Saklakova/iStock via Getty Images

During the third quarter of 2022, the fund declined by -0.30% net of fees1. For the first three quarters of 2022, the fund’s performance, net of fees, was -2.87%. Given the fund’s concentrated portfolio structure and focus on asymmetric opportunities, I anticipate that the fund will be rather volatile from quarter to quarter.

|

Praetorian Capital Fund LLC |

||

|

Gross Return |

Net Return* |

|

|

Q1 2022 |

19.79% |

15.55% |

|

Q2 2022 |

-18.16% |

-15.69% |

|

Q3 2022 |

0.01% |

-0.30% |

|

YTD 2022 |

-1.95% |

-2.87% |

|

2021 |

181.80% |

142.87% |

|

2020 |

159.39% |

127.51% |

|

2019 |

18.27% |

14.97% |

|

Since Inception (1/1/19) |

747.67% |

517.02% |

| *Unaudited net return data is estimated, net of all fees and expenses (using the expense structure in place at the time, which was: a maximum of 2% expenses from Inception through December 2020 and a 1.25% Management fee since January 2021). |

During the third quarter, many of our core portfolio positions declined for a second consecutive quarter. This decline represents a long-overdue pullback within a portfolio that I believe remains on trend and undervalued.

Offsetting this decline in our core portfolio, our Event-Driven Book produced a small positive return. This subpar return from the Event-Driven book is mostly a reflection of a decision on my part to keep overall Event-Driven exposure at a reduced level, leading us to take fewer positions than normal in the Event-Driven book.

Additionally, my Event-Driven strategies tend to perform better in a volatile or rising market, as they are primarily long-biased. I am hopeful that the remainder of 2022 will lead to a recovery in our Event-Driven performance but intend to keep exposure rather reduced until the market evolves from a down-trending one, to one with more volatility or preferably an up-trending one.

During 2020 and 2021, this fund relied strongly on the Event-Driven book to produce returns and help to offset pullbacks in our core book. The lack of Event-Driven returns over the past two quarters clearly has been a hinderance to the fund’s overall returns. Like many things in markets, Event-Driven returns tend to be cyclical, and after several anemic quarters, I’d anticipate a recovery at some point.

As noted over the past few quarters, I would like to caution you that our portfolio has become somewhat lopsided in terms of exposure to inflation assets, particularly with a focus on energy assets. Partly this is due to disproportionate appreciation of those assets as a percentage of the portfolio and partly this is a result of what I see as the most attractive opportunity set in the current market.

As commodities tend to be more volatile than the overall market, it bears mentioning that this increased exposure is likely to increase the overall volatility of our fund-particularly as the Federal Reserve has embarked on a rate cycle that is specifically targeting inflation assets.

Market Views

I have genuinely been surprised at the vigor with which the Federal Reserve has raised rates in their campaign to quash inflation. For my entire investing career, the Fed has been dovish, standing by and ready to reassure speculators at every market gyration. For the first time in my career, they’re actively targeting the stock market in an effort to create a recession and reduce the “wealth effect” when it comes to consumer spending. This is a terrifying policy change that was unexpected by most market observers-including myself.

At the same time, I feel that they have no real heart for this campaign. As political animals, they’ll be forced to pivot after they succeed in breaking something. Unfortunately, breaking something may lead to scary outcomes in the shorter term and we’ve kept our exposures at reduced levels until it is clear that they’re ready to pivot. When they do pivot, I believe that energy will be the primary beneficiary as both oil and uranium currently exhibit structural deficits that will be difficult to overcome absent substantial increases in capital spending.

In fact, I think that the magnitude of the movements in energy pricing will stun people who are accustomed to gradual changes in commodity price regimes. If anything, the volatility in European energy prices ought to be a wake-up call for all market participants. It would seem that with structural deficits and rapidly growing demand, the rules have adjusted, and many investors are unprepared for the change. To me, this creates opportunity.

