Wachiwit

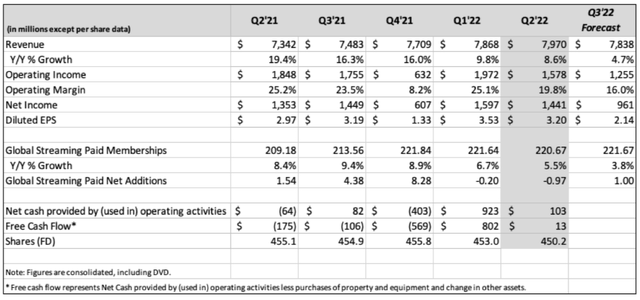

Netflix (NASDAQ:NFLX) reported Q2 revenue growth of 13% on a constant currency basis and while the reported revenue and EPS came in below expectations, the company experienced a $339 million revenue headwind from adverse currency impacts.

In addition, the biggest positive update during the quarter was global streaming paid memberships declining only 1 million sequentially, which was 1 million better than the expected 2 million decline. Q3 guidance also calls for 1 million of subscriber growth, which puts the company back on track with Q1 levels.

Longer-term, the company has talked about sustainable double-digit revenue growth and margin expansion and given the continued weakness in the stock’s price, I believe long-term investors should look to step in.

The stock currently trades at under 17x 2023 EPS, which seems to be a great entry point for long-term investors. Yes, the reported revenue and EPS results may continue to be pressured in the near term given the strong dollar causing foreign currency headwinds, however, the core demand trends remain healthy.

Netflix also recently announced a partnership with Microsoft (MSFT) with the companies targeting an initial rollout of their advertising platform in 2023. While it’s a little too early to know the complete financial impact of this partnership, I do believe it gives Netflix great long-term optionality.

Q2 Earnings Review And Guidance

Revenue during the quarter grew 9% yoy to $7.97 billion but missed consensus expectations by $60 million, or around 1%. While the top line revenue miss is not a big deal, investors will surely start to pay closer attention in the coming quarters. Revenue during Q2 was also impacted by $339 million of adverse foreign currency, which seemed to have gotten worse throughout the quarter. On a constant currency basis, revenue grew 13% during the quarter.

After reporting weaker than expected global streaming paid net additions last quarter (Q1 declined 200k, missing expectations by 2.7 million), all eyes were focused on this quarter’s global streaming paid memberships.

During Q2, global streaming paid memberships came in at 220.67 million, which reflected a sequential decline of around 1 million. While sequential trends were weaker, the 1 million decline was actually better than the expected 2 million membership decline.

While it’s a little difficult to know exactly what drove the better-than-expected global streaming paid membership number, management talked about the material benefits they saw from season 4 of Stranger Things.

Our Q2 slate is emblematic of this approach, headlined by season four of Stranger Things, which returned to tremendous fan reception and was a smash hit by all measures – including an outstanding drama Emmy nomination (along with Ozark season 4 and Squid Game). In its first four weeks, Stranger Things season four generated 1.3 billion hours viewed, making it our biggest season of English TV ever. Season four also re-ignited interest in past episodes with season one through three experiencing a greater than five-fold increase in viewing in the month after the release of season four (vs. the prior month).

One disappointment during the quarter was the company’s Q3 guidance. They expect revenue of $7.84 billion, reflecting 5% yoy growth, though this was well below expectations for $8.10 billion of revenue, or over 8% yoy growth. In addition, operating margin guidance of 16.0% was below expectations and reflects a significant contraction compared to the 23.5% margin in the year-ago period. This led to EPS guidance of $2.14, below consensus expectations for $2.76.

From a global streaming paid membership standpoint, the company is guiding Q3 to 221.67 million, representing a 1 million sequential growth. And while this was below the 1.8 million growth expected from consensus, Q2 membership was 1 million better than expected. Net, the combined Q2/Q3 guidance is ~200k above consensus expectations, a mild positive in light of the somewhat disappointing revenue and EPS guidance.

Investing in Content and Free Cash Flow

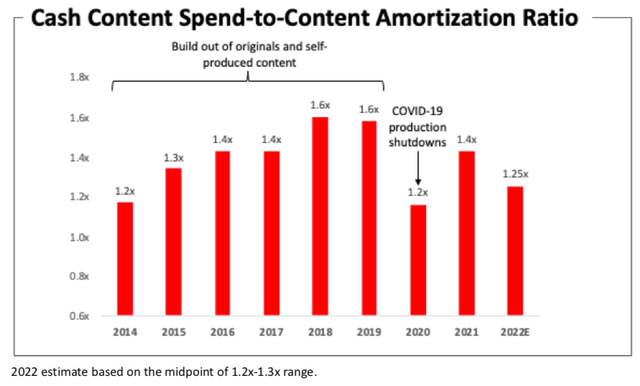

Investing in content is paramount for Netflix’s success, and this requires significant capital investments. This also places increased risk on the company’s title investments, as they could spend millions of dollars on a new series and if it does not gain traction with viewers, it will be very difficult for that project to breakeven.

