55m state. That will result in no cash taxes for the indefinite future.

Further dilution?

- 7.1m shares outstanding. 0.7m equity equivalent options which translates to ~0.5m dilution using the treasury method.

- $23m cash, no debt, no preferred, no warrants. Clean cap structure of common shares and cash. Management learned their lesson about taking potentially highly dilutive securities. They are fully funded to reach profitability, with trough cash of $16m in 2025 and reaching profitability and FCF generation thereafter.

- Management has the right amount of cash and does not plan additional share issuance.

Risks

- History of losses and dilution. Maybe this time isn’t different. Same management as before.

- Quell loses more money than expected (mgmt seems to have learned from their past mistake of spending too much on advertising).

- DPNCheck grows slower than expected.

Conclusion

DPNCheck is a screening product sold to MA insurers which gives better member health outcomes, lower cost, and increased revenue for MA insurers. The product has consistently grown >20%. Discontinuation of Quell marketing in 2018 is masking the strong, underlying growth in DPNCheck. The result is rev growth is now accelerating. A clean cap structure and strong balance sheet with $3.24/share which is sufficient to fund the business to profitability. Potential $15/share fair value in 5 years based on 20x FCF.

Long-Term Projections

company filings and my projections

company filings and my projections

Be the first to comment