Wachiwit

Investment Thesis

Netflix (NASDAQ:NFLX) has seen its shares crushed in the past several months by more than 60%. Consequently, the stock is clearly cheaper than it was. But now that Netflix is no longer a premium growth stock, a stock that is consistently growing at more than 20%, I wonder whether this quarter was enough to get investors clamoring back for the stock?

I don’t believe it was such a quarter.

Keep in mind that Netflix declares that its operating margins appear to be weaker than they would have otherwise been due to currency effects and other one-off costs associated with rightsizing its business, something we’ll discuss in the analysis.

Nevertheless, ultimately, the stock is still being priced at approximately 45x next year’s free cash flows. That’s a rich price for what’s on offer.

Netflix is No Longer a Premium-Growth Company

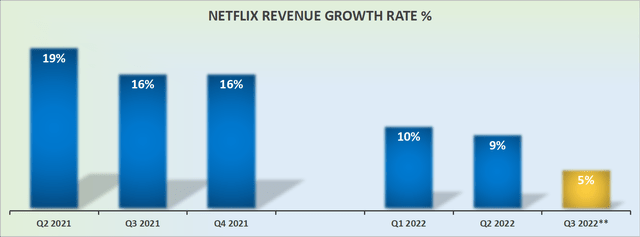

Netflix revenue growth rates

Netflix’s Q3 guidance is a stark reminder that Netflix is no longer a premium-growth company. Netflix is not going to generate a +20% CAGR on a sustainable basis any time soon.

It’s not only the fact Netflix is comping against 2021, a period of strong growth. Or the fact that we are now in a highly inflationary environment. Or that energy costs are so high and eating away at discretionary household income. It’s a combination of all of the above.

Growth in Subscribers?

During the earnings call, Netflix charged that during an economic downturn, entertainment is resilient as consumers look for escapism. Management describes that Netflix provides households with terrific value, particularly against other alternative options.

Moving on, to compound issues, Netflix has a lot of competition. And even though I fully recognize that for SA readers, paying for Netflix is not optional. I do not believe that the same argument can be made about the rest of Netflix’s global membership base.

Indeed, let me put it this way. What percentage of potential members that haven’t got Netflix yet, would now, post-pandemic all of sudden look to subscribe to Netflix?

I contend that if members are not on Netflix now, they are unlikely to seek to adopt Netflix amidst this cost of living crisis and slowing economic environment.

On the other hand, keep in mind that Netflix itself is forecasting that for Q3 2022, global net additions are likely to increase by 1 million.

On yet the other hand, I believe that the vast majority of this increase is likely to come from Netflix’s APAC region. Where average revenue per membership is approximately half of Netflix’s mature UCAN market.

Essentially, Netflix’s growth from APAC isn’t likely to be a needle-mover on the bull investment thesis.

Netflix’s Advertising Prospects

Netflix believes that it can reignite its revenue growth rates through a focus on unlocking pent-up demand by having an ad-supported tier.

That being said, Netflix openly declares that advertising revenues will roll out in small pilots at first with the goal of rapidly iterating this offering. Netflix isn’t going to rush this rollout. It will take several years.

The goal is to over time get its advertising business to bring in substantial incremental membership, through lower price points and this will be accretive to Netflix’s operating margins.

On the earnings call, Netflix’s management said that the advertising tier will be customer-centric and focused on the customer experience.

Profit Margins Suffer From Currency

Historically bears, myself included, have pointed out that Netflix’s GAAP reporting and free cash flow reporting were very far apart. The market has never been interested in this in the slightest.

Mentioning Netflix’s inability to make free cash flows became a muted subject. Now, with the stock down more than 60% from its highs, Netflix will need everything working in its favor to persuade investors back into the stock.

I’m not referring to investors that already own the stock and are looking to buy the dip. I’m not referring to bottom fishers that are looking for a quick bounce off the bottom.

I’m referring to institutional capital that actually moves the stock higher. Would the fact that Netflix’s Q2 2022 operating margins be down 540 basis points y/y be enough to entice investors back into the stock?

Similarly, as we look ahead to Netflix’s Q3 2022 guidance, operating margins once again leave investors feeling sullen, as its operating margins continue to compress y/y.

That being said, as mentioned already, currency changes are plaguing Netflix’s financials.

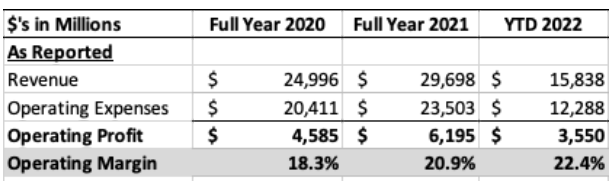

Netflix’s Q2 2022 shareholder letter

The above figure shows Netflix’s operating margins if it is rebased on the start of each year.

Hence, if we exclude the currency impact, Netflix believes that its operating margins for 2022 would probably reach 20%.

NFLX Stock Valuation – Too Difficult to Find Upside

The problem with Netflix is that it’s no longer a growth company. It’s a mature business without a mature free cash flow profile. How does one even start to value such a business?

Do we measure the business on its future free cash flow profile? If we say that by 2023 Netflix turns on the free cash flow spigot and starts generating more than $2 billion of free cash flow, then the stock today is priced at 45x next year’s free cash flow. Is that a bargain price?

Typically, for a business that is growing its revenues in the teens, you’d want to pay around 10x to 15x free cash flow multiple. You don’t want to pay more than 40x forward free cash flow for a business that isn’t going to return to 20% CAGR on a sustainable basis.

Particularly for a discretionary business that has a myriad of competition from countless sources, not only from streaming options, but even further afield, such as gaming and other forms of entertainment.

The Bottom Line

While I fully recognize that the stock jumped 7% after-hours on the back of these results, I believe that this is more of a relief rally rather than a strong rally that would get investors back into the stock in a serious manner.

The problem with investing is opportunity cost. Any tech investor that is worth her salt will be right now very aggressively scanning the market for some of the countless growth tech companies of tomorrow available at insane bargain prices.

I’m not convinced that Netflix’s story is now all of sudden all that compelling to get serious institutions clamoring for the stock anytime soon. In essence, there are countless better opportunities elsewhere.

Be the first to comment