Unfortunately for the Fed, higher energy prices will feed into higher structural inflation levels and at some point, the Fed will have to decide if they want to continue fighting inflation (which is likely impossible to quash outside of a global depression that dramatically reduces energy demand) or if they want to adjust their mandate and accept an increased level of inflation.

Despite them clinging to their inflation-fighting mandate all year, I believe they have no desire to inflict a depression on voters. They’ll eventually pivot and accept dramatically higher inflation levels, while continuing to subsidize interest rates to avert the depression that they seem fixated on creating. As a result, we have continued to increase our exposure to US housing on this pullback, as that will be a prime beneficiary of this set of macroeconomic outcomes.

Thoughts On Portfolio Valuations

Despite only experiencing a -2.87% net decline (performance net of fees) in our fund since the start of the year, many of our largest positions have experienced far more dramatic declines and now represent unusual value. As a way of demonstrating the magnitude of the declines, as of the end of the third quarter, these are our top 5 positions and the declines experienced from their peak price points during 2022.

|

Ticker |

Position Name |

% Decline From 2022 Peak |

|

Sprott Physical Uranium Trust |

-25.84% |

|

|

St. Joe Co. |

-48.51% |

|

|

Builders FirstSource Inc. |

-31.87% |

|

|

Valaris Ltd. |

-22.87% |

|

|

United States Brent Oil Fund |

-25.84% |

Now, you should be asking yourself how it is possible that so many positions have declined dramatically, yet the fund hasn’t performed demonstrably worse. The answer would be a combination of continued gains from the Event-Driven book, realized gains on a number of profitable investments and loss mitigation strategies when trading around core positions. Additionally, we did not own BLDR or BNO at the start of the year, so they are new additions, purchased at depressed prices.

Absent these factors, our returns for the year would have been a good deal worse. While the percentage decline from the peak price in a year, is a somewhat arbitrary way to think about a portfolio’s return, I think it is important to point out that the portfolio itself is doing a whole lot better than its larger components. Additionally, the magnitude of the declines from the peak prices is likely indicative of the relative value inherent in our portfolio.

As an absolute performance vehicle, I believe that a benchmark would be a foolish metric to use when referencing this fund’s performance. At the same time, it’s hard to ignore the fact that many global equity and bond markets are down dramatically, and our fund is down a good deal less despite being more than 100% net long for most of the year and rarely utilizing shorts or hedges. I believe this is due to my constant focus on sectors that are positively inflecting with strong macro tailwinds.

History has shown that despite what happens in global economics or geopolitics, there is always a bull market somewhere. The key is to identify those bull markets and then find the components within those markets that offer exponential upside with a reduced opportunity for a permanent loss of capital. Discipline in this regard often trumps simple valuation, as cheap stocks can always get cheaper. Meanwhile, those with strong tailwinds rarely stay cheap for long.

As a result of focusing on inflecting trends, we’ve side-stepped a good deal of the carnage in global risk markets, while capturing returns from the Event-Driven book. As a result, I think that we’ve set ourselves up for the continuation of the various trends that we are most fixated on. While history only somewhat repeats when it comes to the markets, my experience has been that strong trends often struggle to produce price positive performance during periods of overall market weakness.

Then, when there is a pause in the decline of the overall market, those positions that declined the least with the broader market, tend to lead the next charge higher. The overall strength of many of our positions is indicative to me that we may be setting up for a similar explosive move higher in our portfolio positions when the market eventually bottoms.

For now, my focus is on avoiding unforced errors, keeping exposure down and being prepared to dramatically increase our exposure to inflation assets when the Fed finally pauses in its rate cycle.

Russian Securities

During last quarter’s letter, I gave an update on our Russian securities positions and noted that we had moved them into a side-pocket and marked them all at zero. Nothing has changed regarding the side-pocket or the mark on the positions. However, we did succeed in removing the GDR wrapper from 3 of our Russian positions and now own Russian shares. Our fourth position is a Cypriot company and thus far, we have not been capable of removing the GDR wrapper. Fortunately, it does not appear to be at the same risk of disappearing if we do not remove the wrapper.

While it may require some time until we can liquidate these positions, we believe that we’ll ultimately realize sizable gains on them.

