James_Gabbert/iStock via Getty Images

Introduction

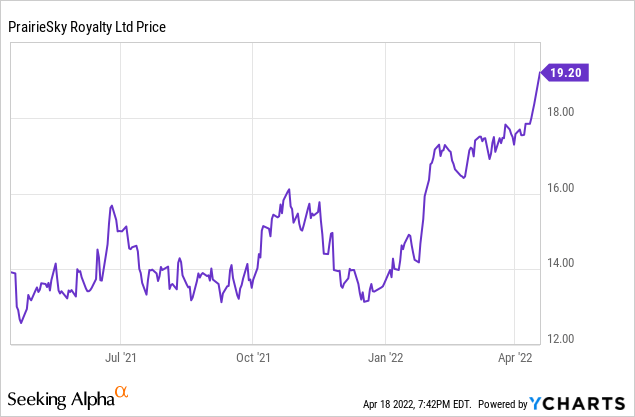

It’s been about two months since I discussed PrairieSky Royalty (OTCPK:PREKF) here on Seeking Alpha and although the share price has only increased by just over 10%, the company is in a much better shape than it was two months ago. The oil price is higher than I had anticipated, which means the incoming cash flows are also beating my expectations.

PrairieSky’s most liquid listing is on the Toronto Stock Exchange where it’s trading with PSK as its ticker symbol. The average daily volume is approximately 620,000 shares per day, which clearly provides superior liquidity. Additionally, the TSX listing has options available. I will use the Canadian Dollar as a base case throughout this article, unless otherwise indicated.

The free cash flow gushes in, day after day

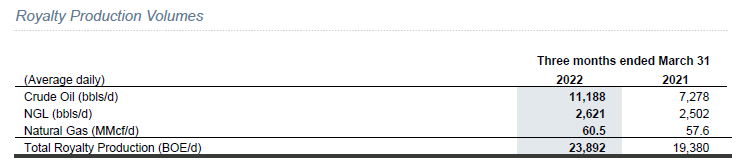

During the first quarter of 2022, PrairieSky Royalty saw its royalty production increase to just under 23,900 barrels of oil-equivalent per day, of which just under 11,200 barrels were represented by crude oil while the NGLs also contributed just over 2,600 boe/day. The remainder of the oil-equivalent production rate came from the natural gas production which averaged in excess of 60.5 MMcf per day.

PSK Investor Relations

The crude oil was sold at an average price of C$97.99, which appears to be rather disappointing compared to the US$94.29 average WTI oil price during the quarter – but keep in mind PrairieSky’s main producing assets are in Canada and Canadian oil prices are usually trading at a small discount while the heavy oil is usually trading at a discount of US$10-15 per barrel. On average, the realized price per barrel of oil-equivalent almost doubled compared to a year ago thanks to a much higher realized price in all divisions.

PSK Investor Relations

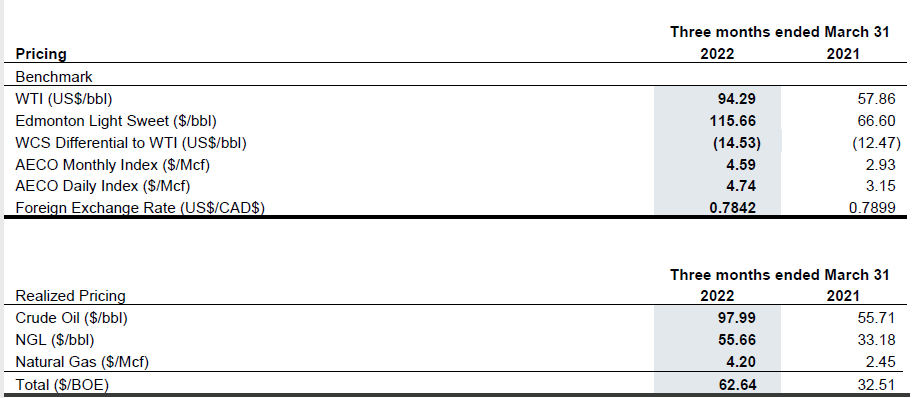

The total revenue generated from the royalty entitlement was just under C$135M while PSK also generated C$5.2M in ‘other revenue’. This other revenue mainly consists of lease rental income and bonus considerations and although they make up just a very small part of the total revenue, every million counts.

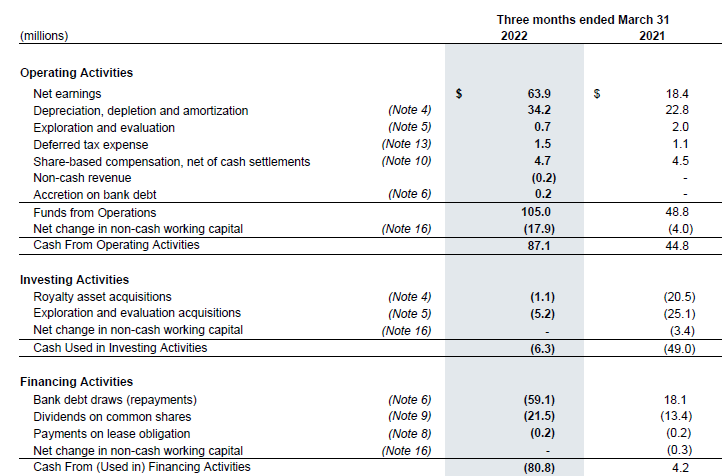

The operating costs of PSK are relatively low and a large portion of these operating expenses are related to depletion and amortization expenses, a non-cash expense. With a net income of C$63.9M or C$0.27 per share, PrairieSky delivered a good quarter.

