selvanegra/iStock via Getty Images

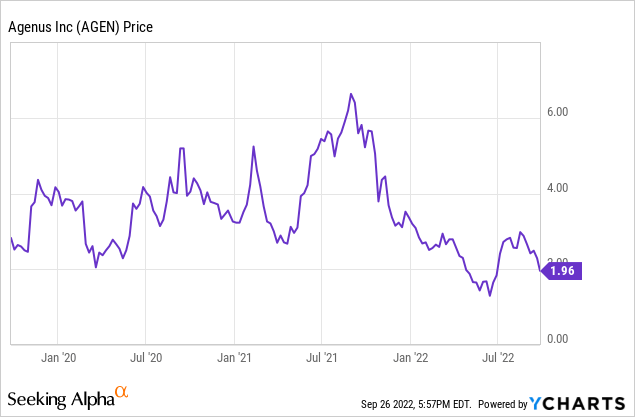

Agenus (NASDAQ:AGEN) has been a big disappointment to investors since the FDA removed its accelerated approval status for balstilimab for cervical cancer in October 2021. Approaching a year later, Agenus has launched Phase 2 trials for Botensilimab, a next-generation CTLA-4 cancer therapy. I believe these trials are highly likely to produce impressive results and greatly enhance shareholder value. Agenus has a broad pipeline beyond that, including several therapies licensed to larger companies for development. It even has a commercial product, a component of the Shingrix vaccine, generating royalties from GSK (GSK). In this article, I will summarize the rest of the pipeline, including licensed antibodies that are in clinical trials. The focus of the article will be the new Botensilimab trials and their potential to turn the company around. Before doing that, I will review Q2 2022 results, so readers can understand Agenus’s current cash and cash flow situation.

Agenus Q2 2022 Results

Agenus Q2 2022 results were reported on August 9, 2022. For me, the key figure is cash remaining to continue clinical development, which was $238 million. That was down sequentially from $263 million, so the burn rate was $25 million per quarter or, if constant, would be $100 million per year. But the burn rate could go up with the initiation of new Phase 2 trials. Research and development expense was $45 million, administrative expense was $19 million. Net loss for the quarter was $49 million, or $0.17 per share. It is difficult to predict when cash will run out since the runway could be extended by milestone payments from partners.

New Botensilimab Trials

Next generation CTLA-4 agent, Botensilimab, formerly AGEN1181, presented data at SITC in 2021 showing durable responses in nine cancer types in over 100 heavily pretreated patients. In June 2022 Agenus reported exciting clinical activity for the Botensilimab/Balstilimab combination for MSS (microsatellite stable) colorectal cancer at an ESMO Congress. AGEN1181 is designed to delete T-regs and increase priming compared to current CTLA-4 agents. It also overcomes the genetic polymorphism displayed by about 40% of the target cancers (to which Yervoy is unresponsive). Both monotherapy and combination therapy have been well-tolerated.

On September 12 Agenus announced the initiation of Botensilimab Phase 2 trials for MSS colorectal cancer and for melanoma. In the colorectal cancer trial, where patients must have been previously treated with chemotherapy, there will be cohorts treated with Botensilimab as a monotherapy, and in combination with Balstilimab. The melanoma trial will test the monotherapy on patients who already proved refractory to prior PD-1 therapy. A third trial of Botensilimab for pancreatic cancer is likely to start before the end of 2022. Other indications may also be tested at later dates.

Given that earlier trials had some success in patients that were much more heavily pretreated (failed several prior lines of therapy), the hope is the new participants will have even better responses. Both MSS colorectal cancer and melanoma are common enough that the commercial value of a successful therapy would be significant. No timeline for data readouts has been given.

QS-21 Stimulon

Agenus is a commercial-stage company because it receives royalty revenue from QS-21 Stimulon, an ingredient for vaccines. In Q2 Agenus reported only $144 thousand in non-cash royalties from GSK, compared to $7.8 million in Q2 2021. But it also reported a $17.3 million royalty sales milestone. In addition to the royalties on sales of Shingrix, QS-21 is in GSK’s malaria vaccine. When that will ramp up is open to question as it was delayed in part by the pandemic response. Agenus believes that Stimulon demand will increase significantly, and so has invested in additional production capacity.

Rest of Pipeline

The main point of the article was the update on Botensilimab, which is part of the pipeline. The Agenus pipeline has many other potential sources of value, but each case is dependent on successful clinical trials, regulatory approvals, and market acceptance. Agenus has been able to operate largely using cash generated by licensing to major pharmaceutical companies. Presently, MK-4083 is an ILT4 agonist antibody licensed to Merck (MRK) for a variety of cancers, likely as a combination agent. Incyte (INCY) has four Agenus antibodies in cancer trials, again as combination agents. Bristol Myers Squibb (BMY) licensed a TIGIT bispecific antibody. Gilead has option rights on AGEN2373, a CD137 antibody. UroGen (URGN) has licensed Zalifrelimab as a possible combination therapy.

The ability of Agenus to generate and validate antibodies, including bispecific and Fc-engineered antibodies, has been its greatest strength so far. I believe new antibodies will continue to be generated and licensed to other companies.

Conclusion

The new Botensilimab trials could end in failure; any clinical trial can. Note that the earlier Balstilimab and Zalifrelimab trials were not failures; they had positive data. Rather, following approval of an existing PD1 therapy in the same indication, the FDA removed Fast Track status, resulting in the need for an additional Phase 3 trial. Agenus decided to save the cost of that trial and move on to the Botensilimab trials. The reality is that the Agenus PD1 and CTLA-4 agents are well vetted already. That still needs to be turned into data that the FDA can approve.

Perhaps the biggest unknown is whether, given successful Phase 2 Botensilimab trial data, Agenus can gain fast-track FDA approval. If there is a need for Phase 3 trials, that would be a significant expense, requiring more cash to be raised, and putting any payoff another two years or more down the line. Despite the risks and the not particularly rapid progress by partners to date, I think Agenus is an excellent long-term investment. It currently has a market cap of just about $600 million. If even one of its therapies, internal or outlicensed, can make it to commercialization, suddenly investors would evaluate the full pipeline with different eyes. If Botensilimab gets positive data from its current Phase 2 trials, which I expect to be more likely than not, then Agenus should see a significant jump in its stock price and market capitalization.

Be the first to comment