Mario Tama/Getty Images News

Investment Thesis

Netflix, Inc. (NASDAQ:NFLX) stock could take another near -30% hammering when the market opens later as Co-CEO Reed Hastings & Team delivered a bombshell to investors. We were previously optimistic about NFLX stock. But, we were wrong, as the company admitted that its judgment was affected by the COVID-19 metrics. As a result, its ability to measure its performance and issue accurate guidance has been significantly hampered.

The company needs to keep executing for a stock that has consistently traded at a significant growth premium. But, given its commentary at its FQ1 earnings call, the company’s execution over the last two quarters has been found wanting. Notably, we think the company has overestimated its leadership position and underestimated its competitive threat.

Therefore, it was arguably another lost quarter for Netflix. Despite the cautious optimism demonstrated by management in the call, many questions regarding its advertising and gaming strategy remained hanging.

However, even with the continued digestion of its growth premium, NFLX stock still traded at a premium against its legacy peers. And, it’s a premium that will be increasingly more challenging to justify if management’s execution remains subpar.

Therefore, we revise our rating on NFLX stock from Buy to Hold on execution and peer valuation concerns. Furthermore, our attention had already shifted to other growth plays given the recent tech stocks bottom.

Netflix Shocked Investors With Another Disastrous Guidance

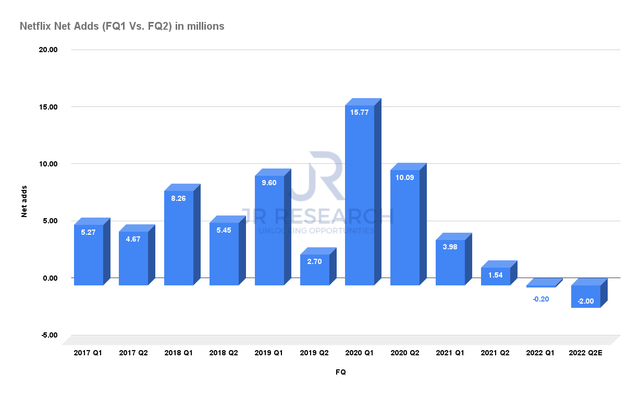

Netflix paid membership net adds (Company filings)

Even though Netflix reported below consensus estimates for its Q1 revenue, it outperformed on EPS. The company reported revenue of $7.87B, up 9.8% YoY (consensus: $7.94B). However, its GAAP EPS came in at $3.53, down 5.9% YoY. But, it was ahead of the Street consensus estimates of $2.95.

Netflix guided for $8.05B in revenue for Q2, up 9.7% YoY. However, it was markedly below the consensus estimates of $8.22B (up 12% YoY). The guidance was troubling because the consensus estimates modeled for Netflix’s revenue to reach its nadir in FQ1. However, the revised guidance has delayed it to FQ2 at least.

Furthermore, Netflix investors already understood the significance of its net adds to its growth premium after its disastrous FQ4 card in January. However, the company compounded its poor execution further in its FQ1 earnings as it reported net adds of -200K. Nevertheless, it included 700K of account losses from Russia. But, even after excluding those losses, the normalized 500K net adds were still significantly lower than its previous 2.5M guidance.

Moreover, Netflix guided for -2M growth in paid subscribers for FQ2. But the company emphasized that Q2 has often been a weaker quarter seasonally. Our analysis of its past results is consistent with management’s commentary, as seen above. Therefore, investors should expect a softer quarter in Q2. But, we think the critical question in investors’ minds would be whether Netflix’s troubles with user acquisition and churn could portend substantial structural weakness ahead.

Notably, CFO Spence Neumann quickly pointed out that its FQ2 guidance should not be regarded as a structural trend of Netflix’s acquisition challenges. He accentuated (edited):

We’re not providing full-year guidance. But, I just want to make sure there’s not a read-through from negative 2 million paid net adds in Q2, that there’s going to be a steady trend of negative adds.

We’re not expecting our revenue growth to reaccelerate before the end of the year, but we will grow revenue. And there will be paid net adds growth. (Netflix’s FQ1’22 earnings call)

Netflix Has Failed To Justify Its Growth Premium

NFLX stock NTM normalized P/E Vs. peers (TIKR)

Readers can easily glean that NFLX stock has continued to trade at a premium before yesterday’s earnings call. Its NTM normalized P/E was 31.3x, ahead of arch-rival Disney (DIS) stock’s 27.6x, and also ahead of its legacy peers Paramount (PARA) and Comcast (CMCSA). Both stocks traded at significantly lower multiples, at 13.4x, and 13.6x, respectively.

Furthermore, NFLX stock traded well ahead of the Media industry’s median P/E of 19x. Despite its horror show in Q4, the market still expects Netflix to continue its track record of solid execution. Therefore, we can understand why investors decided to bail out of NFLX stock post-market, given management’s astonishing admission of “poor” judgment and weak execution. Hastings enunciated (edited):

I think our views now are a little different because our numbers are a little different. If we had attained our 2.5M net adds guidance, I think that would have been consistent with our thesis.

And the lower user acquisition really forced us to kind of tease apart what’s going on. But, COVID created a lot of noise on how to read the situation. It boosted us a lot in 2020. And then in 2021, I think we thoughtfully said it was mostly pull-forward growth.

But now, coming into 2022, that doesn’t really hold. So then pushing into it, we realized, with all of the account sharing, our pretty high market penetration, combined with the competition, is really what we think is driving the lower acquisition and lower growth. (Netflix earnings)

Is NFLX Stock A Buy, Sell, Or Hold?

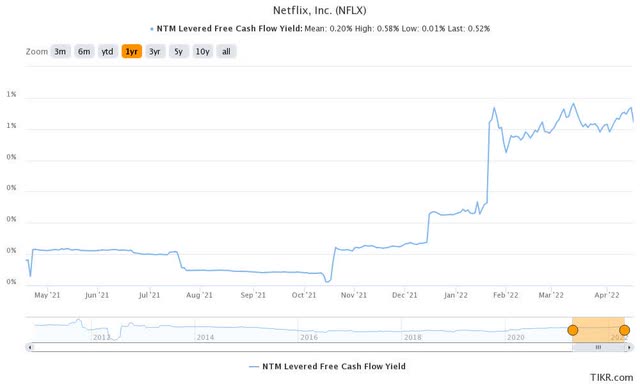

NFLX stock NTM FCF yield % (TIKR)

We revise NFLX stock from Buy to Hold. While a sell rating seems like the obvious choice, we think the market has already priced in the subpar Q1 report.

NFLX stock’s growth premium is apparent based on its weak pre-earnings NTM FCF yield of 0.52%. Hence, NFLX investors should be assuaged as the company guided that it’s committed to maintaining its operating margins and breakeven FCF guidance for FY22.

Based on its pre-market price of $258, NFLX stock NTM FCF yield would improve to 0.7%. Therefore, even with the significant value compression, Netflix would still trade at a marked growth premium.

But, we think FY22 could potentially be where its operating metrics bottom out. Based on pre-earnings consensus estimates, its FCF yield could improve to 1.6%, based on FY23E FCF margins. If we based it on its pre-market price, its FY23 FCF yield could improve to 2.1%. Hence, we believe the pessimism over NFLX stock seems to be priced in.

Be the first to comment