PSK Investor Relations

The net income more than tripled, which shows what the torque on the commodity prices means for a royalty company like PrairieSky.

As a royalty business operates a very capex-light model (pretty much everything is a sunk cost), it is more important to look at a company’s cash flow result rather than the net income. Mainly because this excludes the non-cash expenses related to depletion, depreciation and amortization but also because it excludes the share-based compensation, which weighed on the Q1 results. Although we can’t completely ignore this share-based compensation, it is not a cash outflow and will be recorded as an increase of the total amount of shares outstanding further down the road. So they don’t have a cash impact, but a dilutive impact.

In Q1, the FFO came in at C$105M which is more than twice as high as in Q1 2021. We should also deduct the lease payments and it could make sense to deduct the exploration and evaluation acquisitions as well although this is not a ‘sustaining’ capex. In any case, the FFO was C$105M which is slightly higher than in Q4 last year.

PSK Investor Relations

The company is currently paying a quarterly dividend of C$0.12 for a total dividend yield of 2.5% based on the current share price. The payout ratio is just over 25% which means PSK is hoarding the majority of the cash to strengthen its balance sheet.

The net debt is decreasing fast, faster than anticipated

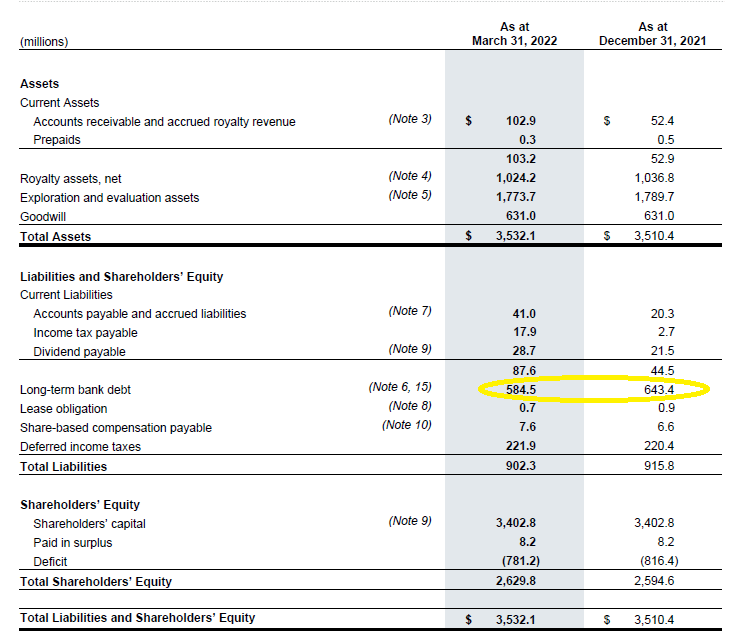

I was expecting a slightly higher FFO result in the first quarter, but perhaps I was a little bit too optimistic. After all, the recent acquisitions also increased the total debt position of the company, which result in a higher than average interest expense (although the Q1 interest expense came in below C$5M). In the first quarter, for instance, the interest expenses and these interest payments are coming down nicely as the net debt is also decreasing.

As of the end of March, the bank debt had decreased from C$643M as of the end of FY 2021 to just C$585M as of the end of March. That’s a decrease of almost C$60M as PrairieSky used its entire discretionary free cash flow (defined as FFO minus lease payments minus dividends and changes in the working capital position) to reduce the debt.

PSK Investor Relations

In theory, this should result in a lower interest expense in Q2 but I’m not so sure about that yet. The interest rates on the market are increasing and I would expect the cost of debt to increase from 2.9% in Q1 2022. This likely won’t be a massive increase but even a small increase to 3.5-3.7% will result in the interest expenses remaining at least stable, even if PrairieSky pays off another C$50M of the loan. Of course, this is not a prohibiting factor as the tipping point will likely be reached in the second half of this year as the net debt continues to decrease while interest rate increases may start to stall. I just wouldn’t bank on seeing the interest expenses going down in Q2.

Investment thesis

In my February article, I was anticipating PrairieSky to generate a full-year FFO of C$450-500M and although the Q1 result fell a little bit short of my expectations, I remain convinced an oil (and gas) royalty company like PrairieSky is the best way to gain exposure to the oil price with a low-risk vehicle.

As PrairieSky gets a cut of the top line and thus eliminates the operating risk as the operator needs to keep its costs under control and the profitability of a well is not a factor at play, its incoming cash flows will remain at an elevated level in the current oil price environment. Unless the oil (and gas) price suddenly collapses, I expect the Q2 results to be better than the Q1 results and PrairieSky will likely end June with a net debt of less than C$500M which would already put the company at a debt ratio of less than 1.25 times the FFO.

Unfortunately, I have no position in PrairieSky, but I have exposure to the other oil and gas royalty companies in Canada as I strongly believe this sector is the easiest way to gain exposure to oil and gas prices.

Be the first to comment