Operational Updates

As the fund continues to grow, with quarter-end Assets Under Management of approximately $162 million, we have taken steps to strengthen our infrastructure and improve our research ability. As you may be aware, we recently moved into a new office space in Rincon, Puerto Rico (see images below). This is a big improvement from running the fund from our respective homes. We needed the space as we have recently added three equity analysts, Brandon Coffin, Michael Haddad and Osman Poroy to the team. We also have space for additional staffing as we continue to grow. As of January 1st of 2023, we expect to have 9 full-time staff in Puerto Rico, including Lauren and Nick Cousyn, whom you’ve likely interacted with if you contributed capital to the fund in the past year.

It took a long time to get into this office and a combination of supply chain issues along with Hurricane Fiona pushed our timelines back even further. The office is complete with a backup generator and internet redundancies, further hardening our systems. I’m super excited that we are finally all set up and in one place. I believe strongly that we are now positioned for much more efficient and in-depth work at the fund level as a result of all being together (finally).

Position Review (top 5 position weightings at quarter end from largest to smallest)

Uranium Basket (Entities holding physical uranium along with production and exploration companies)

It may take some time still, but I believe that society will eventually settle on nuclear power as a compromise solution for baseload power generation. This will come at a time when there is a deficit of uranium production, compared with growing demand. As aboveground stocks are consumed, uranium prices should appreciate towards the marginal cost of production. Additionally, there is currently an entity named Sprott Physical Uranium Trust that is aggressively issuing shares through an At-The-Market offering, or ATM, in order to purchase uranium (we are long this entity).

I believe that these uranium purchases will accelerate the price realization function by sequestering much of the available above-ground stockpile at a time when utilities have run down their inventories and need substantial purchases to re-stock. The combination of these factors ought to lead to a dramatic increase in the price of uranium as it will take at least two years for incremental supply to come online-even if the re-start decision were made today.

While most of our exposure to physical uranium is within the Sprott trust, because it allows us to express this view with reduced risk, we also own shares of Kazatomprom (KAP – UK). I am well aware that mining is one of the riskiest businesses out there, but Kazatomprom is the lowest-cost diversified producer globally, with incredible scale in what is a highly-consolidated industry.

At the same time, I recognize that we take on certain risks when owning a company engaged in mineral extraction, especially in a country like Kazakhstan that can be politically unstable at times. That said, I believe that the recent change in government will do little to impact the operating environment in Kazakhstan, though the tax rate may expand moderately.

Ironically, uranium will be a prime beneficiary of sanctions on Russia as Russia is one of the world’s largest enrichers of uranium. As the West is forced to enrich more of the uranium that ultimately goes into reactors, underfeeding of tails will flip to an overfeeding of tails. The net effect could be anywhere between 10% and 30% of the global supply of uranium disappearing-which may dramatically accelerate the timing of my thesis while increasing the ultimate magnitude of the upward swing in uranium prices.

Energy Services Basket (Positions Not Currently Disclosed)

In 2020 when oil traded below zero, drilling activity ground to a halt and many energy service providers declared bankruptcy. Many of these businesses had teetered on the verge of bankruptcy for years due to reduced demand and over-leveraged balance sheets. The bankruptcies led to consolidation and reduced future industry capacity, removing future competition in the recovery.

With oil prices now at multi-year highs, I believe that demand for drilling and other services will recover. While producers have been slow to increase spending on exploration, despite dramatic recoveries in energy prices, I believe that this only extends the timing on the thesis. In the end, the only way to reduce energy prices is to see a dramatic increase in global oilfield services spending. Any postponement of this spending only leads to higher prices and more wealth transfer from the global economy to the oil producers, which will likely end up resulting in an increase in spending on exploration and production.

We purchased many of these positions at fractions of the equipment’s replacement cost, despite restored balance sheets and positive operating cash flow. As spending in the sector recovers, I believe that the potential for cash flow will become more apparent and this equipment will trade up to valuations closer to replacement cost.