Many years ago, the company looked to move towards creating Netflix original content, moving away from the licensed model. After spending five years of building out their internal studios to produce original content, the company is now through the most cash-intensive part of this transition.

As we’ve discussed previously, we are now self-funding. For the full year 2022, we expect FCF to be approximately +$1 billion, plus or minus a few hundred million dollars (assuming no material further movements in F/X).

We expect annual positive FCF going forward (with substantial growth in FCF in 2023 vs. 2022) due to our increasing revenue, solid profitability, and the successful multi-year evolution of our content model.

As a result, our cash content spend-to-content amortization expense ratio peaked at 1.6x (along with peak negative FCF of -$3.3B in 2019) and is expected to be about 1.2-1.3x in 2022 and to decline going forward, based on our current plans, which assume no material expansion into new content categories in ’23.

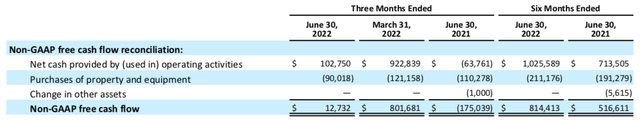

As seen in the chart above, this transition has taken many years and was negatively impacted during COVID as they had to shut down productions. However, Netflix remains back on track with their content production plan and now expects free cash flow of around $1 billion during 2022.

Yes, free cash flow was relatively weak during Q2 at just $13 million, however, this was a significant improvement from the $175 million free cash flow loss in the year-ago period. Year to date through Q2, free cash flow has amassed to $814 million, well above the year-ago level of $517 million.

As management previously alluded to, free cash flow should grow nicely in 2023 vs. 2022 due to revenue growth, continued profitability improvement, and the multi-year evolution of their content delivery model.

Competition and Microsoft Partnership

The global pandemic certainly caused a more competitive content streaming environment. Consumers quickly moved towards online entertainment and the rise of platforms such as Hulu, Disney+, ESPN+, HBO, Peacock, Paramount Plus, and many others, caused the streaming service environment to remain very competitive.

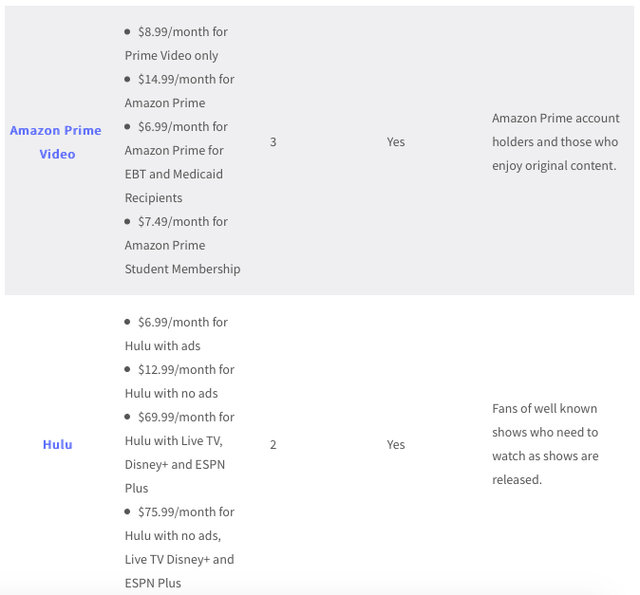

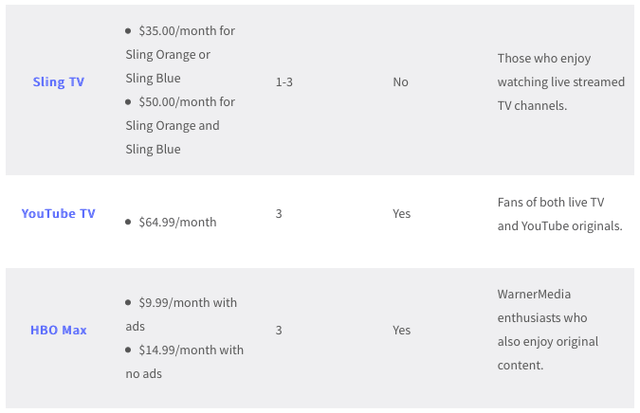

MoneyGeek provides a great chart comparing some of the different streaming services. With prices ranging from $4.99/month to $75.99/month, consumers clearly have plenty of options to choose from. This can put some pressure on the streaming service to constantly provide new content at affordable prices, as switching costs in this industry are very low for the consumer.

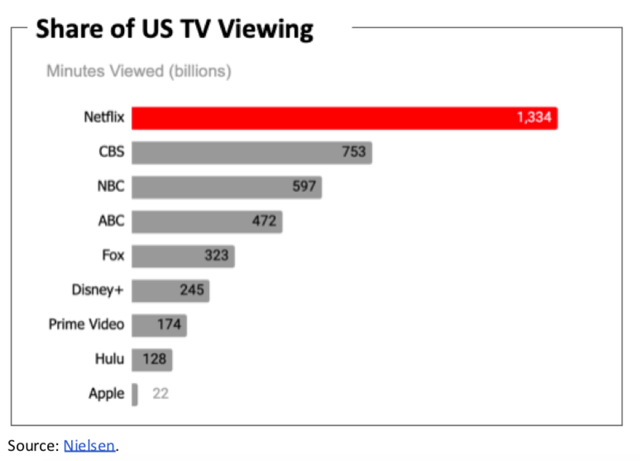

In addition, Netflix provided the above chart in their Q2 earnings release, which breaks out the most popular streaming services by the number of minutes watched. While it’s not too surprising to see Netflix at the top, this chart does take into account the numerous number of consumers re-watching old content on Netflix and may not accurately portray where the new customer cohorts are moving to and/or moving away from.

