tcerovski/iStock Editorial via Getty Images

Since I wrote about Netflix (NASDAQ:NFLX) in August of this year, the stock is effectively flat. Shares are down over 60% year-to-date and nearly 70% from the all-time high reached in November 2021. In the short term, immediate concerns of shedding subscribers and the prospect of an economic downturn are headwinds for the stock. However, in the long-term, it is difficult to see how Netflix won’t be one of about three major players in the streaming and “TV” market. I think it is reasonable to expect certain niche players like Paramount+ and Discovery+ (or whatever it’s called) to either fold or be rolled up into larger services. At this point, it seems clear that the major mainstream services will be Netflix, Amazon Prime (AMZN) boosted by its NFL contract, and eventually Apple TV (AAPL). That said, I expect Disney+ (DIS) and Hulu to continue growing and secure a very loyal subscriber base given the strength of the content offerings. Disney’s content portfolio and its future potential are impressive.

What to Expect from Tuesday’s Earnings Release

Netflix will release third quarter earnings on October 18. Following the large bleeding of subscribers in the last two quarters, I would expect that number to be much smaller, or effectively neutral. Those who haven’t dumped Netflix at this point, probably won’t. In fact, the company expects global streaming paid subscriptions to rise quarter-over-quarter and year-over-year by a small margin (under 1% versus Q1 2022 and about 3.8% year-over-year.)

I hope that management will provide more color on several topics: subscriber growth (including ad-supported adoption), advertiser appetite (demand and prices paid) to advertise on the platform, relevant updates on the ad partnership with Microsoft (MSFT), and impact of the strengthening dollar on global operations.

Performance

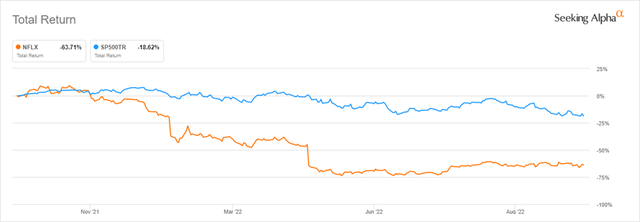

The stock price has been flat since my previous article published in August. The stock has experienced a significant downturn over the last year, greater than that of the broader market, due to slowing revenue growth and declining subscriber base. The objective with the ad-supported models is to offer lower entry points to not only stop losing subscribers, but to return to growth. Furthermore, given the exceptionally large viewership globally, the ad space itself is expected to be valuable real estate to advertisers.

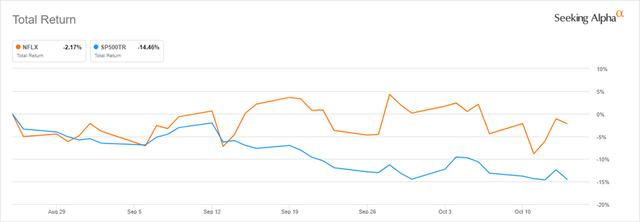

Since I last published on Netflix on August 25, the stock has outperformed the S&P 500, although it is effectively flat.

Performance of NFLX versus the S&P 500 since August 25 (Seeking Alpha)

However, over the last year, Netflix has far underperformed the S&P 500, falling over 60% compared to nearly 19% for the S&P 500.

At its current valuation, Netflix is trading well below its pre-pandemic level, despite its business being significantly larger. Revenue in 2019 was under $20.2 billion compared to $29.7 billion in 2021 and trailing twelve-month revenue of $31.0 billion through the second quarter of this year. Total shareholder’s equity has risen from $7.6 billion at year-end 2019 to $19.1 billion as of the second quarter. I am not providing these comparisons to try to claim Netflix is a bargain, but to point out that the company is materially larger with more assets, equity and profitability.

1-year return of NFLX versus the S&P 500 (Seeking Alpha)

Ad-Supported Subscription

On October 13, the company released details on its first ad-supported plan, Basic with Ads. The pricing will be $6.99/month and will be available starting November 3 in Australia, Brazil, Canada, France, Germany, Italy, Japan, Korea, Mexico, Spain, the UK, and the US. Subscribers choosing this plan can expect about 4-5 minutes of ads per 1-hour of viewing time. Certain movie and TV titles won’t be available due to licensing agreements, but the company is working on improving that moving forward.