Oil Futures, Futures and ETF Options and Call Spreads

I believe that years of reduced capital expenditures, along with ESG restricting capital access, combined with Western governments that are openly hostile to fossil fuels, have created an environment for dramatically higher oil prices. While we could purchase oil producers, I feel it is far more conservative to simply own the physical commodity itself.

We own December 2025 oil futures, along with various futures calls and call spreads, an ETF and ETF call options and call spreads. I believe that this leveraged play on oil gives us the most upside to oil and ultimately inflation, while exposing us to reduced risk when compared to producers.

St. Joe (JOE)

JOE owns approximately 175,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE will grow revenue at 30% to 50% each year for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at a single-digit multiple on Adjusted Funds from Operations (AFFO) looking out to 2024, while substantial asset value is tossed in for free.

Besides the valuation, growth, and high Return on Invested Capital (ROIC) of the business, why else do I like JOE? For starters, land tends to appreciate rapidly during periods of high inflation- particularly an inflationary period where interest rates are likely to remain suppressed by the Federal Reserve. More importantly, I believe we are about to witness a massive population migration as people with means choose to flee big cities for somewhere peaceful.

I suspect that every convulsion of urban chaos and/or tax-the-rich scheming will launch JOE shares higher, and it will ultimately be seen as the way to “play” the stream of very wealthy refugees fleeing for somewhere better.

Builders FirstSource (BLDR)

Builders FirstSource produces and distributes building materials, primarily for the home building industry. It trades at a low-single digit cash flow multiple on recent earnings and is using that cash flow to rapidly repurchase shares. One could say that the low multiple is due to peak cyclical earnings. I take a different view and believe that we’re in the early stages of a long-term housing boom caused by migration to low tax states along with a catch-up phase as home construction rates were below trendline over the past decade.

I believe that the US needs in excess of 1 million new single-family homes each year, just to provide for population growth, ignoring the other factors. As a result, this business does not appear to be at peak earnings; instead, I believe we are seeing a new baseline for earnings-though the earnings will be quite volatile-particularly if interest rates remain elevated or increase further.

Summary

During the third quarter of 2022, the fund experienced a pullback in many of its core positions. I have used this pullback to moderately increase a number of our positions, which has increased our overall exposure. Our exposure is a bit more concentrated in inflation, particularly in energy, than I’d normally expect it to be, but those are also my favorite themes. We’ve expressed this view through instruments like physical uranium, long-dated oil futures and futures options, energy equipment services companies, and land plays, which I believe should have a reduced risk of permanent impairment.

I also believe we are in the early stages of this inflationary boom and while there will be sizable volatility going forward, we are positioned well.

Sincerely,

Harris Kupperman

APPENDIX

|

Praetorian Capital Fund LLC Quarterly Returns |

||

|

Gross Return |

Net Return* |

|

|

Q1 2022 |

19.79% |

15.55% |

|

Q2 2022 |

-18.16% |

-15.69% |

|

Q3 2022 |

0.01% |

-0.30% |

|

YTD 2022 |

-1.95% |

-2.87% |

|

Q1 2021 |

57.50% |

45.66% |

|

Q2 2021 |

28.14% |

23.96% |

|

Q3 2021 |

11.42% |

9.85% |

|

Q4 2021 |

25.32% |

22.44% |

|

YTD 2021 |

181.80% |

142.87% |

|

Q1 2020 |

-41.22% |

-41.22% |

|

Q2 2020 |

54.32% |

54.32% |

|

Q3 2020 |

34.09% |

29.32% |

|

Q4 2020 |

113.25% |

93.94% |

|

2020 |

159.39% |

127.51% |

|

Q1 2019 |

6.10% |

4.88% |

|

Q2 2019 |

7.99% |

6.44% |

|

Q3 2019 |

-10.51% |

-8.40% |

|

Q4 2019 |

15.34% |

12.42% |

|

2019 |

18.27% |

14.97% |

| *Unaudited net return data is estimated, net of all fees and expenses (using the expense structure in place at the time, which was: a maximum of 2% expenses from Inception through December 2020 and a 1.25% Management fee since January 2021). |