I believe this industry will continue to remain competitive for the long term as there will not likely be a clear winner. Consumers will constantly look for streaming services to produce new content to watch, placing consistent demand for companies to invest in production.

Netflix also recently announced a partnership with Microsoft to become their technology and sales partner. Netflix will continue to give consumers a choice for a lower-priced option with advertisements, but this partnership with Microsoft targets a more premium offering, with the company targeting an initial launch in early 2023.

They [Microsoft] are investing heavily to expand their multi-billion advertising business into premium television video, and we are thrilled to be working with such a strong global partner. We’re excited by the opportunity given the combination of our very engaged audience and high quality content, which we think will attract premium CPMs from brand advertisers.

We’ll likely start in a handful of markets where advertising spend is significant. Like most of our new initiatives, our intention is to roll it out, listen and learn, and iterate quickly to improve the offering. So, our advertising business in a few years will likely look quite different than what it looks like on day one. Over time, our hope is to create a better-than-linear-TV advertisement model that’s more seamless and relevant for consumers, and more effective for our advertising partners. While it will take some time to grow our member base for the ad tier and the associated ad revenues, over the long run, we think advertising can enable substantial incremental membership (through lower prices) and profit growth (through ad revenues).

Clearly, it’s too early to know how this may impact the future cadence of Netflix’s subscriber growth, but by partnering with another large-scale technology company, the combined force will have plenty of data analytics around consumer behaviors to put together a great offering. With the initial rollout expected in 2023, I don’t believe we will start to see a material change in the company’s financials until late-2023 and beyond.

Valuation

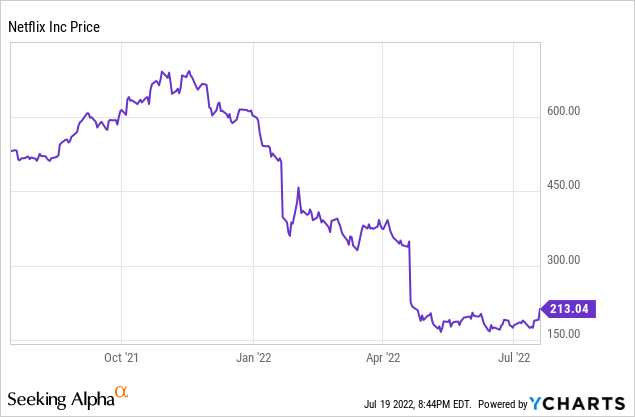

With the stock down over 70% since late-2021 and the company providing some positive updates during Q2 earnings, I believe long-term investors should start to step in. After the Q1 earnings report, I noted that investors should look to become more bullish if the stock were to trade under $225. The stock closed at $202 before reporting Q2 earnings, and I believe the long-term outlook has significantly improved over the recent months.

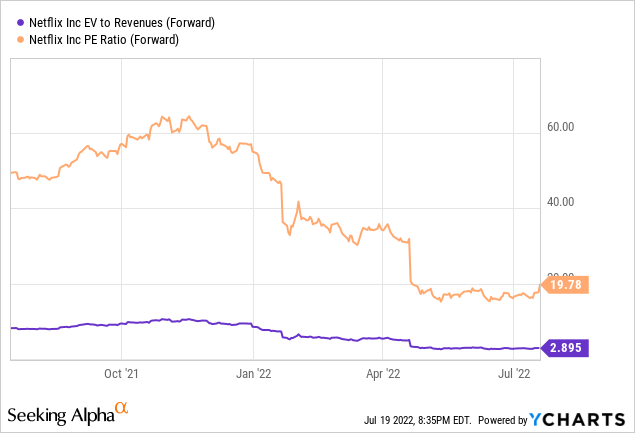

Valuation has pulled back significantly and investors may actually start to value Netflix on a P/E basis rather than the traditional methods of revenue multiples. Given revenue growth has materially slowed in recent years given the law of large numbers, a more consistent approach may be to look at the company’s earnings.

Prior to Q2 earnings, consensus estimated 2023 EPS of around $12 (per Yahoo Finance) and while the Q3 EPS guidance was below expectations, I believe the long-term outlook remains healthy.

Using 2023 EPS of $12, the stock currently trades at just under 17x 2023 EPS. To me, this seems like a great value to own a leading streaming service that will likely continue to grow nicely over the coming years.

Even if the company’s subscriber base remains pressured in the near-term given increased competition, Netflix continues to deliver original content that drives user engagement and viewership. With valuation now approaching “cheap” levels on an earnings basis, long-term investors should look to step in, albeit there may continue to be some volatility along the way.

Be the first to comment