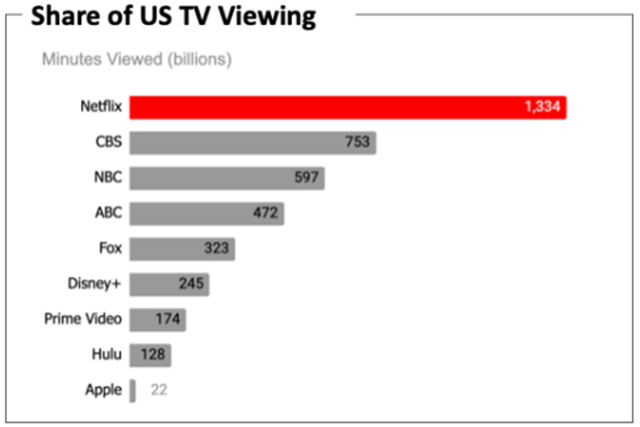

As I discussed in my previous article, according to data recorded by Nielsen and provided by Netflix in its Q2 2022 shareholder letter, viewed minutes on Netflix far outpace those on other platforms, and are nearly as large as the next two competitors combined. These data were collected from September 20, 2021 through May 8, 2022, and are expressed in billions of minutes viewed, so in Netflix’s case, that means over 1.3 trillion minutes watched by their subscribers. I would not expect average viewing minutes per household to be materially different for the ad-supported model as the 4-5 minutes of ads per hour is far below that of traditional networks that typically display +/- 15 minutes of ads per hour. Hopefully management will provide some additional context around viewership and how they expect that to translate into ad revenue.

Minutes Viewed by Service Provider (Netflix (data provided by Nielsen))

Challenging Foreign Exchange Environment

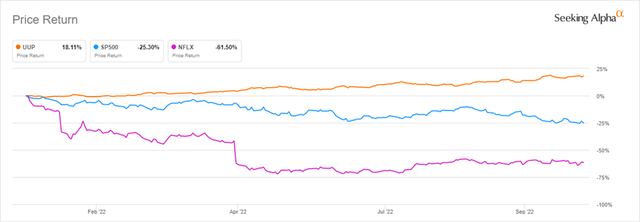

Foreign exchange has continued to create a headwind for Netflix, which truly has global exposure with the major exception of China. Due to the growth of the company overseas, foreign exchange exposure has continued to grow. This has been a challenge in recent months as the US dollar has continued to strengthen versus most currencies around the world. The company does not directly hedge its foreign exchange exposure. Rather the company attempts to match expenses and revenue within the same currency and will occasionally tweak subscription prices to offset foreign exchange changes. Again, I am looking forward to any additional information on the impact of exchange rates on the operating results, and how that might look moving forward. Even if the dollar doesn’t weaken, but stayed flat from here, that would at least lessen the burden on future results and improve year-over year comps.

YTD Performance of US Dollar versus S&P 500 and NFLX (Seeking Alpha)

Neutral Impact from Inflation and Recession Possibility

As the economy here and abroad faces increasing challenges in terms of inflation, geopolitical concerns, and the possibility of recession, the availability of lower cost options will be appealing to consumers feeling the squeeze. For those households at the margin, those most impacted by inflation, at-home entertainment is, and will continue to be, a good alternative to going out. With Netflix, unlike some of the other platforms, this is an option if you don’t live in China. And given that inflation has been a global phenomenon this cycle, that should help Netflix.

Regardless of the status of the economy in coming months, I continue to see Netflix’s service as a great value to households. Because of this, it is not a stretch to expect the new versatility of payment schedules to boost subscriber numbers and add to the top and bottom line.

Final Thoughts

Netflix will release earnings on the 18th. Investors will be looking closely at changes in subscribers, top line revenue, and further details on tiered pricing for sharing and its ad-supported model. My perspective is that this transition, like many in the company’s history, is underappreciated and that the upside is meaningfully larger than the downside for long-term investors that can see and accept that long-term vision. Fortunately, for those that understand and believe this long-term thesis, the beaten down stock price provides an excellent entry point. If the management and company are successful at bringing back subscriber growth while monetizing this enormously valuable property, investors entering the stock today will be handsomely rewarded in coming years, far above the expected returns of the S&P 500. I understand that the company faces numerous challenges, but despite what any naysayer might think about the next move for the company, given its track record and attractive prospects, it is reasonable to think they will be successful in returning to subscriber, revenue, and margin growth. I look forward to your feedback in the comment section below.

Be the first to comment