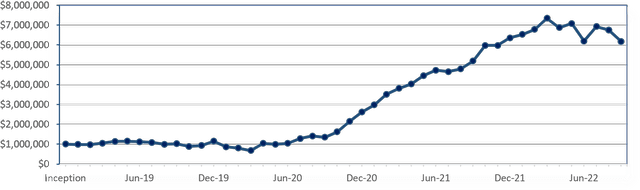

Praetorian Capital Fund LLC (Onshore)–Net Return Since Inception*

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Full Year |

|

2022 |

2.76% |

3.92% |

8.21% |

-6.36% |

2.97% |

-12.57% |

11.97% |

-2.51% |

-8.67% |

-2.87% |

|||

|

2021 |

13.76% |

18.12% |

8.40% |

5.82% |

10.54% |

5.98% |

-1.58% |

3.00% |

8.36% |

15.19% |

-0.01% |

6.30% |

142.87% |

|

2020 |

-24.62% |

-7.18% |

-15.98% |

53.65% |

-4.55% |

5.23% |

22.71% |

10.22% |

-4.38% |

20.03% |

32.50% |

21.95% |

127.51% |

|

2019 |

-1.31% |

-1.33% |

7.71% |

8.82% |

0.63% |

-2.81% |

-3.18% |

-8.08% |

2.93% |

-13.10% |

4.26% |

24.09% |

14.97% |

DisclaimerThis document is being provided to you on a confidential basis. Accordingly, this document may not be reproduced in whole or part, and may not be delivered to any person without the consent of Praetorian Capital Management LLC (“PCM”). Nothing set forth herein shall constitute an offer to sell any securities or constitute a solicitation of an offer to purchase any securities. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents for Praetorian Capital Fund LLC (the “Fund”) which include, among others, a confidential offering memorandum, operating agreement and subscription agreement. Such formal offering documents contain additional information not set forth herein, including information regarding certain risks of investing in the Fund, which are material to any decision to invest in the Fund. No information is warranted by PCM or its affiliates or subsidiaries as to completeness or accuracy, express or implied, and is subject to change without notice. This document contains forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward looking statements reflect PCM’s views as of such date with respect to possible future events. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond PCM’s control. Investors are cautioned not to place undue reliance on such statements. No party has an obligation to update any of the forward-looking statements in this document. Opinions, estimates, and forward-looking statements in these materials constitute PCM’s judgment and should be considered current only as of the date of publication without regard to the date on which you may receive or access the information. PCM maintains the right to delete or modify information without prior notice. Statements made herein that are not attributed to a third-party source reflect the views and opinions of PCM. Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by PCM based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance. The past performance of the Fund, or PCM, its principals, members, or employees is not indicative of future returns. The performance reflected herein and the performance for any given investor may differ due to various factors including, without limitation, the timing of subscriptions and withdrawals, applicable management fees and incentive allocations, and the investor’s ability to participate in new issues. All references to a “net return” or “performance, net of fees” within this letter are for a net return of an investor that is subject to all standard fees and accrued incentive allocation, if any, at Praetorian Capital Fund LLC (“PCF”), as provided for in the PCF’s offering documents, and has been an investor in the PCF since the beginning of the current year or period. There is no guarantee that PCM will be successful in achieving the Fund’s investment objectives. An investment in the Fund contains risks, including the risk of complete loss. The investments discussed herein are not meant to be indicative or reflective of the portfolio of the fund. Rather, such examples are meant to exemplify PCM’s analysis for the fund and the execution of the fund’s investment strategy. While these examples may reflect successful trading, obviously not all trades are successful and profitable. As such, the examples contained herein should not be viewed as representative of all trades made by PCM.

|

Footnotes1 All references to a “net return” or “performance, net of fees” within this letter are for a net return of an investor that is subject to all standard fees and accrued incentive allocation, if any, at Praetorian Capital Fund LLC (“PCF”), as provided for in the PCF’s offering documents, and has been an investor in the PCF since the beginning of the current year or period. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment